- News

- World News

- Rest of World News

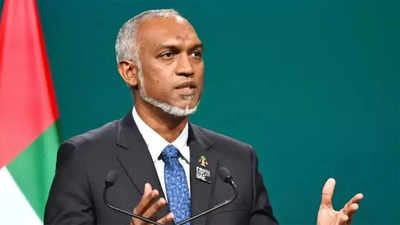

- Maldives faces high debt distress risk and economic vulnerability, warns World Bank

Trending

Maldives faces high debt distress risk and economic vulnerability, warns World Bank

The Maldives faces high debt distress risk and economic vulnerability, with public debt reaching 110% of GDP. The World Bank warns of annual debt servicing needs of $512 million in 2024 and 2025, increasing to $1.07 billion by 2026, emphasizing the critical need for fiscal reforms. The Maldives reported that the public debt grew by $90.8 million in the first quarter of 2024.

For years, the Maldives has been spending beyond its means, leading to high debt distress risk and financing challenges, according to the World Bank.

World Bank country director for the Maldives, Nepal, and Sri Lanka Faris H Hadad-Zervos issued a warning that the island nation's annual debt servicing needs will likely be $512 million for the current and following years, increasing to $1.07 billion in 2026.

Hadad-Zervos shared this information in a recent post on his official X account, stating that the Maldives faces significant vulnerability to economic shocks.

His warning follows a statement from the Maldives' Ministry of Finance, which highlighted that the public and publicly guaranteed debt now stands at nearly 110% of the country's GDP. Reliant on tourism, the Maldives struggled significantly due to Covid-19 lockdowns and only began recovering in 2023.

The Ministry reported that the public debt grew by $90.8 million in the first quarter of 2024, following a total debt of $8.09 billion at the end of 2023.

"For decades, Maldives has been spending beyond its means. Sharp spending rise and subsidies have widened the deficit, leading to a vulnerable fiscal situation and unsustainable debt," Hadad-Zervos warned in his post on X this Monday.

The World Bank official indicated that the Maldives would need to manage annual debt servicing of $512 million for 2024 and 2025, escalating to $1.07 billion by 2026. "Maldives faces high debt distress risk and financing challenges, making it vulnerable to shocks," he cautioned.

Highlighting the critical need for fiscal reforms, Hadad-Zervos suggested several measures. These included phasing out blanket subsidies, addressing weaknesses in State-Owned Enterprises (SOEs), improving the efficiency of healthcare spending, and streamlining the public investment programme.

He also shared a video message along with his post on X, stating, "Last year, the Maldives economy hit choppy waters," pointing out that the "nation's economic engine," its tourism industry, had slowed down due to reduced tourism receipts.

"The decision to halt subsidy reforms, coupled with continued high spending, has strained the nation's finances," Hadad-Zervos further warned, as reported by news portal Sun.mv on Wednesday.

The recently released report "Scaling Back and Rebuilding Buffers," part of the Maldives Development Update from the World Bank, echoed these concerns. It noted a noticeable slowdown in the country's tourism and other major industries.

Sun.mv, citing the Update, reported that although tourist arrivals have increased, the positive impact on the GDP is being tempered by lower spending per tourist and shorter stays.

The Washington-based lender emphasized the necessity for "fiscal consolidation in the country," anticipating impacts on real household incomes due to subsidy reforms and a decrease in government spending and investment.

It further projected that the Maldives' economy would grow by 4.7% this year, a reduction from previous estimates, reflecting a moderation in growth momentum, according to the World Bank.

World Bank country director for the Maldives, Nepal, and Sri Lanka Faris H Hadad-Zervos issued a warning that the island nation's annual debt servicing needs will likely be $512 million for the current and following years, increasing to $1.07 billion in 2026.

Hadad-Zervos shared this information in a recent post on his official X account, stating that the Maldives faces significant vulnerability to economic shocks.

His warning follows a statement from the Maldives' Ministry of Finance, which highlighted that the public and publicly guaranteed debt now stands at nearly 110% of the country's GDP. Reliant on tourism, the Maldives struggled significantly due to Covid-19 lockdowns and only began recovering in 2023.

According to the Ministry of Finance's Quarterly Debt Bulletin for Quarter 1, 2024, released on June 1, the public and publicly guaranteed (PPG) debt has reached $8.2 billion. This accounts for 110% of the Maldives' GDP.

The Ministry reported that the public debt grew by $90.8 million in the first quarter of 2024, following a total debt of $8.09 billion at the end of 2023.

"For decades, Maldives has been spending beyond its means. Sharp spending rise and subsidies have widened the deficit, leading to a vulnerable fiscal situation and unsustainable debt," Hadad-Zervos warned in his post on X this Monday.

The World Bank official indicated that the Maldives would need to manage annual debt servicing of $512 million for 2024 and 2025, escalating to $1.07 billion by 2026. "Maldives faces high debt distress risk and financing challenges, making it vulnerable to shocks," he cautioned.

Highlighting the critical need for fiscal reforms, Hadad-Zervos suggested several measures. These included phasing out blanket subsidies, addressing weaknesses in State-Owned Enterprises (SOEs), improving the efficiency of healthcare spending, and streamlining the public investment programme.

He also shared a video message along with his post on X, stating, "Last year, the Maldives economy hit choppy waters," pointing out that the "nation's economic engine," its tourism industry, had slowed down due to reduced tourism receipts.

"The decision to halt subsidy reforms, coupled with continued high spending, has strained the nation's finances," Hadad-Zervos further warned, as reported by news portal Sun.mv on Wednesday.

The recently released report "Scaling Back and Rebuilding Buffers," part of the Maldives Development Update from the World Bank, echoed these concerns. It noted a noticeable slowdown in the country's tourism and other major industries.

Sun.mv, citing the Update, reported that although tourist arrivals have increased, the positive impact on the GDP is being tempered by lower spending per tourist and shorter stays.

The Washington-based lender emphasized the necessity for "fiscal consolidation in the country," anticipating impacts on real household incomes due to subsidy reforms and a decrease in government spending and investment.

It further projected that the Maldives' economy would grow by 4.7% this year, a reduction from previous estimates, reflecting a moderation in growth momentum, according to the World Bank.

End of Article

FOLLOW US ON SOCIAL MEDIA