Prime rate: Difference between revisions

| Line 26: | Line 26: | ||

* [http://www.moneycafe.com/library/prime.htm Money Cafe Prime Rate including historical data] |

* [http://www.moneycafe.com/library/prime.htm Money Cafe Prime Rate including historical data] |

||

* [http://research.stlouisfed.org/fred2/data/PRIME.txt Prime Rate Changes History: Dates and Rates] - Fed prime rate, not WSJ prime rate |

* [http://research.stlouisfed.org/fred2/data/PRIME.txt Prime Rate Changes History: Dates and Rates] - Fed prime rate, not WSJ prime rate |

||

* [http://www.fxstreet.com/fundamental/interest-rates-table/] World Interest Rates |

|||

[[Category:Banking]] |

[[Category:Banking]] |

||

Revision as of 14:19, 6 March 2008

The examples and perspective in this article may not represent a worldwide view of the subject. |

Prime rate is a term applied in many countries to a reference interest rate used by banks. The term originally indicated the rate at which banks lent to their most favored customers, though this is no longer always the case. Some variable interest rates may be expressed as a percentage above or below prime rate.

Use in different banking systems

USA and Canada

Historically, in North American banking, the prime rate was the interest rate although this is no longer the case. The prime rate varies little among banks, and adjustments are generally made by banks at the same time, although this does not happen with great frequency. The prime rate is currently 6.00% in the United States (since January 30, 2008), according to data published by The Wall Street Journal Online and the Federal Reserve Bank.[1] Canadian prime rate is currently 5.25% according to data published by Bank of Canada.

Overview

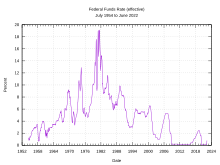

In the US, the prime rate runs approximately 300 basis points (or 3 percentage points) above the federal funds rate, the interest rate that banks charge to each other for overnight loans made to fulfill reserve funding requirements. (The Federal funds rate plus a much smaller increment is frequently used for lending to the most creditworthy borrowers today, as is LIBOR, the London Interbank Offered Rate.) The Federal Open Market Committee (FOMC) meets eight times per year wherein they set a target for the federal funds rate. Other rates, including the Prime Rate, derive from this base rate.

The most commonly recognized prime rate index is the Wall Street Journal Prime Rate (WSJ Prime Rate), published in the Wall Street Journal. Unlike other indexed rates, the prime rate does not change on a regular basis; rather, it changes whenever banks need to alter the rates at which borrowers obtain funds. The WSJ defines the prime rate as "The base rate on corporate loans posted by at least 75% of the nation's 30 largest banks."

When 23 out of 30 of the United States' largest banks change their prime rate, the WSJ prints a composite prime rate change.

Uses

The Prime Rate is used often as an index in calculating rate changes to adjustable rate mortgages (ARM) and other variable rate short term loans. It is used in the calculation of some private student loans. Many credit cards and home equity lines of credit with variable interest rates have their rate specified as the prime rate (index) plus a fixed value commonly called the spread.

References

- ^ "Federal Reserve Statistical Data". Federal Reserve.

External links

- PrimeRateValue.com - View the current Prime Rate

- Money Cafe Prime Rate including historical data

- Prime Rate Changes History: Dates and Rates - Fed prime rate, not WSJ prime rate

- [1] World Interest Rates