Post-Dobbs insights from 2022’s Kansas election and what they portend for 2024

Millions were spent on linear TV in the summer election of 2022 as viewership was steadily declining

Meantime GenZ and Millennials who mobilized for that summer’s election in the wake of Dobbs then sat out the fall general election

Introduction

It was recently reported by Axios that “The advertising dollars spent on U.S. elections and advocacy issues will grow to roughly $16 billion next year, up 31.2% compared to the last presidential election in 2020. . . ” and that “The U.S. political ad market has gotten so big that next year it’s expected to become the 10th largest ad market in the world, surpassing all of Australia.” Of course, it is not just political campaigns that account for this spending. There is also an ever-increasing amount spent by advocacy groups on various causes, including statewide referenda and direct ballot measures across the country.

The Washington Post recently offered an example of this proliferation of initiatives when it reported that “Voters in about a dozen states in 2024 could decide the fate of abortion rights with constitutional amendments on the ballot in a pivotal election year — including in several battlegrounds that will be key to deciding the presidential race and which party controls Congress,” and offered the following graphic visualization: *

*Wang, Amy B and Caldwell, Leigh Ann, 12 states where the fate of abortion rights could be on 2024 ballots, The Washington Post, December 20, 2023.

That same article included the retrospective observation that “Weeks after the Dobbs v. Jackson Women’s Health Organization decision, voters in deep-red Kansas defeated a ballot measure that would have removed abortion protections from the state’s constitution,” offering affirmation of the ongoing relevance of that Kansas 2022 vote to today’s political discussion.

At Comscore, we have been researching the political insights that can be derived from the ways in which media is used and consumed by audiences. For example, a collaboration between Comscore and the American Communities Project produced a study into cable news viewing habits, at the community level, suggesting that the choice of news sources may serve as an indicator of an individual's ideological views, including voting behavior.

So, while there is no scarcity of analysis about the surge in voter registration and turnout in the 2022 Kansas election, somewhat less attention has been paid to the viewing audiences who may, or may not, have been exposed to the voluminous ads upon which millions of dollars were spent to influence that election’s outcome. To take a closer look at this question, Comscore applied detailed media-audience data and insights from tools like the interactive Comscore Markets map, seen below, in a collaborative study with L2 and Vivvix, who provided voter and ad-cost data, respectively.

This resulting collaborative report offers insights into $9.2M of ad-spend on traditional linear TV placements during this Kansas summer election, with ad-spend increasing in volume as election day in August 2022 got closer, in reverse correlation to an ever-decreasing number of viewers who tuned-in to linear TV over that same period.

Notably, when the Value Them Both Amendment was defeated in that August 2022 election, there was no corollary substantive issue directly on the Kansas November 2022 general election ballot, and noticeable numbers of voters who had registered and mobilized in the run up to the August 2022 primary election, then sat out the November 2022 midterms just three months later – with this trend especially pronounced among the Millennial and Gen-Z groups, offering potentially cautionary insights as the 2024 election approaches.

Our research was not designed to investigate a causal relationship among these various factors, and we do not imply any. However, we did observe interesting correlations that we share in the report below.

History of the Value Them Both Amendment

In April 2019, the Kansas Supreme Court held in a 6-1 decision that their state bill of rights protects "a woman's right to make decisions about her body." A flurry of legislative activity followed, culminating with a proposal seeking to vitiate the Court’s ruling by amending the state’s constitution. That measure, called the Value Them Both Amendment, was placed on the August 2022 election ballot alongside state office primary elections. The measure’s placement on the primary election ballot raised questions, as did the measure’s naming convention and its explanatory language, all of which received intense scrutiny as being unnecessarily confusing to potential voters.

Then, in the lead up to that August election, investigative news outlets published a draft opinion from the U.S. Supreme Court, subsequently published in final form in the case of Dobbs v. Jackson Women's Health Organization, overturning the seminal case of Roe v. Wade. The draft opinion was leaked in May 2022, and the final decision was released in June 2022. Thus, the stage was set for the August primary election in Kansas to offer voters their first opportunity to speak in response to the Dobbs decision.

Intense Advocacy & Outcome of the Election

Given the watershed potential for the Kansas summer election, advocacy groups and others poured money into efforts to influence its outcome. As contemporaneously reported by Axios, opponents and advocates spent a combined $22 million seeking to influence that Kansas vote, and The Beacon reported that much of that money was spent on political ads.

