Members of Congress keep messing up — over and over and over again — in failing to abide by an 11-year-old financial disclosure and conflicts-of-interest law.

And the habitual lack of compliance with the Stop Trading on Congressional Knowledge (STOCK) Act — dozens of lawmakers have violated its disclosure provisions during the past three years, often offering tortured excuses — is eroding the public’s trust, one of the law’s original authors tells Raw Story.

“I mean, come on. ‘The dog ate my homework,’ aren’t we a little more grown up than that?” said former Rep. Brian Baird (D-WA). “If we're capable of voting on whether or not to raise or lower taxes or send people to war, I think we can report when we make an investment.”

This year alone, Raw Story has identified at least 15 members of Congress who have violated the STOCK Act. At least 78 members of Congress violated the STOCK Act's disclosure provisions from 2021 to 2022, according to a tally maintained by Insider. Not to mention a number of recent reports have identified conflicts of interest in the executive branch and judiciary.

RELATED ARTICLE: Busted: These 6 members of Congress violated a federal conflicts-of-interest law

“Most members are pretty responsible and honest people, and they take their job and their role of service seriously, but if anybody is violating that, it undermines the trust of the whole institution, and the public thinks we're all just a bunch of self-centered greedy rascals taking advantage of our position,” Baird said. “We aren't, but when people either refuse to file or refuse to follow the rules, they pass a negative light on everybody in the institution, and that's unfair to all of us.”

“There are people who, because of the STOCK Act, believe that every member of Congress is corrupt. I absolutely do not believe that,” said Baird, who is a member of nonprofit reform group Issue One’s ReFormers Caucus. “The whole reason I introduced it was just as we have insider trading laws for the very small number of people who make insider trades outside of Congress, if any member of Congress or their staff are doing it, those members need to be called out, identified and punished with serious consequences.”

To date, those consequences are “essentially a slap on the wrist,” Aaron Scherb, senior director of legislative affairs at nonprofit government watchdog Common Cause, told Raw Story earlier this month.

The standard late fee for a STOCK Act disclosure violation is up to $200 per transaction. But oftentimes, the House Committee on Ethics or U.S. Senate Select Committee on Ethics, which internally investigate alleged violations, will waive the fee.

Baird said the consequences for not following the law need to be drastically higher.

“I think $50,000 is a nice round number. I think it's gotta have teeth, and no exceptions,” Baird said.

Combating a history of congressional insider trading

Baird, who represented Washington’s third district from 1999 to 2011, introduced the first draft of the STOCK Act back in 2006 along with late former Rep. Louise Slaughter (D-NY) when there were reports of Congress members and their staff day trading from their congressional offices, including scandals involving former Senate Majority Leader Bill Frist and a top aide to the former House Majority Leader Rep. Tom DeLay.

“Certainly their focus should have been somewhere else, but on top of that, how could they possibly not have access to information or a role that could influence the value of at least some of their trades? That doesn’t pass the smell test,” Baird said. “When one or two do that, then it feeds the whole ‘oh, they're all a bunch of bums.’”

Baird said he anticipated the STOCK Act to get widespread bipartisan support when he first introduced it, but it wasn’t until years later and a series of media reports on insider trading around the 2008 recession that the bill passed.

“It was crazy. When I first introduced [the] STOCK Act, I thought everybody would join. I thought everybody would say ‘yeah, we need to clean this up for all of our benefits,’ and there was actually quite a bit of resistance, and that resistance added to the skepticism,” Baird said. “Only when a few signature cases came out and 60 Minutes did that report did members finally clue in that, you know what? The public's kind of upset about this. The public just thought they smelled a rat.”

President Barack Obama signed the STOCK Act into law in 2012 in order to make congressional insider trading illegal, curb conflicts of interest and promote transparency around how congressional leaders and their staff conduct their personal stock transactions.

