In the last 19 years, only 0.79 % trading sessions saw intraday declines higher than 5 % .

ITC Share Price

ITC Share Price

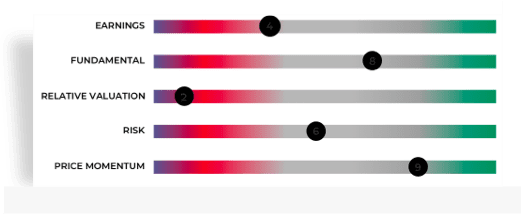

ITC share price insights

Company has spent less than 1% of its operating revenues towards interest expenses and 8.65% towards employee cost in the year ending 31 Mar, 2024. (Source: Consolidated Financials)

10 day moving crossover appeared yesterday. Average price decline of -1.94% within 7 days of this signal in last 5 years.

Stock gave a 3 year return of 103.44% as compared to Nifty 100 which gave a return of 52.57%. (as of last trading session)

ITC Ltd. share price moved down by -0.49% from its previous close of Rs 432.30. ITC Ltd. stock last traded price is 430.20

Share Price Value Today/Current/Last 430.20 Previous Day 432.30

Key Metrics

PE Ratio (x) | 26.38 | ||||||||||

EPS - TTM (₹) | 16.39 | ||||||||||

MCap (₹ Cr.) | 5,39,714 | ||||||||||

Sectoral MCap Rank | 1 | ||||||||||

PB Ratio (x) | 7.21 | ||||||||||

Div Yield (%) | 3.18 | ||||||||||

Face Value (₹) | 1.00 | ||||||||||

Beta Beta

| 0.91 | ||||||||||

VWAP (₹) | 431.78 | ||||||||||

52W H/L (₹) |

ITC Share Price Returns

| 1 Day | -0.47% |

| 1 Week | -1.17% |

| 1 Month | -0.36% |

| 3 Months | 1.86% |

| 1 Year | -3.39% |

| 3 Years | 106.97% |

| 5 Years | 53.35% |

ITC News & Analysis

News Ahead of Market: 10 things that will decide D-Street action on Wednesday

Ahead of Market: 10 things that will decide D-Street action on Wednesday

News Sensex, Nifty end flat after volatile session ahead of US Fed rate decision, CPI data

Sensex, Nifty end flat after volatile session ahead of US Fed rate decision, CPI data

News Mphasis promoter entity pares 15% stake for Rs 6,735 crore

Mphasis promoter entity pares 15% stake for Rs 6,735 croreCompliances-Reg. 39 (3) - Details of Loss of Certificate / Duplicate Certificate

Announcements

ITC Share Recommendations

Recent Recos

Current

Mean Recos by 35 Analysts

SellSellHoldBuyStrong

Buy

- Target₹460

- OrganizationEmkay Global Financial Services

- ADD

Analyst Trends

| Ratings | Current | 1 Week Ago | 1 Month Ago | 3 Months Ago |

|---|---|---|---|---|

| Strong Buy | 13 | 13 | 15 | 16 |

| Buy | 19 | 19 | 17 | 17 |

| Hold | 3 | 3 | 3 | 3 |

| Sell | - | - | - | - |

| Strong Sell | - | - | - | - |

| # Analysts | 35 | 35 | 35 | 36 |

ITC Financials

Income (P&L)

Balance Sheet

Cash Flow

Ratios

MD&A

Insights

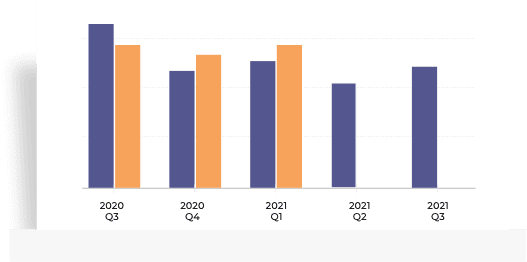

Employee & Interest Expense

Company has spent less than 1% of its operating revenues towards interest expenses and 8.65% towards employee cost in the year ending 31 Mar, 2024. (Source: Consolidated Financials)

