Professional Documents

Culture Documents

Himmat Steel Case

Himmat Steel Case

Uploaded by

Satvik ShuklaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Himmat Steel Case

Himmat Steel Case

Uploaded by

Satvik ShuklaCopyright:

Available Formats

NATIONAL COMPANY LAW APPELLATE TRIBUNAL

PRINCIPAL BENCH, NEW DELHI

Company Appeal (AT) (Insolvency) No. 286 of 2022

IN THE MATTER OF:

1. Central Bank of India,

Main Branch, GE Road,

Raipur, Chattisgarh – 492001

Through its Authorized Officer,

Mr. Virendra Tiwari,

Branch Manager, Main Branch,

GE Road, Raipur, Chattisgarh – 492001

Email: [email protected]

Mobile: 0771-2228800/0771-2537912 ...Appellant

Versus

1. Himmat Steel Foundry Limited,

Registered Office:

Shop No.-5, 2nd Floor,

Durga College Complex, K.K. Road,

Moudhapara, Raipur,

Chhattisgarh - 492007 …Respondent

For Appellant: Mr. Abhijeet Sinha, Mr. Akshat Bajpai, Mr. Mohit, Mr.

Sharma, Advocates

For Respondent: Mr. Abhrajit Mitra, Sr. Advocate with Ms. Neha Somani,

PCS. Mr. Kunal Godhwani, Advocate

JUDGEMENT

Ashok Bhushan, J:

1. This Appeal by the Financial Creditor-Central Bank of India has been

filed challenging the Judgement and Order dated 03rd February, 2022

passed by the National Company Law Tribunal, Cuttack Bench, Cuttack

(hereinafter referred to as “The Adjudicating Authority”) rejecting Application

-2-

under Section 7 of Insolvency and Bankruptcy Code, 2016 (hereinafter

referred to as “The Code”) filed by the Appellant as barred by time.

2. Brief facts of the case necessary to be noted for deciding this Appeal

are:-

The Appellant-Financial Creditor extended various credit facilities to

the Corporate Debtor-Himmat Steel Foundry Ltd. Accounts were

declared as Non-Performing Assets by the Appellant on 01.10.1994.

Credit Facilities were recalled on 28th July, 1995 and suit was filed by

the Appellant for recovery which was transferred to the Debt Recovery

Tribunal, Jabalpur (DRT). DRT passed decree dated 10th April, 2000 in

favour of the Appellant for recovery of amount of Rs. 8,68,64,184.29/-.

On an Application O.A. No. 274 of 2001 filed by IDBI Bank, another

Financial Creditor of the Corporate Debtor, decree was passed on 26th

July, 2004 for recovery of sum of Rs. 8,97,47,340/-.

On 07th August, 2006, the Corporate Debtor submitted a proposal for

‘One Time Settlement’ offering an amount of Rs. 13.16 Cr. A notice

under Section 13(2) of SARFAESI Act, 2002 was served by the

Appellant for repayment of outstanding debt along with interest. On

03.09.2009, Appellant served possession notice. On 04.11.2009, the

Corporate Debtor again submitted a proposal for One Time Settlement.

Revised OTS Proposal was submitted. On 17th June, 2013 and 06th

March, 2019, in Financial Statement of the Respondent year 2018-19

there were acknowledgment of the debt by the Corporate Debtor. On

06th March, 2020, the Financial Creditor filed an Application under

Section 7 claiming an amount of Rs. 21,85,19,39,325/- which

Company Appeal (AT) (Insolvency) No. 286 of 2022

-3-

consisted of principal amount of Rs. 8,68,64,184.29/- rest being

interest. The Corporate Debtor did not file any Reply to Section 7

Application. Parties were heard by the Adjudicating Authority on 03rd

January, 2022 when the matter was reserved for Orders. Adjudicating

Authority passed an Order on 03rd February, 2022 dismissing Section

7 Application as barred by time.

The Adjudicating Authority in the Impugned Order considered the

question “whether the petition under Section 7 of IBC, 2016 filed is in

time ?”. The Adjudicating Authority took the view that in pursuance of

the decree dated 10th April, 2000 passed by the DRT, Financial

Creditor had fresh limitation of three years but the Application under

Section 7 was filed after expiry of the period of three years on 13th

October, 2020 which is hopelessly barred by time. The

acknowledgement in the balance-sheet in 2018 and the OTS Proposals

in 2019 shall not make Application within time. Acknowledgement of

the liability after expiry of limitation is of no consequence and

Application was consequently dismissed.

