The Noida-based IT services firm retained its sales guidance of 9.5-11.5% for the year ahead.

The product business, which HCL built by acquiring intellectual property from companies such as IBM, will likely generate $1billion in revenue this year. The company also appointed non-executive director Roshni Nadar as vice chairman of the board. “The outlook is very positive, there is a strong demand at least in the US market and we are seeing significant discretionary spend and hope to benefit from that.

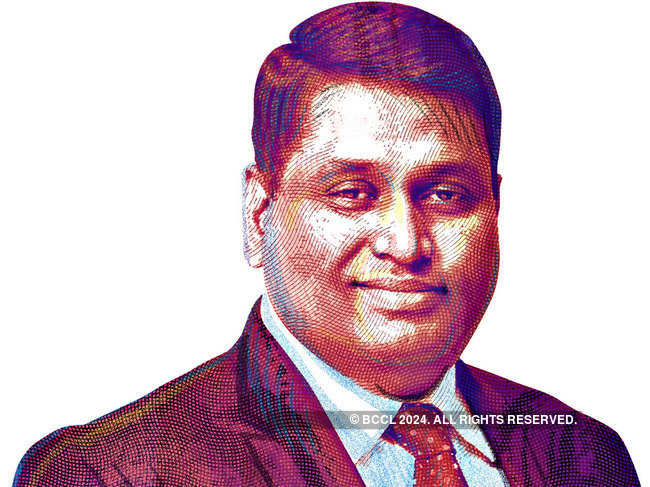

We are very positive that the next two quarters will be better and we hope to reach the midpoint of our guided revenue range,” HCL Technologies CEO C Vijayakumar tells ET’s Surabhi Agarwal in an interview. Edited excerpts:

What are the signs that make you positive about the growth prospects?

Discover the stories of your interest

Some of the infrastructure would go on cloud, but they also are building software defined data centres and digital workplaces. Their internal IT organisations… are focusing on becoming more employee-centric and employee-experience oriented kind of services. Our digital workplace, which has cognitive work desk, significant amounts of automation and social collaboration, is gaining good traction.

If you look at our engineering services, we are seeing two or three trends driving demand… A lot of companies are becoming more softwarised, which means they have to build new platforms. A lot of product companies are trying to move their products to software-as-aservice (SaaS) solution, which would mean a lot of re-engineering opportunities of these products.

The whole industrial segment, Industry 4.0, IoT is driving growth besides the core application services business, which is mostly digital and analytics. The macro (economy) is also looking better; if you see in the US and the spending, people are little more comfortable in discretionary areas that are more useful for transformation and to be competitive in their businesses.

What does Roshini Nadar’s appointment as vice-chairman mean?

Do we see her more involved in the day-to-day operations? It is a very good development; she has been a member of the board since 2013, so the board has decided to elevate her as vice-chairman.

She is the non-executive director. So, she would have a board-level responsibility, not necessarily in the operations

This quarter, the financial services business has been flat…

We have had these specific client issues that are causing a little bit of softness. Overall, it is pretty good outside the two clients.

These two (client issues) are in Europe. Last year, we had the highest growth in financial services across the industry.

Where do you expect discretionary spend to increase?

Retail, consumer packaged goods (CPG) and financial services are the two areas. We are also seeing a little bit of growth in telecom and life sciences.

This year, HCL has been less active as far as acquisitions are concerned. Is that strategic?

Nothing intentional, we are also digesting all the acquisitions and how you can get true benefits of synergy and cross-sell from these acquisitions, but we continue to be on the lookout. We are open.

Get Unlimited Access to The Economic Times

Get Unlimited Access to The Economic Times