Stock Research Report for HDFC Bank Ltd

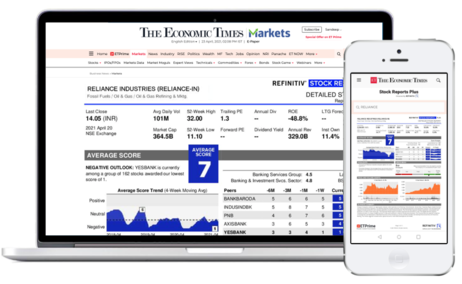

Stock score of HDFC Bank Ltd moved down by 1 in a month on a 10 point scale (Source: Refinitiv). Get detailed report on HDFC Bank Ltd by subscribing to ETPrime.

Get 4000+ Stock Reports worth₹ 1,499* with ETPrimeat no extra cost for you

*As per competitive benchmarking of annual price. T&C apply

Make Investment decisions

with proprietary stock scores on earnings, fundamentals, relative valuation, risk and price momentum

Find new Trading ideas

with weekly updated scores and analysts forecasts on key data points

In-Depth analysis

of company and its peers through independent research, ratings, and market data

HDFC Bank Limited (the Bank) is a financial services conglomerate that offers a full suite of financial services, from banking to insurance, and mutual funds through its subsidiaries. The Bank caters to a range of banking services covering commercial and investment banking and transactional/branch banking. Its Treasury segment includes net interest earnings from its investment portfolio, money market borrowing and lending, gains or losses on investment operations and on account of trading in foreign exchange and derivative contracts. The Retail Banking segment includes Digital Banking, and Other retail banking. The Wholesale Banking segment provides loans, non-fund facilities and transaction services to large corporates, public sector units, government bodies, financial institutions and medium scale enterprises. Its subsidiaries include HDFC Securities Ltd., HDB Financial Services Ltd., HDFC Asset Management Co. Ltd, and HDFC ERGO General Insurance Co. Ltd.