3. Mr. Abhijeet Sinha, Learned Counsel appearing for the Appellant

challenging the Order contends that computation of limitation ought not be

made with effect from 10th April, 2000 when decree was passed by the DRT

in favour of the Financial Creditor rather computation of limitation should

be taken with effect from 26th July, 2004 when DRT passed decree in favour

of another Financial Creditor i.e. IDBI Bank. Learned Counsel for the

Appellant further relies on Section 25(3) of the Indian Contract Act. It is

submitted that OTS offer given by the Corporate Debtor amounts to

Company Appeal (AT) (Insolvency) No. 286 of 2022

-4-

extension of limitation within Section 18 of the Limitation Act. Balance-sheet

of the Corporate Debtor which contains acknowledgement at least from

2008-09 till 2017-18 are acknowledgement within the meaning of Section 18

of the Limitation Act. Learned Counsel for the Appellant has also referred to

Section 14 of the Limitation Act and Section 5 of the Limitation Act.

4. Mr. Abhrajit Mitra, Sr. Advocate appearing for the Respondent refuting

the submissions of Learned Counsel for the Appellant contends that

Application filed under Section 7 by the Appellant was hopelessly barred by

time. The Account was declared NPA on 01.10.1994 and after passing the

decree by the DRT dated 10th April, 2000, Appellant could have availed the

limitation of three years till 09th April, 2003. The decree by DRT in favour of

IDBI Bank-another Financial Creditor of the Corporate Debtor is not relevant

for purposes of computation of the Limitation for filing the Section 7

Application. The period of limitation for taking the action on basis of decree

dated 10th April, 2000 came to end and any subsequent acknowledgement

shall not save the limitation for the Appellant. Appellant cannot be permitted

to take a case for explaining the limitation which was not mentioned in

Form-A and the enclosures thereto. With regard to argument based on

Section 25(3) of the Contract Act, Learned Sr. Counsel submits that no plea

was taken before the Adjudicating Authority and for the first time in the

Rejoinder-Affidavit filed in this Appeal, Section 25(3) has been referred to.

The IBC is a complete Code in itself and has overriding effect on provisions

inconsistent with IBC. The provisions of Section 25(3) is inconsistent with

Section 238-A even after Order passed by the Adjudicating Authority

Company Appeal (AT) (Insolvency) No. 286 of 2022

-5-

rejecting Section 7 Application, the Appellant is proceeding under SARFAESI

Act.

5. We have considered the submissions of Learned Counsel for the

parties and have perused the record.

6. The issue needs to be answered in this Appeal is as to whether the

Application filed by the Appellant under Section 7 on 16.03.2020 was barred

by time. The law is well settled that limitation for filing the Section 7

Application is limitation as prescribed under Article 137 of the Limitation

Act, 1963. Article 137 of the Limitation Act, 1963 is as follows:

Description of application Period of Time from

limitation which period

begins to run

137. Any other application Three When the right

for which no period of years to apply

limitation is provided accrues.

elsewhere in this division.

7. Brief facts which have been brought on record are that the Account of

the Corporate Debtor was declared NPA on 01.10.1994, suit was filed by the

Financial Creditor for recovery of the defaulted amount which was

transferred to the DRT and was decided by the Judgement and Decree dated

10th April, 2000 decreeing the claim of Rs. 8,68,64,184.29/- against the

Corporate Debtor and its personal guarantors. In view of the Judgment of

the Hon’ble Supreme Court in “Dena Bank Vs. C. Shivakumar Reddy,

[(2021) 10 SCC 330], Decree passed by the DRT gave a fresh period of

limitation of three years which came to an end on 09th April, 2003. This

Tribunal while entertaining this Appeal on 21st March, 2022, passed

following order:

Company Appeal (AT) (Insolvency) No. 286 of 2022

-6-

“21.03.2022: Heard Learned Counsel for the

Appellant. Learned Counsel for the Appellant submits

that although three years period of limitation taking

from Judgment and Decree of the DRT dated 10 th

April, 2000 has come to an end but in event the

Judgment of the DRT dated 26th July, 2004 passed

in O.A. No. 274/2001 filed by the Industrial

Development Bank of India is taken for purpose of

extending the limitation of the Appellant, the

application is to be treated within time. It is fairly

submitted that said Order was not before the

Adjudicating Authority. Learned Counsel has also

referred to Section 7(1) Explanation and submits that

a default includes a default in respect of a financial

debt owed not only to the applicant financial creditor

but to any other financial creditors of the corporate

debtor.

