It's a question almost every worker and retiree has wondered: When will Social Security run out? This pillar of retirement finances has been struggling for years, but it's not about to completely disappear. Let's take a closer look at why it's struggling, how long it will last, and what the government could do to fix the problem.

Wie es funktioniert

Understanding Social Security and how it works

President Franklin D. Roosevelt signed the Social Security Act into law in 1935 to provide monthly checks to seniors to help them remain financially stable in retirement. It also offered benefits to disabled workers and surviving family members of deceased workers. Its mission remains the same to this day.

Social Security receives funding from three sources:

- Social Security payroll taxes

- Interest earned on investments by Social Security trust funds

- Social Security benefit taxes

The bulk of the program's funding comes from Social Security payroll taxes that almost all workers pay. It's even possible to work and claim benefits at the same time. Currently, the tax rate is 12.4%, split evenly between the employee and the employer. But you may not pay this tax on all your income. In 2024, only the first $168,600 earned is subject to these taxes.

The government places the money collected from Social Security taxes into two trust funds: (1) the Old-Age & Survivors Insurance (OASI) Trust Fund for seniors and the families of deceased workers and (2) the Disability Insurance (DI) Trust Fund for disabled workers and their families.

The Social Security Administration invests the money in government-backed securities and spends the proceeds on various programs. This has led some to suggest that the government is robbing Social Security. But that's not true. As with all Treasury bonds, the government pays back what it borrows over time with interest, which becomes an additional source of funding for the program.

Finally, some seniors owe federal income taxes on some of their Social Security benefits if their income exceeds certain thresholds for their tax filing status. A few state governments tax Social Security, as well. But these taxes go to the states rather than funding current beneficiaries' Social Security checks.

Why it matters

Why is Social Security important?

Social Security provides critical support for retired workers and their spouses, disabled workers, and family members who have lost loved ones. It was long considered one leg of a "three-legged stool" of retirement planning, alongside a pension and personal savings.

As pensions have become increasingly rare, people have relied more heavily on Social Security to help them cover their retirement costs. However, according to the Social Security Administration, the program was only intended to cover about 40% of pre-retirement income for workers with average earnings.

The benefit formula is structured in such a way that lower earners may find their checks cover more than 40% of their pre-retirement income. Higher earners may have to cover more of their retirement costs on their own, though.

Funds low?

Why is Social Security running out of money?

When people say Social Security is running out of money, they mean the program's trust funds are nearing depletion. The latest Social Security Trustees Report projects that the trust fund that pays retirement benefits will be depleted in 2035 unless the government makes changes to the program. If not, it will be able to pay out only about 83% of scheduled benefits.

The reason the trust funds are now so low is due to the changing demographics of the United States. The baby boomers are one of the largest generations, with about 70 million alive today. When they were young, the Social Security taxes they paid on their incomes put a lot of money into Social Security's trust funds.

But many of those baby boomers have retired. By 2030, they'll all be 65 or older. Younger generations haven't had as many children. That means fewer workers are paying into Social Security and more seniors than ever are drawing from it. The government has had to use some of the extra money in the trust funds to ensure all seniors get their benefits, but that's not sustainable over the long term.

How to fix it

How to fix the Social Security problem

The federal government understands that Social Security is facing a funding crisis. But lawmakers haven't yet agreed on how to address the funding shortfall. Some proposed options include:

Increasing the payroll tax rate

As discussed above, workers currently pay Social Security taxes on 12.4% of their income. The latest Social Security Trustees Report says that for the program to remain solvent for the next 75 years, the government could permanently increase the Social Security payroll tax from 12.4% to 15.73%. But if it delays taking action until the 2035 deadline, the necessary payroll tax hike could jump by 4.02 percentage points, bringing the total payroll tax to 16.42%.

Cutting benefits

No one wants to reduce benefits, but cutting benefits for current and future retirees would enable the program to continue providing checks without hiking taxes on workers. The Trustees Report estimates that a 24.6% benefit reduction for all benefits scheduled for 2035 and later would be necessary to compensate for the projected shortfall.

Raising the full retirement age

When Social Security first began, 65 was the full retirement age (FRA) -- the age at which you qualify for your full benefit based on your work history. But the government changed the FRA first to 66 and then to 67 for people born in 1960 or later.

People can still claim benefits as early as 62, but their checks shrink for each month they claim benefits before their FRA. Increasing the FRA further could help ease some of the financial strain on the program. But it may result in smaller lifetime benefits for today's workers.