Quarterly | Annual Mar 2024 Dec 2023 Sep 2023 Jun 2023 Mar 2023 Total Income 18,606.53 18,676.20 18,439.35 17,886.76 18,244.54 Total Income Growth (%) -0.37 1.28 3.09 -1.96 -0.30 Total Expenses 11,759.97 11,980.52 11,773.27 10,936.85 11,399.42 Total Expenses Growth (%) -1.84 1.76 7.65 -4.06 -0.42 EBIT 6,846.56 6,695.68 6,666.08 6,949.91 6,845.12 EBIT Growth (%) 2.25 0.44 -4.08 1.53 -0.12 Profit after Tax (PAT) 5,120.55 5,335.23 4,898.07 5,104.93 5,175.48 PAT Growth (%) -4.02 8.93 -4.05 -1.36 3.37 EBIT Margin (%) 36.80 35.85 36.15 38.86 37.52 Net Profit Margin (%) 27.52 28.57 26.56 28.54 28.37 Basic EPS (₹) 4.10 4.28 3.93 4.11 4.17 All figures in Rs Cr, unless mentioned otherwise

Annual FY 2024 FY 2023 FY 2022 FY 2021 FY 2020 Total Assets 91,826.16 85,882.98 77,259.55 73,819.30 77,367.04 Total Assets Growth (%) 6.92 11.16 4.66 -4.59 7.76 Total Liabilities 16,936.19 16,344.19 14,437.68 13,125.15 11,716.31 Total Liabilities Growth (%) 3.62 13.21 10.00 12.02 -4.85 Total Equity 74,889.97 69,538.79 62,821.87 60,694.15 65,650.73 Total Equity Growth (%) 7.70 10.69 3.51 -7.55 10.37 Current Ratio (x) 3.00 2.89 2.81 3.27 4.13 Total Debt to Equity (x) 0.00 0.00 0.00 0.00 0.00 Contingent Liabilities 0.00 3,093.75 3,205.16 3,527.64 3,784.02 All figures in Rs Cr, unless mentioned otherwise

Annual FY 2024 FY 2023 FY 2022 FY 2021 FY 2020 Net Cash flow from Operating Activities 17,178.86 18,877.55 15,775.51 12,527.09 14,689.66 Net Cash used in Investing Activities 1,562.77 -5,732.29 -2,238.49 5,682.91 -6,174.02 Net Cash flow from Financing Activities -18,550.96 -13,006.03 -13,580.50 -18,633.83 -8,181.48 Net Cash Flow 190.67 139.23 -43.48 -366.88 334.16 Closing Cash & Cash Equivalent 625.89 405.91 266.68 310.16 677.04 Closing Cash & Cash Equivalent Growth (%) 54.19 52.21 -14.02 -54.19 97.46 Total Debt/ CFO (x) 0.00 0.00 0.00 0.00 0.00 All figures in Rs Cr, unless mentioned otherwise

Annual FY 2024 FY 2023 FY 2022 FY 2021 FY 2020 Return on Equity (%) 27.45 27.75 24.40 21.80 23.44 Return on Capital Employed (%) 34.76 35.81 31.89 28.49 29.80 Return on Assets (%) 22.27 22.34 19.72 17.82 19.78 Interest Coverage Ratio (x) 630.60 639.94 571.51 403.54 369.66 Asset Turnover Ratio (x) 0.80 0.83 0.76 66.74 63.85 Price to Earnings (x) 26.18 24.88 20.28 20.45 13.83 Price to Book (x) 7.18 6.89 4.95 4.46 3.24 EV/EBITDA (x) 18.23 17.08 13.55 13.48 9.36 EBITDA Margin (%) 40.88 38.97 37.07 39.85 44.24 MANAGEMENT DISCUSSION AND ANALYSIS (FY 19-20)

Headwinds - rising taxes and illicit trade

The Cigarettes Business consolidated its market standing during the year through continued focus on delivering world-class products along with best-in-class execution. However, persistent weakness in the demand environment coupled with growth in illicit cigarette trade weighed on performance. Steep increase in taxes w.e.f. 1st February 2020 and disruptions in operations in March 2020 exacerbated the situation.

FMCG - bright spot

In the FMCG-Others Segment, comparable revenue grew ahead of the industry, amidst subdued demand conditions, while profitability improved significantly. Segment EBITDA margins improved by appx. 160 bps to 7.1% during the year despite heightened competitive intensity, early closure of educational institutions that impacted the Education and Stationery Products Business, elevated input costs and gestation costs of new products/categories and manufacturing facilities and impact due to disruptions following the outbreak of the pandemic.

Covid impact - Maximum on Hotel segment

In the Hotels Business, while the first three quarters witnessed strong performance, driven largely by excellent response to the Company?s new iconic properties, the outbreak of COVID-19 pandemic severely impacted performance in the fourth quarter.

