- News

- Business News

- India Business News

- NPS vs PPF Calculator: Is National Pension System Better Than Public Provident Fund To Become A Crorepati? Explained

NPS vs PPF Calculator: Is National Pension System Better Than Public Provident Fund To Become A Crorepati? Explained

NPS vs PPF Calculator: Is NPS Better Than PPF To Become A Crorepati?

NPS vs PPF Calculator: Which is a better investment bet for retirement planning - National Pension System or Public Provident Fund? If accumulating a corpus of over Rs 1 crore is your aim, then both NPS and PPF are seen to be good investments, but which one should you pick? What are the minimum and maximum investment limits for NPS and PPF and what are returns? How do the tax benefits of NPS and PPF compare? We take a look at some PPF and NPS calculations, average returns and other important aspects to compare the two schemes: (AI image)

NPS vs PPF: Minimum & Maximum Investment Amount

NPS vs PPF: In NPS the minimum annual investment is Rs 6,000, while there is no upper limit on investments. On the other hand for PPF accounts, the minimum annual investment is Rs 500 and the maximum you can invest in a year is Rs 1.5 lakh. (AI image)

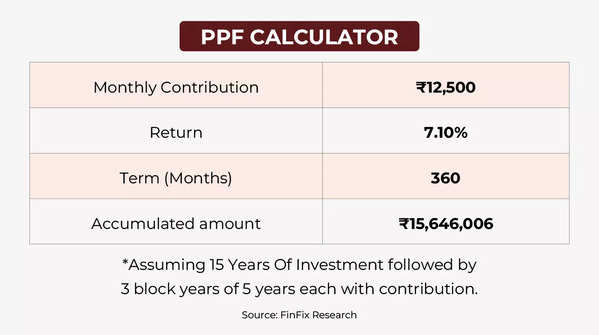

PPF Calculator

Public Provident Fund Calculator: Assuming that a person starts investing in PPF at the age of 30 and continues to do so till the age of 60, that is for a period of 30 years (15 years minimum lock in plus 3 block extensions of 5 years) or 360 months, then a monthly contribution of Rs 12,500 or an annual contribution of Rs 1.5 lakh with an interest rate of 7.1% will result in a corpus of over Rs 1.5 crore. (AI image)

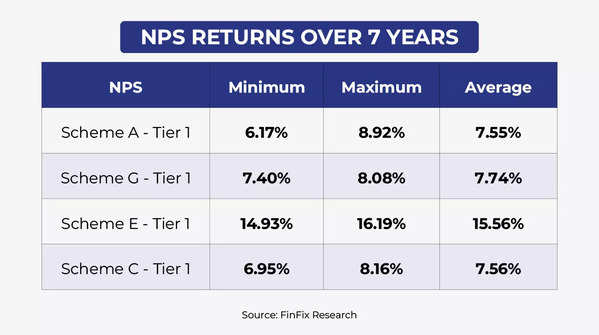

NPS Average Returns

National Pension System Returns: There are four Asset Classes - Asset class E - Equity and related instruments, Asset class C - Corporate debt and related instruments, Asset class G - Government Bonds and related instruments and Asset Class A - Alternative Investment Funds including instruments like CMBS, MBS, REITS, AIFs, Invlts etc. Here we are looking at the average returns over 7 years from Scheme A, Scheme G, Scheme E and Scheme C, as provided by FinFix Research. The average return from Scheme A is at 7.55%, for Scheme G is 7.74%, for Scheme E is 15.56% and for Scheme C it stands at 7.56%. (AI image)

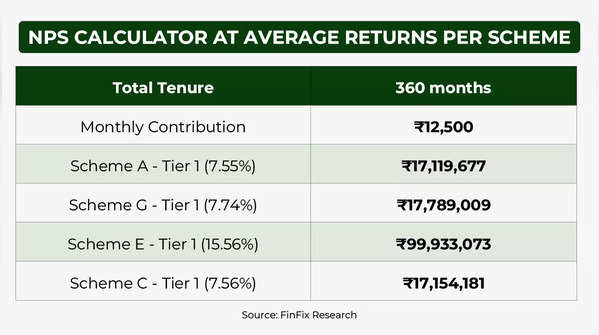

NPS Calculator

National Pension System Calculator: According to FinFix Research, with a monthly contribution of Rs 12,500/- or an annual contribution of Rs 1.5 lakh, over a period of 30 years you will get a corpus of over 1.7 crore from Scheme A, Scheme G and Scheme C. However, if you are not risk averse and invest in Scheme E, you will get over Rs 9.9 crore at the average return of 15.56%. It’s important to remember that these calculations are based on average returns over a 7 year period. With a 30 year time horizon for investment in mind, the returns are bound to differ. (AI image)

NPS vs PPF Tax Benefits

NPS vs PPF tax benefits: The maximum amount of yearly investment in PPF, that is Rs 1.5 lakh, is exempt from tax under Section 80C. Additionally, PPF is a EEE product, which means that the interest earned and the maturity proceeds are fully tax exempt. In case of NPS, tax exemptions up to Rs 2 lakh (1.5 lakh + Rs 50,000) are available. At the time of maturity, 60% of total corpus is tax exempt, the remaining 40% invested in annuity is also exempt, but income earned from the annuity is taxable depending on your tax slab. (AI image)

NPS vs PPF: Liquidity

NPS Vs PPF: The liquidity in both NPS and PPF is low because both have a long lock-in period. While PPF is a risk-free option with its sovereign guarantee, NPS risks depend on the scheme you pick, with the equity option being higher risk. (AI image)

NPS vs PPF: Eligibility

NPS vs PPF: An Indian citizen in the age group of 18 to 70 years can open an NPS account, whereas any citizen above 18 years can open a PPF account. However while NRIs can open NPS accounts, they can’t opt for PPF. (AI image)

NPS vs PPF Flexibility

NPS vs PPF: In NPS, you have the freedom to choose your investment portfolio, a flexibility not available in PPF. NPS has evolved to offer even greater flexibility, allowing investors to adjust their asset allocation up to four times a year. Importantly, switching between asset classes or changing pension fund managers has no tax implications. (AI image)

NPS vs PPF: Partial Withdrawal Rules

NPS vs PPF: For NPS partial withdrawal is allowed only after 10 years. To exit NPS before retirement, 80% of the corpus has to be used in buying an annuity plan. In case of PPF, partial withdrawals are allowed from 7th year onwards under specific conditions. (AI image)