2. Issue Notice to the Respondent through Speed

Post as well as Email. Requisites along with process

fee, if not filed, be filed within three days. Reply

Affidavit may be filed within two weeks. Rejoinder, if

any, may be filed within two weeks, thereafter.

List this Appeal ‘For Admission (After Notice)’

on 22nd April, 2022. Looking to the nature of the

issues raised in the Appeal, Appeal may itself be

decided on the next date.”

8. The principal submission which has been placed by Mr. Abhijeet Sinha

is that computation for period of limitation should be on the basis of decree

passed by DRT in the suit filed by IDBI Bank dated 26th July, 2004. Learned

Counsel for the Appellant has relied on Section 7(1) proviso and the

Explanation. Section 7(1) is as follows:

Company Appeal (AT) (Insolvency) No. 286 of 2022

-7-

“7. (1) A financial creditor either by itself or jointly

with other financial creditors, or any other person on

behalf of the financial creditor, as may be notified by

the Central Government may file an application for

initiating corporate insolvency resolution process

against a corporate debtor before the Adjudicating

Authority when a default has occurred.

Provided that for the financial creditors, referred to in

clauses (a) and (b) of sub-section (6A) of section 21,

an application for initiating corporate insolvency

resolution process against the corporate debtor shall

be filed jointly by not less than one hundred of such

creditors in the same class or not less than ten per

cent. of the total number of such creditors in the same

class, whichever is less:

Provided further that for financial creditors who are

allottees under a real estate project, an application for

initiating corporate insolvency resolution process

against the corporate debtor shall be filed jointly by

not less than one hundred of such allottees under the

same real estate project or not less than ten per cent.

of the total number of such allottees under the same

real estate project, whichever is less:

Provided also that where an application for initiating

the corporate insolvency resolution process against a

corporate debtor has been filed by a financial creditor

referred to in the first and second provisos and has

not been admitted by the Adjudicating Authority

before the commencement of the Insolvency and

Bankruptcy Code (Amendment) Act, 2020, such

Company Appeal (AT) (Insolvency) No. 286 of 2022

-8-

application shall be modified to comply with the

requirements of the first or second proviso within

thirty days of the commencement of the said Act,

failing which the application shall be deemed to be

withdrawn before its admission.”

9. The Explanation to Section 7 is also to the following effect:

“Explanation.—For the purposes of this sub-section, a

default includes a default in respect of a financial

debt owed not only to the applicant financial creditor

but to any other financial creditor of the corporate

debtor.”

10. Section 7(1) enables a Financial Creditor to file an Application for

initiating ‘Corporate Insolvency Resolution Process’ against the Corporate

Debtor when a default has occurred. By virtue of Explanation, the default

referred to in sub-section 1 includes a default in respect of Financial Debt

owed not only to the Applicant Financial Creditor but to any other Financial

Creditor of the Corporate Debtor.

11. The submissions of Learned Counsel for the Appellant is that although

when limitation is computed taking the decree passed by DRT in favour of

the Appellant dated 10th April, 2000, the Application is barred by time but in

event the decree dated 26th July, 2004 in O.A. No. 274/2021 filed by the

IDBI Bank is taken into consideration, the Application is within time. Copy

of the Application filed under Section 7 is part of the record of this Appeal as

Annexure BB.

12. We need to look into the Application under Section 7 to find out as to

for what “default” the Application under Section 7 has been filed. Part-IV of

Company Appeal (AT) (Insolvency) No. 286 of 2022

-9-

the Application deals with particulars of financial debt. Entire Part-IV of the

Application is as follows:

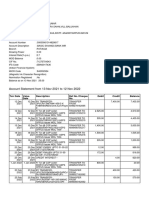

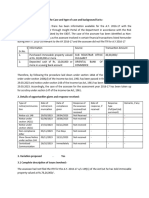

“Part-IV

Particulars of Financial Debt

1. Total amount The total amount granted by the Applicant

of debt granted Financial Creditor to the Corporate Debtor

and Date of under the respective facility is as under:

disbursement

of loan Sr. Date of Nature of Total

No. Sanction Facility Amount (In

Rs.)

