PEPPERSTONE GROUP LTD

Euro eases on French poll gridlock, dollar sluggish after US payrolls

Euro slipped post-French election with a hung parliament favoring left-wing alliance and Macron. Le Pen’s party lagged. Weak U.S. payrolls hurt dollar, upping Fed cut odds. Yen rose to 160.70 yen, sterling hit a 3-1/2-week top post-Labour Party win. Bitcoin fell amid Mt. Gox woes; dollar index at 104.97 amid CME Group’s Fed cut odds.

Asian stocks advance as S&P 500 closes above 5,500: Markets wrap

Market euphoria as S&P 500 hits records, Calvasina bullish. Job openings up, Fed's easing stance challenged. Eyes on US payrolls data for June update.

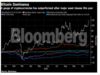

Get-rich-quick trades suddenly reverse as Nvidia, Bitcoin slump

Investors face volatility as Bitcoin and Nvidia suffer losses, emphasizing the need for market diversification beyond technology.

Rishi Sunak's summer election brings hope to Britain's bruised financial sector

Executives in London's financial hub are cautiously optimistic about the upcoming UK elections on July 4, hoping for a government that prioritizes stability and supports the finance sector. Despite the likelihood of a Labour Party victory, which would mark a significant political shift, business leaders are relatively calm. Boris Johnson's past dismissals of financial concerns, particularly regarding Brexit, strained relations with the City, but recent efforts to mend ties have been noted.

BoE inches closer to rate cut as second policymaker backs easing

Deputy Governor Dave Ramsden joined external member Swati Dhingra in calling for an immediate cut in the base rate from its current level of 5.25%, where it was held for the sixth straight meeting.

Dollar firm as US rates and earnings take centre stage

The dollar ticked higher against the euro and yen in subdued trade after last week's volatility, with markets taking their lead from the Fed's higher-for-longer messaging and a firmer Wall Street ahead of results from megacap growth companies.

- Go To Page 1

Currencies calm but cautious after a weary week

Eyes are on the yen this week, with the Bank of Japan's (BOJ) Friday policy review the notable item on the economic calendar.

Asia stocks slide, gold rises as Middle East conflict sparks safety rush

Markets in Asia began the week on a cautious footing. MSCI's broadest index of Asia-Pacific shares outside Japan fell 0.7% after Iran had, late on Saturday, launched explosive drones and missiles at Israel in retaliation for a suspected Israeli attack on its consulate in Syria on April 1.

Dollar struggles to retain gains even as March rate cut odds recede

The Bank of Japan's two-day meeting begins on Monday. Wagers for an exit from negative rates at this meeting have been wound down in the wake of the New Year's Day earthquake on Japan's west coast alongside dovish BOJ commentary.

Bitcoin rally cools in countdown to US spot ETF decision by SEC

The token dipped to $46,850 as of 1:05 p.m. Tuesday in Singapore after a 6.5% jump on Monday in the US to a 21-month high. Bitcoin’s new year climb now stands at 10%, contrasting with drops over the same period in stocks and gold.

European shares tentative as nerves over US debt talks linger

European shares opened cautiously on Monday and Wall Street futures struggled as traders awaited news on U.S. debt ceiling negotiations prior to the impending June 1 deadline. President Joe Biden and House Speaker Kevin McCarthy will meet to discuss the debt ceiling. A failure to lift the debt ceiling would trigger a default and chaos in financial markets, adding to interest rates. HSBC's chief Asia economist, Frederic Neumann, believes the debt ceiling issues will be short-lived, despite risks of greater financial volatility. China's ban on Micron helped stocks of Micron rivals rise and are likely to benefit as companies seek memory products from other sources.

Markets on edge as US debt ceiling talks approach crunch time

Asian stocks and US futures fell on Monday as concerns about US debt ceiling negotiations weighed on market sentiments, hazardous banking fears and fresh geopolitical anticipations. US House of Representatives Speaker, Kevin McCarthy, and President, Joe Biden, meet on Monday to take a crucial call on the debt ceiling, less than two weeks before the end-of-May deadline. As the break in the negotiations last week, the inability to lift the debt ceiling might lead to a default and spark chaos in financial markets. Meanwhile, concerns over regional banks led US bank shares to continue their decline.

