Professional Documents

Culture Documents

Q3 Part 2 Problem On Job Order Costing

Q3 Part 2 Problem On Job Order Costing

Uploaded by

Ladybellereyann A TeguihanonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Q3 Part 2 Problem On Job Order Costing

Q3 Part 2 Problem On Job Order Costing

Uploaded by

Ladybellereyann A TeguihanonCopyright:

Available Formats

Q3 Part 2 Problem Solving on Job Order Costing 1st Semester A.Y.

2021-2022

Problem 1

S5Tank Co. uses a job order costing system and the following information is available from its records. The

company has 3 jobs in process: #5, #8, and #12.

Raw material used P120,000

Direct labor per hour P8.50

Overhead applied based on

direct labor cost 120%

Direct material was requisitioned as follows for each job respectively: 30 percent, 25 percent, and 25 percent; the

balance of the requisitions was considered indirect. Direct labor hours per job are 2,500; 3,100; and 4,200;

respectively. Indirect labor is P33,000. Other actual overhead costs totaled P36,000.

Required:

1. What is the prime cost of Job #5?

2. What is the total amount of overhead applied to Job #8?

3. What is the total amount of actual overhead?

4. How much overhead is applied to Work in Process?

5. If Job #12 is completed and transferred, what is the balance in Work in Process Inventory at the end of the

period if overhead is applied at the end of the period?

6. Assume the balance in Work in Process Inventory was P18,500 on June 1 and P25,297 on June 30. The balance

on June 30 represents one job that contains direct material of P11,250. How many direct labor hours have been

worked on this job (rounded to the nearest hour)?

Answers:

1. P57,250 [120,000 x 30% + (8.5x2500)]

2. P31,620 [3,100x8.5 x1.2]

3. P93,000 [24,000 from RM + 33,000 +36,000]

4. P99,960 [sum all DL hours x 8.5 x 1.2]

5. P170,720 [(120,000 x 55%)+(5,600x8.5)+(47,600x1.2)

6. 751 [(25,297-11,250)/2.2)/8.5)

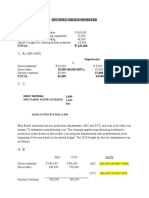

Problem 2

Aye Co. uses a job order costing system. During April 2001, the following costs appeared in the

Work in Process Inventory account:

Beginning balance P 24,000

Direct material used 70,000

Direct labor incurred 60,000

Applied overhead 48,000

Cost of goods manufactured 185,000

Aye Co. applies overhead on the basis of direct labor cost. There was only one job left in WIP

Inventory at the end of April which contained P5,600 of overhead. What amount of direct

material was included in this job?

Answer: P4,400

Solution:

Work In Process, Beg P24,000

Manufacturing Cost:

Direct Material Used 70,000

Direct labor incurred 60,000

Applied Overhead 48,000 178,000

Goods Available for Production 202,000

Cost of Goods Manufactured (185,000)

Work in Process, End 17,000

Breakdown of the WIP End:

Balance P17,000

Overhead (5,600)

Direct Labor (7,000) [5,600/80%]

Direct Material P4,400

How to compute the predetermined OH rate:

1. Since the overhead applied is based on direct labor cost, we can use the data above 48,000/60,000.

2. 80% is the answer, which means in every direct labor cost, 80% of that amount is equal to the OH

applied.

3. Ending WIP end contains P5,600 Overhead, gross it up using 80% to get the direct labor cost.

Problem 3

Elemenopi Co. is a print shop that produces jobs to customer specifications. During January

2001, Job #1253 was worked on and the following information is available:

Direct material used P2,500

Direct labor hours worked 15

Machine time used 6

Direct labor rate per hour P7

Overhead application rate per

hour of machine time P18

What was the total cost of Job #1253 for January?

Answer: P2,713

Solution:

Direct Material Used P2,500

Direct labor cost (15x7) 105

OH Cost (18 x 6) 108

Total Cost of Job P2,713

Problem 4

The following information pertains to XYZ Co. for September 2001.

Direct Material Direct Labor Overhead

Job #123 P3,200 P4,500 ?

Job #125 ? 5,000 ?

Job #201 5,670 ? P5,550

XYZ Co. applies overhead for Job #123 at 140 percent of direct labor cost and at 150 percent of

direct labor cost for Jobs #125 and #201. The total cost of Jobs #123 and #125 is identical.

