Professional Documents

Culture Documents

Test Series: March 2023 Mock Test Paper 1 Intermediate: Group - I Paper - 1: Accounting

Test Series: March 2023 Mock Test Paper 1 Intermediate: Group - I Paper - 1: Accounting

Uploaded by

Kartik GuptaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Test Series: March 2023 Mock Test Paper 1 Intermediate: Group - I Paper - 1: Accounting

Test Series: March 2023 Mock Test Paper 1 Intermediate: Group - I Paper - 1: Accounting

Uploaded by

Kartik GuptaCopyright:

Available Formats

Test Series: March 2023

MOCK TEST PAPER 1

INTERMEDIATE: GROUP – I

PAPER – 1: ACCOUNTING

Question No. 1 is compulsory.

Answer any four questions from the remaining five questions.

Wherever necessary suitable assumptions may be made and disclosed b y way of a note.

Working Notes should form part of the answer.

(Time allowed: Three hours) (Maximum Marks: 100)

1. (a) How will you disclose following items while preparing Cash Flow Statement of Gagan Ltd. as per

AS-3 for the year ended 31st March, 2022?

(i) 10% Debentures issued: As on 01-04-2021 ` 1,10,000

As on 31-03-2022 ` 77,000

(ii) Debentures were redeemed at 5% premium at the end of the year. Premium was charged

to the Profit & Loss Account for the year.

(iii) Unpaid Interest on Debentures: As on 01-04-2021 ` 275

As on 31-03-2022 ` 1,175

(iv) Debtors of ` 36,000 were written off against the Provision for Doubtful Debts A/c during the

year.

(v) 10% Bonds (Investments): As on 01-04-2021 ` 3,50,000

As on 31-03-2022 ` 3,50,000

(vi) Accrued Interest on Investments: As on 31-03-2022 ` 10,500

(b) D Ltd. acquired a machine on 01-04-2017 for ` 20,00,000. The useful life is 5 years. The

company had applied on 01-04-2017, for a subsidy to the tune of 80% of the cost. The sanction

letter for subsidy was received in November 2020. The Company’s Fixed Assets Account for the

financial year 2020-21 shows a credit balance as under:

Particulars `

Machine (Original Cost) 20,00,000

Less: Accumulated Depreciation (from 2017-18- to 2019-20 on

Straight Line Method) 12,00,000

8,00,000

Less: Grant received (16,00,000)

Balance (8,00,000)

You are required to explain how should the company deal with this asset in its accounts for

2020-21?

(c)

Particulars Kg. `

Opening Inventory: Finished Goods 1,000 25,000

Raw Materials 1,100 11,000

Purchases 10,000 1,00,000

© The Institute of Chartered Accountants of India

Labour 76,500

Overheads (Fixed) 75,000

Sales 10,000 2,80,000

Closing Inventory: Raw Materials 900

Finished Goods 1200

The expected production for the year was 15,000 kg of the finished product. Due to fall in market

demand the sales price for the finished goods was ` 20 per kg and the replacement cost for the

raw material was ` 9.50 per kg on the closing day. You are required to calculate the closing

inventory as on that date.

(d) ABC Ltd. was making provision for non-moving inventories based on no issues for the last 12

months up to 31.3.2021.

The company wants to provide during the year ending 31.3.2022 based on technical evaluation:

Total value of inventory ` 100 lakhs

Provision required based on 12 months issue ` 3.5 lakhs

Provision required based on technical evaluation ` 2.5 lakhs

Does this amount to change in Accounting Policy? Can the company change the method of

provision? (4 parts x 5 Marks = 20 Marks)

2. (a) Sanket had 50,000 Equity shares of XYZ Ltd. on 01.01.2022 at a book value of ` 25 per share

(face value ` 10). On 01.06.2022, he purchased another 10,000 shares of the company at ` 20

per share.

The director of XYZ Ltd. announces a bonus and right issue. No dividend was payable on these

issues. The terms of the issue were as follows:

• Bonus basis 1:6 (Date: 16.08.2022)

• Right basis 3: 7 (Date: 31.08.2022) price `15 per share

• Due date for payment 30.09.2022

• Shareholders can transfer their rights in full or in part.

Accordingly, Sanket sold 33 1/3% of his entitlement in the market for consideration of ` 4 per

share on 31.08.2022 & he procured other entitlement by payment.

Dividends for the year ended 31.03.2022 at the rate of 20% were declared by XYZ Ltd. and

received by Sanket on 31.10.2022. Dividend amount for shares acquired by him on 01.06.2022

are to be adjusted against the cost of purchase.

On 15.11.2022, Sanket sold 25,000 equity shares at premium ` 12 per share.

You are required to prepare in books of Sanket.

(i) Investment Account

(ii) Profit & Loss Account (Extract for Investment)

Books of accounts are closed by Sanket on 31.12.2022 and market price of shares on that date is

` 20 per share.

(b) A fire occurred in the premises of M/s. Raxby & Co. on 30-06-2022. From the salvaged

accounting records, the following particulars were ascertained

`

Stock at cost as on 01-04-2021 1,20,000

2

© The Institute of Chartered Accountants of India

Stock at cost as on 31-03-2022 1,30,000

Purchases less return during 2021-22 5,25,000

Sales less return during 2021-2022 6,00,000

Purchases from 01-04-2022 to 30-06-2022 97,000

Purchases upto 30-06-2022 did not include ` 35,000 for which

purchase invoices had not been received from suppliers, though

goods have been received in godown.

Sales from 1.4.2022 to 30.6.2022 1,66,000

In valuing the stock for the Balance Sheet at 31st March, 2022, ` 5,000 had been written off on

certain stock which was a poor selling line having the cost of ` 8,000. A portion of these goods

were sold in May, 2022 at a loss of ` 1,000 on original cost of ` 7,000. The remainder of the

stock was now estimated to be worth its original cost. Subject to that exception, gross profit had

remained at a uniform rate throughout the year.

The value of the salvaged stock was ` 10,000. M/s. Raxby & Co. had insured their stock for

` 1,00,000 subject to average clause.

Compute the amount of claim to be lodged to the insurance company. (10 + 10 = 20 Marks)

3. (a) On 31st March, 2022 Chennai Branch submits the following Trial Balance to its Head Office at

Lucknow:

Debit Balances ` in lacs

Furniture and Equipment 18

Depreciation on furniture 2

Salaries 25

Rent 10

Advertising 6

Telephone, Postage and Stationery 3

Sundry Office Expenses 1

Stock on 1st April, 2021 60

Goods Received from Head Office 288

Debtors 20

Cash at bank and in hand 8

Carriage Inwards 7

448

Credit Balances

Outstanding Expenses 3

Goods Returned to Head Office 5

Sales 360

Head Office 80

448

Additional Information:

Stock on 31st March, 2022 was valued at ` 62 lacs. On 29th March, 2022 the Head Office

dispatched goods costing ` 10 lacs to its branch. Branch did not receive these goods before 1st

© The Institute of Chartered Accountants of India

April, 2022. Hence, the figure of goods received from Head Office does not include these goods.

Also the head office has charged the branch ` 1 lac for centralized services for which the branch

has not passed the entry.

You are required to :(i) pass Journal Entries in the books of the Branch to make the necessary

adjustments and (ii) prepare Final Accounts of the Branch including Balance Sheet.

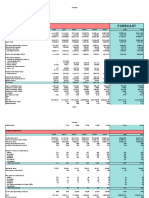

(b) M/s P have 2 Departments - X and Y. From the following information, prepare departmental

Trading A/c and General Profit & Loss Account for the year ended on 31st March 2022.

Amount (`)

Department X Department Y

Opening stock as on 1-04-2021 (at cost) 2,45,000 2,43,000

Purchases 13,72,000 13,41,000

Carriage Inward 21,000 40,500

Wages 1,89,000 1,62,000

Sales 20,02,000 20,70,000

Purchased Goods Transferred:

By Department Y to X 2,25,000

By Department X to Y 1,26,000

Finished Goods Transferred:

By Department Y to X 6,75,000

By Department X to Y 6,12,500

Return of Finished Goods:

By Department Y to X 1,57,500

By Department X to Y 1,44,000

Closing Stock:

Purchased Goods 84,000 1,35,000

Finished Goods 3,57,000 2,79,000

Purchased goods have been transferred mutually at their respective departmental purchase cost

and finished goods at departmental market price and 30% of the closing finished stock with each

department represents finished goods received from the other department. (12+ 8 = 20 Marks)

4 (a) Lucky does not maintain proper books of accounts. However, he maintains a record of his bank

transactions and also is able to give the following information from which you are requested to

prepare his final accounts for the year 2021-22:

1.4.2021 31.3.2022

` `

Debtors 1,02,500 −

Creditors − 46,000

Inventory 50,000 62,500

Bank Balance − 50,000

Fixed Assets 7,500 9,000

Details of his bank transactions were as follows:

`

Received from debtors 3,40,000

4

© The Institute of Chartered Accountants of India

Additional capital brought in 5,000

Sale of fixed assets (book value ` 2,500) 1,750

Paid to creditors 2,80,000

Expenses paid 49,250

Personal drawings 25,000

Purchase of fixed assets 5,000

No cash transactions took place during the year. Goods are sold at cost plus 25%. Cost of

goods sold was ` 2,60,000.