Frightful February ends buy everything calls in emerging Asia

The brief rally in developing-nation assets highlights the difficulty in calling the peak in US rates, as robust data dash hopes for a Federal Reserve pivot. Most analysts don’t see a recovery just yet, with Goldman Sachs Group Inc. warning that emerging-market debt may face a repeat of the risks seen in 2022.

Asian stocks pull back, dollar regains footing ahead of U.S. payrolls data

Overnight, markets sensed the end of the massive global tightening cycle, after policymakers in Britain and Europe signalled their intention to pause, sending local bonds rallying and currencies lower.

Stocks regroup as investors hold their breath on Ukraine

Asian stocks steadied on Wednesday and demand for safe-havens waned a little as investors regarded Russian troop movements near Ukraine and initial Western sanctions as leaving room to avoid a war, while a rate hike lifted New Zealand's dollar.

Asian shares drop as Treasury yields hit fresh highs

Asia's share markets struggled on Wednesday as U.S. Treasury yields hit fresh two-year highs and a global technology stock sell-off unsettled investors worrying about inflation and bracing for tighter U.S. monetary policy.

Stablecoins steal the limelight from subdued bitcoin

Stablecoins are a form a virtual currency with values pegged to traditional assets such as the U.S. dollar or commodities, and their rise has accelerated discussion by central banks across the world about digital versions of their currencies.

As stock markets set new records, hedge-fund managers aren't buying the frenzy

Superlatives on the rally are piling up. Without a single down session, the Nasdaq 100 just scored two perfect weeks in a row, something that has happened only once before -- in 2017.

Bitcoin struggles for footing on worries over China, leverage

Bitcoin, the biggest and most popular cryptocurrency, rose slightly to $38,072 after plunging 14 per cent on Wednesday to its lowest since late January.

$600 billion wiped out! Crypto tumble is becoming very painful

The value of more than 7,000 tokens tracked by CoinGecko has shrunk more than $600 billion in the past week to $1.9 trillion.

Bitcoin price tumbles, recoups after Elon Musk's U-turn on Tesla payments

Bitcoin price dropped from around $54,819 to $45,700, its lowest since March 1, in just under two hours following Elon Musk's tweet that Tesla will stop accepting the world's largest cryptocurrency for payments against its electric cars.

Bitcoin falls after rallying in weekend to record above $61,000

Bitcoin reached its latest all-time high on optimism that some of the pandemic relief payments in the U.S. will end up chasing the digital token’s towering rally.

Bitcoin breaks through $55,000 mark as risk appetite revives

Recent trends signal digital tokens are stepping closer to mainstream finance.

Asian shares rise as risk assets shine; Australian central bank eyed

Australian shares jumped 0.8% in early trade, while E-mini S&P futures climbed 0.15%. Japan's Nikkei opened 0.93% higher.

Asian shares near all-time peak, oil heads to $60/barrel on economic revival hopes

Japan's Nikkei climbed 0.3% while Australian shares advanced 0.5% led by technology and mining shares.

Australia, NZ shares gain as Biden transition, vaccine cheer lift risk assets

The Dow Jones Industrial Average breached the 30,000 level overnight for the first time on optimism surrounding vaccine progress and Biden's transition.

Stocks up as vaccine shields against second-wave worries

MSCI's broadest index of Asia-Pacific shares outside Japan rose 0.4% and Japan's Nikkei rose 1%, although most of the action was switching between sectors within markets, as investors shift from coronavirus winners into some of the hardest hit sectors.

Bitcoin surge widens cryptocurrency’s lead over gold as top asset of 2020

Crypto believers say an escalating pandemic and sliding greenback amid ever looser monetary policy will spur more gains as investors seek stores of value. Skeptics argue crypto markets have a history of wild swings and are merely riding a tide of liquidity.

Dollar in the doldrums; US politics, Fed minutes eyed

The risk-sensitive Australian dollar inched up to a three-session high of $0.7194, but also remained contained in the channel it has traded in for a week.

Load More