- News

- Business News

- India Business News

- HDFC stock falls nearly 5%, drags sensex down

Trending

HDFC stock falls nearly 5%, drags sensex down

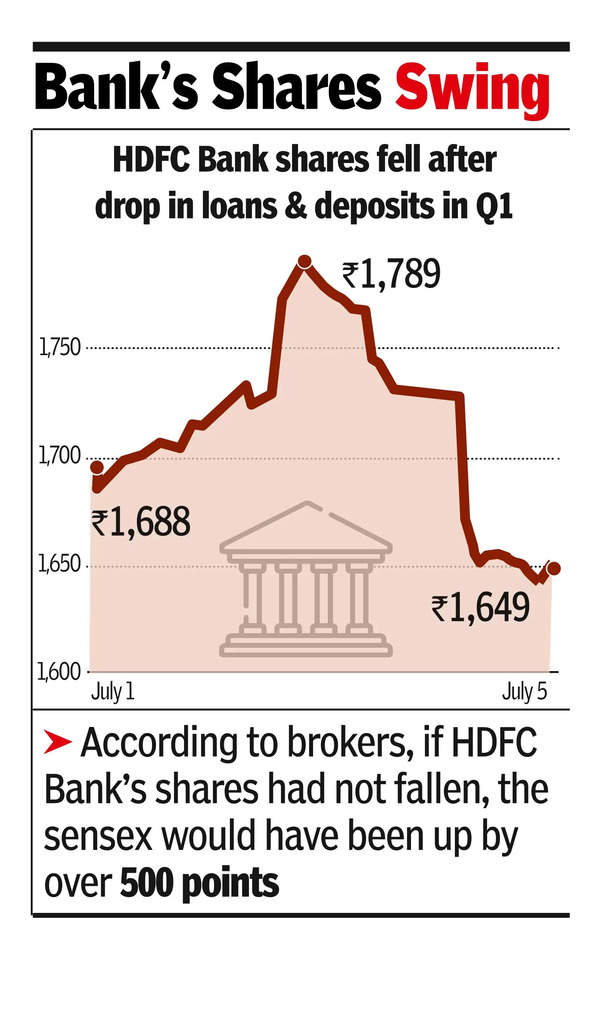

MUMBAI: HDFC Bank shares fell 4.6% on Friday, dragging the sensex below the 80,000 mark despite relatively strong sentiment in the equities market. The country's largest private lender came under pressure after it reported a decline in both loans and current & savings account deposits in the first quarter.

The sensex closed 53 points down at 79,996 largely because of HDFC Bank.Nifty, which represents a broader range of stocks, continued to gain and closed 22 points higher at 24,324, with most of the gains coming in the last 30 minutes of the trade.

According to brokers, if HDFC Bank's shares had not fallen, the sensex would have been up by over 500 points. Despite HDFC Bank being a drag, the sensex had its best week in over six months as well as the fifth consecutive week of gains.

"The broader market outperformed the benchmarks, with Nifty mid-cap and small-cap indices gaining more than 0.5% each. Technically, Nifty managed to defend the 24,200 support level on a closing basis, indicating strength. As long as the index holds this support, it may attempt to test the levels of 24,500-24,600," said Hrishikesh Yedve of Asit C Mehta Investment.

In Friday's session, HDFC Bank erased the gains it had made earlier in the week after reporting its June-end shareholding numbers. The increased headroom for foreign investors had raised expectations that the stock's weightage in the Morgan Stanley Emerging Markets index would rise, attracting more passive foreign funds. Traders now await commentary from the management, which is expected during its quarterly results later this month.

The sensex closed 53 points down at 79,996 largely because of HDFC Bank.Nifty, which represents a broader range of stocks, continued to gain and closed 22 points higher at 24,324, with most of the gains coming in the last 30 minutes of the trade.

According to brokers, if HDFC Bank's shares had not fallen, the sensex would have been up by over 500 points. Despite HDFC Bank being a drag, the sensex had its best week in over six months as well as the fifth consecutive week of gains.

Among the 30 sensex stocks, 17 posted gains. SBI shares gained the most at 2.5%, while Reliance Industries, which gained 2.3%, hit a new lifetime high at Rs 3,197. Shares of Raymond jumped 10% on Friday after the textile major said it will demerge its real estate business.

"The broader market outperformed the benchmarks, with Nifty mid-cap and small-cap indices gaining more than 0.5% each. Technically, Nifty managed to defend the 24,200 support level on a closing basis, indicating strength. As long as the index holds this support, it may attempt to test the levels of 24,500-24,600," said Hrishikesh Yedve of Asit C Mehta Investment.

In Friday's session, HDFC Bank erased the gains it had made earlier in the week after reporting its June-end shareholding numbers. The increased headroom for foreign investors had raised expectations that the stock's weightage in the Morgan Stanley Emerging Markets index would rise, attracting more passive foreign funds. Traders now await commentary from the management, which is expected during its quarterly results later this month.

End of Article

FOLLOW US ON SOCIAL MEDIA