1. What amount of overhead is applied to Job #123?

Answer: P6,300

P4,500 x 140% = P6,300

2. What amount of overhead is applied to Job #125?

Answer: P7,500

P5,000 150% = 7,500

3. What is the amount of direct material for to Job #125?

Answer: P1,500

Job #123 = P3,200 + 4,500 + 6,300

= 14,000

Job #125 = 14,000

Direct Labor (5,000)

Overhead (7,500)

Direct Materials P1,500

4. Assume that Jobs #123 and #201 are incomplete at the end of September. What is the

balance in Work in Process Inventory at that time?

Answer: P28,920

Job #123 = 14,000

Job #201 = P5,670 +5,550 + (5,550/150%) 14,920

P28,920

Problem 5

HAYNAKU Company manufactures custom-built conveyor systems for factory and commercial

operations. Cardo Dalisay is the cost accountant for HAYNAKU and he is in the process

of educating a new employee, Popoy Bash, about the job order costing system that

HAYNAKU uses. (The system is based on normal costs; overhead is applied based on

direct labor cost and rounded to the next whole dollar.) Cardo gathers the following job

order cost records for May:

Direct Direct Total

Job No. Materials Labor Applied OH Cost

667 P 5,901 P1,730 P 1,990 P 9,621

669 18,312 1,810 2,082 22,204

670 406 500 575 1,481

671 51,405 9,500 10,925 71,830

672 9,615 550 633 10,798

To explain the missing job number, Cardo informed Popoy that Job #668 had

been completed in April. He also told him that Job #667 was the only job in process at

the beginning of May. At that time, the job had been assigned P4,300 for direct

material and P900 for direct labor. At the end of May, Job #671 had not been

completed; all others had. Cardo asked Popoy several questions to determine whether

he understood the job order system.

Required: Help Popoy answer the following questions:

a. What is the predetermined overhead rate used by HAYNAKU Company?

b. What was the total cost of beginning Work in Process inventory?

c. What was total prime cost incurred for the month of May?

d. What was cost of goods manufactured for May?

ANSWER:

a. Use any job started in May:

Rate = MOH JOB P670 P575 = 115%/DL Cost

DL COST P500

b. DM P4,300

DL 900

FOH 1,035 (P900 × 115%)

P6,235

c. Prime Cost =DM + DL

DM = P85,639 – 4,300 = P81,339

DL = 14,090 – 900 = 13,190

P94,529

d. COGM = P9,621 + 22,204 + 1,481 + 10,798 = P44,104

Problem 6

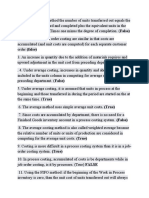

HUHUHU Company’s payroll records show the following information for November 16-31.

HUHUHU Company is operating five days per week.

Employee Working Days Rate Regular Previous Salary

OT Hrs Nov 1-15

Spongebob 11 P200/day 4 P2,400

Patrick 11 140/day 6 2,000

Sandy 9 180/day 4 1,620

Assumptions on Deductions:

a. The monthly contributions are only deducted on the 16th to 30th payroll.

b. Wtax on Compensation is 4% of monthly gross salary

c. SSS is 4.5% of monthly gross salary (employee share)

d. Philhealth is 3.5% of monthly gross salary (employee share)

e. Pag-IBIG is 2% of monthly gross salary (employee share)

Job #121 was done by Spongebob and Patrick, and Job #122 for Sandy. Job #121 has Direct Materials

Cost amounting to P8,000 and P7,600 for Job #122. Overhead application rate for both jobs is 80% of

direct labor. Assume that labor cost is classified as direct labor. Only Job #122 is left in the production as

of month end.

Required:

1. Compute the following in relation to the labor cost:

a. Regular Pay (Nov 16-30) of all employees

b. Overtime (Nov 16-30) of all employees

c. Gross Pay (Nov 16-30) of all employees

d. Total Wtax of all employees (employee share)

e. Total SSS Payable of all employees (employee share)

f. Total Philhealth Payable of all employees (employee share)

g. Total Pag-IBIG Payable of all employees (employee share)

h. Total Deductions of all emplpyees

i. Net Salary of all employees (for Nov 16 to 30)

2. How much is the cost of goods manufactured?

3. How much is the cost of Job 121?

4. How much is the WIP ending?

Solution:

Payroll for the Period November 16 to 30, 20xx

Deductions

Employee Name Days of Work Rate Regular Pay Overtime Gross Pay Net Salary

Wtax SSS PhilHealth Pag-IBIG Total

Spongebob 11 P200/day 2,200.00 125.00 2,325.00 189.00 212.63 165.38 94.50 661.50 1,663.50

Patrick 11 140/day 1,540.00 131.25 1,671.25 146.85 165.21 128.49 73.43 513.98 1,157.28

Sandy 9 180/day 1,620.00 112.50 1,732.50 134.10 150.86 117.34 67.05 469.35 1,263.15

Total 5,360.00 368.75 5,728.75 469.95 528.69 411.21 234.98 1,644.83 4,083.93

Journal Entries:

Salaries Expense P5,728.75

Wtax Payable P469.95

SSS Payable 528.69

PhilHealth Payable 411.21

Pag-IBIG Payable 234.98

Salaries Payable 4,083.93

2. Cost of Goods Manufactured (Job #121)

Direct Materials P8,000

Direct Labor 3,996.25 (Spongebob and Patrick Gross Pay Nov 16 to 30)

Direct Labor 4,400 (Nov 1 to 15)

Overhead 6,717 (80% of direct labor)

Total P23,113.25

3. Job #121 = P23,113.25

4. WIP Ending (Job #122)

Direct Materials P7,600

Direct Labor 1,732.50 (Sandy Gross Pay (Nov 16 to 30)

Direct Labor 1,620 (Sandy Nov 1 to 15)

Overhead 2,682 (80% of direct labor)

Total 13,634.50

You might also like

- Assignment - Service Cost AllocationDocument4 pagesAssignment - Service Cost AllocationRoselyn LumbaoNoch keine Bewertungen

- NRLD 2023-1 FinalDocument349 pagesNRLD 2023-1 FinalamitNoch keine Bewertungen

- Chapter 4. AssignmentDocument13 pagesChapter 4. AssignmentAnne Thea AtienzaNoch keine Bewertungen

- CH 05Document42 pagesCH 05Ferb CruzadaNoch keine Bewertungen

- Compost Tea - 2010 PDFDocument76 pagesCompost Tea - 2010 PDFgiovinkou100% (6)

- Week 5 Normal Job Order CostingDocument8 pagesWeek 5 Normal Job Order CostingRujean Salar AltejarNoch keine Bewertungen

- Solution Guide - Activity On Accounting For Materials CostDocument4 pagesSolution Guide - Activity On Accounting For Materials CostMirasol100% (2)

- B 1. An Equivalent Unit of Material or Conversion Cost Is Equal ToDocument4 pagesB 1. An Equivalent Unit of Material or Conversion Cost Is Equal ToKATHRYN CLAUDETTE RESENTENoch keine Bewertungen

- Job Order Costing TheoryDocument3 pagesJob Order Costing TheoryMiscaCruzNoch keine Bewertungen

- Chapter 5Document12 pagesChapter 5?????0% (1)

- 6.2 Midterm Quiz No. 2 - Job Order CostingDocument7 pages6.2 Midterm Quiz No. 2 - Job Order CostingRoselyn Lumbao100% (1)

- Job Order Costing ProblemsDocument15 pagesJob Order Costing ProblemsClarissa Teodoro100% (2)

- AFAR 15 Job Order CostingDocument11 pagesAFAR 15 Job Order CostingMartin ManuelNoch keine Bewertungen

- Cost Draft 2Document13 pagesCost Draft 2wynellamae100% (1)

- Multiple Choices - TheoreticalDocument8 pagesMultiple Choices - TheoreticalIsabelle AmbataliNoch keine Bewertungen

- Cost Acc. & Control QuizzesDocument18 pagesCost Acc. & Control Quizzesjessamae gundanNoch keine Bewertungen

- Mid Term Quiz 2 On Cost Accounting and Control - Manufacturing Overhead - DepartmentalizationDocument3 pagesMid Term Quiz 2 On Cost Accounting and Control - Manufacturing Overhead - DepartmentalizationGabriel Adrian ObungenNoch keine Bewertungen

- COST ACCTG Semi Final Exam 2020Document9 pagesCOST ACCTG Semi Final Exam 2020TyrsonNoch keine Bewertungen

