Professional Documents

Culture Documents

Accounting What The Numbers Mean 11th Edition Marshall Solutions Manual Download

Accounting What The Numbers Mean 11th Edition Marshall Solutions Manual Download

Uploaded by

Ralph PuentesOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting What The Numbers Mean 11th Edition Marshall Solutions Manual Download

Accounting What The Numbers Mean 11th Edition Marshall Solutions Manual Download

Uploaded by

Ralph PuentesCopyright:

Available Formats

Accounting What the

Numbers Mean 11th

Edition Marshall

Full download link at:

Test bank:

https://testbankpack.com/p/test-

bank-for-accounting-what-the-

numbers-mean-11th-edition-

marshall-mcmanus-viele-

1259535312-9781259535314/

Solution Manual:

https://testbankpack.com/p/solution-

manual-for-accounting-what-the-

numbers-mean-11th-edition-

marshall-mcmanus-viele-

1259535312-9781259535314/

CHAPTER

Cost Accounting

13 and Reporting

CHAPTER OUTLINE:

I. Cost Management

A. Value Chain Functions

II. Cost Accumulation and Assignment

A. Cost Objects

B. Cost Pools

C. Cost Assignment

© McGraw-Hill Education, 2017 13-1

Chapter 13 Cost Accounting and Reporting

III. Cost Classifications

A. Cost Relationship to Product or Activity

1. Direct cost

2. Indirect cost

B. Costs for Cost Accounting Purposes

1. Product costs

a. Raw materials

b. Direct labor

c. Manufacturing overhead

2. Period costs

IV. Cost Accounting Systems

A. Cost Accounting Systems - General

1. Inventory accounts

2. Cost of a unit of product

3. Cost flows illustrated

4. Statement of Cost of Goods Manufactured

5. Income Statement

B. Cost Accounting Systems - Job Order Costing, Process Costing, and Hybrid Costing

C. Cost Accounting Methods - Absorption Costing and Direct Costing

D. Cost Accounting Systems in Service Organizations

E. Activity-Based Costing

1. Cost distortion

2. Activity-based management

© McGraw-Hill Education, 2017 13-2

Instructor’s Manual / Solutions Manual

TEACHING/LEARNING OBJECTIVES:

Primary: To have the student understand:

1. The relationship of cost accounting to financial accounting and managerial accounting.

2. An awareness of the strategic role that cost management plays in the organization’s value

chain functions.

3. The difference between direct and indirect costs and the process for pooling and assigning

indirect costs to cost objects. Specifically, the application of manufacturing overhead to jobs.

4. The elements of product cost, and that product costs are accounted for differently than period

costs.

5. The process by which costs flow through a manufacturing environment.

Supporting: To have the student understand:

6. The management planning and control process.

7. The inventory accounts of the manufacturing firm and how the value of the inventory is

determined.

8. How the financial statements differ for the manufacturing firm and how the statement of

costs of goods manufactured measures the results of the production activity.

9. The role of activity-based costing in the analysis and assignment of costs.

TEACHING OBSERVATIONS:

1. Students will generally understand how product costs are determined if they first have a solid

understanding of the direct vs. indirect cost classifications. Use several examples of different

cost objects to illustrate that a certain cost may be direct to one cost object but could become

indirect as the cost object changes. These examples will help the student understand the

application of manufacturing overhead to jobs.

2. Use the flow of cost model to emphasize the cost accumulation process. If students can

picture how costs flow through raw material, work in process, finished goods, and cost of

goods sold, they will have a better appreciation for the reporting issues concerning inventory

valuation and the statement of cost of goods manufactured needed for income determination

for the manufacturing firm.

3. Spend time with Problems P13.20, P13.22, and/or Case C13.23 to help students understand

the elements of product cost, and the flow of costs in a manufacturing environment.

© McGraw-Hill Education, 2017 13-3

Chapter 13 Cost Accounting and Reporting

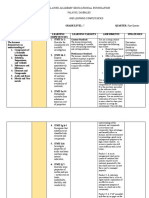

ASSIGNMENT OVERVIEW:

LEARNING DIFFICULTY & OTHER

NO. OBJECTIVES TIME ESTIMATE COMMENTS

M13.1 3,4 Easy, 3-5 min. Brief introduction to total manufacturing costs calculation.

M13.2 5,6 Easy, 5-7 min. Straight-forward predetermined overhead rate and unit cost

determination.

M13.3 6 Med., 7-10 min. Focus is on underapplied overhead and application relationships.

M13.4 7 Easy, 5-7 min. Introduction to statement of cost of goods manufactured.

M13.5 8 Easy, 5-7 min. Compares variable and absorption unit cost calculations.

M13.6 9 Med., 7-10 min. Introduces and explores activity-based costing concepts.