(b) The following are the extracts from the Balance Sheet of Alfa Ltd. as on 31st March, 2022:

Share capital: 1,12,500 Equity shares of `10 each fully paid – ` 11,25,000; 3,375 10%

Redeemable preference shares of `100 each fully paid – ` 3,37,500.

Reserve & Surplus: Capital reserve – `2,25,000; General reserve –` 2,25,000; Profit and Loss

Account – `1,68,750.

On 1st April 2022, the Board of Directors decided to redeem the preference shares at premium of

10% by utilization of reserves.

You are required to prepare necessary Journal Entries including cash transactions in the books

of the company. (15+5 = 20 Marks)

5. (a) The following information of Harry Ltd. for the year ending 31 st March, 2022 and 31st March, 2021

is provided as:

2022 2021

` `

Equity share capital 1,20,000 1,00,000

Reserves:

Profit and Loss Account 9,000 8,000

Current Liabilities:

Trade Payables 8,000 5,000

Income tax payable 3,000 2,000

Dividends payable 4,000 2,000

Fixed Assets (at W.D.V)

Building 19,000 20,000

Furniture & Fixture 34,000 22,000

Cars 25,000 16,000

Long Term Investments 32,000 28,000

Current Assets:

Inventory 14,000 8,000

Trade Receivables 8,000 6,000

Cash & Bank 12,000 17,000

© The Institute of Chartered Accountants of India

The Profit and Loss account for the year ended 31 st March, 2022 disclosed:

`

Profit before tax 8,000

Income Tax (3,000)

Profit after tax 5,000

Further Information is available:

1. Depreciation on Building ` 1,000

2. Depreciation on Furniture & Fixtures for the year ` 2,000

3. Depreciation on Cars for the year ` 5,000. One car was disposed during the year for `

3,400 whose written down value was ` 2,000.

4. Purchase investments for ` 6,000.

5. Sold investments for ` 10,000, these investments cost ` 2,000.

6. Dividend payable at 31.3.2021 has been paid during the current year.

Prepare Cash Flow Statements as per AS-3 (revised) using indirect method.

(b) Omega Limited (listed company) issued ` 4,50,000 5% Debentures on 30th September 2020 on

which interest is payable half yearly on 31st March and 30th September. The company has power

to purchase debentures in the open market for cancellation thereof. On 31 December 2020,

investments made for the purpose of redemption were ` 67,500. The following purchases were

made during the year ended 31st December, 2022 and the cancellation were made on the same

date

1st March 2022 - ` 75,000 nominal value purchased for ` 74,175 ex-interest.

1st September 2022 - ` 60,000 nominal value purchased for ` 60,375 cum-interest.

You are required to draw up the following accounts up to the date of cancellation:

(i) Debentures Account; and

(ii) Own Debenture (Investment) Account. Ignore taxation. (15+5=20 Marks)

6. (a) Preet Ltd. is installing a new plant at its production facility. It has incurred these costs:

Cost of the plant (cost per supplier’s invoice plus taxes) ` 10,00,000

Initial delivery and handling costs ` 80,000

Cost of site preparation ` 2,40,000

Consultants used for advice on the acquisition of the plant ` 2,80,000

Estimated dismantling costs to be incurred after 7 years ` 1,20,000

Operating losses before commercial production ` 1,60,000

Please advise Preet Ltd. on the costs that can be capitalised in accordance with AS 10

(Revised).

(b) Kartik Ltd. is a non-investment company and has been incurring losses for the past few years.

The company provides the following information for the current year:

(` in lakhs)

Paid up equity share capital 270

Paid up Preference share capital 45

Reserves (including Revaluation reserve ` 22.5 lakhs) 337.5

Securities premium 90

© The Institute of Chartered Accountants of India

Long term loans 90

Deposits repayable after one year 45

Application money pending allotment 1620

Accumulated losses not written off 45

Investments 405

Kartik Ltd. has only one whole-time director, Mr. Kumar. You are required to calculate the

amount of maximum remuneration that can be paid to him as per provisions of the Companies

Act, 2013, if no special resolution is passed at the general meeting of the company in respect of

payment of remuneration.

OR

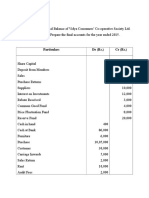

Following is the extract of the Balance Sheet of Madhu Ltd.as at 31 st March, 2022

`

Authorized capital:

45,000 12% Preference shares of ` 10 each 4,50,000

6,00,000 Equity shares of ` 10 each 60,00,000

64,50,000

Issued and Subscribed capital:

36,000 12% Preference shares of ` 10 each fully paid 3,60,000

4,05,000 Equity shares of ` 10 each, ` 8 paid up 32,40,000

Reserves and surplus:

General Reserve 5,40,000

Capital Redemption Reserve 1,80,000

Securities premium (collected in cash) 1,12,500

Profit and Loss Account 9,00,000

On 1st April, 2022, the Company has made final call @ ` 2 each on 4,05,000 equity shares. The

call money was received by 20 th April, 2022. Thereafter, the company decided to capitalize its

reserves by way of bonus at the rate of one share for every four shares held by utilizing the

balance of profit and loss account to the minimum extent.

You are required to prepare necessary journal entries in the books of the company and prepare

the relevant extract of the balance sheet as on 30th April, 2022 after bonus issue.

(c) Vital Limited borrowed an amount of `150 crores on 1.4.2021 for construction of boiler plant @

10% p.a. The plant is expected to be completed in 4 years. Since the weighted average c ost of

capital is 13% p.a., the accountant of Vital Ltd. capitalized ` 19.50 crores for the accounting

period ending on 31.3.2022. Due to surplus fund out of `150 crores, an income of ` 1.50 crores

was earned and credited to profit and loss account. Comment on the above treatment of

accountant with reference to relevant accounting standard.

(d) (i) With regard to financial statements name any four.

(1) Users

(2) Qualitative characteristics

(3) Elements

(ii) What are fundamental accounting assumptions? (4 Parts x 5 Marks = 20 Marks)

© The Institute of Chartered Accountants of India

Test Series: March 2023

MOCK TEST PAPER 1

INTERMEDIATE:-GROUP – I

1. (a) Cash Flow Statement of Gagan Ltd. for the year ended March 31, 2022

A Cash Flow from Operating Activities

Net Profit as per Profit & Loss A/c --------

Add: Premium on Redemption of Debentures 1,650

Add: Interest on 10% Debentures 11,000

Less: Interest on 10% Investments (35,000)

B Cash Flow from Investing Activities

Interest on Investments [35,000-10,500] 24,500

C Cash Flow from Financing Activities

Interest on Debentures paid [11,000 - (1,175 - 275)] (10,100)

Redemption of Debentures [(1,10,000 - 77,000) at 5% premium] (34,650)

Note: Debtors written off against provision for doubtful debts does not require any further

adjustment in Cash Flow Statement.

(b) From the above account, it is inferred that the Company has deducted grant from the book value

of asset for accounting of Government Grants. Accordingly, out of the ` 16,00,000 that has been

received, ` 8,00,000 (being the balance in Machinery A/c) should be credited to the machinery

A/c.

The balance ` 8,00,000 may be credited to P&L A/c, since already the cost of the asset to the

tune of ` 12,00,000 had been debited to P&L A/c in the earlier years by way of depreciation

charge, and ` 8,00,000 transferred to P&L A/c now would be partial recovery of that cost.

There is no need to provide depreciation for 2020-21 or 2021-22 as the depreciable amount is

now Nil.

(c) Calculation of cost for closing inventory

Particulars `

Cost of Purchase (10,200 x 10) 1,02,000

Direct Labour 76,500

75,000 x 10,200

Fixed Overhead 51,000

15,000

Cost of Production 2,29,500

Cost of closing inventory per unit (2,29,500/10,200) ` 22.50

Net Realisable Value per unit ` 20.00

Since net realisable value is less than cost, closing inventory will be valued at ` 20.