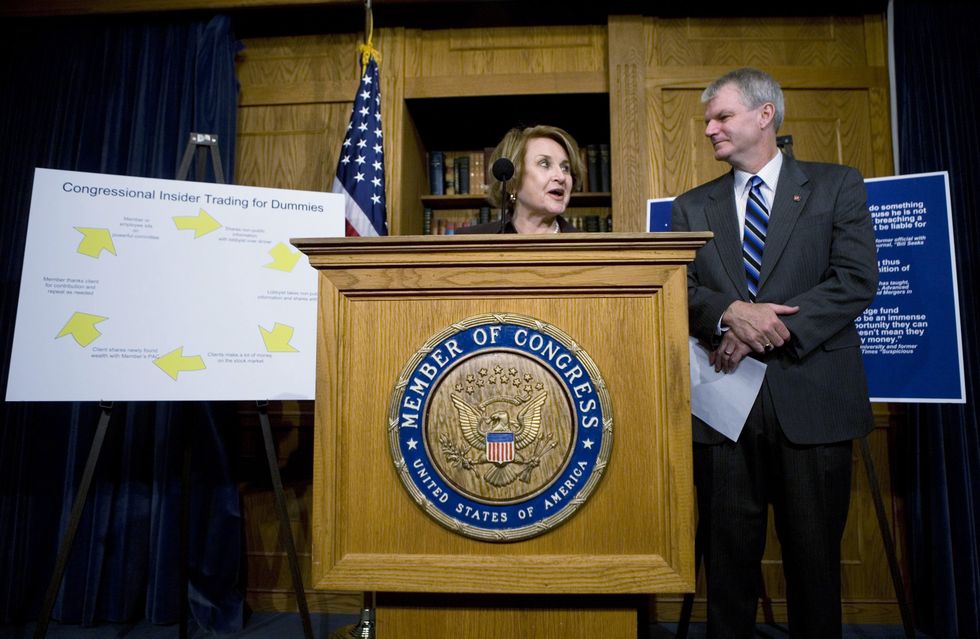

In 2007, then-Rep. Brian Baird (D-WA) (R) appears with then-House Rules Chairwoman Louise Slaughter (D-NY) (L) to press their colleagues for new laws governing how lawmakers may trade stocks. Brendan Smialowski/Getty Images

In 2007, then-Rep. Brian Baird (D-WA) (R) appears with then-House Rules Chairwoman Louise Slaughter (D-NY) (L) to press their colleagues for new laws governing how lawmakers may trade stocks. Brendan Smialowski/Getty Images

But since then, many lawmakers have fallen well short of the STOCK Act’s ideals, either by trading stocks that directly conflict with their congressional work or failing to properly disclose their trades in the first place.

Since 2021, Republican and Democratic members of Congress have introduced various bills named with similarly reinforcing acronyms — such as the ETHICS Act, TRUST in Congress Act and PELOSI Act — to strengthen the STOCK Act or outrightly ban congressional stock trading.

But none have successfully passed into law, even though a significant majority of Republican and Democratic voters alike support a ban on congressional stock trading, according to a Morning Consult poll last year.

Last year, then-House Speaker Nancy Pelosi (D-CA) — a skeptic of stock-trade bans whose husband is a prolific trader — effectively killed an effort to do so toward the end of the 117th Congress.

The law currently requires federal lawmakers to report within 45 days any individual stock, bond, Treasury security or cryptocurrency transactions they, their spouses or dependent children conduct. Baird’s draft of the STOCK Act called for a 48-hour disclosure deadline, and he said he still supports significantly shortening the reporting time.

“The reason for that is in other fields of finance, people sometimes have to report [within] 48 hours and then it would be immediately obvious,” Baird said. “If we're marking up a bill at a conference committee, and somebody makes a trade after the conference committee but before the bill’s even available to the public, it'd be so easy to trace.”

Gray areas in the STOCK Act

The requirements of the STOCK Act aren’t always clear with how the law is currently written, and the House Committee on Ethics, in particular, has been publicly silent when it comes to commenting on its rules or recent violations.