1. *02-11- Overdraft 1,25,00,000

1989 against

Book

Debts

2. *02-11- Working 2,00,00,000

1989 Capital

Loan

3. 02-01- Term 55,00,000

1990 Loan

4. 02-11- Working 1,24,00,000

1989 Capital

Term

Loan

5. 18-11- In Land 30,00,000

1989 Letter of

Credit

6. 20-08- Deferred 16,31,752

1985 payment

21-08- Guarantee 35,69,200

1985 Limit

19-12- 63,92,400

1987

Total 6,49,93,352

Note:

1. *The above specified dates are the date

on which aforesaid loan/facilities were

last sanctioned/extended.

2. Amount The Applicant Financial Creditor claims an

claimed to be amount of Rs. 21,85,19,39,325/- (Rupees

in default and Two Thousand One Hundred and Eighty

the date on Five Crores Ninteen Lakhs Thirty Nine

which the Thousand Three Hundred and Twenty

default Five Only) comprising of Rs.

occurred. 8,68,64,184.29/- as the total principal

Company Appeal (AT) (Insolvency) No. 286 of 2022

-10-

amount towards the loan facility provided

by the Applicant Financial Creditor to

Corporate Debtor and interest charged by

the Applicant Financial Creditor as per the

terms and condition of the loan agreement

till 23rd August, 1995 and Rs.

21,76,50,75,140.71 (Rupees Two

Thousand One Hundred Seventy Six Crore

Fifty Lacs Seventy Five Thousand One

Hundred Forty)towards the interest

@23.25% pursuant to the decree dated

10th April, 2000 passed by the Hon’ble

Debt Recovery Tribunal, Jabalpur.

Further, following is the bifurcation of Rs.

8,68,64,184.29/- (amount in default till

23rd August, 1995):

Sr. Nature of Facility Outstanding

No. Amount

1 Overdraft against 6,18,728.60

Book Debts

2 Working Capital 3,48,86,089.77

Loan

3 Term Loan 1,47,48,163.82

4 Working Capital 3,30,06,250.60

Term Loan

5 Deferred payment 36,04,951.50

Guarantee Limit

Total 8,68,64,184.29

Date of NPA is 1st October, 1994

Copy of workings for computation of

amount due and number of days of

default is annexed hereto and marked as

Exhibit-Z.

13. When we look into the Part-IV, the default on basis of which, the

Application has been filed is default committed by the Corporate Debtor in

payment of the financial facilities extended by the Appellant. The basis of the

Application is not the default committed qua IDBI Bank another Financial

Creditor. When the Application is not founded on the default of the another

Financial Creditor-IDBI Bank although under Section 7 Sub-Section 1 read

with Explanation it is permissible for a Financial Creditor to file Section 7

Company Appeal (AT) (Insolvency) No. 286 of 2022

-11-

Application on default committed by the Corporate Debtor of any other

Financial Creditor and when factually the Application under Section 7 filed

not for the default of IDBI Bank rather the Application is specifically filed

confined to the default of the Corporate Debtor of the Financial Facilities

extended by the Appellant, we do not find any substance in the submission

of Learned Counsel for the Appellant that limitation for filing Section 7

Application be computed on the basis of decree of the IDBI Bank passed in

favour of IDBI Bank dated 26th July, 2004. The Decree passed by the DRT

dated 26th July, 2004 on the Application filed by the IDBI was not even filed

before the Adjudicating Authority and for the first time the decree has been

filed along with this Appeal. Mere filing decree in this Appeal shall not entitle

the Appellant to compute the limitation for filing Section 7 Application in

question on the basis of decree dated 26th July, 2004. We thus are of the

view that the decree dated 26th July, 2004 passed in the O.A. of IDBI is

irrelevant for the purposes of computation of limitation for filing Section 7

Application by the Appellant. The Adjudicating Authority has rightly come to

the conclusion that Section 7 Application which was filed on 16th March,

2020 is barred by time. Limitation which was available to the Appellant on

the basis of decree of DRT dated 10th April, 2000 came to an end on 09th

April, 2003. It is also relevant to notice that acknowledgement claimed by

the Appellant by virtue of OTS or any acknowledgement in the Financial

Statement are all acknowledgement which are subsequent to expiry of

limitation i.e. subsequent to 09th April, 2003. Acknowledgement under

Section 18 can be relied on only when acknowledgement is within time and

Company Appeal (AT) (Insolvency) No. 286 of 2022

-12-

limitation. Section 18(1) of the Limitation Act is clear in this regard which is

as follows:

“18. Effect of acknowledgement in writing-(1)

Where, before the expiration of the prescribed period

for a suit or application in respect of any property or

right, an acknowledgement of liability in respect of

such property or right has been made in writing

signed by the party against whom such property or

right is claimed, or by any person through whom he

derives his title or liability, a fresh period of limitation

shall be computed from the time when the

acknowledgement was so signed.”