E13.7 2 Easy, 3-5 min. Introduces students to activities in the organizational value chain.

E13.8 2 Easy, 3-5 min. See 13.7.

E13.9 3,4 Easy, 3-5 min. Straight-forward.

E13.10 3,4 Easy, 3-5 min. Good in-class exercise.

E13.11 4 Easy, 3-5 min. Use as an opportunity to clarify cost terminology.

E13.12 4 Easy, 3-5 min. Good in-class exercise.

E13.13 5 Med., 7-10 min. Straight-forward product costing problem.

E13.14 5 Med., 7-10 min. See 13.13. Good in-class demonstration problem.

E13.15 5,6 Med., 5-8 min. Before working through the calculations, ask students: “Why

does manufacturing overhead need to be applied using a

predetermined annualized rate?”

E13.16 5,6 Med., 7-10 min. See 13.15. Good in-class demonstration problem.

E13.17 5,6 Med., 5-8 min. Use as a “warm up” problem before covering activity-based

costing. Emphasize the cost-benefit trade-off of developing

more precise overhead application methods.

E13.18 5,6 Med., 7-10 min. Good homework assignment.

E13.19 8 Med., 7-10 min. Students do not generally have trouble with the absorption

costing topic if they understand the distinction between product

and period costs. Emphasize the balance sheet / income

statement link as shown in Exhibit 13.9.

E13.20 8 Med., 7-10 min. See 13.19. Straight-forward problem.

P13.21 9 Med., 10-12 min. Emphasize the managerial benefits of using the ABC approach in

terms of cost planning and control.

P13.22 9 Med., 10-15 min. Group learning problem. An easy way to get students to think

about the advantages/disadvantages of using the ABC approach.

P13.23 8 Med., 7-10 min. See 13.19.

P13.24 8 Med., 7-10 min. See 13.19.

P13.25 4,5,7 Med.-Hard, Excel problem. Emphasize the flow of product costs through

20-30 min. the accounting system, as illustrated in Exhibit 13.12.

P13.26 4,5,7 Med.-Hard, See 13.25. Good homework assignment.

20-30 min.

P13.27 5,7 Med., 10-12 min. Good in-class demonstration problem.

P13.28 4,5,7 Med.- Hard, Excel problem. Good homework assignment.

20-30 min.

C13.29 4,5,7 Hard, 15-20 min. Group learning problem.

C13.30 4,5,7 Med.-Hard, Group learning problem. Can also be used as a self-study /

30-40 min. review problem.

C13.31 5,7 Med., 50-60 min. Internet case. Good group assignment using Intel's Annual

Reports at www.intel.com to reinforce the differences in

reporting inventories and calculating cost of goods sold for

manufacturing firms.

C13.32 9 Easy, 30-40 min. Internet case. Writing assignment that emphasizes how

companies implement and use ABC.

© McGraw-Hill Education, 2017 13-4

Instructor’s Manual / Solutions Manual

SOLUTIONS:

M13.1.

Total manufacturing cost = (Direct materials + Direct labor + Manufacturing overhead)

Direct materials …….…………………………………………. $ 18,000

Direct labor………………………………..…………………… 26,000

Manufacturing overhead:

Factory supplies………………………………………..……… $ 2,500

Plant depreciation……………………………………………… 6,200

Indirect labor………………………………………………...… 8,000

Utilities………………………………………………………… 7,500 24,200

Total manufacturing cost……………………………………… $68,200

M13.2.

Predetermined overhead application rate

= ($1,800,000 estimated total overhead cost / 720,000 estimated machine hours)

= $2.50 per machine hour

Total cost for 2,000,000 units produced:

Raw materials …………………………………………………………… $1,450,000

Direct labor ……………………………………………………………… 2,282,500

Overhead (715,000 machine hours * $2.50 predetermined rate) ……….. 1,787,500

Total manufacturing cost………………………………………………… $5,520,000

Cost per unit = ($5,520,000 total cost / 2,000,000 units produced)

= $2.76 per unit.

E13.3.

Actual overhead incurred …………………………………………..……… $88,000

Applied overhead (? direct labor hours * $4 per direct labor hour)…….… (?)

Underapplied overhead ………….………………………………………… $12,000

Direct labor hours = Overhead applied / Overhead rate per direct labor hour

Direct labor hours = $76,000 / $4

Direct labor hours = 19,000

© McGraw-Hill Education, 2017 13-5

Chapter 13 Cost Accounting and Reporting

M13.4.