- Multiple Choice-Problems 1. A: Direct MaterialDocument11 pagesMultiple Choice-Problems 1. A: Direct MaterialIT GAMINGNoch keine Bewertungen

- Chapter 8 de LeonDocument1 pageChapter 8 de LeonRose Ann De GuzmanNoch keine Bewertungen

- Accounting For Factory OverheadDocument12 pagesAccounting For Factory OverheadStephNoch keine Bewertungen

- Job Order CostingDocument10 pagesJob Order CostingGennelyn Grace Penaredondo100% (1)

- Problem 5 COSTACDocument3 pagesProblem 5 COSTACEms DelRosario100% (1)

- Chapter 11 Joint and by ProductsDocument10 pagesChapter 11 Joint and by ProductsRuby P. MadejaNoch keine Bewertungen

- TEST BANK Cost Accounting 14E by Carter Ch08 TEST BANK Cost Accounting 14E by Carter Ch08Document16 pagesTEST BANK Cost Accounting 14E by Carter Ch08 TEST BANK Cost Accounting 14E by Carter Ch08mEOW SNoch keine Bewertungen

- Standard Costing - Answer KeyDocument6 pagesStandard Costing - Answer KeyRoselyn LumbaoNoch keine Bewertungen

- Both Statements Are FalseDocument26 pagesBoth Statements Are FalseBanana QNoch keine Bewertungen

- Quiz On Cost Accounting and Control - Ch. 1-3-1Document3 pagesQuiz On Cost Accounting and Control - Ch. 1-3-1Elmarie Versaga DesuyoNoch keine Bewertungen

- Cost AccountingDocument4 pagesCost AccountingRoselyn LumbaoNoch keine Bewertungen

- Cos AccDocument6 pagesCos Accyza0% (3)

- Process Costing Part 2 IllustrationsDocument3 pagesProcess Costing Part 2 IllustrationsNCTNoch keine Bewertungen

- Discussion of Assignment - Just in Time and Backflush CostingDocument4 pagesDiscussion of Assignment - Just in Time and Backflush CostingRoselyn Lumbao100% (1)

- Cost Accounting ProblemsDocument3 pagesCost Accounting ProblemsRowena TamboongNoch keine Bewertungen

- Labor RaibornDocument16 pagesLabor RaibornChristine Joy GalbanNoch keine Bewertungen

- Cost Accounting & Control Long Quiz No. 2Document6 pagesCost Accounting & Control Long Quiz No. 2JUSTIN KYLE SIMPOROSONoch keine Bewertungen

- Chapter 11 Standard CostingDocument33 pagesChapter 11 Standard CostingMaricar ManansalaNoch keine Bewertungen

- Theories: Manufacturing - Actual Costing ReviewerDocument12 pagesTheories: Manufacturing - Actual Costing ReviewerJuan Dela CruzNoch keine Bewertungen

- Activity Based Costing (ABC) and Just in Time Costing (JIT)Document18 pagesActivity Based Costing (ABC) and Just in Time Costing (JIT)Clarissa TeodoroNoch keine Bewertungen

- MAS - CH 15 Exercises On STD Costs - Variance Analysis - BalatbatDocument30 pagesMAS - CH 15 Exercises On STD Costs - Variance Analysis - BalatbatAzureBlazeNoch keine Bewertungen

- Finished Goods Inventory: Exercise 1-1 (True or False)Document16 pagesFinished Goods Inventory: Exercise 1-1 (True or False)Isaiah BatucanNoch keine Bewertungen

- Prelim Mas 1-TestDocument16 pagesPrelim Mas 1-TestChrisNoch keine Bewertungen

- Cost AccountingDocument9 pagesCost Accountingnicole friasNoch keine Bewertungen

- Process CostingDocument19 pagesProcess CostingmilleranNoch keine Bewertungen

- Answer Q1 Job Order CostingDocument5 pagesAnswer Q1 Job Order CostingDiane Cris Duque100% (1)

- 8.1 Cost HWDocument3 pages8.1 Cost HWJune Maylyn MarzoNoch keine Bewertungen

- Cost Accounting Midterm Examination ReviewerDocument7 pagesCost Accounting Midterm Examination ReviewerCj TolentinoNoch keine Bewertungen

- M8 CHP 12 4 Allocation of Joint CostsDocument2 pagesM8 CHP 12 4 Allocation of Joint CostsQueennie EllamNoch keine Bewertungen

