2000s United States housing market correction: Difference between revisions

m WikiCleaner 0.71 - Repairing link to disambiguation page - You can help! |

mNo edit summary |

||

| Line 1: | Line 1: | ||

A '''United States housing market correction''' is a [[Market trends|market correction]] or "bubble bursting" of a [[United States housing bubble]]; the most recent one started in [[2005]]. |

|||

A [[real estate bubble]] is a type of [[economic bubble]] that occurs periodically in local or global [[real estate]] markets.A [[housing bubble]] is characterized by rapid increases in the [[real estate appraisal|valuations]] of [[real property]] such as [[House|housing]] until unsustainable levels are reached relative to incomes, [[Housing bubble#Housing ownership and rent measures|price-to-rent ratios]], and other economic indicators of affordability. This in turn is followed by a market correction in which decreases in home prices can result in many owners holding [[negative equity]], a [[mortgage]] debt higher than the value of the property. |

A [[real estate bubble]] is a type of [[economic bubble]] that occurs periodically in local or global [[real estate]] markets.A [[housing bubble]] is characterized by rapid increases in the [[real estate appraisal|valuations]] of [[real property]] such as [[House|housing]] until unsustainable levels are reached relative to incomes, [[Housing bubble#Housing ownership and rent measures|price-to-rent ratios]], and other economic indicators of affordability. This in turn is followed by a market correction in which decreases in home prices can result in many owners holding [[negative equity]], a [[mortgage]] debt higher than the value of the property. |

||

Revision as of 05:11, 21 March 2008

A United States housing market correction is a market correction or "bubble bursting" of a United States housing bubble; the most recent one started in 2005. A real estate bubble is a type of economic bubble that occurs periodically in local or global real estate markets.A housing bubble is characterized by rapid increases in the valuations of real property such as housing until unsustainable levels are reached relative to incomes, price-to-rent ratios, and other economic indicators of affordability. This in turn is followed by a market correction in which decreases in home prices can result in many owners holding negative equity, a mortgage debt higher than the value of the property.

Timeline

Timeline 1985–ongoing

- 1985–1991: Savings and Loan crisis

- 1991–1997: Flat Housing prices

- 1991: US recession, new construction prices fall, but above inflationary growth allows them to return by 1997 in real terms.

- 1997: Mortgage denial rate of 29 percent for conventional home purchase loans [3]

- September 23, 1998: New York Fed brings together consortium of investors to bail out Long-Term Capital Management

- 1998: Inflation-adjusted home price appreciation exceeds 10%/year in most West Coast metropolitan areas[4]

- 1999: Gramm-Leach-Bliley Act, repealed the Glass-Steagall Act of 1933, allowed commercial and investment banks to consolidate.

- 1995–2001: Dot-com bubble

- March 10, 2000: Dot-com bubble collapse NASDAQ Composite index peaked

- 2000–2003: Early 2000s recession (exact time varies by country)

- 2001–2005: United States housing bubble (part of the world housing bubble)

- 2001: US Federal Reserve lowers Federal funds rate 11 times, from 6.5% to 1.75%.[5]

- 2002–2003: Mortgage denial rate of 14 percent for conventional home purchase loans, half of 1997 [6]

- 2002: Annual home price appreciation of 10% or more in California, Florida, and most Northeastern states.

- 2004: U.S. homeownership rate peaked with an all time high of 69.2 percent. [7]

- 2004–2005: Arizona, California, Florida, Hawaii, and Nevada record price increases in excess of 25% per year.

- 2005–ongoing: United States housing market correction ("bubble bursting")

- 2005: Boom ended August 2005. The booming housing market halted abruptly for many parts of the U.S. in late summer of 2005.

- 2006: Continued market slowdown. Prices are flat, home sales fall, resulting in inventory buildup. U.S. Home Construction Index is down over 40% as of mid-August 2006 compared to a year earlier.

- 2007: Year-to-year decreases in both U.S. home sales and home prices accelerates rather than bottoming out, with U.S. Treasury secretary Paulson calling the "the housing decline ... the most significant risk to our economy."[8]

Timeline 2007

- 2007: Home sales continue to fall. The plunge in existing-home sales is the steepest since 1989. In Q1/2007, S&P/Case-Shiller house price index records first year-over-year decline in nationwide house prices since 1991.[9] The subprime mortgage industry collapses, and a surge of foreclosure activity (twice as bad as 2006[10]) and rising interest rates threaten to depress prices further as problems in the subprime markets spread to the near-prime and prime mortgage markets.[11] The U.S. Treasury secretary calls the "ongoing housing correction" "the most significant risk to our economy."[8]

- February–ongoing: 2007 Subprime mortgage financial crisis Subprime industry collapse; more than 25 subprime lenders declaring bankruptcy, announcing significant losses, or putting themselves up for sale.

- April 2: New Century Financial, largest U.S. subprime lender, files for chapter 11 bankruptcy.

- August: worldwide "credit crunch" as subprime mortgage backed securities are discovered in portfolios of banks and hedge funds around the world, from BNP Paribas to Bank of China. Many lenders stop offering home equity loans and "stated income" loans. Federal Reserve injects about $100B into the money supply for banks to borrow at a low rate.

- August 6: American Home Mortgage files for chapter 11 bankruptcy.

- August 7: Democratic presidential front-runner Hillary Clinton proposes a $1 billion bailout fund to help homeowners at risk for foreclosure.[12]

- August 16: Countrywide Financial Corporation, the biggest U.S. mortgage lender, narrowly avoids bankruptcy by taking out an emergency loan of $11 billion from a group of banks.[13]

- August 17: Federal Reserve lowers the discount rate by 50 basis points to 5.75% from 6.25%.