As NRV of the finished goods is less than its cost, relevant raw materials will be valued at

replacement cost i.e. ` 9.50.

Therefore, value of closing inventory: Finished Goods (1,200 x 20) ` 24,000

Raw Materials (900 x 9.50) ` 8,550

` 32,550

© The Institute of Chartered Accountants of India

(d) The decision of making provision for non-moving inventories on the basis of technical evaluation

does not amount to change in accounting policy. Accounting policy of a company may require

that provision for non-moving inventories should be made. The method of estimating the

amount of provision may be changed in case a more prudent estimate can be ma de. In the

given case, considering the total value of inventory, the change in the amount of required

provision of non-moving inventory from ` 3.5 lakhs to ` 2.5 lakhs is also not material. The

disclosure can be made for such change in the following lines by way of notes to the accounts

in the annual accounts of ABC Ltd. for the year 2021-22:

“The company has provided for non-moving inventories on the basis of technical evaluation

unlike preceding years. Had the same method been followed as in the previo us year, the profit

for the year and the corresponding effect on the year end net assets would have been lower by `

1 lakh.”.

2. (a) Books of Sanket

Investment Account

(Scrip: Equity Shares in XYZ Ltd.)

No. Amount No. Amount

` `

1.1.2022 To Bal b/d 50,000 12,50,000 31.10.2022 By Bank (dividend — 20,000

1.6.2022 To Bank 10,000 2,00,000

16.8.2022 To Bonus 10,000 — on shares

(W.N.1) acquired on

30.9.2022 To Bank 20,000 3,00,000 1.6.2022) (W.N.4)

(Rights

Shares)

(W.N.3)

15.11.2022 To Profit (on sale 69,444 15.11.2022 By Bank 25,000 5,50,000

of shares) (Sale of shares)

31.12.2022 By Bal. c/d 65,000 12,49,444

(W.N.6)

90,000 18,19,444 90,000 18,19,444

Profit and Loss Account (An extract for investment)

31.12.2022 To Balance c/d (profit) 2,09,444 31.8.22 By Sale of rights (W.N.3) 40,000

31.10.22 By Dividend (W.N.4) 1,00,000

15.11.22 By Profit transferred 69,444

2,09,444 2,09,444

Working Notes:

(1) Bonus Shares = = 10,000 shares

(2) Right Shares = = 30,000 shares × 2/3 = 20,000 shares

(3) Right shares renounced = 30,000×1/3 = 10,000 shares

Sale of right shares = 10,000 x 4 = ` 40,000

Right shares subscribed = 20,000 shares

Amount paid for subscription of right shares = 20,000 x 15 = ` 3,00,000

2

© The Institute of Chartered Accountants of India

(4) Dividend received = 50,000 (shares as on 1st April 2022) × 10 × 20% = ` 1,00,000

Dividend on shares purchased on 1.6.2022 = 10,000×10×20% = ` 20,000 is adjusted to

Investment A/c

(5) Profit on sale of 25,000 shares

= Sales proceeds – Average cost

Sales proceeds = ` 5,50,000

Average cost = = ` 4,80,556

Profit = ` 5,50,000 – ` 4,80,556 = ` 69,444.

(6) Cost of shares on 31.12.2022 = ` 12,49,444

Market value of share = 65,000 shares × ` 20 = 13,00,000

Shares will be valued at ` 12,49,444 as market value is more than cost.

(b) M/s Raxby & Co.

Trading Account for 2021-22

(to determine the rate of gross profit)

` ` `

To Opening Stock 1,20,000 By Sales A/c 6,00,000

To Purchases 5,25,000 By Closing Stock :

To Gross Profit 90,000 As valued 1,30,000

Add: Amount written off

to restore stock to

full cost 5,000 1,35,000

7,35,000 7,35,000

90,000

The normal rate of gross profit to sales is = 100 = 15%

6,00,000

Memorandum Trading Account up to June 30, 2022

Normal Abnormal Total Normal Abnormal Total

items items items items

` ` ` ` ` `

To Opening 1,27,000 8,000* 1,35,000 By Sales 1,60,000 6,000 1,66,000

Aktie

To Purchases By Loss — 1,000 1,000

(97,000+35,000) 1,32,000 — 1,32,000

To Gross Profit By Closing

(15% on Stock

` 1,60,000) 24,000 — 24,000 (bal. fig.) 1,23,000 1,000 1,24,000

2,83,000 8,000 2,91,000 2,83,000 8,000 2,91,000

* at cost.

Calculation of Insurance Claim

`

Value of stock on June 30, 2022 1,24,000

Less: Salvage (10,000)

Loss of stock 1,14,000

3

© The Institute of Chartered Accountants of India

Claim subject to average clause:

Amount of Policy

× Actual Loss of Stock = 1,00,000 / 1,24,000 X 1,14,000

Value of stock

= ` 91,935 (approx.)

Therefore, insurance claim will be limited to ` 91,935 (approx.)

3. (a) (i) Books of Branch

Journal Entries

(` in lacs)

Dr. Cr.

Goods in Transit A/c Dr. 10

To Head Office A/c 10

(Goods dispatched by head office but not

received by branch before 1st April, 2022)

Expenses A/c Dr. 1

To Head Office A/c 1

(Amount charged by head office for centralised

services)

(ii) Trading and Profit & Loss Account of the Branch

for the year ended 31st March, 2022

` in lacs ` in lacs

To Opening Stock 60 By Sales 360

To Goods received from By Closing Stock 62

Head Office 288

Less : Returns (5) 283

To Carriage Inwards 7

To Gross Profit c/d 72

422 422

To Salaries 25 By Gross Profit b/d 72

To Depreciation on Furniture 2

To Rent 10

To Advertising 6

To Telephone, Postage & Stationery 3

To Sundry Office Expenses 1

To Head Office Expenses 1

To Net Profit Transferred to

Head Office A/c 24

72 72

© The Institute of Chartered Accountants of India

Balance Sheet as on 31st March, 2022

Liabilities ` in lacs Assets ` in lacs

Head Office 80 Furniture & Equipment 20

Add : Goods in transit 10 Less : Depreciation (2) 18

Head Office Expenses 1 Stock in hand 62

Net Profit 24 Goods in Transit 10

115 Debtors 20

Outstanding Expenses 3 Cash at bank and in

hand 8

118 118

(b) Departmental Trading Account in the books of M/s P

for the year ended 31 st March 2022

Particulars Department Department Particulars Department Department

X Y X Y

` ` ` `

To Opening 2,45,000 2,43,000 By Sales 20,02,000 20,70,000

stock

To Purchases 13,72,000 13,41,000 By Transfers:

To Carriage 21,000 40,500 Purchased 1,26,000 2,25,000

inward goods

To Wages 1,89,000 1,62,000 Finished 4,55,000 5,31,000*

To Transfers goods (net of

returns)

Purchased 2,25,000 1,26,000 By Closing

goods stock:

Finished 5,31,000 4,55,000 Purchased 84,000 1,35,000

goods goods

(net of returns)

To Gross profit 4,41,000 8,72,500 Finished 3,57,000 2,79,000

c/d goods

30,24,000 32,40,000 30,24,000 32,40,000

General Profit and Loss A/c

for the year ended 31 st March, 2022

Particulars ` Particulars `

To Provision for By Gross profit b/d

unrealized profit

included in closing

stock

Department X (W.N. 3) 35,921 Department X 4,41,000

Net transfers of finished goods by

Department X to Y = ` 6,12,500 – ` 1,57,500 = ` 4,55,000

Department Y to X = ` 6,75,000 – ` 1,44,000= ` 5,31,000

5

© The Institute of Chartered Accountants of India

Department Y (W.N. 3) 15,024 Department Y 8,72,500

To Net profit 12,62,555

13,13,500 13,13,500

Working Notes:

1. Calculation of rates of gross profit margin on sales

Department X Department Y

` `

Sales 20,02,000 20,70,000

Add: Transfer of finished goods 6,12,500 6,75,000

26,14,500 27,45,000

Less: Return of finished goods (1,57,500) (1,44,000)

24,57,000 26,01,000

Gross Profit 4,41,000 8,72,500

Gross profit margin = (4,41,000/24,57,000) x 100 (8,72,500/26,01,000) x 100

= 17.95% = 33.54%

2. Finished goods from other department included in the closing stock

Department X Department Y

` `

Stock of finished goods 3,57,000 2,79,000

Stock related to other department

(30% of finished goods) 1,07,100 83,700

3. Unrealized profit included in the closing stock

Department X = 33.54% of ` 1,07,100 = ` 35,921

Department Y = 17.95% of ` 83,700 = ` 15,024

4. (a) Trading and Profit and Loss Account

for the year ended 31st March, 2022

Amount Amount

` `

To Opening Inventory 50,000 By Sales (` 2,60,000 3,25,000

125/100)

