- News

- City News

- Hyderabad News

- Penny-wise, rupee-foolish: The costly realities for Hyderabad's lower-middle class

Trending

Penny-wise, rupee-foolish: The costly realities for Hyderabad's lower-middle class

In Hyderabad, the lower-middle class juggles financial burdens due to rising living costs and education expenses. While struggling with monthly expenditure challenges, they strive to maintain a comfortable lifestyle by engaging in various entertainment activities.

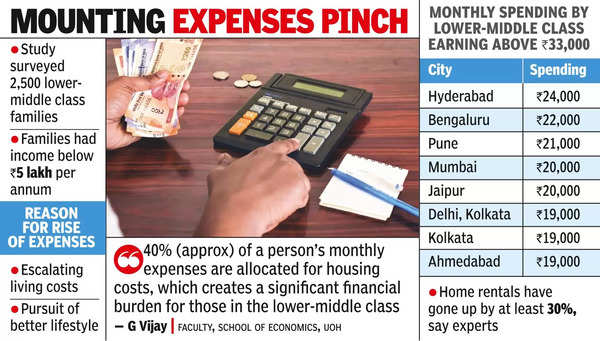

‘The Great Indian Wallet’ study by Home Credit, a consumer finance provider, shows that among 17 major cities in India, Hyderabad residents — who have a monthly income exceeding 33,000 on average — have the highest spending of 24,000 per month.

The study that surveyed 2,500 lower-middle class families, whose income is below 5 lakh per annum, showed that escalating living costs and the pursuit of a better lifestyle significantly contributed to a rise in monthly expenses.

Among costs that have seen a steep increase post-pandemic are home rentals, which have gone up by at least 30%, said experts. This has forced residents to allocate a substantial portion of their income towards housiLower-middle class spend highest among big citiesng.

“Approximately 40% of a person’s monthly expenses are allocated for housing costs, which creates a significant financial burden for those in the lower middle class,” said G Vijay, a faculty member at School of Economics, UoH, reacting to the study. He added that the current economic climate, characterised by rising inflation rates, has resulted in a disparity between the income levels of employees and their ability to cover living expenses.

Education is another area that has become increasingly expensive, the study said. “Costs have risen by a staggering 51%, leading to education expenses now consuming 15% of the wallet share. These numbers paint a stark picture of the challenges faced by a lower-middle class consumer,” the report added. It further said that balancing essential needs like food, lodging and education while striving for financial stability now requires careful planning and resourcefulness among this section.

Speaking to TOI, a professor from Centre for Economic and Social Studies (CESS), said, “In spite of increased educational expenses, parents are willing to invest in their children's education.”

For her part, a local N Kamal Tej, elaborated on her struggles in making ends meet. The techie, who lives in Begumpet, said, “For the past three years, I have been employed at a tech firm in Nanakramguda. My current salary is 35,000, but a significant portion of my income, 15,000 goes towards rent. While I can cover my essential monthly expenses, I find it challenging to set aside any savings. My monthly expenditure is nothing less than 30,000.”

However, despite the relatively modest income levels, Hyderabadis still strive to maintain a comfortable lifestyle by frequently dining out, enjoying movies in theatres, subscribing to multiple OTT platforms, engaging in more travel, the study showed.

End of Article

FOLLOW US ON SOCIAL MEDIA