- August 31: President Bush announces a limited bailout of U.S. homeowners unable to pay the rising costs of their debts.[14]Ameriquest, once the largest subprime lender in the U.S., goes out of business;[15]

- September 1–3: Fed Economic Symposium in Jackson Hole, WY addressed the housing recession that jeopardizes U.S. growth. Several critics argued that the Fed should use regulation and interest rates to prevent asset-price bubbles,[16] blamed former Fed-chairman Alan Greenspan's low interest rate policies for stoking the U.S. housing boom and subsequent bust,[17][18], and Yale University economist Robert Shiller warned of possible home price declines of 50 percent.[19]

- September 17: Former Fed Chairman Alan Greenspan said "we had a bubble in housing"[20][21] and warns of "large double digit declines" in home values "larger than most people expect."

- September 18: The Fed lowers interest rates by half a percent (50 basis points) to 4.75% in an attempt to limit damage to the economy from the housing and credit crises.[22]

- September 28: Television finance personality Jim Cramer warns Americans on The Today Show, "don't you dare buy a home—you'll lose money," causing a furor among realtors.[23]

- September 30: Affected by the spiraling mortgage and credit crises, Internet banking pioneer NetBank goes bankrupt, the first FDIC-insured bank to fail since the savings and loan crisis,[24], and the Swiss bank UBS announced that it lost US$690 million in the third quarter.[25]

- September 30:Prices fell 4.9 percent from September 2006 in 20 large metropolitan areas, according to Standard & Poor’s/Case-Shiller indexes. This is the 9th straight month priced have fallen.[26]

- October 10: US Government and private industry created Hope Now Alliance to help some sub-prime borrowers. [27]

- October 15–17: A consortium of U.S. banks backed by the U.S. government announced a "super fund" or super-SIV" of $100 billion to purchase mortgage backed securities whose mark-to-market value plummeted in the subprime collapse.[28] Fed chairman Ben Bernanke expressed alarm about the dangers posed by the bursting housing bubble;)[citation needed] Secretary of the Treasury Paulson said "the housing decline is still unfolding and I view it as the most significant risk to our economy. … The longer housing prices remain stagnant or fall, the greater the penalty to our future economic growth."[8]

- October 31: Federal Reserve lowers the federal funds rate by 25 basis points to 4.5 percent and the discount window rate by 25 basis points to 5 percent.

- October 31: Prices fell 6.1 percent from October 2006 in 20 large metropolitan areas, according to Standard & Poor’s/Case-Shiller indexes. This is the 10th straight month priced have fallen.[26]

- October 31: The Department of Housing and Urban Development adopted new regulations banning so-called "seller-funded" downpayment programs.[29]

- November 1: Federal Reserve injects $41B into the money supply for banks to borrow at a low rate. The largest single expansion by the Fed since $50.35B on September 19, 2001.

- December 6: President Bush announced a plan to voluntarily freeze the mortgages of a limited number of mortgage debtors holding ARMs for 5 years. The plan run by the Hope Now Alliance. Its phone number is 1-888-995-HOPE.[30] Some experts criticized the plan as "a Band-Aid when the patient needs major surgery"[31], a "teaser-freezer",[32] and a "bail-out".[33][34]

- December 11: Federal Reserve lowers the federal funds rate by 25 basis points to 4.25 percent and the discount window rate by 25 basis points to 4.75 percent.

- December 12: Federal Reserve injects $40B into the money supply for banks to borrow at a low rate and coordinates such efforts with central banks from Canada, United Kingdom, Switzerland and European Union.

- December 24: A consortium of banks officially abandons the U.S. government-supported "super-SIV" mortgage crisis bail-out plan announced in mid-October,[35] citing a lack of demand for the risky mortgage products on which the plan was based, and widespread criticism that the fund was a flawed idea that would have been difficult to execute.[35]

- December 26: Standard & Poor’s/Case-Shiller indexes of housing prices in 20 large metropolitan areas for October 2007 is released showing that for the 10th straight month priced have fallen, but most worrying is that the decline in home prices accelerated and spread to more regions of the country in October. "Since their peak in July 2006, home prices in the 20 regions have dropped 6.6 percent.[26] Economists' predictions of the total amount of home price declines from the bubble's peak range from moderate 10–15 percent to larger 30–50 percent price declines in some areas.[19][26]

- December 28: The U.S. Commerce Department reported that November 2007 new home sales were down 9 pct to a seasonally-adjusted annual rate of 647,000 the lowest sales rate since April 1995.[36]

- 2007: Home sales continue to fall. The plunge in existing-home sales is the steepest since 1989. In Q1/2007, S&P/Case-Shiller house price index records first year-over-year decline in nationwide house prices since 1991.[9] The subprime mortgage industry collapses, and a surge of foreclosure activity (twice as bad as 2006[10]) and rising interest rates threaten to depress prices further as problems in the subprime markets spread to the near-prime and prime mortgage markets.[11] The U.S. Treasury secretary calls the "ongoing housing correction" "the most significant risk to our economy."[8]

Market correction predictions

| |

|

Based on the historic trends in valuations of U.S. housing,[39][40] many economists and business writers have predicted a market correction, ranging from a few percentage points, to 50% or more from peak values in some markets,[41][42][43][44][45] and, in spite of the fact that this cooling has not affected all areas of the U.S., some have warned that it could and that the correction would be "nasty" and "severe".[46][47] Chief economist Mark Zandi of the research firm Moody's Economy.com predicted a "crash" of double-digit depreciation in some U.S. cities by 2007–2009.[48][49]