14. We thus are of the view that Application filed by the Appellant was

clearly barred by time and has rightly been rejected by the Adjudicating

Authority.

15. Now coming to the submission of Learned Counsel for the Appellant

based on Section 25(3) of the Contract Act which has been raised during the

course of the submission, we find force in the submission of Learned Sr.

Counsel for the Respondent that the said submission needs no consideration

since the said submission was never raised either before the Adjudicating

Authority or in this Appeal or in the grounds of the Appeal. Reference of

Section 25(3) is made only in the Rejoinder-Affidavit filed by the Appellant

and has been reiterated during the course of the submission.

16. We thus are of the view that submission for which there was no

foundation in the Application filed under Section 7 or any document filed

before the Adjudicating Authority nor any such of submissions was even

raised in the grounds of the Appeal, raising submission in Rejoinder-Affidavit

Company Appeal (AT) (Insolvency) No. 286 of 2022

-13-

and during the course of the submission is not sufficient for consideration in

this Appeal. Submission based on Section 25(3) of the Contract Act are

submissions which are submissions requiring consideration of facts and

evidence and is not a submission which is based on a pure question of law

hence we are of the view that such submission of the Appellant based on

Section 25(3) needs no consideration in this Appeal.

17. In view of the foregoing discussion, we do not find any merit in the

Appeal. The Appeal is dismissed.

[Justice Ashok Bhushan]

Chairperson

[Mr. Barun Mitra]

Member (Technical)

NEW DELHI

14th November, 2022

Basant

Company Appeal (AT) (Insolvency) No. 286 of 2022

You might also like

- Unit - 1 Legal Method NotesDocument15 pagesUnit - 1 Legal Method NotesSatvik ShuklaNoch keine Bewertungen

- Which of The Following Should Not Be Considered CashDocument5 pagesWhich of The Following Should Not Be Considered CashErica FlorentinoNoch keine Bewertungen

- Acknowledge ReceiptDocument4 pagesAcknowledge Receiptdimenmark0% (1)

- National Company Law Appellate Tribunal, Principal Bench, New DelhiDocument32 pagesNational Company Law Appellate Tribunal, Principal Bench, New DelhisamsthenimmaneNoch keine Bewertungen

- In The Supreme Court of India Civil Appellate Jurisdiction: Judgment L. Nageswara Rao, JDocument22 pagesIn The Supreme Court of India Civil Appellate Jurisdiction: Judgment L. Nageswara Rao, JsamsthenimmaneNoch keine Bewertungen

- Sec10A Period of Default 1715772988Document10 pagesSec10A Period of Default 1715772988advsakthinathanNoch keine Bewertungen

- Tax Refund Amounts During The Moratorium Period Is Not AllowedDocument16 pagesTax Refund Amounts During The Moratorium Period Is Not Alloweddivya20barotNoch keine Bewertungen

- HARISH RAGHAVJI PATEL Vs Clearwater CapitalDocument26 pagesHARISH RAGHAVJI PATEL Vs Clearwater CapitalSachika VijNoch keine Bewertungen

- Cygnus - 13.12.2023 OrderDocument59 pagesCygnus - 13.12.2023 OrderNikhil MaanNoch keine Bewertungen

- Vistra ITCL para 9, 11Document43 pagesVistra ITCL para 9, 11Lavanya PathakNoch keine Bewertungen

- Sanjay D. Kakade vs. HDFC Ventures Trustee Company Ltd.Document56 pagesSanjay D. Kakade vs. HDFC Ventures Trustee Company Ltd.Sachika VijNoch keine Bewertungen

- Dena Bank Vs C Shivakumar Reddy and Ors 04082021 SC20210508211806011COM440734Document47 pagesDena Bank Vs C Shivakumar Reddy and Ors 04082021 SC20210508211806011COM440734Sravan KumarNoch keine Bewertungen

- C.P. (IB) No. 178/KB) /2022 in The Matter Of:: in The National Company Law Tribunal Kolkata Bench-Ii KolkataDocument5 pagesC.P. (IB) No. 178/KB) /2022 in The Matter Of:: in The National Company Law Tribunal Kolkata Bench-Ii Kolkataa_alok25Noch keine Bewertungen

- 2021 2 1502 46783 Judgement 11-Sep-2023Document12 pages2021 2 1502 46783 Judgement 11-Sep-2023Rahul TiwariNoch keine Bewertungen