But even seasoned observers of the political landscape seemed unprepared for how that election played out. Despite preelection polling reports characterizing the outcome as too close to call or predicting passage by a relatively narrow margin, the referendum was voted down by an 18% margin (59% ‘No’/41% ‘Yes’) with voters turning out in their highest-ever numbers for a Kansas primary election, yielding headlines like: Kansas voters defeat abortion amendment in unexpected landslide.

Given the significantly inaccurate preelection polling, we wondered whether a closer look into Kansans’ media consumption in the lead-up to that election could shed some light on these missed calls. What emerges is a somewhat unexpected reverse correlation between media viewership and the voluminous political ad-spend.

Linear TV Ad-spend & Contemporaneous Linear TV Viewership

The chart below provides a visualization of $9.2M spent on linear TV advertising by those seeking to influence the election, broken out by the corresponding political leanings of the advertisements, from early June through election day in August 2022:

Source: Vivvix CMAG

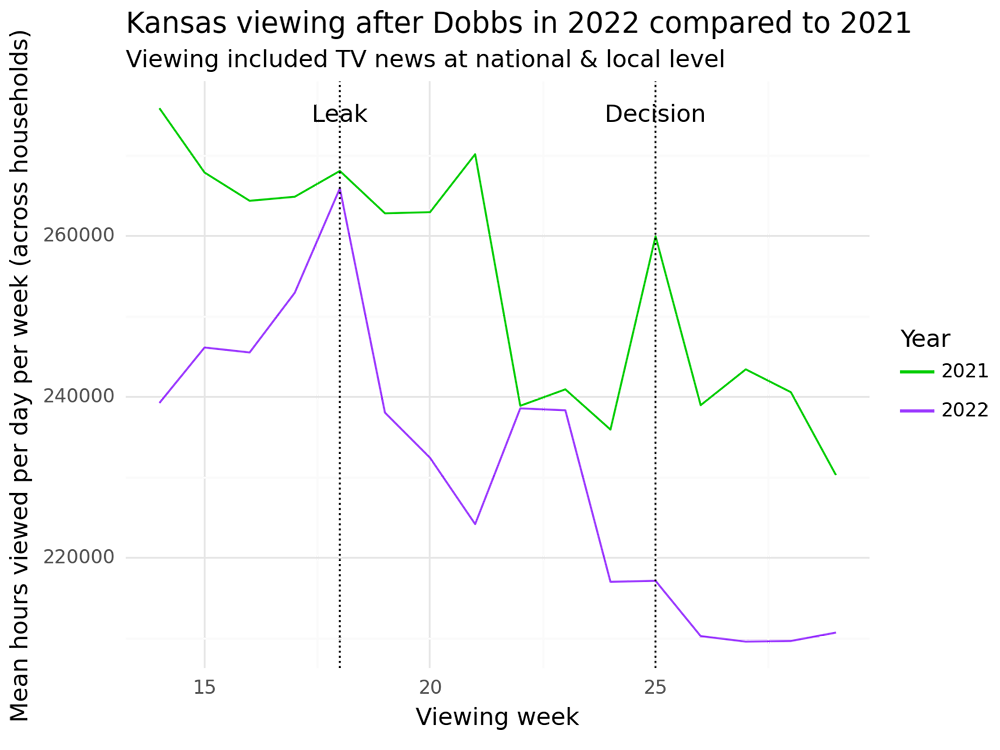

While the ad-spend dollars trended upward from June through August, Kansans’ overall linear TV viewership during those same months was progressively declining as shown by the purple line in the first chart below – although viewership on news programming did exhibit some interesting upticks, notably at the time of the leaked Dobbs decision draft, as seen in the purple line in the second chart below:

Source: Comscore TV. Local TV® All Broadcast Networks, Preliminary Data, Kansas Markets (Kansas City, MO; Joplin, MO; St. Joseph, MO; Tulsa, OK; Wichita, KS; Topeka, KS; Lincoln-Hastings-Kearney, NE), May 3rd to August 3rd, 2022, US.

Source: Comscore TV. Local TV® All Broadcast Networks, Preliminary Data, Kansas Markets (Kansas City, MO; Joplin, MO; St. Joseph, MO; Tulsa, OK; Wichita, KS; Topeka, KS; Lincoln-Hastings-Kearney, NE), May 3rd to August 3rd, 2022, US.