Bubble bursts

The booming housing market appears to have halted abruptly for many parts of the U.S. in late summer of 2005, and as of summer 2006, several markets are facing the issues of ballooning inventories, falling prices, and sharply reduced sales volumes. In August 2006, Barron's magazine warned, "a housing crisis approaches", and noted that the median price of new homes has dropped almost 3% since January 2006, that new-home inventories hit a record in April and remain near all-time highs, that existing-home inventories are 39% higher than they were just one year ago, and that sales are down more than 10%, and predicts that "the national median price of housing will probably fall by close to 30% in the next three years … simple reversion to the mean."[44] Fortune magazine labelled many previously strong housing markets as "Dead Zones;"[50] other areas are classified as "Danger Zones" and "Safe Havens." Fortune also dispelled "four myths about the future of home prices."[51] In Boston, year-over-year prices are dropping,[52] sales are falling, inventory is increasing, foreclosures are up,[53][54] and the correction in Massachusetts has been called a "hard landing".[55] The previously booming[56] housing markets in Washington DC, San Diego CA, Phoenix AZ, and other cities have stalled as well.[57][58] Searching the Arizona Regional Multiple Listing Service (ARMLS) shows that in summer 2006, the for-sale housing inventory in Phoenix has grown to over 50,000 homes, of which nearly half are vacant (see graphic).[59] Several home builders have revised their forecasts sharply downward during summer 2006, e.g., D.R. Horton cut its yearly earnings forecast by one-third in July 2006,[60] the value of luxury home builder Toll Brothers' stock fell 50% between August 2005 and August 2006,[61] and the Dow Jones U.S. Home Construction Index was down over 40% as of mid-August 2006.[62] CEO Robert Toll of Toll Brothers explained, "builders that built speculative homes are trying to move them by offering large incentives and discounts; and some anxious buyers are canceling contracts for homes already being built."[63] Homebuilder Kara Homes, known for their construction of "McMansions", announced on 13 September 2006 the "two most profitable quarters in the history of our company", yet filed for bankruptcy protection less than one month later on 6 October.[64] Six months later on 10 April 2007, Kara Homes sold unfinished developments, causing prospective buyers from the previous year to lose deposits, some of whom put down more than $100,000.[65]

As the housing market began to soften in winter 2005 through summer 2006,[66][67] NAR chief economist David Lereah predicted a "soft landing" for the market.[68] However, based on unprecedented rises in inventory and a sharply slowing market throughout 2006, Leslie Appleton-Young, the chief economist of the California Association of Realtors, said that she is not comfortable with the mild term "soft landing" to describe what is actually happening in California's real estate market.[69] The Financial Times warned of the impact on the U.S. economy of the "hard edge" in the "soft landing" scenario, saying "A slowdown in these red-hot markets is inevitable. It may be gentle, but it is impossible to rule out a collapse of sentiment and of prices. … If housing wealth stops rising … the effect on the world's economy could be depressing indeed."[70] "It would be difficult to characterize the position of home builders as other than in a hard landing", said Robert Toll, CEO of Toll Brothers.[71] Angelo Mozilo, CEO of Countrywide Financial, said "I've never seen a soft-landing in 53 years, so we have a ways to go before this levels out. I have to prepare the company for the worst that can happen."[72] Following these reports, Lereah admitted that "he expects home prices to come down 5% nationally", and said that some cities in Florida and California could have "hard landings."[73] National home sales and prices both fell dramatically again in March 2007 according to NAR data, with sales down 13% to 482,000 from the peak of 554,000 in March 2006 and the national median price falling nearly 6% to $217,000 from the peak of $230,200 in July 2006 . The plunge in existing-home sales is the steepest since 1989 .[74] The new home market is also suffering. The biggest year over year drop in median home prices since 1970 occurred in April of 2007. Median prices for new homes fell 10.9 percent according to the Commerce Department.[75]

Based on slumping sales and prices in August 2006, economist Nouriel Roubini warned that the housing sector is in "free fall" and will derail the rest of the economy, causing a recession in 2007.[76] Joseph Stiglitz, winner of the Nobel Prize in economics in 2001, agreed, saying that the U.S. may enter a recession as house prices decline.[77] The extent to which the economic slowdown, or possible recession, will last depends in large part on the resiliency of the U.S. consumer spending, which now makes up approximately 70% of the US$13.7 trillion economy. The evaporation of the wealth effect amid the current housing downturn could negatively affect the consumer confidence and provide further headwind for the U.S. economy and that of the rest of the world. The World Bank recently lowered the global economic growth rate due to a housing slowdown in the United States, but it does not believe that the U.S. housing malaise will further spread to the rest of the world. The Fed chairman Benjamin Bernanke said in October 2006 that there is currently a "substantial correction" going on in the housing market and that the decline of residential housing construction is one of the "major drags that is causing the economy to slow"; he predicted that the correcting market will decrease U.S. economic growth by about one percent in the second half of 2006 and remain a drag on expansion into 2007.[78]

Others speculate on the negative impact of the retirement of the Baby Boom generation and the relative cost to rent on the declining housing market.[79][80] In many parts of the United States, it is significantly cheaper to rent the same property than to purchase it; the national median mortgage payment is $1,687 per month, nearly twice the median rent payment of $868 per month.[81]

Subprime mortgage industry collapse

In March 2007, the United States' subprime mortgage industry collapsed due to higher-than-expected home foreclosure rates, with more than 25 subprime lenders declaring bankruptcy, announcing significant losses, or putting themselves up for sale.[82] The stock of the country's largest subprime lender, New Century Financial, plunged 84% amid Justice Department investigations, before ultimately filing for Chapter 11 bankruptcy on 2 April 2007 with liabilities exceeding $100 million.[83] The manager of the world's largest bond fund PIMCO, warned in June 2007 that the subprime mortgage crisis was not an isolated event and will eventually take a toll on the economy and whose ultimate impact will be on the impaired prices of homes.[84] Bill Gross, "a most reputable financial guru", sarcastically and ominously criticized the credit ratings of the mortgage-based CDOs now facing collapse:

AAA? You were wooed Mr. Moody’s and Mr. Poor’s, by the makeup, those six-inch hooker heels, and a “tramp stamp.” Many of these good looking girls are not high-class assets worth 100 cents on the dollar. … And sorry Ben, but derivatives are a two-edged sword. Yes, they diversify risk and direct it away from the banking system into the eventual hands of unknown buyers, but they multiply leverage like the Andromeda strain. When interest rates go up, the Petri dish turns from a benign experiment in financial engineering to a destructive virus because the cost of that leverage ultimately reduces the price of assets. Houses anyone? … AAAs? [T]he point is that there are hundreds of billions of dollars of this toxic waste and whether or not they’re in CDOs or Bear Stearns hedge funds matters only to the extent of the timing of the unwind. [T]he subprime crisis is not an isolated event and it won’t be contained by a few days of headlines in The New York Times … The flaw lies in the homes that were financed with cheap and in some cases gratuitous money in 2004, 2005, and 2006. Because while the Bear hedge funds are now primarily history, those millions and millions of homes are not. They’re not going anywhere … except for their mortgages that is. Mortgage payments are going up, up, and up … and so are delinquencies and defaults. A recent research piece by Bank of America estimates that approximately $500 billion of adjustable rate mortgages are scheduled to reset skyward in 2007 by an average of over 200 basis points. 2008 holds even more surprises with nearly $700 billion ARMS subject to reset, nearly ¾ of which are subprimes … This problem—aided and abetted by Wall Street—ultimately resides in America’s heartland, with millions and millions of overpriced homes and asset-backed collateral with a different address—Main Street.[85]

Financial analysts predict that the subprime mortgage collapse will result in earnings reductions for large Wall Street investment banks trading in mortgage-backed securities, especially Bear Stearns, Lehman Brothers, Goldman Sachs, Merrill Lynch, and Morgan Stanley.[82] The solvency of two troubled hedge funds managed by Bear Stearns was imperliled in June 2007 after Merrill Lynch sold off assets seized from the funds and three other banks closed out their positions with them. The Bear Stearns funds once had over $20 billion of assets, but lost billions of dollars on securities backed by subprime mortgages.[86] H&R Block reported that it made a quarterly loss of $677 million on discontinued operations, which included subprime lender Option One, as well as writedowns, loss provisions on mortgage loans and the lower prices available for mortgages in the secondary market for mortgages. The units net asset value fell 21% to $1.1 billion as of April 30 2007.[87] The head of the mortgage industry consulting firm Wakefield Co. warned, "This is going to be a meltdown of unparalleled proportions. Billions will be lost." Bear Stearns pledged up to US$3.2 billion in loans on 22 June 2007 to bail out one of its hedge funds that was collapsing because of bad bets on subprime mortgages.[88] Peter Schiff, president of Euro Pacific Capital, argued that if the bonds in the Bear Stearns funds were auctioned on the open market, much weaker values would be plainly revealed. Schiff added, "This would force other hedge funds to similarly mark down the value of their holdings. Is it any wonder that Wall street is pulling out the stops to avoid such a catastrophe? … Their true weakness will finally reveal the abyss into which the housing market is about to plummet."[89] The New York Times report connects this hedge fund crisis with lax lending standards: "The crisis this week from the near collapse of two hedge funds managed by Bear Stearns stems directly from the slumping housing market and the fallout from loose lending practices that showered money on people with weak, or subprime, credit, leaving many of them struggling to stay in their homes."[88]

In the wake of the mortgage industry meltdown, Senator Chris Dodd, Chairman of the Banking Committee held hearings in March 2007 and asked executives from the top five subprime mortgage companies to testify and explain their lending practices; Dodd said, "predatory lending practices" endangered the home ownership for millions of people.[90] Moreover, Democratic senators such as Senator Charles Schumer of New York are already proposing a federal government bailout of subprime borrowers in order to save homeowners from losing their residences. Opponents of such proposal assert that government bailout of subprime borrowers is not in the best interests of the U.S. economy because it will simply set a bad precedent, create a moral hazard, and worsen the speculation problem in the housing market. Lou Ranieri of Salomon Brothers, inventor the mortgage-backed securities market in the 1970s, warned of the future impact of mortgage defaults: "This is the leading edge of the storm. … If you think this is bad, imagine what it's going to be like in the middle of the crisis." In his opinion, more than $100 billion of home loans are likely to default when the problems in the subprime industry appear in the prime mortgage markets.[91] Fed Chairman Alan Greenspan praised the rise of the subprime mortgage industry and the tools with which it uses to assess credit-worthiness in an April 2005 speech:

Innovation has brought about a multitude of new products, such as subprime loans and niche credit programs for immigrants. Such developments are representative of the market responses that have driven the financial services industry throughout the history of our country … With these advances in technology, lenders have taken advantage of credit-scoring models and other techniques for efficiently extending credit to a broader spectrum of consumers. … Where once more-marginal applicants would simply have been denied credit, lenders are now able to quite efficiently judge the risk posed by individual applicants and to price that risk appropriately. These improvements have led to rapid growth in subprime mortgage lending; indeed, today subprime mortgages account for roughly 10 percent of the number of all mortgages outstanding, up from just 1 or 2 percent in the early 1990s.[92]

Because of these remarks, along with his encouragement for the use of adjustable-rate mortgages, Greenspan has been criticized for his role in the rise of the housing bubble and the subsequent problems in the mortgage industry.[93][94]

Alt-A mortgage problems

Subprime and Alt-A (including "stated income" or "liar's loans" which are basically loans made to home buyers without the verification of borrowers' incomes; home buyers tend to overstate their incomes in order to get the loan amounts they desire to purchase their dream homes, thus called the "liar's loans") loans account for about 21 percent of loans outstanding and 39 percent of mortgages made in 2006.[95] In April 2007, financial problems similar to the subprime mortgages began to appear with Alt-A loans made to homeowners who were thought to be less risky.[95] American Home Mortgage said that it would earn less and pay out a smaller dividend to its shareholders because it was being asked to buy back and write down the value of Alt-A loans made to borrowers with decent credit; causing company stocks to tumble 15.2 percent. The delinquency rate for Alt-A mortgages has been rising in 2007.[95] In June 2007, Standard & Poor's warned that U.S. homeowners with good credit are increasingly falling behind on mortgage payments, an indication that lenders have been offering higher risk loans outside the subprime market; they said that rising late payments and defaults on Alt-A mortgages made in 2006 are "disconcerting" and delinquent borrowers appear to be "finding it increasingly difficult to refinance" or catch up on their payments.[95] Late payments of at least 90 days and defaults on 2006 Alt-A mortgages have increased to 4.21 percent, up from 1.59 percent for 2005 mortgages and 0.81 percent for 2004, indicating that "subprime carnage is now spreading to near prime mortgages."[85]