Earlier this month, two members of Congress appeared to be more than a year late in reporting spinoffs and exchanges of their stocks, based on a plain reading of the STOCK Act’s text.

But spokespeople for both of the lawmakers said their bosses were in compliance with STOCK Act rules.

Democratic Whip Rep. Katherine Clark (D-MA) reported on June 8 that she received up to $30,000 in shares of Warner Bros. Discovery stock in exchange for AT&T Inc. stock as a result of a spinoff in April 2022.

The law states that an amendment to the Ethics in Government Act of 1978 requires congressional members and staff "to file reports within 30 to 45 days after receiving notice of a purchase, sale or exchange which exceeds $1,000 in stocks, bonds, commodities futures, and other forms of securities and subject to any waivers and exclusions.”

“This was an automatic spinoff that applied to all AT&T stockholders as a result of the Warner Brothers Discovery merger,” said Kathryn Alexander, a spokesperson for Clark, who violated the STOCK Act during 2021 in a separate matter and has since stopped actively trading stocks.

“It was not initiated by the congresswoman, her spouse or financial adviser, and was unknown to them at the time it occurred,” Alexander continued. “Congresswoman Clark supports strengthening financial disclosure requirements for members of Congress during their tenure.”

RELATED ARTICLE: Can’t stop, won’t stop: Another congressman violates STOCK Act

Rep. Brian Babin (R-TX) filed a financial disclosure report on June 9, disclosing four stock purchases from 2022 valued between $18,004 and $95,000, two of which were corporate spinoffs. One of the trades was disclosed more than a year after a federal deadline, and the other three were between nine to 10 months late.

Babin serves on the House Committee on Transportation and Infrastructure and the House Committee on Science, Space and Technology — along with related subcommittees. Babin’s investments include FTAI Infrastructure, a company that primarily works in the energy, intermodal transport and rail sectors; BHP Group, an Australian mining and petroleum company; and Woodside Energy Group, an Australian petroleum exploration and production company.

Sarah Reese, a spokesperson for Babin, told Raw Story: “Per the House Committee on Ethics: ‘The congressman has submitted his financial disclosure statement and corresponding [periodic transaction reports] and is currently compliant with all financial disclosure reporting requirements.’”

Reese did not confirm who from the Ethics Committee made the statement and when.

If the Ethics Committee indeed told Babin that he was correct in reporting the spinoffs when he asked about his latest report, presumably Clark should’ve disclosed her spinoffs as well, and they would both be late in disclosing them, experts told Raw Story.

Herein lies the confusion.

A January memo from the House Committee on Ethics to all House representatives, employees and officers made it clear that stock exchanges must be reported according to the STOCK Act’s disclosure requirements.

But buried on page 40 of the Committee's 2023 guide is this statement: “Exchange transactions are somewhat rare and refer only to a limited set of circumstances that involves the exchange of stock certificates following the purchase of one company by another, a merger of two companies, or a spinoff of one company from another. Exchanges are only reportable when the original stock owned is surrendered for new stock. Please consult with Committee staff for further guidance."

RELATED ARTICLE: ‘It just strains credibility’: Washington state congressmen struggle to comply with conflicts-of-interest law

This is not the first time that the House Committee on Ethics has supposedly offered conflicting guidance. Early in June, Raw Story reported that Rep. Rick Larsen (D-WA), was seemingly late in reporting 28 financial transactions totaling up to $420,000 — an ostensible violation of the STOCK Act.

But his congressional office said conflicting guidance from the House Committee on Ethics caused Larsen to not report until May 26 trades he made as far back as 2020.

“In 2020, while setting up a managed IRA account to diversify his portfolio, Rep. Larsen received initial guidance from the House Ethics Committee that he did not need to file Periodic Transaction Reports because he did not control selection or trade of any security in the new portfolio,” Joe Tutino, a spokesperson for Rep. Larsen, told Raw Story in a statement.