- Rohit MotiwatDocument6 pagesRohit MotiwatarundhatiNoch keine Bewertungen

- Company Appeal (AT) (Ins.) No. 727-728 of 2023Document26 pagesCompany Appeal (AT) (Ins.) No. 727-728 of 2023Surya Veer SinghNoch keine Bewertungen

- Insolvency Case 2 EnglishDocument14 pagesInsolvency Case 2 EnglishPratyush LohumiNoch keine Bewertungen

- Prashant AgarwalDocument10 pagesPrashant AgarwalarundhatiNoch keine Bewertungen

- Reliance Home Finance Limited Vs Raghav Sarees Princ2022170622165048301COM475912Document6 pagesReliance Home Finance Limited Vs Raghav Sarees Princ2022170622165048301COM475912kalyanighayalNoch keine Bewertungen

- Nabinagar Power Generating Company LTD Vs Ram RataNL2023190423165007208COM549304Document9 pagesNabinagar Power Generating Company LTD Vs Ram RataNL2023190423165007208COM549304Dhananjai RaiNoch keine Bewertungen

- Cold Storage Case NCLATDocument19 pagesCold Storage Case NCLATsrinivas gowdNoch keine Bewertungen

- NCLAT Case On 90 Days Period For Claim Is Directory, Not MandatoryDocument17 pagesNCLAT Case On 90 Days Period For Claim Is Directory, Not MandatoryAashish 001Noch keine Bewertungen

- Ruling NCLATDocument31 pagesRuling NCLATCA Pallavi KNoch keine Bewertungen

- State Bank of India VS NAVJEEVAN TYRES PVT LTD NCLT MUMBAIDocument11 pagesState Bank of India VS NAVJEEVAN TYRES PVT LTD NCLT MUMBAISachika VijNoch keine Bewertungen

- Company Appeal (AT) (Ins.) No. 1070 of 2022Document15 pagesCompany Appeal (AT) (Ins.) No. 1070 of 2022Surya Veer SinghNoch keine Bewertungen

- hiren-meghji-bharani-vs-shankeshwar-properties-NCLAT NDDocument12 pageshiren-meghji-bharani-vs-shankeshwar-properties-NCLAT NDNishi AgrawalNoch keine Bewertungen

- Vistra ITCL SC para 33, 34Document16 pagesVistra ITCL SC para 33, 34Lavanya PathakNoch keine Bewertungen

- SLB Welfare AssociationDocument26 pagesSLB Welfare AssociationSurya Veer SinghNoch keine Bewertungen

- 673 Kotak Mahindra Bank Limited V Kew Precision Parts PVT LTD 5 Aug 2022 430323Document15 pages673 Kotak Mahindra Bank Limited V Kew Precision Parts PVT LTD 5 Aug 2022 430323samsthenimmaneNoch keine Bewertungen

- Vikash Kumar Mishra & Ors. v. Orbis Trusteeship Service Private Limited & AnrDocument6 pagesVikash Kumar Mishra & Ors. v. Orbis Trusteeship Service Private Limited & AnrJayant SharmaNoch keine Bewertungen

- Jayam Vyapaar Private LimitedDocument4 pagesJayam Vyapaar Private LimitedSachika VijNoch keine Bewertungen

- IPay Clearing Services Private Limited V ICICI Bank LimitedDocument21 pagesIPay Clearing Services Private Limited V ICICI Bank LimitedArunjeet SinghNoch keine Bewertungen

- Sandeep Mehta and Vijay Bishnoi, JJ.: Equiv Alent Citation: 2020 (37) G.S.T.L. 289Document15 pagesSandeep Mehta and Vijay Bishnoi, JJ.: Equiv Alent Citation: 2020 (37) G.S.T.L. 289nidhidaveNoch keine Bewertungen

- 2019 31 1501 26209 Judgement 16-Feb-2021Document23 pages2019 31 1501 26209 Judgement 16-Feb-2021Ashok GNoch keine Bewertungen

- 9910105061602021Document26 pages9910105061602021Surya Veer SinghNoch keine Bewertungen

- Vijaya Municipal Corporation Vs Vensar ConstructionDocument7 pagesVijaya Municipal Corporation Vs Vensar ConstructiontanyaNoch keine Bewertungen

- JK Jute Mills Company Limited Vs Surendra Trading NL2017050517163156110COM620844Document14 pagesJK Jute Mills Company Limited Vs Surendra Trading NL2017050517163156110COM620844Rahul BarnwalNoch keine Bewertungen

