ETtech

ETtech“Capital Group through various of its investment vehicles now owns around 10% in the company,” said a person with knowledge of the matter.

This comes at a time when India received record inflow of foreign portfolio investments (FPI) into its equities markets, buoyed by a steady macroeconomic environment and a booming stock market. More than Rs 2 lakh crore worth of Indian equities have been bought by FPIs in FY24, the highest since 2021, according to National Securities Depository data.

Besides global investors, domestic institutional players have also bought stakes in PB Fintech. Data from BSE as of March 2024 show that mutual funds own 10% of PB Fintech, compared with 7.4% in June last year. At the time of the IPO, their stake was 2.5%.

Interestingly, insurance companies have purchased stakes in the parent of Policybazaar, the largest online insurance marketplace in the country. Life insurance firms like SBI Life, Max Life Insurance and Bajaj Life have cumulatively invested Rs 2,900 crore in the company, according to the person cited earlier. The market capitalisation of the firm as of July 2 (Tuesday) was Rs 67,686 crore.

Discover the stories of your interest

PB Fintech did not respond to emailed queries.

It is not only PB Fintech which has attracted investments from Indian and global institutional investors. One 97 Communications, which runs Paytm, had around 6.2% of its stake held by mutual funds as of March 2024 compared with 2.5% in June 2023. FPIs held 20% in One 97 at the end of March compared with 15.6% around a year back.

New-age food delivery company Zomato had around 45% of its shares held by FPIs as of March 2024, compared with 30% a year earlier. Mutual funds doubled their stake to almost 12%.

While large institutional investors have increased their shareholding in PB Fintech, its early investors have exited or part-sold their shares at significant gains.

In January ET wrote that SoftBank, one of the largest shareholders in Policybazaar before it went public, had completely exited the company at significant gains. On an investment of around $200 million, the Japanese technology investor garnered around $650 million.

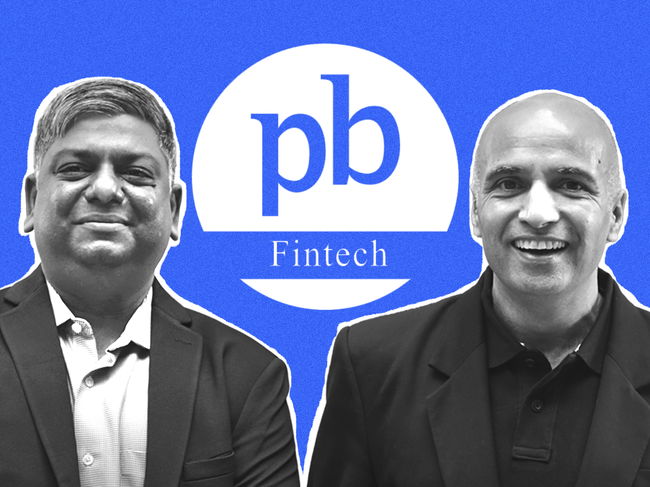

Yashish Dahiya and Alok Bansal, the cofounders of the PB Fintech group part-sold their stake in the company on May 17. Dahiya sold 5.4 million shares worth around Rs 700 crore and Bansal sold 2.9 million shares in the company worth approximately Rs 377 crore.

Get Unlimited Access to The Economic Times

Get Unlimited Access to The Economic Times