To Purchases (balancing figure) 2,72,500 By Closing Inventory 62,500

To Gross profit c/d

(` 2,60,000 25/100) 65,000 _______

3,87,500 3,87,500

To Expenses 49,250 By Gross profit b/d 65,000

To Loss on sale of fixed assets 750

To Depreciation on fixed assets

(W.N.1) 1,000

To Net profit 14,000 ______

65,000 65,000

© The Institute of Chartered Accountants of India

Balance Sheet as on 31st March, 2022

Amount Amount

Liabilities ` Assets `

Capital (W.N. 5) 1,69,000 Fixed assets 9,000

Add: Additional capital 5,000 Debtors (W.N. 3) 87,500

Net profit 14,000 Inventory 62,500

1,88,000 Bank balance 50,000

Less: Drawings (25,000) 1,63,000

Creditors 46,000 _______

2,09,000 2,09,000

Working Notes:

1. Fixed assets account

` `

To Balance b/d 7,500 By Bank (sale) 1,750

To Bank 5,000 By Loss on sale of fixed asset(2,500- 750

1,750)

By Depreciation (balancing figure) 1,000

_____ By Balance c/d 9,000

12,500 12,500

2. Bank account

` `

To Balance b/d (balancing figure) 62,500 By Creditors 2,80,000

To Debtors 3,40,000 By Expenses 49,250

To Capital 5,000 By Drawings 25,000

To Sale of fixed assets 1,750 By Fixed assets 5,000

_______ By Balance c/d 50,000

4,09,250 4,09,250

3. Debtors account

` `

To Balance b/d 1,02,500 By Bank 3,40,000

To Sales 3,25,000 By Balance c/d 87,500

125 (balancing figure)

(` 2,60,000 )

100 _______ _______

4,27,500 4,27,500

4. Creditors account

` `

To Bank 2,80,000 By Balance b/d (balancing figure) 53,500

To Balance c/d 46,000 By Purchases (from trading account) 2,72,500

3,26,000 3,26,000

7

© The Institute of Chartered Accountants of India

5. Balance Sheet as on 1st April, 2021

Liabilities ` Assets `

Creditors (W.N. 4) 53,500 Fixed assets 7,500

Capital (balancing figure) 1,69,000 Debtors 1,02,500

Stock 50,000

_______ Bank balance (W.N. 2) 62,500

2,22,500 2,22,500

4 (b) In the books of Alfa Limited

Journal Entries

Date Particulars Dr. (`) Cr. (`)

2022

April 10% Redeemable Preference Share Capital A/c Dr. 3,37,500

1

Premium on Redemption of Preference Shares Dr. 33,750

To Preference Shareholders A/c 3,71,750

(Being the amount payable on redemption

transferred to Preference Shareholders Account)

Preference Shareholders A/c Dr. 3,71,750

To Bank A/c 3,71,750

(Being the amount paid on redemption of

preference shares)

General Reserve A/c Dr. 2,25,000

Profit & Loss A/c Dr. 1,12,500

To Capital Redemption Reserve A/c 3,37,500

(Being the amount transferred to Capital

Redemption Reserve Account as per the

requirement of the Act)

Profit & Loss A/c Dr. 33,750

To Premium on Redemption of Preference 33,750

Shares A/c

(Being premium on redemption charged to Profit

and Loss A/c)

Note: Capital reserve cannot be utilized for transfer to Capital Redemption Reserve.

5 (a) Harry Ltd.

Cash Flow Statement

for the year ended 31st March, 2022

(`) (`)

Cash flows from operating activities

Net Profit before taxation 8,000

Adjustments for:

Depreciation ` (1,000 + 2,000 +5,000) 8,000

Profit on sale of Investment (8,000)

8

© The Institute of Chartered Accountants of India

Profit on sale of car (1,400)

Operating profit before working capital changes 6,600

Increase in Trade receivables (2,000)

Increase in inventories (6,000)

Increase in Trade payables 3,000

Cash generated from operations 1,600

Income taxes paid (2,000)

Net cash generated from operating activities (A) (400)

Cash flows from investing activities

Sale of car 3,400

Purchase of car (16,000)

Sale of Investment 10,000

Purchase of Investment (6,000)

Purchase of Furniture & fixtures (14,000)

Net cash used in investing activities (B) (22,600)

Cash flows from financing activities

Issue of shares for cash 20,000

Dividends paid (2,000)

Net cash from financing activities(C) 18,000

Net decrease in cash and cash equivalents (A + B +C) (5,000)

Cash and cash equivalents at beginning of period 17,000

Cash and cash equivalents at end of period 12,000

Working Notes:

1. Calculation of Income taxes paid

`

Income tax expense for the year 3,000

Add: Income tax liability at the beginning of the year 2,000

5,000

Less: Income tax liability at the end of the year (3,000)

2,000

2. Calculation of Fixed assets acquisitions

Furniture & Fixtures (`) Car (`)

W.D.V. at 31.3.2022 34,000 25,000

Add back: Depreciation for the year 2,000 5,000

Disposals — 2,000

36,000 32,000

Less: W.D.V. at 31. 3. 2021 (22,000) (16,000)

Acquisitions during 2021-22 14,000 16,000

© The Institute of Chartered Accountants of India

(b) Omega Limited

Debenture Account

2022 ` 2022 `

Mar 1 To Own Debentures 74,175 Jan 1 By Balance b/d 4,50,000

Mar 1 To Profit on cancellation

(25,000-24,725) 825

Sep 1 To Own Debentures

(Note 3) 59,124

Sep 1 To Profit on cancellation

(20,000-19,708) 876

Dec 31 Balance c/d 3,15,000

4,50,000 4,50,000

Own Debenture (Investment) Account

Nominal Interest Cost Nominal Interest Cost

Cost Cost

` ` ` ` ` `

2022 2022

Mar 1 To Bank Mar 1 By Debentures A/c -

(W.N. 1) 75000 1563 74,175 75,000 74,175

Sep 1 To Bank Sep 1 By Debentures A/c -

(W.N. 2

& 3) 60,000 1,251 59,124 60,000 59,124

Dec. 31 By P&L A/c

- - 2,814 -

1,33,29 1,35,00

1,35,000 2,814 9 0 2,814 1,33,299

Working notes:

1. 75,000 x 5% x 5/12 = 1,563

2. 60,000 x 5% x 5/12 = 1,251

3. 60,375 – 1,251= 59,124

6 (a) According to AS 10 (Revised), these costs can be capitalised:

1. Cost of the plant ` 10,00,000

2. Initial delivery and handling costs ` 80,000

3. Cost of site preparation ` 2,40,000

4. Consultants’ fees `2,80,000

5. Estimated dismantling costs to be incurred after 7 years ` 1,20,000

` 17,20,000

Note: Operating losses before commercial production amounting to ` 1,60,000 are not

regarded as directly attributable costs and thus cannot be capitalized. They should be written

off to the Statement of Profit and Loss in the period they are incurred.

10

© The Institute of Chartered Accountants of India

(b) Calculation of effective capital and maximum amount of monthly remuneration

(` in lakhs)

Paid up equity share capital 270

Paid up Preference share capital 45

Reserve excluding Revaluation reserve (337.5- 22.5) 315

Securities premium 90

Long term loans 90

Deposits repayable after one year 45

855

Less: Accumulated losses not written off (45)

Investments (405)

Effective capital for the purpose of managerial remuneration 405

Since Kartik Ltd. is incurring losses and no special resolution has been passed by the company

for payment of remuneration. Effective capital of the company is less than 5 crores, maximum

remuneration payable to the Managing Director should be @ ` 60,00,000 per annum.

Note: Revaluation reserve and application money pending allotment are not included while

computing effective capital of Kartik Ltd.

OR

Bonus

Journal Entries in the books of Madhu Ltd.

` `

1-4-2022 Equity share final call A/c Dr. 8,10,000

To Equity share capital A/c 8,10,000

(For final calls of ` 2 per share on 4,05,000 equity

shares due as per Board’s Resolution dated….)