ITC Peer Comparison

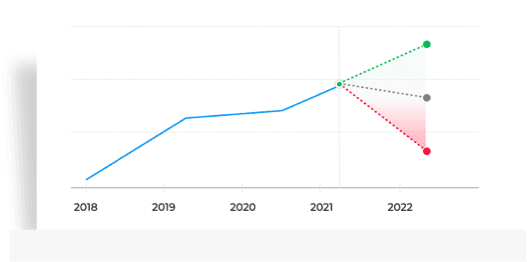

ITC Stock Performance

Ratio Performance

Insights

Stock Returns vs Nifty 100

Stock gave a 3 year return of 103.44% as compared to Nifty 100 which gave a return of 52.57%. (as of last trading session)Stock Returns vs Nifty FMCG

Stock generated 103.44% return as compared to Nifty FMCG which gave investors 62.84% return over 3 year time period. (as of last trading session)

Choose from Peers

Choose from Stocks

- 1D

- 1W

- 1M

- 3M

- 6M

- 1Y

- 5Y

Loading...Insights

Stock Returns vs Nifty 100

Stock gave a 3 year return of 103.44% as compared to Nifty 100 which gave a return of 52.57%. (as of last trading session)Stock Returns vs Nifty FMCG

Stock generated 103.44% return as compared to Nifty FMCG which gave investors 62.84% return over 3 year time period. (as of last trading session)

See All Parameters

MF Ownership

3,203.76

Amount Invested (in Cr.)

5.01%

% of AUM

0.53

% Change (MoM basis)

BHARAT 22 ETF-G

Equity: Large Cap

2,779.63

Amount Invested (in Cr.)

15.49%

% of AUM

0.66

% Change (MoM basis)

2,191.32

Amount Invested (in Cr.)

4.83%

% of AUM

0.00

% Change (MoM basis)

MF Ownership as on 30 April 2024

ITC F&O Quote

Futures

Options

- Expiry

Price

433.900.10 (0.02%)

Open Interest

1,18,25,60038,86,400 (32.86%)

Open High Low Prev Close Contracts Traded Turnover (₹ Lakhs) 433.10 435.20 431.30 433.80 8,721 60,491.89 Open Interest as of 24 Apr 2024

Corporate Actions

ITC Board Meeting/AGM

ITC Dividends

- Others

Meeting Date Announced on Purpose Details May 23, 2024 May 09, 2024 Board Meeting Audited Results & Final Dividend Jan 29, 2024 Jan 15, 2024 Board Meeting Quarterly Results & Interim Dividend Dec 23, 2023 Nov 17, 2023 POM - Oct 19, 2023 Oct 05, 2023 Board Meeting Quarterly Results Aug 14, 2023 Jul 31, 2023 Board Meeting Quarterly Results & Scheme of Arrangement Type Dividend Dividend per Share Ex-Dividend Date Announced on Final 750% 7.5 Jun 04, 2024 May 23, 2024 Interim 625% 6.25 Feb 08, 2024 Jan 29, 2024 Special 275% 2.75 May 30, 2023 May 19, 2023 Final 675% 6.75 May 30, 2023 May 18, 2023 Interim 600% 6.0 Feb 15, 2023 Feb 03, 2023 All Types Ex-Date Record Date Announced on Details Bonus Jul 01, 2016 Jul 04, 2016 May 20, 2016 Bonus Ratio: 1 share(s) for every 2 shares held Bonus Aug 03, 2010 Aug 04, 2010 Jun 18, 2010 Bonus Ratio: 1 share(s) for every 1 shares held Splits Sep 21, 2005 Sep 28, 2005 Jun 17, 2005 Split: Old FV10.0| New FV:1.0 Bonus Sep 21, 2005 Sep 28, 2005 Jun 17, 2005 Bonus Ratio: 1 share(s) for every 2 shares held Bonus Sep 12, 1994 Oct 06, 1994 Jul 12, 1994 Bonus Ratio: 1 share(s) for every 1 shares held

About ITC

ITC Ltd., incorporated in the year 1910, is a Large Cap company (having a market cap of Rs 540,588.44 Crore) operating in Tobacco sector. ITC Ltd. key Products/Revenue Segments include Packaged Food Item, Agricultural Products, Paper & Paper Boards, Others, Tobacco Unmanufactured, Service (Hotel), Other Operating Revenue, Printed Materials for the year ending 31-Mar-2023. Show More

