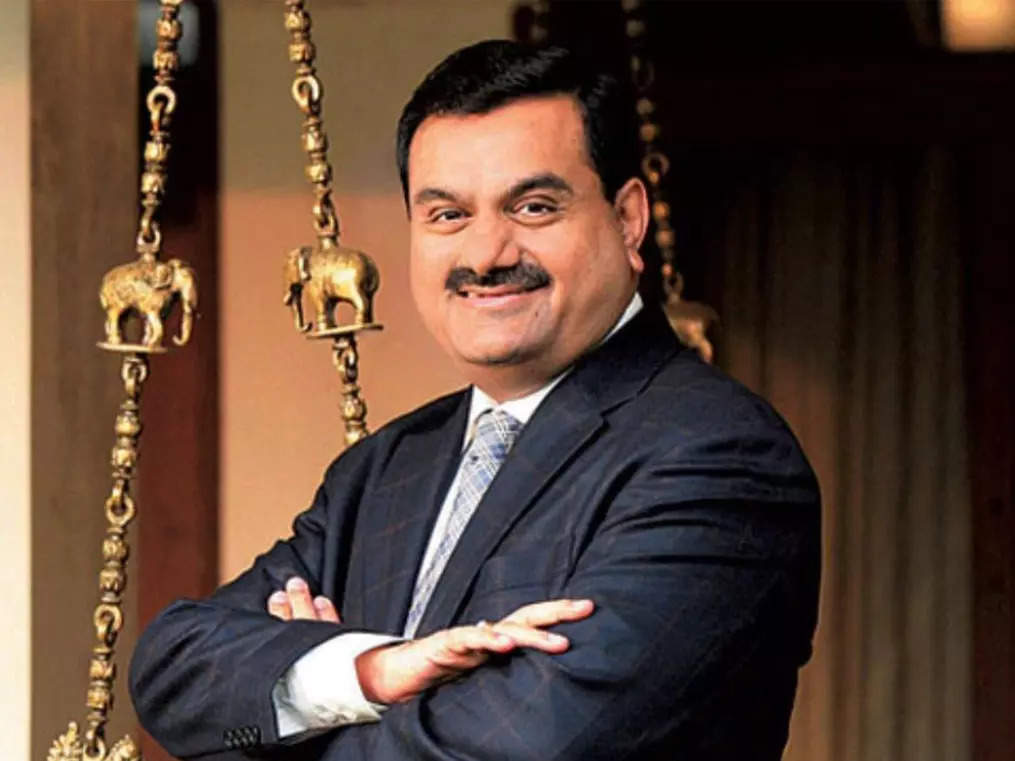

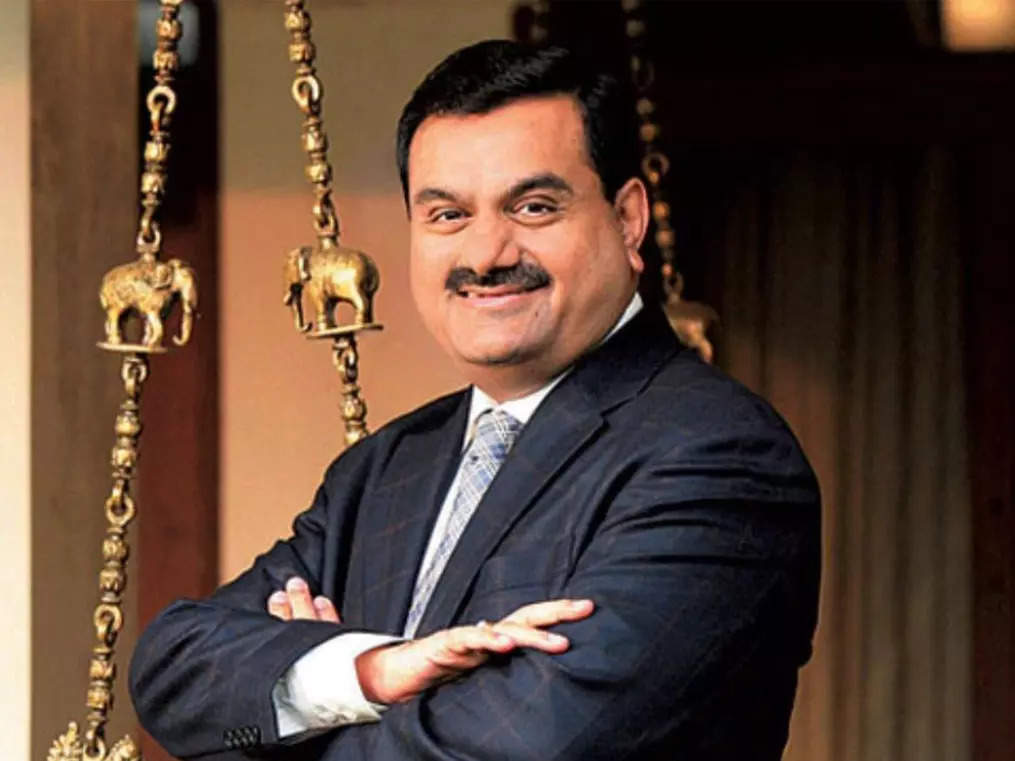

Business News›Prime›Markets›Trust deficit? Why most Adani Group firms are yet to rebound even a year after Hindenburg report.

Investing

Trust deficit? Why most Adani Group firms are yet to rebound even a year after Hindenburg report.

Synopsis

Most Adani Group companies are yet to fully recover from the damage done by the Hindenburg Research report. While their financials have improved during this period, investors seem to be cautious as valuations still look stretched.

A year after Hindenburg Research dropped a bomb, five out of seven Adani Group companies are still trading below their closing prices as on January 23 — the day before the US short seller released a scathing research report on the Indian conglomerate. Only Adani Ports and SEZ and Adani Power have managed to shrug off the impact of the report that alleged manipulation in stock prices besides claiming that Adani Group companies were overvalued by

( Originally published on Jan 24, 2024 )

- FONT SIZEAbcSmallAbcMediumAbcLarge

ET

Uh-oh! This is an exclusive story available for selected readers only.

Worry not. You’re just a step away.

Get Unlimited Access to The Economic Times

Get Unlimited Access to The Economic Times