20-4-2022 Bank A/c Dr. 8,10,000

To Equity share final call A/c 8,10,000

(For final call money on 4,05,000 equity shares

received)

Securities Premium A/c Dr. 1,12,500

Capital redemption reserve A/c Dr. 1,80,000

General Reserve A/c Dr. 5,40,000

Profit and Loss A/c (b.f.) Dr. 1,80,000

To Bonus to shareholders A/c 10,12,500

(For making provision for bonus issue of one share

for every four shares held)

Bonus to shareholders A/c Dr. 10,12,500

To Equity share capital A/c 10,12,500

(For issue of bonus shares)

Extract of Balance Sheet as at 30th April, 2022 (after bonus issue)

`

Authorized Capital

45,000 12% Preference shares of ` 10 each 4,50,000

6,00,000 Equity shares of ` 10 each 60,00,000

11

© The Institute of Chartered Accountants of India

Issued and subscribed capital

36,000 12% Preference shares of `10 each, fully paid 3,60,000

5,06,250 Equity shares of ` 10 each, fully paid 50,62,500

(Out of the above, 1,01,250 equity shares @ ` 10 each were issued by way of bonus

shares)

Reserves and surplus

Profit and Loss Account 7,20,000

(c) Para 10 of AS 16 ‘Borrowing Costs’ states that to the extent the funds are borrowed specifically

for the purpose of obtaining a qualifying asset, the amount of borrowing costs eligible for

capitalization on that asset should be determined as the actual borrowing costs incurred on that

borrowing during the period less any income on the temporary investment of those borrowings.

The capitalization rate should be the weighted average of the borrowing costs applicable to the

borrowings of the enterprise that are outstanding during the period, other than borrowings made

specifically for the purpose of obtaining a qualifying asset. Hence, in the above case, treatmen t

of accountant of Vital Ltd. is incorrect. The amount of borrowing costs capitalized for the

financial year 2021-22 should be calculated as follows:

Actual interest for 2021-22 (10% of ` 150 crores) ` 15.00 crores

Less: Income on temporary investment from specific borrowings (` 1.50 crores)

Borrowing costs to be capitalized during year 2021-22 ` 13.50 crores

(d) (i) (1) Users of financial statements: Investors, Employees, Lenders, Supplies/Creditors,

Customers, Government & Public

(2) Qualitative Characteristics of Financial Statements:

Understandability, Relevance, Comparability, Reliability & Faithful Representation

(3) Elements of Financial Statements:

Asset, Liability, Equity, Income/Gain and Expense/Loss

(ii) Fundamental Accounting Assumptions:

Accrual, Going Concern and Consistency

12

© The Institute of Chartered Accountants of India

Test Series: March-2023

MOCK TEST PAPER-1

INTERMEDIATE: GROUP – I

PAPER – 2: CORPORATE AND OTHER LAWS

Division A is compulsory

In Division B, Question No.1 is compulsory

Attempt any Three questions out of the remaining Four questions

Time Allowed – 3 Hours Maximum Marks – 100

Division A (30 Marks)

I. Shiv IT Solutions Ltd. is a company engaged in the business of providing customised software to its

clients. These software’s are usually related to the employee’s attendance, leave management, salary

preparation, tax calculation and other matters incidental to HR.

The company is having its own building and other infrastructure in Bengaluru and also at Brussels,

Belgium. The company have patent rights over few of its software’s and also have the trade mark right

over the company’s logo.

The company got sanctioned term loan facility of ` 10 crores from Best Bank Ltd on 1 st January, 2022

by creating a charge on the assets of the company which includes the company’s own buildings and

intangible assets. The charge should have been created by the company within the time prescribed

under the Companies Act, 2013 with the Registrar, however, the company could not get registration of

charges within the prescribed time line.

During the course of Secretarial Audit of the company, for the year ended March 2022, it came in the

knowledge of the Company Secretary in Practice, that charge was not registered with the Registrar. He

mentioned it in the report and advised the company to get it registered. However, the Action Ta ken

Report (ATR) on the audit objection made by the Company Secretary was not apprised to the Board and

no follow up was made by the company thereafter.

Bank’s concurrent auditor and statutory auditor also pointed out this issue and narrated that since charge

was not created by the company, hence this advance be treated as clean advance and interest rate of

clean / unsecured advance, which is 22% (as against the normal rate of 11%) should be applied from

the date of disbursement on the outstanding amount till date. Bank also asked a professional, whether

it can get the charge registered, at its own, to satisfy the audit objection.

The Bank applied for registration of charge which was considered by the Registrar and registration of

creation of charge was granted. The Bank in order to address the audit objections, applied the interest

@ 22% on the outstanding amount in the loan account of the company. The co mpany aggrieved with

the decision of the Bank, managed to liquidate the term loans account by raising funds from other

sources and filed the ‘Satisfaction of Charge’ with the Registrar.

Multiple Choice Questions [2 MCQs of 2 Marks each: Total 4 Marks]

1. The company can create charge in favour of the lender on the the assets which are:

(a) Tangible Assets and situated in India only

(b) Intangible Assets and situated in India only

(c) Assets that are tangible or otherwise and situated in India or Brussels (Belgium)

(d) Assets that are tangible or otherwise and situated in India only

© The Institute of Chartered Accountants of India

2. Where the company fails to get the registration of charge, whether the Best Bank Ltd, in whose

favour the charge was to be created, can move the application for creation of charge:

(a) No. It is the responsibility of the borrower company only to get the charge registered in favour

of the lender.

(b) If the company do not get the charge registered in favour of the lender, the lender suo-moto

cannot move application for registration of charge in its favour.

(c) The borrower company can be held liable to pay the penalty only.

(d) Yes. The lender company can move the application for registration of charge in its favour, if

the borrower do not get the charge registered with the prescribed time.

3. Pratham Limited has decided to spend ` 40 lakhs on project of CSR. The average net profit of the

company is ` 10 crores. But due to some reasons, company was able to spend only ` 30 lakhs.

Now what will be the option for the company for the rest ` 10 lakhs.

(a) Penal provision will be applicable for unspent amount of ` 10 lakhs.

(b) No penal provision but explanation is required in Board report for not spending ` 10 lakhs

(c) No penal provision

(d) The company is required to transfer the amount to separate fund. (2 Marks)

4. The company X plans to cover its skilled as well as semi-skilled workers of its units under medical

health insurance plan, for which the company X will bear the expenses. Will this expenditure be

permissible under CSR activities as per the provisions of the Companies Act, 2013:

(a) only expenditure on skilled workers is allowed

(b) expenditure on both skilled and semi- skilled workers is allowed

(c) Resolution to be passed in board meeting before incurring this expenditure and in the board

report it must be mentioned, so that the same will be permissible under CSR activities

(d) such expenditure is not permissible under eligible CSR activities (2 Marks)

5. Which among the following companies is not required to provide its members the facility to exercise

right to vote by electronic mode under the provisions of the Companies Act, 2013?

(a) B Limited, whose equity shares (the company is having both equity as well as preference

shares) are listed on a recognised stock exchange.

(b) A Limited, whose equity shares (only type of share the company is having) are listed on a

recognised stock exchange

(c) C Limited, whose preference shares (the company is having both equity as well as preference

shares) are listed on a recognised stock exchange

(d) D Limited, whose equity shares as well as preference shares are listed on a recognised stock

exchange. (2 Marks)

6. The Corporate Social Responsibility Committee of the board shall consist of:

(a) Three or more directors out of which at two directors shall be Independent Director

(b) Three or more directors out of which at least one director shall be Independent Director.

2

© The Institute of Chartered Accountants of India

(c) Three or more directors and all should be Independent Directors

(d) Three or more directors with condition of not a single director should be Independent Director

(1 Mark)

7. New Ltd. is incorporated on 3 rd January, 2022. As per the Companies Act, 2013, what will be the

financial year for the company:

(a) 31st March, 2022

(b) 31st December, 2022

(c) 31st March, 2023

(d) 30th September, 2023 (2 Marks)

8. “Associate company”, in relation to another company, means a company in which that

other company has a significant influence, but which is not a subsidiary company of

the company having such influence and includes a joint venture company. Here, the words

‘significant influence’ means:

(a) Control of at least 10% of total voting power

(b) Control of at least 15% of total voting power

(c) Control of at least 20% of total voting power

(d) Control of at least 25% of total voting power (1 Mark)

9. First annual general meeting of the company should be held within ……… from the closing of the

first financial year.

(a) 6 months

(b) 9 months

(c) 12 months

(d) 18 months (1 Mark)

10. Victory Limited was incorporated in January 2015. How much expenditure Victory Limited shall

ensure to spend in pursuance of its Corporate Social Responsibility Policy:

(a) The company shall ensure to spend in every financial year, at least 2% of the average gross

profits of the company made during the 2 immediately preceding financial years.