Executives

Auditors

- SP

Sanjiv Puri

Chairman & Managing DirectorSDSupratim Dutta

Executive Director & CFONANakul Anand

Executive DirectorSBSumant Bhargavan

Executive DirectorAKAjit Kumar Seth

Non Executive DirectorANAnand Nayak

Non Executive DirectorShow More - S R B C & Co. LLP

Industry

Key Indices Listed on

Nifty 50, S&P BSE Sensex, Nifty 100, + 37 more

Address

Virginia House,37, Jawaharlal Nehru Road,Kolkata, West Bengal - 700071

More Details

Brands

FAQs about ITC share

- 1. What is ITC share price and what are the returns for ITC share?ITC share price was Rs 430.30 as on 13 Jun, 2024, 03:31 PM IST. ITC share price was down by 0.47% based on previous share price of Rs 433. ITC share price trend:

- Last 1 Month: ITC share price moved down by 0.36%

- Last 3 Months: ITC share price moved up by 1.86%

- Last 12 Months: ITC share price moved down 3.39%

- Last 3 Years: ITC Share price moved up by 106.97%

- 2. Who are peers to compare ITC share price?Top 3 Peers for ITC are Godfrey Phillips India Ltd., VST Industries Ltd. and Golden Tobacco Ltd.

- 3. What are the key metrics to analyse ITC Share Price?Key Metrics for ITC are:

- PE Ratio of ITC is 26.38

- Price/Sales ratio of ITC is 7.55

- Price to Book ratio of ITC is 7.21

- 4. What are the returns for ITC share?Return Performance of ITC Shares:

- 1 Week: ITC share price moved down by 1.17%

- 1 Month: ITC share price moved down by 0.36%

- 3 Month: ITC share price moved up by 1.86%

- 6 Month: ITC share price moved down by 5.56%

- 5. Who owns ITC?,DII and FII owns 31.26 and 43.26 shares of ITC

- Domestic Institutional Investors holding has gone up from 31.26 (31 Dec 2023) to 33.14 (31 Mar 2024)

- Foreign Institutional Investors holding have gone down from 43.26 (31 Dec 2023) to 40.95 (31 Mar 2024)

- Other investor holding has gone up from 25.48 (31 Dec 2023) to 25.9 (31 Mar 2024)

- 6. What is the PE & PB ratio of ITC?The PE ratio of ITC stands at 26.38, while the PB ratio is 7.21.

- 7. What are the ITC quarterly results?On Consoldiated basis, ITC reported a total income and loss of Rs 18606.53 Cr and Rs 5120.55 respectively for quarter ending 2024-03-31. Total Income and profit for the year ending 2024-03-31 was Rs 73608.84 Cr and Rs 20458.78 Cr.

- 8. What dividend is ITC giving?An equity Final dividend of Rs 7.5 per share was declared by ITC Ltd. on 23 May 2024. So, company has declared a dividend of 750% on face value of Rs 1 per share. The ex dividend date was 04 Jun 2024.

- 9. What is the market cap of ITC?Within the Tobacco sector, ITC stock has a market cap rank of 1. ITC has a market cap of Rs 5,39,715 Cr.

- 10. What is ITC's 52 week high / low?In last 52 weeks ITC share had a high price of Rs 499.70 and low price of Rs 399.35

- 11. Who's the chairman of ITC?Sanjiv Puri is the Chairman & Managing Director of ITC

- 12. Should I buy, sell or hold ITC?As per Refinitiv (erstwhile Thomson Reuters), overall mean recommendation by 35 analysts for ITC stock is to Buy. Recommendation breakup is as follows

- 13 analysts are recommending Strong Buy

- 19 analysts are recommending to Buy

- 3 analysts are recommending to Hold

- 13. What is the CAGR of ITC?The CAGR of ITC is 9.52.

Trending in Markets

DATA SOURCES: TickerPlant (for live BSE/NSE quotes service) and Dion Global Solutions Ltd. (for corporate data, historical price & volume, F&O data). Sensex & BSE Quotes and Nifty & NSE Quotes are real-time and licensed from BSE and NSE respectively. All timestamps are reflected in IST (Indian Standard Time).

DISCLAIMER: Any and all content on this website including tools/analysis is provided to you only for convenience and on an “as-is, as- available” basis without representation and warranties of any kind. The content and any output of such tools/analysis is for informational purposes only and should not be relied upon or construed as an investment advice or guarantee for any specific performance/returns advice or considered as recommendation for the purchase or sale of any security or investment. You are advised to exercise caution, discretion and independent judgment with regards to the same and seek advice from professionals and certified experts before taking any decisions.

By using this site, you agree to the Terms of Service and Privacy Policy.