Exploring Undervalued Small Caps With Insider Insights In July 2024

As global markets exhibit mixed signals with the S&P 500 reaching new heights while small-cap indices like the Russell 2000 show marginal declines, investors are navigating a complex landscape. Economic indicators such as a cooling labor market and fluctuating interest rates further color this intricate picture, influencing investor sentiment towards different market segments. In this context, identifying undervalued small-cap stocks requires a nuanced understanding of market dynamics and an ability to discern potential in less conspicuous areas of the market.

Top 10 Undervalued Small Caps With Insider Buying

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Nexus Industrial REIT | 2.4x | 3.0x | 20.77% | ★★★★★★ |

Norcros | 7.9x | 0.5x | 43.59% | ★★★★★☆ |

Tokmanni Group Oyj | 17.0x | 0.5x | 38.44% | ★★★★★☆ |

Primaris Real Estate Investment Trust | 11.2x | 2.9x | 36.95% | ★★★★★☆ |

Titan Machinery | 3.6x | 0.1x | 30.54% | ★★★★★☆ |

Kambi Group | 18.2x | 1.6x | 24.57% | ★★★★☆☆ |

Sagicor Financial | 1.2x | 0.4x | -93.83% | ★★★★☆☆ |

Bytes Technology Group | 28.4x | 6.4x | -12.42% | ★★★☆☆☆ |

Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

Freehold Royalties | 15.3x | 6.6x | 49.17% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

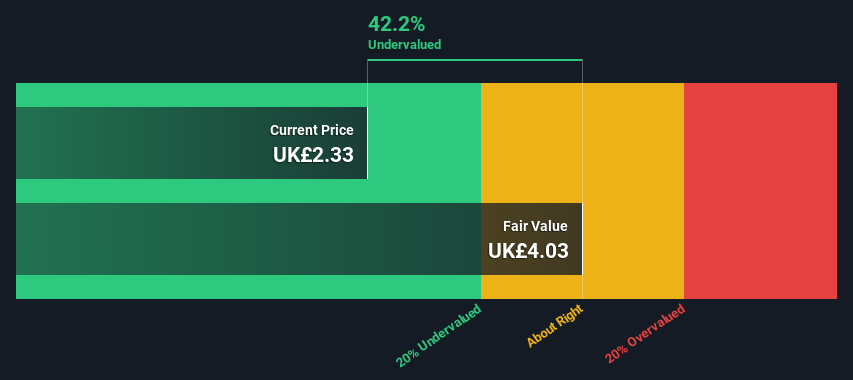

MONY Group

Simply Wall St Value Rating: ★★★★★★

Overview: MONY Group operates in diverse sectors including money, travel, cashback, insurance, and home services.

Operations: The entity generates its highest revenue from the Insurance segment at £220 million, followed by significant contributions from Money and Cashback segments. Over recent periods, the gross profit margin has shown a consistent trend around 67%, reflecting efficient cost management relative to revenue generation.

PE: 17.5x

MONY Group, transitioning its name on May 20, 2024, reflects a strategic rebranding alongside its notable first-quarter revenue increase to £114.6 million from £106.3 million the previous year. With earnings expected to rise by over 10% annually and funding sourced entirely from higher-risk external borrowings, this highlights a bold financial strategy. Recently, insider confidence was underscored by significant share purchases, signaling strong belief in the company's prospects among those who know it best. This paints a picture of a firm with potential for growth despite its reliance on volatile funding sources.

Dive into the specifics of MONY Group here with our thorough valuation report.

Gain insights into MONY Group's historical performance by reviewing our past performance report.