(b) The company shall ensure to spend in every financial year, at least 2% of the average net

profits of the company made during the 3 immediately preceding financial years.

(c) The company shall ensure to spend in every financial year, at least 1% of the average net

profits of the company made during the 2 immediately preceding financial years.

(d) The company shall ensure to spend in every financial year, at least 1% of the average net

profits of the company made during the 3 immediately preceding financial years.

(1 Mark)

© The Institute of Chartered Accountants of India

11. Birthday Card Limited, a listed company can appoint or re-appoint, Mishra & Associates (a firm of

Chartered Accountants), as their statutory auditors for:

(a) One year only

(b) One term of 3 consecutive years only

(c) One term of 4 consecutive years only

(d) Two terms of 5 consecutive years (1 Mark)

12. Which of the following is a prohibited service to be rendered by the auditor of a company?

(a) Design and implementation of any financial information system

(b) Making report to the members of the company on the accounts examined by him

(c) Compliance with the auditing standards

(d) Reporting of fraud against the company by officers or employees to the Central Government

(1 Mark)

13. Which among the following will not be considered as a “Foreign Instrument” under the provisions

of the Negotiable Instruments Act, 1881?

(a) A bill drawn on a person residing outside India but payable in India or outside India

(b) A bill drawn on a person resident outside India but payable outside India

(c) A bill drawn on a person residing outside India but payable in India

(d) A bill drawn on a person resident in India but payable outside India (2 Marks)

14. A substituted agent acts on behalf of …………

(a) Principal

(b) Sub-agent

(c) Agent

(d) anyone, as decided by the agent only (1 Mark)

15. As per the provisions of the Indian Contract Act, 1872, the finder of lost goods:

(a) cannot sue and also cannot retain the goods so found

(b) can sue but cannot retain the goods so found

(c) cannot sue but retain the goods so found

(d) can sue and also retain the goods so found (1 Mark)

16. X, a shareholder of a company lost his share certificate. He applied for the duplicate. The company

agreed to issue the same on the term that X will compensate the company against the loss where

any holder produces the original certificate. This is called:

(a) Contract of indemnity

(b) Contract of Guarantee

(c) Quasi Contract

(d) Bailment (2 Marks)

© The Institute of Chartered Accountants of India

17. As per Rule of Literal Construction, Technical words are to understood in:

(a) Normal sense

(b) Ordinary sense

(c) Technical sense

(d) Legal sense (1 Mark)

18. A clause that begins with the words ‘Notwithstanding anything contained’ is called:

(a) An obstacle clause

(b) A non- obstante clause

(c) An objectionable clause

(d) A superior clause (1 Mark)

19. Pick the odd one out of the following aids to interpretation—

(a) Preamble

(b) Marginal Notes

(c) Proviso

(d) Usage (1 Mark)

20. In all Central Acts and Regulations, unless there is anything repugnant in the subject or context,

words importing the masculine gender shall be taken:

(a) To exclude females

(b) To exclude girl child

(c) To include females

(d) To exclude boy child (1 Mark)

21. An instrument which is vague and cannot be clearly identified either as a bill of exchange, or as a

promissory note……..

(a) is called an ambiguous instrument

(b) can be classified only as a promissory note

(c) can be classified only as a bill of exchange

(d) has to be categorised as an invalid instrument (2 Marks)

Division B (70 Marks)

1. (a) The Board of Directors of Stamp Limited, a listed company appointed Mr. Chatterjee, Chartered

Accountant as its first auditor within 30 days of the date of registration of the company to hold office

from the date of incorporation to conclusion of the first Annual General Meeting (AGM). At the first

AGM, Mr. Chatterjee was re-appointed to hold office from the conclusion of its first AGM till the

conclusion of 6th AGM. In the light of the provisions of the Companies Act, 2013, examine the

validity of appointment/ reappointment in the following cases:

(i) Appointment of Mr. Chatterjee by the Board of Directors.

© The Institute of Chartered Accountants of India

(ii) Re-appointment of Mr. Chatterjee at the first AGM in the above situation. (6 Marks)

(b) Virjesh Limited is a company in which Hrishkesh Limited is holding 60% of its paid up share capital.

One of the shareholders of Hrishkesh Limited made a charitable trust and donated his 10% shares

in Hrishkesh Limited and ` 50 crores to the trust. He appoints Virjesh Limited as the trustee. All

the assets of the trust are held in the name of Virjesh Limited. Can a subsidiary company hold

shares in its holding company in this way? (6 Marks)

(c) Masoom owns a residential property at Kailash Colony, Delhi. Masoom has given his residential

property on rent amounting to ` 50,000 per month to Kamal. Pankaj became the surety for payment

of rent by Kamal. Subsequently, without Pankaj’s consent, Kamal agreed to pay higher rent to

Masoom. After a few months of this, Kamal defaulted in paying the rent. Evaluate the position of

Pankaj in this regard as per the provisions of the Indian Contract Act, 1872. (4 Marks)

(d) On a Bill of Exchange for ` 1 lakh, X’s acceptance to the Bill is forged. ‘A’ takes the Bill from his

customer for value and in good faith before the Bill becomes payable. State with reasons whether ‘A’

can be considered as a ‘Holder in due course’ and whether he (A) can receive the amount of the Bill

from ‘X’. Answer as per the provisions of the Negotiable Instruments Act, 1881. (3 Marks)

2. (a) Happy Limited received a proxy form 54 hours before the time fixed for the start of the meeting.

The company refused to accept the proxy form on the ground that the Articles of the company

provided that a proxy form must be filed 60 hours before the start of the meeting. Define proxy and

decide under the provisions of the Companies Act, 2013, whether the proxy holder can compel the

company to admit the proxy in this case? (4 Marks)

(b) Explain the following as per the provisions of the Companies Act, 2013:

(i) Who shall sign Board’s Report

(ii) Filing of financial statements with the Registrar when AGM is not held (6 Marks)

(c) Examine whether the following constitute a contract of ‘Bailment’ under the provisions of the Indian

Contract Act, 1872:

(i) Golu parks his car at a parking lot, locks it, and keeps the keys with himself.

(ii) Seizure of goods by customs authorities. (4 Marks)

(d) What are the parties to promissory note and a bill of exchange. (3 Marks)

3. (a) Shilpi Developers India Limited owed to Sunil ` 10,000. On becoming this debt payable, the

company offered Sunil 100 shares of ` 100 each in full settlement of the debt. The said shares

were allotted to Sunil as fully paid-up in lieu of his debt. Examine the validity of this allotment in

the light of the provisions of the Companies Act, 2013. (5 Marks)

(b) The Annual General Meeting of Angels Limited held on 30th May, 2022, declared a dividend at the

rate of 30% payable on its paid-up equity share capital as recommended by Board of Directors.

However, the Company was unable to post the dividend warrant to Mr. A, an equity shareholder,

up to 25th July, 2022. Mr. A filed a suit against the Company for the payment of dividend along

with interest at the rate of 20 percent per annum for the period of default. Decide in the light of

provisions of the Companies Act, 2013, whether Mr. A would succeed? Also, state the directors’

liability in this regard under the Act. (5 Marks)

(c) A promissory note was made without mentioning any time for payment. The holder added the words

‘on demand’ on the face of the instrument. Whether this may be treated as material alteration in

the instrument? Give answer referring to the provisions of the Negotiable Instruments Act, 1881.

(4 Marks)

© The Institute of Chartered Accountants of India

(d) Viraj, a director of the company, not being personally concerned or interested, financially or

otherwise, in a matter of a proposed motion placed before the Board Meeting, did not disclose his

interest although he has knowledge that his sister is interested in that proposal. He res trains from

making any disclosure of his interest on the presumption that he is not required by law to disclose

any interest as he is not personally interested or concerned in the proposal. He made his

presumption relying on the 'Rule of Literal Construction'. Explaining the scope of interpretation

under this rule in the given situation, decide whether the decision of Viraj is correct? (3 Marks)

4. (a) State the purposes for which the securities premium account can be utilized? (6 Marks)

(b) Examine the validity of the following different decisions/proposals regarding change of office by A

Limited under the provisions of the Companies Act, 2013:

(i) The Registered office is shifted from Thane (Local Limit of Thane District) to Dadar (Local

limit of Mumbai District), both places falling within the jurisdiction of the Registrar of Mumbai,

by passing a special resolution but without obtaining the approval of the Regional Director.

(ii) The registered office situated in certain place of a city is proposed to be shifted to another

place within the local limits of the same city under the authority of Board Resolution.