- Cost Accounting QuestionsDocument14 pagesCost Accounting QuestionsMhico MateoNoch keine Bewertungen

- Cost Accounting Chapter5 Problem1 3Document9 pagesCost Accounting Chapter5 Problem1 3Baby MushroomNoch keine Bewertungen

- Joint Products and By-Products: de Leon/ de Leon/ de LeonDocument17 pagesJoint Products and By-Products: de Leon/ de Leon/ de LeonMay Grethel Joy PeranteNoch keine Bewertungen

- Cost Accounting DQ - Prelims - AnswersDocument17 pagesCost Accounting DQ - Prelims - AnswersKurt dela TorreNoch keine Bewertungen

- Practice Exam Chapter 1-3Document5 pagesPractice Exam Chapter 1-3Renz Paul MirandaNoch keine Bewertungen

- 06 Process CostingDocument16 pages06 Process CostingChristian Blanza LlevaNoch keine Bewertungen

- AnswerDocument31 pagesAnswerJabeth IbarraNoch keine Bewertungen

- Practice PROBLEMS For FM AnaysisDocument14 pagesPractice PROBLEMS For FM AnaysisElla MontefalcoNoch keine Bewertungen

- Bacostmx-3tay2021-Finals Quiz 1Document6 pagesBacostmx-3tay2021-Finals Quiz 1Marjorie NepomucenoNoch keine Bewertungen

- BFM 113 - Reviewer For Final Departmental Exam - Working Capital ManagementDocument8 pagesBFM 113 - Reviewer For Final Departmental Exam - Working Capital ManagementAudreyMaeNoch keine Bewertungen

- Gamma CompanyDocument7 pagesGamma Companykay_kleirNoch keine Bewertungen

- Job OrderDocument7 pagesJob OrderShannon Mojica100% (2)

- Job Order CostingDocument14 pagesJob Order Costingmariciela100% (2)

- JOBCOSTINGDocument4 pagesJOBCOSTINGkakaoNoch keine Bewertungen

- Exercises On Introduction To Cost AccountingDocument4 pagesExercises On Introduction To Cost AccountingAsi Cas Jav100% (1)

- Rizal's Family BackgroundDocument33 pagesRizal's Family BackgroundLadybellereyann A TeguihanonNoch keine Bewertungen

- The Women in Jose Rizal's LifeDocument15 pagesThe Women in Jose Rizal's LifeLadybellereyann A TeguihanonNoch keine Bewertungen

- Rizal and The Propaganda MovementDocument20 pagesRizal and The Propaganda MovementLadybellereyann A TeguihanonNoch keine Bewertungen

- Rizal's EducationDocument52 pagesRizal's EducationLadybellereyann A TeguihanonNoch keine Bewertungen

- To The Filipino YouthDocument10 pagesTo The Filipino YouthLadybellereyann A TeguihanonNoch keine Bewertungen

- Jose Rizal's TravelsDocument33 pagesJose Rizal's TravelsLadybellereyann A TeguihanonNoch keine Bewertungen

- Through Education The Motherlan Receives LightDocument14 pagesThrough Education The Motherlan Receives LightLadybellereyann A TeguihanonNoch keine Bewertungen

- Lesson 5 Organizational Analysis and Competitive Advantage PDFDocument47 pagesLesson 5 Organizational Analysis and Competitive Advantage PDFLadybellereyann A TeguihanonNoch keine Bewertungen

- Strategic Audit TemplateDocument8 pagesStrategic Audit TemplateLadybellereyann A TeguihanonNoch keine Bewertungen

- Marketing Management - Chapter 4Document28 pagesMarketing Management - Chapter 4Ladybellereyann A TeguihanonNoch keine Bewertungen

- Gross EstateDocument13 pagesGross EstateLadybellereyann A TeguihanonNoch keine Bewertungen

- HBO Chapter 2 - Indicidual Differences, Mental ABility & PersonalityDocument57 pagesHBO Chapter 2 - Indicidual Differences, Mental ABility & PersonalityLadybellereyann A TeguihanonNoch keine Bewertungen

- Illustration Deduction and Taxable EstateDocument8 pagesIllustration Deduction and Taxable EstateLadybellereyann A TeguihanonNoch keine Bewertungen

- Scene 1: An Awful DayDocument8 pagesScene 1: An Awful DayKhúc ĐạtNoch keine Bewertungen