- In The Matter ofDocument8 pagesIn The Matter ofRamesh KalyanNoch keine Bewertungen

- Clean Slate, Sec. 31, Balance Sheet - Ghanshyam MishraDocument139 pagesClean Slate, Sec. 31, Balance Sheet - Ghanshyam MishraNitin AsatiNoch keine Bewertungen

- Sale of CD Assets Shown As OTS 1711599186Document8 pagesSale of CD Assets Shown As OTS 1711599186advsakthinathanNoch keine Bewertungen

- STATE TAX OFFICER CaseDocument31 pagesSTATE TAX OFFICER Casedevanshi jainNoch keine Bewertungen

- In The Supreme Court of India: Dinesh Maheshwari and Vikram Nath, JJDocument28 pagesIn The Supreme Court of India: Dinesh Maheshwari and Vikram Nath, JJAnushree MahindraNoch keine Bewertungen

- Case CommentaryDocument7 pagesCase CommentaryHritik KashyapNoch keine Bewertungen

- EPC Constructions India Limited MA 344-2019 IN CP 1832-2017 NCLT ON 15.04.2019 FINAL PDFDocument9 pagesEPC Constructions India Limited MA 344-2019 IN CP 1832-2017 NCLT ON 15.04.2019 FINAL PDFShreeyaNoch keine Bewertungen

- Case8 - NewDelhiBenchV-SSP Private Limited V. Govind Jee Dairy Milk Private Limited - 28.03.2023Document3 pagesCase8 - NewDelhiBenchV-SSP Private Limited V. Govind Jee Dairy Milk Private Limited - 28.03.2023priyanka prashantNoch keine Bewertungen

- Periasamy Palani Gounder and Ors Vs Radhakrishnan NL2022150322171212327COM850540Document53 pagesPeriasamy Palani Gounder and Ors Vs Radhakrishnan NL2022150322171212327COM850540RAMA PRIYADARSHINI PADHYNoch keine Bewertungen

- Convertion of Debentures Into EquityDocument21 pagesConvertion of Debentures Into Equitydivya20barotNoch keine Bewertungen

- Anthony Samy v. SBI, 2023 SCC OnLine DRAT 650 at para 5-10Document5 pagesAnthony Samy v. SBI, 2023 SCC OnLine DRAT 650 at para 5-10Pival K. PeddireddiNoch keine Bewertungen

- Jindal Stainless Ltd. V MR Shailendra AjmeraDocument29 pagesJindal Stainless Ltd. V MR Shailendra AjmeraNishi AgrawalNoch keine Bewertungen

- ICICI Bank vs. BKM IndustriesDocument26 pagesICICI Bank vs. BKM IndustriesParth ShahaneNoch keine Bewertungen

- HPCL NCLT 518904Document11 pagesHPCL NCLT 518904brahmaNoch keine Bewertungen

- National Company Law Appellate Tribunal, Principal Bench, New DelhiDocument42 pagesNational Company Law Appellate Tribunal, Principal Bench, New Delhijscorporatesolutions84Noch keine Bewertungen

- Case4 - NewDelhiBenchV-Intec Capital V. SRD Management Company Private-06-03.2023Document4 pagesCase4 - NewDelhiBenchV-Intec Capital V. SRD Management Company Private-06-03.2023priyanka prashantNoch keine Bewertungen

- Eeb 3 DD 3450 D 9Document15 pagesEeb 3 DD 3450 D 9Imran ShaikhNoch keine Bewertungen

- Latest Case Laws For IBC (Not There in Module)Document6 pagesLatest Case Laws For IBC (Not There in Module)keerthana mNoch keine Bewertungen

- NCLAT OrderDocument32 pagesNCLAT OrderShiva Rama Krishna BeharaNoch keine Bewertungen

- Written SubmissionsDocument14 pagesWritten SubmissionsSahil ShrivastavNoch keine Bewertungen

- ICICI Bank UK PLC Vs Anshu Jain and Ors 14082020 DE202019082015420446COM578819Document3 pagesICICI Bank UK PLC Vs Anshu Jain and Ors 14082020 DE202019082015420446COM578819starNoch keine Bewertungen

- B'mukerian Papers Limited and ... Vs Debt Recovery Appellate Tribunal ... On 24 May, 2012'Document5 pagesB'mukerian Papers Limited and ... Vs Debt Recovery Appellate Tribunal ... On 24 May, 2012'Bruce AlmightyNoch keine Bewertungen