(4 Marks)

(c) Yellow and Pink had a long dispute regarding the ownership of a land for which a legal suit was

pending in the court. The court fixed the date of hearing on 29.04.2022, which was announced to

be a holiday subsequently by the Government. What will be the computation of time of the hearing

in this case under the General Clauses Act, 1897? (4 Marks)

(d) Explain the following in context of use of definitional sections in Interpretation of Statutes:

(i) Definitions subject to a contrary context

(ii) Ambiguous definitions (3 Marks)

5. (a) With a view to transact some urgent business, Ratna, Rimpi and Ratnesh, the three directors of

Shilpkaar Constructions Limited are desirous of calling a general meeting of shareholders by giving

shorter notice than 21 days’ clear notice. The fourth director, Nilesh is of the opinion that such an

action will attract penalty provisions since there is contravention. The paid-up share capital of the

company is ` 30 crores divided into 3 crores shares of ` 10 each. Keeping in view the applicable

provisions of the Companies Act, 2013, discuss the possibility of calling a general meeting by giving

shorter notice. (6 Marks)

(b) Enumerate the amounts which when received by a company in the ordinary course of business are

not to be considered as deposits. (Write any three) (4 Marks)

(c) Explain the following as per the provisions of the Indian Contract Act, 1872

(i) What is the meaning of ‘Agent’ and ‘Principal’?

(ii) Who can appoint an agent. (4 Marks)

(d) The Income Tax Act, 1961 provides that the gratuity paid by the government to its employees is

fully exempt from tax. You are required to explain the scope of the term 'government' and clarify

whether the exemption from gratuity income will be available to the State Government Employees?

Give your answer in accordance with the provisions of the General Clauses Act, 1897. (3 Marks)

© The Institute of Chartered Accountants of India

Test Series: March-2023

MOCK TEST PAPER 1

INTERMEDIATE GROUP – I

PAPER – 2: CORPORATE AND OTHER LAWS

ANSWERS

Division A

I. 1. (c)

2. (d)

3. (c)

4. (d)

5. (c)

6. (b)

7. (c)

8. (c)

9. (b)

10. (b)

11. (d)

12. (a)

13. (b)

14. (a)

15. (c)

16. (a)

17. (c)

18. (b)

19. (d)

20. (c)

21. (a)

Division B

1. (a) As per section 139(6) of the Companies Act, 2013, the first auditor of a company, other than a

Government company, shall be appointed by the Board of Directors within thirty days from the

date of registration of the company and such auditor shall hold office till the conclusion of the first

annual general meeting.

Whereas section 139(1) of the Companies Act, 2013 states that every company shall, at the first

annual general meeting (AGM), appoint an individual or a firm as an auditor of the company who

shall hold office from the conclusion of 1 st AGM till the conclusion of its

6th AGM and thereafter till the conclusion of every sixth AGM.

As per section 139(2), no listed company or a company belonging to such class or classes of

companies as may be prescribed, shall appoint or re-appoint an individual as auditor for more

than one term of five consecutive years.

1

© The Institute of Chartered Accountants of India

As per the given provisions following are the answers:

(i) Appointment of Mr. Chatterjee by the Board of Directors is valid as per the provisions of

section 139(6).

(ii) Appointment of Mr. Chatterjee at the first Annual General Meeting is valid due to the fact

that the appointment of the first auditor made by the Board of Directors is a sepa rate

appointment and the period of such appointment is not to be considered, while Mr.

Chatterjee is appointed in the first Annual General Meeting, which is for the period from the

conclusion of the first Annual General Meeting to the conclusion of the six th Annual General

Meeting.

(b) According to section 19 of the Companies Act, 2013 a company shall not hold any shares in its

holding company either by itself or through its nominees. Also, holding company shall not allot or

transfer its shares to any of its subsidiary companies and any such allotment or transfer of shares

of a company to its subsidiary company shall be void.

Following are the exceptions to the above rule;

a. Where the subsidiary company holds such shares as the legal representative of a deceased

member of the holding company; or

b. Where the subsidiary company holds such shares as a trustee; or

c. Where the subsidiary company is a shareholder even before it became a subsidiary

company of the holding company, but in this case, it will not have a right to vote in the

meeting of holding company.

In the given case, one of the shareholders of holding company has transferred his shares in the

holding company to a trust where the shares will be held by subsidiary company. It means now

subsidiary will hold shares in the holding company. But it will hold shares in the capacity of a

trustee. Therefore, we can conclude that in the given situation Vrijesh Limited can hold shares in

Hrishkesh Limited.

(c) According to the provisions of section 133 of the Indian Contract Act, 1872, where there is any

variance in the terms of contract between the principal debtor and creditor without surety’s

consent, it would discharge the surety in respect of all transactions taking place subsequent to

such variance.

In the instant case, Masoom (Creditor) cannot sue Pankaj (Surety), because Pankaj is

discharged from liability when, without his consent, Kamal (Principal debtor) has changed the

terms of his contract with Masoom (creditor).

(d) According to section 9 of the Negotiable Instruments Act, 1881, ‘holder in due course’ means any

person who for consideration becomes the possessor of a promissory note, bill of exchange or

cheque if payable to bearer or the payee or indorsee thereof, if payable to order, before the

amount in it became payable and without having sufficient cause to believe that any defect

existed in the title of the person from whom he derived his title.

As ‘A’ in this case prima facie became a possessor of the bill for value and in good faith before

the bill became payable, he can be considered as a holder in due course.

But where a signature on the negotiable instrument is forged, it becomes a nullity. The holder of

a forged instrument cannot enforce payment thereon. In the event of the holder being able to

obtain payment in spite of forgery, he cannot retain the money. The true owner may sue on tort

the person who had received. This principle is universal in character, by reason wher e of even a

holder in due course is not exempt from it. A holder in due course is protected when there is

© The Institute of Chartered Accountants of India

defect in the title. But he derives no title when there is entire absence of title as in the case of

forgery. Hence ‘A’ cannot receive the amount on the bill.

2. (a) Section 105(1) of the Companies Act, 2013, provides that any member of a company entitled to

attend and vote at a meeting of the company shall be entitled to appoint another person as a

proxy to attend and vote at the meeting on his behalf.

Further, section 105(4) of the Act provides that a proxy received 48 hours before the meeting will

be valid even if the articles provide for a longer period.

In the given case, the company received a proxy form 54 hours before the time fixed for start of

the meeting. Happy Limited refused to accept proxy on the ground that articles of the company

provides filing of proxy before 60 hours of the meeting. In the said case, in line with requirement

of the above stated legal provision, a proxy received 48 hours before t he meeting will be valid

even if the articles provide for a longer period. Accordingly, the proxy holder can compel the

company to admit the proxy.

(b) (i) Signing of Board’s Report [Section 134(6)]: The Board’s report and any annexures thereto

under section 134(3) shall be signed by its chairperson of the company if he is authorised

by the Board and where he is not so authorised, shall be signed by at least two directors,

one of whom shall be a managing director, or by the director where there is one director.

(ii) Annual General meeting not held [Section 137(2)]: Where the AGM of a company for any

year has not been held, the financial statements along with the documents required to be

attached, duly signed along with the statement of facts and reasons for not holding the AGM

shall be filed with the Registrar within thirty days of the last date before which the AGM

should have been held and in such manner, with such fees or additional fees as may be

prescribed.

(c) As per Section 148 of the Act, bailment is the delivery of goods by one person to another for

some purpose, upon a contract, that the goods shall, when the purpose is accomplished, be

returned or otherwise disposed of according to the directions of the person delivering the m.

For a bailment to exist the bailor must give possession of the bailed property and the bailee must

accept it. There must be a transfer in ownership of the goods.

(i) Mere custody of goods does not mean possession. In the given case, since the keys of the

car are with Golu, section 148, of the Indian Contract Act, 1872 shall not applicable. Hence,

it is not bailment.

(ii) Yes, the possession of the goods is transferred to the custom authorities. Therefore ,

bailment exists and section 148 is applicable.

(d) 1. In a promissory note, there are only 2 parties namely:

i. the maker and

ii. the payee

2. In a bill of exchange, there are 3 parties which are as under:

i. the drawer

ii. the drawee

ii. the payee

3. (a) Under Section 62 (1) (c) of the Companies Act, 2013 where at any time, a company having a

share capital proposes to increase its subscribed capital by the issue of further shares, either for

cash or for a consideration other than cash, such shares may be offered to any persons, if it is

© The Institute of Chartered Accountants of India

authorised by a special resolution and if the price of such shares is determined by the valuation

report of a registered valuer (valuation report of a registered valuer, subject to the compliance

with the applicable provisions of Chapter III and any other conditions as may be prescribed).