Foreclosure rates increase

The 30-year mortgage rates increased by more than a half a percentage point to 6.74 percent during May–June 2007 [96], affecting borrowers with the best credit just as a crackdown in subprime lending standards limits the pool of qualified buyers. The national median home price is poised for its first annual decline since the Great Depression, and the NAR reported that supply of unsold homes is at a record 4.2 million. Goldman Sachs and Bear Stearns, respectively the world's largest securities firm and largest underwriter of mortgage-backed securities in 2006, said in June 2007 that rising foreclosures reduced their earnings and the loss of billions from bad investments in the subprime market imperiled the solvency of several hedge funds. Mark Kiesel, executive vice president of a California-based Pacific Investment Management Co. said,

It's a blood bath. … We're talking about a two- to three-year downturn that will take a whole host of characters with it, from job creation to consumer confidence. Eventually it will take the stock market and corporate profit.[97]

According to Donald Burnette of Knight Mortgage Company in Florida, one of the states hit hardest by the bursting housing bubble, the corresponding loss in equity from the drop in housing values has caused new problems. "It is keeping even borrowers with good credit and solid resourses from refinancing to better terms. Even with tighter restrictions on ALT A and the disappearance of most subprime programs, there are many borrowers who would qualify as "A" borrowers who can't qualify to refinance as they no longer have the equity in their homes that they had in 2005 or 2006. They will have to wait for the market to recover to refinance to the terms they deserve."

See also

- 2007 Subprime mortgage financial crisis

- Subprime lending

- Mortgage loan

- Real estate bubble

- List of entities involved in 2007 finance crises

- The world housing bubble

- Economic bubble

- dot-com bubble

- Real estate pricing

- Real estate appraisal

- Real estate economics

- Real estate trends

- Creative Real Estate Investing

- Deed in lieu of foreclosure

- Foreclosure consultant

References and notes

Note:Sources that are blank here can be found here. This is a problem that is not yet fixed.

- ^ Nancy Trejos. "Existing-Home Sales Fall Steeply".

- ^ "Housing Finance in Developed Countries An International Comparison of Efficiency, United States" (PDF). Fannie Mae. 1992.

- ^ "Federal Financial Institutions Examination Council Press Releases". Federal Financial Institutions Examination Council. July 26, 2004.

- ^ Robert J. Shiller. "Understanding Recent Trends in House Prices and Home Ownership" (PDF).

- ^ "Intended federal funds rate, Change and level, 1990 to present".

- ^ "Federal Financial Institutions Examination Council Press Releases". Federal Financial Institutions Examination Council. July 26, 2004.

- ^ "CENSUS BUREAU REPORTS ON RESIDENTIAL VACANCIES AND HOMEOWNERSHIP" (PDF). U.S. Census Bureau. October 26, 2007.

- ^ a b c "Housing woes take bigger toll on economy than expected: Paulson". AFP. 17 October 2007.

{{cite news}}: Check date values in:|date=(help); Italic or bold markup not allowed in:|publisher=(help) - ^ "S&P/Case-Shiller house price index".

- ^ Huffington Post quotes the FDIC's Quarterly Banking Profile: “The next sign of mortgage related financial problems came out in the FDIC's Quarterly Banking Profile. The report noted on page 1, "Reflecting an erosion in asset quality, provisions for loan losses totaled $9.2 billion in the first quarter [of 2007], an increase of $3.2 billion (54.6%) from a year earlier." The reason for the loan-loss provision increases was an across the board increase in delinquencies and charge offs which increased 48.4% from year ago levels. The report noted on page 2 that "Net charge-offs of 1-4 family residential mortgage loans were up by $268 million (93.2%) [from year ago levels]."”

- ^ "Lender Sees Mortgage Woes for 'Good' Risks". New York Times. 25 July 2007.

{{cite news}}: Check date values in:|date=(help) - ^ "Clinton proposes crackdown in mortgage market". August 7, 2007.

- ^ Countrywide Taps $11.5 Billion Credit Line From Banks

- ^ "Bush Moves to Aid Homeowners". Wall Street Journal. 31 August 2007.

{{cite news}}: Check date values in:|date=(help) - ^ "Ameriquest closes, Citigroup buys mortgage assets". Washington Post. 31 August 2007.

{{cite news}}: Check date values in:|date=(help); Italic or bold markup not allowed in:|publisher=(help) - ^ "Fed, Blamed for Asset-Price Inaction, Is Told `Tide Is Turning'". Bloomberg. 4 September 2007.

{{cite news}}: Check date values in:|date=(help) - ^ "Ultra-low Fed rates stoked US housing boom—Taylor". Reuters. 4 September 2007.

{{cite news}}: Check date values in:|date=(help) - ^ "Fed Misread Housing, Gets `F' for Policy Failures, Leamer Says". Bloomberg. 31 August 2007.

{{cite news}}: Check date values in:|date=(help) - ^ a b "Two top US economists present scary scenarios for US economy; House prices in some areas may fall as much as 50% - Housing contraction threatens a broader recession". Finfacts Ireland. 3 September 2007.

The examples we have of past cycles indicate that major declines in real home prices—even 50 percent declines in some places—are entirely possible going forward from today or from the not too distant future.

{{cite news}}: Check date values in:|date=(help) - ^ Cite error: The named reference

Greenspan admits bubble NewsHourwas invoked but never defined (see the help page). - ^ Cite error: The named reference

Greenspan admits bubble FTwas invoked but never defined (see the help page). - ^ "Fed Cuts Key Interest Rates by a Half Point". The New York Times. 18 September 2007.

{{cite news}}: Check date values in:|date=(help); Italic or bold markup not allowed in:|publisher=(help) - ^ "Jim Cramer vs [[National Association of Realtors|NAR]] President". The Today Show. 28 September 2007.