- Flyer UNO Hattenbach TrokarDocument1 pageFlyer UNO Hattenbach Trokarophtho india incNoch keine Bewertungen

- Review of Object OrientationDocument50 pagesReview of Object OrientationJobair Al NahianNoch keine Bewertungen

- Milon Kumar Das.Document2 pagesMilon Kumar Das.Milon Kumar DasNoch keine Bewertungen

- The Royal Air Force AT 100: Passenger Accessibility Pilot Shortage Addressed Plugging Into Electric AviationDocument60 pagesThe Royal Air Force AT 100: Passenger Accessibility Pilot Shortage Addressed Plugging Into Electric AviationIbrahim MadanNoch keine Bewertungen

- Grammar and Tips When Learning Japanese OnomatopoeiaDocument3 pagesGrammar and Tips When Learning Japanese Onomatopoeiaharuki nakazakiNoch keine Bewertungen

- Stairville Consola Junio 2015 PDFDocument28 pagesStairville Consola Junio 2015 PDFSilvia PrietoNoch keine Bewertungen

- Finding Outliers 2 Wayes Z-Score and Interquortile RangeDocument1 pageFinding Outliers 2 Wayes Z-Score and Interquortile RangeAna ChikovaniNoch keine Bewertungen

- Discourse Analysis by Gillian Brown GeorDocument149 pagesDiscourse Analysis by Gillian Brown GeorJihanna AlfitrahNoch keine Bewertungen

- Cambridge International AS & A Level: Chemistry 9701/13Document3 pagesCambridge International AS & A Level: Chemistry 9701/13chaitanya khemaniNoch keine Bewertungen

- SERBIA Registration Requirements For Medicinal ProductsDocument1 pageSERBIA Registration Requirements For Medicinal ProductsMario BasicNoch keine Bewertungen

- Pin Code Door Lock System With ArduinoDocument21 pagesPin Code Door Lock System With ArduinoSagun ShresthaNoch keine Bewertungen

- Introduction To Booster Pump SystemDocument148 pagesIntroduction To Booster Pump SystemWan Muhamad Faiz100% (1)

- Super-Sized Science Projects With Volume - How Much Space Does It Take Up!Document50 pagesSuper-Sized Science Projects With Volume - How Much Space Does It Take Up!Sal OtNoch keine Bewertungen

- 2 Letter WritingDocument7 pages2 Letter WritingDarius DaeNoch keine Bewertungen

- Design and Simulation of Microstrip CoupledDocument76 pagesDesign and Simulation of Microstrip CoupledyyryNoch keine Bewertungen

- Barudan BEMR InstructionsDocument4 pagesBarudan BEMR InstructionsCzaarNoch keine Bewertungen

- Icd 10 Inacbgs Penyakit Kulit Dan Kelamin TerseringDocument1 pageIcd 10 Inacbgs Penyakit Kulit Dan Kelamin TerseringCempaka limaNoch keine Bewertungen

- Can You Explain Model, View, and Controller in MVC?Document39 pagesCan You Explain Model, View, and Controller in MVC?paparos486Noch keine Bewertungen

- Anterior Cruciate LigamentDocument26 pagesAnterior Cruciate LigamentAmandeep Singh100% (2)

- Mels Prep 2016 Opinion PieceDocument11 pagesMels Prep 2016 Opinion Pieceapi-271650264Noch keine Bewertungen

- Ethyl Acetate Design ProjectDocument60 pagesEthyl Acetate Design ProjectAhmed Ali100% (4)

- Abiot GedayDocument68 pagesAbiot GedaySeti MarkosNoch keine Bewertungen

- Studies in The History of Sanskrit Poetics Vol IDocument399 pagesStudies in The History of Sanskrit Poetics Vol Idrgnarayanan100% (2)

- Network Hospital List - 13Document2 pagesNetwork Hospital List - 13manikandan pNoch keine Bewertungen

- ASSIGNMENT 411 - Audit of FS PresentationDocument4 pagesASSIGNMENT 411 - Audit of FS PresentationWam OwnNoch keine Bewertungen

- Humphrey 1993 Aeg in Britain PDFDocument18 pagesHumphrey 1993 Aeg in Britain PDFHoài NguyễnNoch keine Bewertungen

- Egg DropDocument2 pagesEgg DropLeah ClovisNoch keine Bewertungen