In the present case, Shilpi Developers India Limited’s allotment, to be classified as shares issued

for consideration other than cash, must be approved by the members by a special resolution.

Further, the valuation of the shares must be done by a registered valuer, subject to the

compliance with the applicable provisions of Chapter III and any other conditions as may be

prescribed.

(b) Section 127 of the Companies Act, 2013 lays down the penalty for non -payment of dividend

within the prescribed time period of 30 days. According to this section where a dividend has been

declared by a company but has not been paid or the warrant in respect thereof has not been

posted within 30 days from the date of declaration of dividend to any shareholder entitled to the

payment of dividend:

(a) every director of the company shall, if he is knowingly a party to the default, be punishable

with imprisonment maximum up to two years and with minimum fine of rupees one thousand

for every day during which such default continues; and

(b) the company shall be liable to pay simple interest at the rate of 18% per annum during the

period for which such default continues.

Therefore, in the given case Mr. A will not succeed if he claims interest at 20% interest as the

limit under section 127 is 18% per annum.

(c) Material alteration: An alteration is material which in any way alters the operation of the

instrument and affects the liability of parties thereto.

Any alteration is material:

(a) which alters the business effect of the instrument if used for any business purpose;

(b) which causes it to speak a different language in legal effect form that which it originally

spoke or which changes the legal identity or character of the instrument.

The following alteration are specifically declared to be material: any al teration of (i) the date, (ii)

the sum payable, (iii) the time of payment, (iv) the place of payment, or the addition of a place of

payment.

A promissory note was made without mentioning any time for payment. The holder added the

words “on demand” on the face of the instrument. As per the above provision of the Negotiable

Instruments Act, 1881 this is not a material alteration as a promissory note where no date of

payment is specified will be treated as payable on demand. Hence, adding the words “on

demand” does not alter the business effect of the instrument.

(d) Rule of Literal Construction

Normally, where the words of a statute are in themselves clear and unambiguous, then these

words should be construed in their natural and ordinary sense and it is not open to the court to

adopt any other hypothetical construction. This is called the rule of literal construction.

This principle is contained in the Latin maxim “absoluta sententia expositore non indeget” which

literally means “an absolute sentence or preposition needs not an expositor”. In other words,

plain words require no explanation.

Sometimes, occasions may arise when a choice has to be made between two interpretations –

one narrower and the other wider or bolder. In such a situation, if the na rrower interpretation

4

© The Institute of Chartered Accountants of India

would fail to achieve the manifest purpose of the legislation, one should rather adopt the wider

one.

When we talk of disclosure of ‘the nature of concern or interest, financial or otherwise’ of a

director or the manager of a company in the subject-matter of a proposed motion (as referred to

in section 102 of the Companies Act, 2013), we have to interpret in its broader sense of referring

to any concern or interest containing any information and facts that may enable members to

understand the meaning, scope and implications of the items of business and to take decisions

thereon. What is required is a full and frank disclosure without reservation or suppression, as, for

instance where a son or daughter or father or mother or brother or sister is concerned in any

contract or matter, the shareholders ought fairly to be informed of it and the material facts

disclosed to them. Here a restricted narrow interpretation would defeat the very purpose of the

disclosure.

In the given question, Viraj (a director) did not disclose his interest in a matter placed before the

Board Meeting (in which his sister has interest), as he is not personally interested or concerned

in the proposal.

Here, he ought to have considered broader meaning of the provision of law; and therefore, even

though he was personally not interested or concerned in the proposal, he should have disclosed

the interest.

4. (a) Application of Securities Premium Account: As per the provisions of sub-section (2) of section

52 of the Companies Act, 2013, the securities premium account may be applied by the

company—

(a) towards the issue of unissued shares of the company to the members of the company as

fully paid bonus shares;

(b) in writing off the preliminary expenses of the company;

(c) in writing off the expenses of, or the commission paid or discount allowed on, any issue of

shares or debentures of the company;

(d) in providing for the premium payable on the redemption of any redeemable preference

shares or of any debentures of the company; or

(e) for the purchase of its own shares or other securities under section 68.

(b) Regarding the validity of Proposals w.r.t change of registered office by A Limited in the light of

section 12 of the Companies Act, 2013:

(i) In the first case, the Registered office is shifted from Thane to Dadar (one District to another

District) falling under jurisdiction of same ROC i.e. Registrar of Mumbai.

As per Section 12 (5) of the Act which deals with the change in registered office outside the

local limit from one town or city to another in the same state, may take place by virtue of a

special resolution passed by the company. No approval of regional director is required.

Accordingly, said proposal is valid.

(ii) In the second case, change of registered office within the local limits of the same city.

Said proposal is valid in terms it has been passed under the authority of Board resolution.

(c) According to section 10 of the General Clauses Act, 1897, where by any legislation or regulation,

any act or proceeding is directed or allowed to be done or taken in any court or office on a certain

day or within a prescribed period then, if the Court or office is c losed on that day or last day of

the prescribed period, the act or proceeding shall be considered as done or taken in due time if it

is done or taken on the next day afterwards on which the Court or office is open.

5

© The Institute of Chartered Accountants of India

In the given question, the court fixed the date of hearing of dispute between Yellow and Pink, on

29.04.2022, which was subsequently announced to be a holiday.

Applying the above provisions we can conclude that the hearing date of 29.04.2022, shall be

extended to the next working day.

(d) (i) Definitions subject to a contrary context: When a word is defined to bear a number of

inclusive meanings, the sense in which the word is used in a particular provision must be

ascertained from the context of the scheme of the Act, the language of the p rovision and the

object intended to be served thereby.

(ii) Ambiguous definitions: Sometime, we may find that the definition section may itself be

ambiguous, and so it may have to be interpreted in the light of the other provisions of the

Act and having regard to the ordinary meaning of the word defined. Such type of definition is

not to be read in isolation. It must be read in the context of the phrase which it defines,

realising that the function of a definition is to give accuracy and certainty to a wor d or

phrase which would otherwise be vague and uncertain but not to contradict it or depose it

altogether.

5. (a) Normally, general meetings are to be called by giving at least 21 clear days’ notice as required by

section 101 (1) of the Companies Act, 2013.

As an exception, first proviso to Section 101 (1) states that a general meeting may be called after

giving shorter notice than that specified in sub-section (1) of section 101, if consent, in writing or

by electronic mode, is accorded thereto—

in the case of any other general meeting (i.e. other than annual general meeting), by members of

the company—

(a) holding, if the company has a share capital, majority in number of members entitled to vote

and who represent not less than ninety-five per cent. of such part of the paid-up share

capital of the company as gives a right to vote at the meeting; or

(b) having, if the company has no share capital, not less than ninety-five per cent. of the total

voting power exercisable at that meeting.

Second proviso to section 101 (1) clarifies that where any member of a company is entitled to

vote only on some resolution or resolutions to be moved at a meeting and not on the others,

those members shall be taken into account for the purposes of sub section (1) of section 101 in

respect of the former resolution or resolutions and not in respect of the latter.

In view of the above provisions, Shilpkaar Constructions Limited is permitted to call the requisite

general meeting by giving a shorter notice. However, the members holding at least ninety-five per

cent of the paid-up share capital of the company which gives them a right to vote at the meeting

must consent to the shorter notice.

Thus, if the meeting is called after obtaining the consent from members holding at least ninety-

five per cent of the paid-up share capital of the company, the meeting can be validly called at

shorter notice.

(b) According to Rule 2 (1) (c) (xii) of the Companies (Acceptance of Deposits) Rules, 2014,

following amounts if received by a company in the course of, or for the purposes of, the business

of the company, shall not be considered as deposits:

(a) any amount received as an advance for the supply of goods or provision of services

accounted for in any manner whatsoever to be appropriated within a period of three hundred

and sixty-five days from the date of acceptance of such advance:

However, in case any advance is subject matter of any legal proceedings before any court

6

© The Institute of Chartered Accountants of India

of law, the time limit of three hundred and sixty-five days shall not apply.

(b) any amount received as advance in connection with consideration for an immovable

property under an agreement or arrangement. However, such advance is required to be

adjusted against such property in accordance with the terms of agreement or arrangement;

(c) any amount received as security deposit for the performance of the contract for supply of

goods or provision of services;

(d) any amount received as advance under long term projects for supply of capital goods

except those covered under item (b) above;

(e) any amount received as an advance towards consideration for providing future services in

the form of a warranty or maintenance contract as per written agreement or arrangement, if