{{cite news}}: Check date values in:|date=(help); Italic or bold markup not allowed in:|publisher=(help); URL–wikilink conflict (help) - ^ "NetBank Files for Bankruptcy After Regulators Take Over Unit". Bloomerberg. 30 September 2007.

{{cite news}}: Check date values in:|date=(help) - ^ "UBS forecasts pretax loss up to $690 million in 3Q". International Herald Tribune. 30 September 2007.

{{cite news}}: Check date values in:|date=(help); Italic or bold markup not allowed in:|publisher=(help) - ^ a b c d New York Times article Home Prices Fall for 10th Straight Month published December 26, 2007

- ^ http://www.fsround.org/media/pdfs/AllianceRelease.pdf

- ^ "'Super fund' helps ease markets". Financial Times. 15 October 2007.

{{cite news}}: Check date values in:|date=(help); Italic or bold markup not allowed in:|publisher=(help) - ^ Feds cut down-payment assistance programs (Page 1 of 2)

- ^ Fact Sheet: Helping American Families Keep Their Homes

- ^ "Putting a freeze to mortgage meltdown". Marketplace. 6 December 2007.

{{cite news}}: Check date values in:|date=(help); Italic or bold markup not allowed in:|publisher=(help) - ^ "Those Who Avoided Risk Call Plan A Raw Deal". Washington Post. 6 December 2007.

{{cite news}}: Check date values in:|date=(help); Italic or bold markup not allowed in:|publisher=(help) - ^ "Bail-out means the liars have won". The Age. 6 December 2007.

{{cite news}}: Check date values in:|date=(help); Italic or bold markup not allowed in:|publisher=(help) - ^ a b "Banks abandon plan for Super-SIV". Reuters. 24 December 2007.

{{cite news}}: Check date values in:|date=(help) - ^ Forbes article US November new home sales plunge 9 pct to 12-year low UPDATE published December 28, 2007

- ^ "Doors Close for Real Estate Speculators: After Pushing Up Prices, Investors Are Left Holding Too Many Homes". Washington Post. 22 April 2006.

{{cite news}}: Check date values in:|date=(help) - ^ Lereah, David (17 August 2006). "Real Estate Reality Check (Powerpoint talk)". National Association of Realtors Leadership Summit.

{{cite news}}: Check date values in:|date=(help) NAR plot of Condominium Price Appreciation (percentages) in the south and west Vereinigte Staaten, 2002–2006:

Condominium Price Appreciation (percentages) in the south and west United States, 2002–2006. (Source: NAR.) - ^ Cite error: The named reference

IE2was invoked but never defined (see the help page). - ^ "There has never been a run up in home prices like this." Baker, Dean (27 July 2004). "The bubble question: How will rising interest rates affect housing prices?". CNN.

{{cite news}}: Check date values in:|date=(help) - ^ "Alan Greenspan, the United States’ central banker, warned American homebuyers that they risk a crash if they continue to drive property prices higher. … On traditional tests, about a third of U.S. local homes markets are now markedly overpriced." "US heading for house price crash, Greenspan tells buyers". Times Online (UK). 27 August 2005.

{{cite news}}: Check date values in:|date=(help) - ^ "Once a price history develops, and people hear that their neighbor made a lot of money on something, that impulse takes over, and we're seeing that in commodities and housing … Orgies tend to be wildest toward the end. It's like being Cinderella at the ball. You know that at midnight everything's going to turn back to pumpkins & mice. But you look around and say, 'one more dance,' and so does everyone else. The party does get to be more fun—and besides, there are no clocks on the wall. And then suddenly the clock strikes 12, and everything turns back to pumpkins and mice." "Buffett: Real estate slowdown ahead; The Oracle of Omaha expects the housing market to see "significant downward adjustments", and warns on mortgage financing". CNN. 8 May 2006.

{{cite news}}: Check date values in:|date=(help) - ^ "A significant decline in prices is coming. A huge buildup of inventories is taking place, and then we're going to see a major [retrenchment] in hot markets in California, Arizona, Florida and up the East Coast. These markets could fall 50% from their peaks." "Surviving a Real-Estate Slowdown: A 'Loud Pop' Is Coming, But Mr. Heebner Sees Harm Limited to Inflated Regions". The Wall Street Journal. 5 July 2006.

{{cite news}}: Check date values in:|date=(help) - ^ a b "The No-Money-Down Disaster". Barron's. 21 August 2006.

{{cite news}}: Check date values in:|date=(help) - ^ "Bubble Blog: A popular blogger explains how he predicted the cooling of the real estate market and what the mainstream business press can learn from sites like his". Newsweek. 8 August 2006.

{{cite news}}: Check date values in:|date=(help) - ^ "[T]he overall market value of housing has lost touch with economic reality. And there's a nasty correction ahead." Krugman, Paul (2 January 2006). "No bubble trouble?". The New York Times.

{{cite news}}: Check date values in:|date=(help) - ^ "Housing bubble correction could be severe". US News and World Report. 13 June 2006.

{{cite news}}: Check date values in:|date=(help) - ^ "Study sees '07 `crash' in some housing". Chicago Tribune. 5 October 2006.

{{cite news}}: Check date values in:|date=(help) - ^ "Moody's predicts big drop in Washington housing prices". Washington Business Journal. 2 October 2006.

{{cite news}}: Check date values in:|date=(help) - ^ Cite error: The named reference

Fortune deadzonewas invoked but never defined (see the help page). - ^ Cite error: The named reference

Tully Fortune mythswas invoked but never defined (see the help page). - ^ "Housing slowdown deepens in Mass.: Single-family prices, sales slip in March". Boston Globe. 26 April 2006.

{{cite news}}: Check date values in:|date=(help) - ^ Cite error: The named reference

BG ARMwas invoked but never defined (see the help page). - ^ Cite error: The named reference

BH Mass foreclosureswas invoked but never defined (see the help page). - ^ "Sellers chop asking prices as housing market slows: Cuts of up to 20% are now common as analysts see signs of a 'hard landing'". Boston Globe. 9 December 2005.