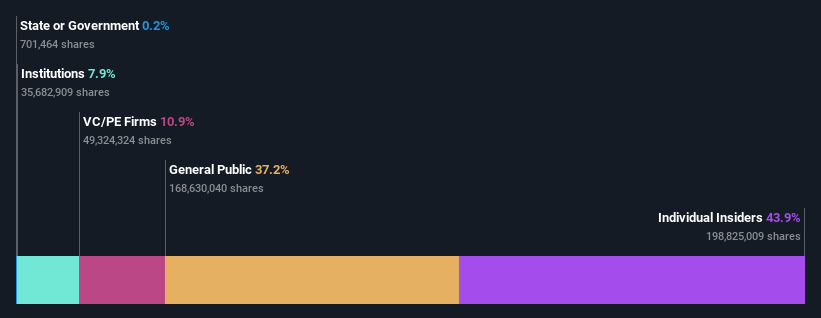

Marksans Pharma

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Marksans Pharma is a pharmaceutical company with operations primarily in the manufacturing and marketing of formulation products, boasting a market capitalization of approximately ₹21.77 billion.

Operations: The company generates a gross profit of ₹11.39 billion on revenues of ₹21.77 billion, reflecting a gross profit margin of 52.32%. Operating expenses for the period amount to ₹7.55 billion, impacting the net income margin which stands at 14.41%.

PE: 27.2x

Marksans Pharma, reflecting a robust financial trajectory with a 21.63% forecasted annual earnings growth, recently announced uplifting Q4 results, showcasing revenue growth from INR 4.97 billion to INR 5.77 billion year-over-year. Amidst this positive backdrop, the firm declared a dividend increase to INR 0.60 per share, underscoring its commitment to shareholder returns despite its volatile share price over the last three months. Insider confidence is evident as they recently purchased shares, signaling belief in the company's prospects amidst external borrowing as its sole funding source—a testament to potential underappreciated by the market.

Unlock comprehensive insights into our analysis of Marksans Pharma stock in this valuation report.

Assess Marksans Pharma's past performance with our detailed historical performance reports.

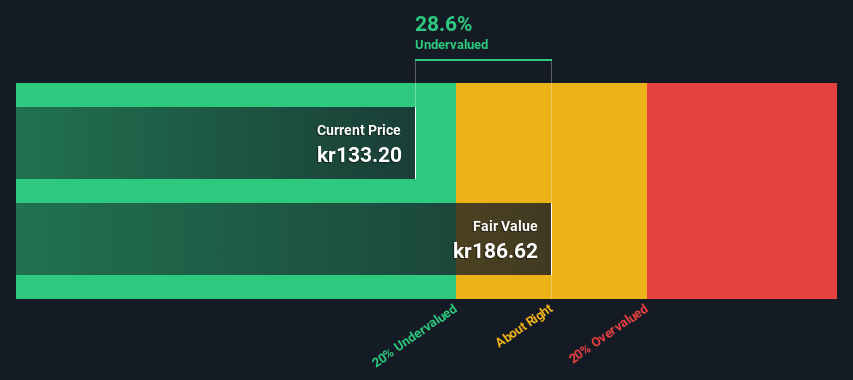

AddLife

Simply Wall St Value Rating: ★★★★★☆

Overview: AddLife is a company specializing in life science products and services, primarily divided into Labtech and Medtech segments, with a market capitalization of approximately SEK 23.20 billion.

Operations: Labtech and Medtech are the primary revenue contributors, generating SEK 3.61 billion and SEK 6.20 billion respectively. The gross profit margin has shown a trend, most recently recorded at approximately 37.17%.

PE: 208.1x

Despite a challenging year with a reduced dividend and lower net income, AddLife's recent insider confidence, demonstrated by share purchases, underscores a belief in the company's resilience. With earnings expected to grow by 56% annually and sales increasing from SEK 2.46 billion to SEK 2.57 billion, their strategic financial maneuvers suggest potential for recovery. However, concerns linger as profit margins have dipped from last year’s 4.8% to just 0.8%, reflecting ongoing pressures but also an opportunity for improvement if managed adeptly.

Click to explore a detailed breakdown of our findings in AddLife's valuation report.

Explore historical data to track AddLife's performance over time in our Past section.

Where To Now?

Click here to access our complete index of 233 Undervalued Small Caps With Insider Buying.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include LSE:MONY NSEI:MARKSANS and OM:ALIF B.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]