The graphs above also show:

1) that decreasing viewership tracked by the purple line for the summer months of 2022 generally mirrors similar viewership declines tracked by the green line during the same period in 2021, suggesting a seasonal pattern of viewership decline during the summertime; and

2) an overall decrease in Kansans’ linear TV viewership between 2021 and 2022, which is consistent with National trends as seen in the graphic below where light blue represents overall declines in linear TV viewing nationally as contrasted with the dark blue lines that represent digital and streaming platform viewership:

But importantly, even those not represented in the linear TV viewing statistics might still have been exposed to advertisements that originated on that medium, because those ads sometimes appeared on other platforms too. For example, trending Social posts during the summer of 2022 included content that originated as a linear TV advertisement, like this Value Them Both Ad Check video clip from a local Kansas City news broadcaster:

Source: Comscore Total Digital

This Ad Check clip garnered one thousand video views, demonstrating how ads originating on linear TV might be viewed elsewhere, so the reverse correlation between ad volumes increasing at a time when TV viewership was decreasing may not tell the full story.

In contrast with decreasing linear TV viewership, voter registrations increased as election day approached. The following visualization shows increasing activity following the Dobbs leak and decision, with a pronounced spike coinciding with the July 12th registration deadline:

Source: L2

Overall, these 2022 registration numbers tracked at levels not seen since the 2020 Presidential election, with Female registrations especially noteworthy as seen in the second chart below:

Source: L2

Source: L2

Then on voting day in August 2022, Female turnout over-indexed again, particularly in the suburbs, as seen in the compelling graphic display below, where the percentages of suburban, rural, and urban voters turning out for this referendum are displayed in differing colors, where 44.5% of voters in the referendum were in suburban areas displayed in red, and among those suburban voters, 56.2% were women.

Source: L2

Gen Z turned out for the Primary then many skipped the Midterms

Other interesting registration-correlations relate to Millennial and GenZ activity, including that:

1) these groups rivaled or led other age demographic groups in registrations, with Females outpacing Males; and

2) GenZ Females and Males both registered at higher levels than their corollaries in other age groups:

Source: L2

Source: L2

In one particularly intriguing trend, voting by Millennial and GenZ groups in August 2022 rivaled or outpaced other age groups, but just three months later these same Millennial and GenZ voters sat out the November 2022 midterm election in greater numbers than did voters in the other age groups, as seen in the second chart:

Source: L2

Source: L2

This attrition of Millennial and GenZ voters suggests that certain of them only mobilized in August because the Value Them Both Amendment was on the ballot. If that is the case, then their failure to mobilize in November offers something of a cautionary tale for Republicans and Democrats alike. For Republicans, their cautionary tale is exemplified by the reelection of incumbent Governor Laura Kelly, a Democrat in an otherwise largely red state, who won reelection by only a slim margin, as some GenZ and Millennial Republican voters who had voted in the August primary sat out the November general election. For Democrats, a somewhat different cautionary tale springs from Governor Kelly’s reelection campaign which had deployed a strategy of downplaying the abortion issue, raising the question of whether partisan affiliation alone will prove sufficient to mobilize some younger voters even when they register as Democrats to vote on an issue of importance to them.

Appendix

About Comscore:

Comscore (Nasdaq: SCOR) is a trusted partner for planning, transacting and evaluating media across platforms. With a data footprint that combines digital, linear TV, over-the-top and theatrical viewership intelligence with advanced audience insights, Comscore allows media buyers and sellers to quantify their multiscreen behavior and make business decisions with confidence. A proven leader in measuring digital and TV audiences and advertising at scale, Comscore is the industry’s emerging, third-party source for reliable and comprehensive cross-platform measurement.

About L2:

L2 is the nation's largest and longest-serving non-partisan voter file provider. For over 50 years, L2 has set the bar for data quality and hygiene by utilizing a 53 sage human and automated processing methodology to ensure our users get the best and most up-to-date look at the electorate in their district, state, or nationally. In addition to the base file, L2 provides hundreds of fields of demographic, consumer, donor, contact, and other information critical to campaigns, advocacy groups, researchers, universities, elected officials, and more to understand and reach voters. L2's 243 million record national consumer file helps L2 validate and enhance its 213 million record voter file.

Paul Westcott is Executive Vice President at L2. Paul has been with the company for ten years. Paul's experience ranges from local campaigns to working at national media organizations as a researcher, assignment editor, and news director before moving to L2. Paul attended Fordham University and holds a BA and MA in political science, both from Fordham.

MediaRadar’s Vivvix CMAG tracks political advertising across the country as well as forward looking spend data. Founded in 1996, Vivvix CMAG has the most complete ad library available in the political world with the most comprehensive advertising intelligence footprint available, with more than $250 billion in media spend coverage and more than 35 million creative assets.