{{cite news}}: Check date values in:|date=(help) - ^ Cite error: The named reference

Barron's BNH1was invoked but never defined (see the help page). - ^ "Bubble, Bubble—Then Trouble: Is the chill in once-red-hot Loudoun County, Va., a portent of what's ahead?". Business Week. 19 December 2005.

{{cite news}}: Check date values in:|date=(help) - ^ "San Diego Home Prices Drop". NBC. 13 July 2006.

{{cite news}}: Check date values in:|date=(help) - ^ "Over 14,000 Phoenix For-Sale Homes Vacant". March 10 2006.

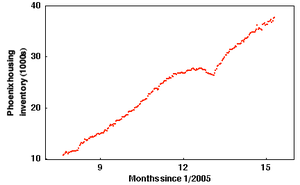

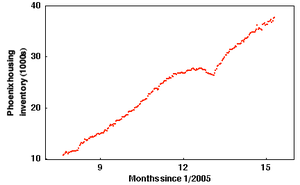

{{cite news}}: Check date values in:|date=(help) Plot of Phoenix inventory:

Inventory of houses for sale in Phoenix, AZ from July 2005 through March 2006. As of March 10 2006, well over 14,000 (nearly half) of these for-sale homes are vacant. (Source: Arizona Regional Multiple Listing Service.) - ^ "D.R. Horton warning weighs on builders: Largest home builder cuts 2006 outlook on difficult housing market". Dow Jones. 14 July 2006.

{{cite news}}: Check date values in:|date=(help) - ^ "Toll Brothers, Inc. (NYSE:TOL)". MarketWatch.

{{cite news}}: Unknown parameter|accessmonthday=ignored (help); Unknown parameter|accessyear=ignored (|access-date=suggested) (help) - ^ "U.S. Home Construction Index (DJ_3728)". Dow Jones.

{{cite news}}: Unknown parameter|accessmonthday=ignored (help); Unknown parameter|accessyear=ignored (|access-date=suggested) (help) - ^ "Toll Brothers lowers outlook: Luxury home builder says buyers still waiting on sidelines". MarketWatch. 22 August 2006.

{{cite news}}: Check date values in:|date=(help) - ^ "BANKRUPTCY CONSIDERED: Kara Homes lays off staff; talk of filing for Chapter 11 makes local clients anxious". Asbury Park Press. 6 October 2006.

{{cite news}}: Check date values in:|date=(help) - ^ "Kara Homes buyers may lose deposits". Asbury Park Press. 10 April 2007.

{{cite news}}: Check date values in:|date=(help) - ^ "Reports of falling sales and investors stuck with properties they can't sell are just the beginning. Property owners should worry; so should their lenders." Fleckenstein, Bill (24 April 2006). "The housing bubble has popped". MSNBC.

{{cite news}}: Check date values in:|date=(help) - ^ “A variety of experts now say, the housing industry appears to be moving from a boom to something that is starting to look a lot like a bust.” "Sales Slow for Homes New and Old". The New York Times. 26 July 2006.

{{cite news}}: Check date values in:|date=(help) - ^ Lereah, David (1 January 2006). "Realtors' Lereah: Housing To Make 'Soft Landing'". Forbes.

{{cite news}}: Check date values in:|date=(help) - ^ “Leslie Appleton-Young is at a loss for words. The chief economist of the California Assn. of Realtors has stopped using the term ’soft landing’ to describe the state’s real estate market, saying she no longer feels comfortable with that mild label. … ‘Maybe we need something new. That’s all I’m prepared to say,’ Appleton-Young said Thursday. … The Realtors association last month lowered its 2006 sales prediction. That was when Appleton-Young first told the San Diego Union-Tribune that she didn’t feel comfortable any longer using ’soft landing.’ ‘I’m sorry I ever made that comment,’ she said Thursday. … For real estate optimists, the phrase ’soft landing’ conveyed the soothing notion that the run-up in values over the last few years would be permanent.” Appleton-Young, Leslie (21 July 2006). "Housing Expert: 'Soft Landing' Off Mark". Los Angeles Times.

{{cite news}}: Check date values in:|date=(help) - ^ "Hard edge of a soft landing for housing". Financial Times. 19 August 2006.

{{cite news}}: Check date values in:|date=(help) - ^ Toll, Robert (23 August 2006). "Housing Slump Proves Painful For Some Owners and Builders: 'Hard Landing' on the Coasts Jolts Those Who Must Sell; Ms. Guth Tries an Auction; 'We're Preparing for the Worst'". Wall Street Journal.

{{cite news}}: Check date values in:|date=(help) - ^ Mozilo, Angelo (9 August 2006). "Countrywide Financial putting on the brakes". Wall Street Journal.

{{cite news}}: Check date values in:|date=(help) - ^ Cite error: The named reference

Lereah hard landingwas invoked but never defined (see the help page). - ^ Cite error: The named reference

WP April 24 2007was invoked but never defined (see the help page). - ^ "http://www.msnbc.msn.com/id/18842917/". MSNBC. 24 May 2007.

{{cite news}}: Check date values in:|date=(help); External link in|title= - ^ Cite error: The named reference

Roubini free fallwas invoked but never defined (see the help page). - ^ Stiglitz, Joseph (8 September 2006). "Stiglitz Says U.S. May Have Recession as House Prices Decline". Bloomberg.

{{cite news}}: Check date values in:|date=(help) - ^ "Bernanke Says `Substantial' Housing Downturn Is Slowing Growth". Bloomberg. 4 October 2006.

