ZERODHA NIFTY 1D RATE LIQUID ETF

NFO Tracker: How new mutual funds launched in 2024 are doing

Discover the top performers like Motilal Oswal Nifty Realty ETF and HDFC Manufacturing Fund, showcasing impressive returns in the market. These funds have attracted significant assets and delivered strong performances within a specific period of time in 2024.

Shriram Mutual Fund launches NIFTY 1D Rate Liquid ETF

This investment scheme focuses on Tri Party Repo agreements involving Government securities or treasury bills. Its goal is to mirror the performance of the NIFTY 1D Rate Index, aiming to achieve similar returns while minimizing any tracking discrepancies.

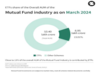

ETFs constitute 13% of the total mutual fund industry AUM: Zerodha Fund House

ETFs now constitute close to 13% of the total Mutual Fund Industry AUM indicating the remarkable adoption of ETFs by retail investors in India, according to a study by Zerodha Fund House.

Kotak Mutual Fund, two others file draft documents with Sebi for 4 funds

Kotak Nifty Midcap 50 Index Fund will be an open-ended scheme replicating/tracking the NIFTY Midcap 50 Index. Benchmarked against NIFTY Midcap 50 Index, it will be managed by Devender Singhal, Satish Dondapati, and Abhishek Bisen.

ETFs trading at abnormal prices due to high volatility: Check this before investing in mutual fund ETF to prevent avoidable loss

Exchange traded funds NAV: The stock market experienced extreme volatility on June 4 and 5 of 2024. As a result of this volatility the market NAV price of many ETFs showed abnormal premiums or discounts to their indicative i-NAV price. Stock broker Zerodha cautions investors to not buy ETFs if its price is trading at a high premium to its i-NAV value.

ET Mutual Funds explains: 5 key differences between index funds and index ETFs in India

Index funds and Index ETFs vary in investment requirements and cost structures, with ETFs requiring a demat account and having lower expense ratios compared to index funds.

Dollar firm ahead of global inflation data

Investors are focusing on U.S., European, and Japanese inflation data to guide the global interest rate outlook for the week, impacting foreign exchange trade dominated by the hunt for 'carry' and supporting the dollar.

Zerodha Nifty 1D Rate Liquid ETF crosses Rs 1,000 crore AUM

Apart from the Liquid ETF, the fund house manages three schemes - Zerodha Nifty LargeMidcap 250 Index Fund, Zerodha ELSS Tax Saver Nifty LargeMidcap 250 Index Fund and Zerodha Gold ETF.

Samco Special Opportunities Fund, and two Bajaj Finserv Mutual Fund NFOs open for subscription this week

Bajaj Finserv Multi Asset Allocation Fund and Samco Special Opportunities Fund NFOs open this week, focusing on diverse investments like equity, debt, Gold ETFs, and special situations for potential capital growth.

Five mutual fund houses files draft offer documents with Sebi

Out of these six funds, four funds will be passive funds (ETF and Index) and two will be sectoral funds. Motilal Oswal Mutual Fund has filed drafts for Motilal Oswal Nifty500 LargeMidSmall Equal-Cap Weighted Index Fund and Motilal Oswal Nifty India Defence Index Fund.

Israel-Iran conflict, Q4 earnings among 11 factors that will steer D-Street this week

The upcoming week promises to show top action with the Iran-Israel conflict taking center stage along with the earnings season which kicked off with the announcement of earnings by TCS. Oil prices, China GDP data, US retail sales figures, and movements in US bond yields and the dollar index will be important macroeconomic events that may influence market sentiments

It's getting increasingly harder for active funds to outperform their benchmarks, says Nithin Kamath

"It's a no-brainer to opt for low-cost index funds as the core of your portfolio. You can complement that with other funds, but the core should be passive funds," Kamath said on X (formerly Twitter).

Zerodha Mutual Fund crosses Rs 1,000 crore asset base

Zerodha mutual fund manages four mutual fund schemes which include only passive funds.

DSP Mutual Fund launches DSP S&P BSE Liquid Rate ETF

DSP Mutual Fund has launched DSP S&P BSE Liquid Rate ETF, an open-ended scheme replicating/ tracking the S&P BSE Liquid Rate Index.

1 lakh investors in 3 months! Zerodha Fund House grabs all eyeballs via passive route

Zerodha Fund House is a joint venture between Zerodha and fintech platform smallcase and is India’s only passive-only fund house providing direct plans to do away with transaction charges.

UTI Mutual Fund launches two passive debt funds; should you invest?

The minimum initial investment amount in both the schemes during NFO period is Rs 5,000 and in multiples of Re 1 thereafter. Subsequent minimum investment amount is Rs 1,000 and in multiples of Re 1 thereafter.

Bloodbath on D-Street! Sensex tanks 1,628 points. Top 5 factors behind today's market crash

The market capitalisation of all listed companies on BSE declined by Rs 4.53 lakh crore to Rs 370.42 lakh crore. The highest-weighted stock on the benchmark indices HDFC Bank closed 8.5% lower, its highest single-session percentage fall since March 23, 2020, after reporting stagnant margins for the second consecutive quarter. Barring the Nifty IT index, all sectoral indices closed in the red. Nifty IT closed 0.64% higher, boosted by a 3.5% jump in L&T Technology Services after the software services company retained its revenue growth forecast for fiscal 2024.

Zerodha Fund House launches India’s first Growth Liquid ETF

The Nifty 1D Rate Index has been developed to measure the returns generated by market participants lending in the overnight market. The index uses the overnight rate provided through the Tri-Party Repo Dealing System (TREPS) for the computation of index values.

As Nifty trades at make-or-break level, will RBI Das play the good or bad cop for D-Street?

The market correction had nothing to do with the monetary policy, and was rather a reflection of the weak global sentiment.

Load More