“In 2022, upon reviewing Rep. Larsen’s draft financial disclosure, Committee staff informed him of updated guidance that required the representative to file a periodic transaction report to come into compliance with the STOCK Act. He worked with Committee staff to file the required periodic transaction report,” Tutino continued.

Last week, Rep. Suzan DelBene (D-WA) filed a disclosure report noting two sales of vested Microsoft shares totaling between $1.25 million and $5.5 million. She reported them between two to eight months past the STOCK Act's 45-day deadline.

However, DelBene previously disclosed her family's significant investments in Microsoft stock on her annual disclosures and a 2022 periodic transaction report. The reports show that her husband, Kurt DelBene, created a forward contract in 2021 for stock he received as a senior Microsoft executive in order to "avoid any actual or apparent conflict of interest" as he was confirmed to the position of assistant secretary for information and technology in the Department of Veterans Affairs, the contract said.

Despite previously disclosing the forward contract — defined by Investopedia as "a customized contract between two parties to buy or sell an asset at a specified price on a future date" — DelBene was told by the House Committee on Ethics that she should still disclose the stock sales as they are executed as a part of the contract, her staff said.

"In March 2022, the DelBenes disclosed a forward contract, which put in place a self-executing stock sale schedule at a set price related to compensation from Mr. DelBene’s previous employment," said Nick Martin, spokesperson for the congresswoman. "This forward contract was drafted by ethics experts and approved by the Department of Veterans Affairs. The entirety of the contract was disclosed over a year ago, and it has not been altered since. The DelBenes cannot adjust or initiate any actions related to the forward contract. These transactions fall under the original forward contract but are being reported separately in the interest of transparency after consulting with the House Ethics Committee and the Department of Veterans Affairs.”

When reached by Raw Story, Tom Rust, staff director and chief counsel for the House Committee on Ethics, said “no comment.”

DelBene, who leads the Democratic Congressional Campaign Committee as chairperson this election cycle, supports in principle the banning of members of Congress from trading individual stocks and is a co-sponsor of the TRUST in Congress Act.

STOCK Act’s impact

Baird said the STOCK Act “hasn't gotten as far as I would have liked it to,” but it has been effective in holding some politicians accountable, he added.

For example, Baird attributes the transparency requirements with flipping the Senate and costing two Republican incumbents their seats in Georgia when former Sens. Kelly Loeffler and David Perdue were investigated for their suspiciously timed trades in 2020 after briefings about the impending COVID-19 pandemic.

“Because they had to report them within 45 days instead of once a year in May, the public could say, ‘Wait a second. Some of the richest people in the Senate were making stock trades while other people were losing their lives, their homes and their businesses,’” Baird said. “It smelled bad, and I think it significantly cost them their elections.”

By not abiding by the STOCK Act’s disclosure requirements, lawmakers such as Sen. Rand Paul (R-KY) were not held accountable by voters, Baird said. Paul was 16 months late in disclosing his wife’s February 2020 stock purchase in Gilead Sciences, which makes an antiviral drug used to treat Covid-19.

“People like Rand Paul and others did not follow the rules and hence were not held accountable by the voters because voters didn't know what to hold them accountable for,” Baird said. “We need to fix it so that those who not only violate the spirit of not making trades, but then also violate the transparency rules, have serious consequences.”

Given that Congress has passed legislation involving rapid reporting to the U.S. Securities and Exchange Commission of trades by investments firms, Baird says the same level of transparency should apply to Congress — and other branches of government for that matter, especially the Supreme Court, which he calls “bereft of ethics.”

“If we require it of others, in general, we’ve probably got to require it of ourselves,” Baird said. “There is a crisis of confidence and trust in people's view of the Congress right now, and one way to address that is to understand that if people think members of Congress are there to serve themselves rather than the public and are taking advantage of their position, it hurts the integrity and the reputation of the institution.”