{{cite news}}: Check date values in:|date=(help) - ^ "The golden age of McMansions may be coming to an end. These oversized homes—characterized by sprawling layouts on small lots, and built in cookie-cutter style by big developers—fueled much of the housing boom. But thanks to rising energy and mortgage costs, shrinking families and a growing number of retirement-age baby boomers set on downsizing, there are signs of an emerging glut. … Some boomers in their late 50s are counting on selling their huge houses to help fund retirement. Yet a number of factors are weighing down demand. With the rise in home heating and cooling costs, McMansions are increasingly expensive to maintain. … The overall slump in the housing market also is crimping big-home sales. … Meantime, the jump in interest rates has put the cost of a big house out of more people's reach." Fletcher, June (19 July 2006). "Slowing Sales, Baby Boomers Spur a Glut of McMansions". The Wall Street Journal.

{{cite news}}: Check date values in:|date=(help) - ^ "With economic signals flashing that the housing boom is over, speculation has now turned to how deep the slump will be and how long it will last … conventional wisdom holds that as long as you don’t plan to sell your house any time soon … you can cash in later. Or can you? The downturn in housing is overlapping with the retirement of the baby boom generation, which starts officially in 2008 … Most of them are homeowners, and many of them will presumably want to sell their homes, extracting some cash for retirement in the process. Theoretically, that implies a glut of houses for sale, which would surely mitigate an upturn in prices, and could drive them ever lower. … The house party is over, but we don’t yet know how bad the hangover is going to be." "It Was Fun While It Lasted". New York Times. 5 September 2006.

{{cite news}}: Check date values in:|date=(help) - ^ Cite error: The named reference

USAT rentwas invoked but never defined (see the help page). - ^ a b Cite error: The named reference

BW mortgage meltdownwas invoked but never defined (see the help page). - ^ "New Century Financial files for Chapter 11 bankruptcy". MarketWatch. 2 April 2007.

{{cite news}}: Check date values in:|date=(help) - ^ Cite error: The named reference

CNN PIMCO not isolatedwas invoked but never defined (see the help page). - ^ a b "When mainstream analysts compare CDOs to "subslime", "toxic waste" and "six-inch hooker heels"…". RGE Monitor. 27 June 2007.

{{cite news}}: Check date values in:|date=(help) - ^ "Merrill sells off assets from Bear hedge funds". Reuters. 21 June 2007.

{{cite news}}: Check date values in:|date=(help) - ^ "H&R Block struck by subprime loss". Financial Times. 21 June 2007.

{{cite news}}: Check date values in:|date=(help) - ^ a b "$3.2 Billion Move by Bear Stearns to Rescue Fund". New york Times. 23 June 2007.

{{cite news}}: Check date values in:|date=(help) - ^ "Bear Stearns Hedge Fund Woes Stir Worry In CDO Market". Barrons. 21 June 2007.

{{cite news}}: Check date values in:|date=(help) - ^ Cite error: The named reference

Reuters Doddwas invoked but never defined (see the help page). - ^ "Next: The real estate market freeze". MSN Money. 12 March 2007.

{{cite news}}: Check date values in:|date=(help) - ^ "Innovation has brought about a multitude of new products, such as subprime loans and niche credit programs for immigrants. Such developments are representative of the market responses that have driven the financial services industry throughout the history of our country …

With these advances in technology, lenders have taken advantage of credit-scoring models and other techniques for efficiently extending credit to a broader spectrum of consumers. The widespread adoption of these models has reduced the costs of evaluating the creditworthiness of borrowers, and in competitive markets cost reductions tend to be passed through to borrowers. Where once more-marginal applicants would simply have been denied credit, lenders are now able to quite efficiently judge the risk posed by individual applicants and to price that risk appropriately. These improvements have led to rapid growth in subprime mortgage lending; indeed, today subprime mortgages account for roughly 10 percent of the number of all mortgages outstanding, up from just 1 or 2 percent in the early 1990s." Alan Greenspan (4 April 2005). "Remarks by Chairman Alan Greenspan, Consumer Finance At the Federal Reserve System's Fourth Annual Community Affairs Research Conference, Washington, D.C." Federal Reserve Board.{{cite news}}: Check date values in:|date=(help) - ^ "In early 2004, he urged homeowners to shift from fixed to floating rate mortgages, and in early 2005, he extolled the virtues of sub-prime borrowing—the extension of credit to unworthy borrowers. Far from the heartless central banker that is supposed to “take the punchbowl away just when the party is getting good,” Alan Greenspan turned into an unabashed cheerleader for the excesses of an increasingly asset-dependent U.S. economy. I fear history will not judge the Maestro's legacy kindly." Stephen Roach (16 March 2007). "The Great Unraveling". Morgan Stanley.

{{cite news}}: Check date values in:|date=(help) - ^ "Greenspan allowed the tech bubble to fester by first warning about irrational exuberance and then doing nothing about via either monetary policy or, better, proper regulation of the financial system while at the same time becoming the “cheerleader of the new economy”. And Greenspan/Bernanke allowed the housing bubble to develop in three ways of increasing importance: first, easy Fed Funds policy (but this was a minor role); second, being asleep at the wheel (together with all the banking regulators) in regulating housing lending; third, by becoming the cheerleaders of the monstrosities that were going under the name of “financial innovations” of housing finance. Specifically, Greenspan explicitly supported in public speeches the development and growth of the risky option ARMs and other exotic mortgage innovations that allowed the subprime and near-prime toxic waste to mushroom." Nouriel Roubini (19 March 2007). "Who is to Blame for the Mortgage Carnage and Coming Financial Disaster? Unregulated Free Market Fundamentalism Zealotry". RGE Monitor.

{{cite news}}: Check date values in:|date=(help) - ^ a b c d "Defaults Rise in Next Level of Mortgages". New York Times. 10 April 2007.

{{cite news}}: Check date values in:|date=(help) Cite error: The named reference "NYT Alt-A loans" was defined multiple times with different content (see the help page). - ^ Mortgage rates take biggest jump in nearly 4 years - Jun. 14, 2007

- ^ "Rate Rise Pushes Housing, Economy to `Blood Bath'". Bloomberg. 20 June 2007.

{{cite news}}: Check date values in:|date=(help)