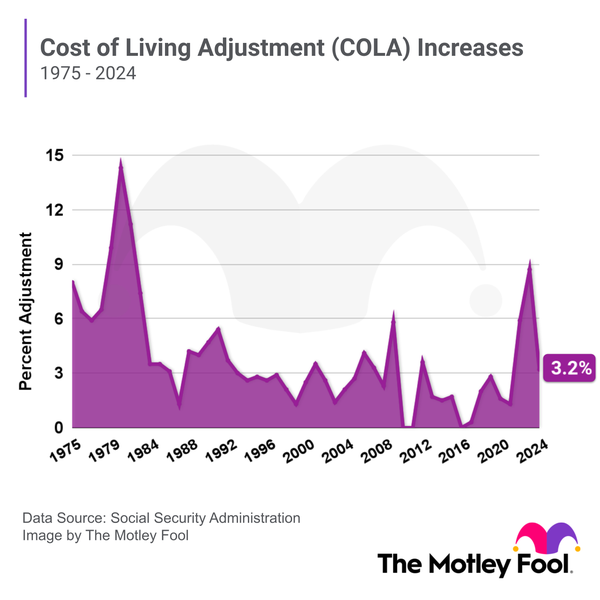

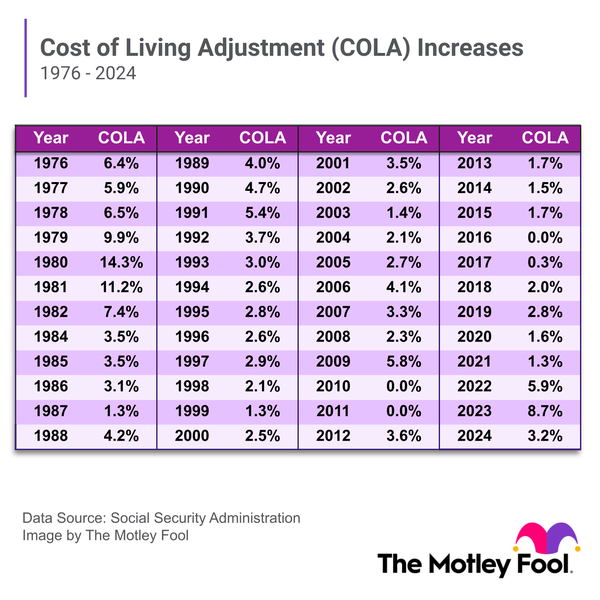

Changing the cost-of-living adjustments

Every year, the Social Security Administration adjusts recipients' benefits to help the program keep up with inflation. This is known as a cost-of-living adjustment (COLA). For 2024, Social Security beneficiaries received a 3.2% COLA. Reducing COLAs for all beneficiaries or even just high-earning beneficiaries could ease some of the program's shortfall.

Most people already pay Social Security taxes on all their income, but high earners don't. While they'll pay taxes on a record $168,600 in 2024, some have suggested that the ceiling should be much higher or that there shouldn't be a ceiling on income subject to Social Security taxes at all. If high earners were paying more in Social Security taxes, that would provide more funding for the program.

A combination of these options

The solution to Social Security's problem could also involve a combination of the suggestions above. For example, the government could raise the Social Security payroll tax rate and cut benefits at the same time. The variety of options makes it impossible for anyone to predict what the final fix will look like.

Related investing topics

Will it run out?

Will Social Security run out?

Even in the worst-case scenario, Social Security will still be around whether you're already retired or have decades to go in the workforce. And it's unlikely that the government will ignore the problem completely. While it may take some time, the government will likely come up with a plan to help Social Security remain solvent for decades to come.

But it's important to prepare yourself for the fact that any solution will make some people unhappy. Workers may have to give up more of their income to the government, or seniors may have to try to get by on less.

If you want to avoid an unpleasant surprise, it's best to save as much as you can now and have a sound retirement income strategy in place. The larger your nest egg, the better you'll be able to weather whatever comes next.

Social Security funding FAQ

Will Social Security still be around in 40 years?

Yes, Social Security should be around for a lot longer than 40 years. But it's uncertain what the program will look like at that time. Right now, its trust funds are projected to be depleted by 2035. After that, it will only be able to pay out about 83% of scheduled benefits unless the government makes some changes to the program.

How much is the average Social Security check?

The average Social Security benefit varies. As of July 2024, the average monthly benefit for all retired workers was $1,919.40. Typically, those who have earned more throughout their careers -- thus having paid more in Social Security taxes -- receive larger checks. The type of benefit also matters. Retired workers typically receive more than spouses or children who claim benefits on their work record.

Which president started borrowing money from Social Security?

No U.S. president has ever borrowed money from Social Security. This is a common misconception because the government invests Social Security trust fund money into government-backed securities.

The U.S. Treasury can use the proceeds to help fund other government programs, but it must pay back what it borrows over time with interest. The interest is another source of revenue for the program. With the trust funds nearing depletion, however, this won't be possible for much longer.