- SC Judgment 1 PDFDocument14 pagesSC Judgment 1 PDFQazi Ammar AlamNoch keine Bewertungen

- Vivek Raheja PDFDocument21 pagesVivek Raheja PDFVishalChoudhuryNoch keine Bewertungen

- An Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersFrom EverandAn Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersNoch keine Bewertungen

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Bachhaj Nahar Vs Nilima Mandal and Ors 23092008 Ss081710COM534258Document8 pagesBachhaj Nahar Vs Nilima Mandal and Ors 23092008 Ss081710COM534258Satvik ShuklaNoch keine Bewertungen

- 6Document8 pages6Satvik ShuklaNoch keine Bewertungen

- 3Document2 pages3Satvik ShuklaNoch keine Bewertungen

- Versus: Efore Uralidhar AND Hander HekharDocument11 pagesVersus: Efore Uralidhar AND Hander HekharSatvik ShuklaNoch keine Bewertungen

- UNIT - 1 Legal EnglishDocument36 pagesUNIT - 1 Legal EnglishSatvik ShuklaNoch keine Bewertungen

- Anuitas DimukaDocument22 pagesAnuitas DimukaNegara AnimeNoch keine Bewertungen

- Case Study No Mod (Iv) Working Capital Turnover MethodDocument1 pageCase Study No Mod (Iv) Working Capital Turnover Methodamarlata_kumariNoch keine Bewertungen

- Đề cươngDocument9 pagesĐề cươngĐinh Trần Đức HoanNoch keine Bewertungen

- Fa AssignmentDocument2 pagesFa AssignmentEdwina HutchinsNoch keine Bewertungen

- Statement 1712036970852Document5 pagesStatement 1712036970852nikamdeepraj777Noch keine Bewertungen

- Project Report On Axis BankDocument37 pagesProject Report On Axis BankVinay JoshiNoch keine Bewertungen

- PDICDocument3 pagesPDICElah ViktoriaNoch keine Bewertungen

- American Express Card 22Document3 pagesAmerican Express Card 22areszNoch keine Bewertungen

- SQLDocument3 pagesSQLcoke911111Noch keine Bewertungen

- Ntu 4 U NSFKukru RfeDocument14 pagesNtu 4 U NSFKukru RfeRAKESH KUMARNoch keine Bewertungen

- Time Value of Money EditedDocument57 pagesTime Value of Money Editedmac bNoch keine Bewertungen

- Model Answer KeyDocument5 pagesModel Answer KeyChristina ShajuNoch keine Bewertungen

- Remitly 5Document2 pagesRemitly 5Ismael LanderosNoch keine Bewertungen

- ILDP Prashant Bhimrao KapseDocument3 pagesILDP Prashant Bhimrao Kapseanil deswalNoch keine Bewertungen

- IDFCFIRSTBankstatement 10104880969 110438261Document6 pagesIDFCFIRSTBankstatement 10104880969 110438261ralesh694Noch keine Bewertungen

- Hypothecation of ReceivablesDocument3 pagesHypothecation of ReceivablesRajeev KumarNoch keine Bewertungen

- TimesheetDocument1 pageTimesheetAnonymous AcwQIiNoch keine Bewertungen

- 2 PDFDocument5 pages2 PDFVishal BawaneNoch keine Bewertungen

- PDF FileDocument3 pagesPDF FileSuhaila hamidNoch keine Bewertungen

- Additional Income and Adjustments To IncomeDocument1 pageAdditional Income and Adjustments To IncomeSz. RolandNoch keine Bewertungen

- Sol. Man. - Chapter 2 Notes PayableDocument12 pagesSol. Man. - Chapter 2 Notes PayableChristine Mae Fernandez Mata100% (1)

- 9105 - Corporate LiquidationDocument4 pages9105 - Corporate LiquidationGo FarNoch keine Bewertungen

- Promissory Note SampleDocument2 pagesPromissory Note SampleRidzsr DharhaidherNoch keine Bewertungen

- State Bank of India3Document15 pagesState Bank of India3ankithesenkiNoch keine Bewertungen

- ShruthiDocument6 pagesShruthiSanjay LeoNoch keine Bewertungen

- App Form-1Document2 pagesApp Form-1ravindraNoch keine Bewertungen

- Al Masraf Bank - AEDDocument4 pagesAl Masraf Bank - AEDTehseenNoch keine Bewertungen

- Invoice No 54829Document3 pagesInvoice No 54829krishna salesNoch keine Bewertungen