ABC Company

Statement of Cost of Goods Manufactured

Raw materials:

Inventory, beginning ……………………………………… $ 8,000

Purchases ……………….………………………………… 36,000

Raw materials available for use…………………………… 44,000

Less: Inventory, ending….………………………………… (10,000)

Cost of raw materials used………………………………… $34,000

Direct labor cost incurred…………………………………… 36,000

Manufacturing overhead applied…...……………………..… 20,000

Total manufacturing costs, August ………….……………… $90,000

Add: Work-in-process, beginning...………….……………… 20,000

Less: Work-in-process, ending…..…………..……………… (22,000)

Cost of goods manufactured………..………..……………… $88,000

M13.5.

Variable Absorption

Costing Costing

Raw material ………...……………………………………… $ 7.00 $ 7.00

Direct labor………………………………………………….. 10.00 10.00

Variable overhead…………………………………………… 8.00 8.00

Fixed overhead ($240,000 / 30,000 units)…………………... 8.00

Unit cost…………………………………………………….. $25.00 $33.00

The difference is attributable to the treatment of fixed overhead costs. With

absorption costing, which is required for financial reporting purposes, fixed

manufacturing overhead costs are “absorbed” into the number of units produced,

unit-by-unit. With variable costing, only those costs that will change in total with

the number of units produced are included as part of the unit cost. With variable

costing, fixed overhead costs will reported as an expense in the period incurred

because they do not change as production activity changes – these fixed costs will

be incurred regardless.

© McGraw-Hill Education, 2017 13-6

Instructor’s Manual / Solutions Manual

M13.6.

Activity-based costing rates for each cost driver:

Activity costing rate = Budgeted cost / Budgeted activity

Machining rate = $250,000 / 10,000 hours

Machining rate = $25/machine hour

Direct labor rate = $280,000 / 20,000 hours

Direct labor rate = $14/direct labor hour

Inspecting rate = $32,000 / 4,000 hours

Inspecting rate = $8/inspection hour

The activity based costing approach is likely to provide better information for

manufacturing managers because overhead costs are applied based on the activities (i.e.,

cost drivers) that cause the incurrence of cost. In this example, one activity (direct labor

time) is currently used to assign overhead to all custom bicycles produced. Yet it’s clear

that much of the overhead cost, slightly more the 50% of the budgeted overhead, is

attributable to other activity – machining and inspection. Since it’s likely that each

custom bicycle produced will require differing amounts of machining, direct labor, and

inspection, depending on the unique specification of the custom designs, ABC will more

accurately associate manufacturing overhead assigned to each bicycle based on required

efforts of each required activity. This improved costing accuracy will lead to more

informed pricing decisions for custom bicycles.

E13.7.

Business Function Cost Item Answer

a. Research & Development 1. Purchase of raw materials __c__

b. Design 2. Advertising __d__

c. Production 3. Salary of research scientists __a__

d. Marketing 4. Shipping expenses __e__

e. Distribution 5. Reengineering of product assembly

process __b__

f. Customer Service 6. Replacement parts for warranty

repairs __f__

7. Manufacturing supplies __c__

8. Sales commissions __d__

9. Purchase of CAD (Computer Aided __b__

Design) software

10. Salary of website designer __d__

© McGraw-Hill Education, 2017 13-7

Chapter 13 Cost Accounting and Reporting

E13.8.

Business Function Cost Item Answer

a. Research & Development 1. Labor time to repair products under

warranty __f__

b. Design 2. TV commercial spots __d__

c. Production 3. Labor costs of filling customer

orders __e__

d. Marketing 4. Testing of competitor's product __a__

e. Distribution 5. Direct manufacturing labor costs __c__

f. Customer Service 6. Development of order tracking

system for the Internet __e__

7. Printing cost of new product

brochures __d__

8. Hours spent designing child-proof

bottles __b__

9. Training costs for representatives

to staff the customer call center __f__

10. Installation of robotics equipment

in manufacturing plant __c__

E13.9. Product

Direct Indirect Period Variable Fixed

Wages of assembly-line workers… x _____ _____ x _____

Depreciation-plant equipment … _____ x _____ _____ x

Glue and thread …………………. _____ x _____ x _____

Outbound shipping costs………… _____ _____ x x _____

Raw materials handling costs…… _____ x _____ x _____

Salary of public relations manager _____ _____ x _____ x

Production run setup costs ……… _____ x _____ x _____

Plant utilities ……………………. _____ x _____ x x

Electricity cost of retail stores…… _____ _____ x x x

Research and development

expenses ………………………… _____ _____ x x x

Note: The last three items are each likely to have a mixed cost behavior pattern.

© McGraw-Hill Education, 2017 13-8

Instructor’s Manual / Solutions Manual

E13.10. Product

Direct Indirect Period Variable Fixed

Raw materials ………………… x _____ _____ x _____

Staples used to secure packed

boxes of product ………………… _____ x _____ x _____

Plant janitors' wages ……………. _____ x _____ x x

Order processing clerks' wages … _____ _____ x x _____

Advertising expenses …………… _____ _____ x _____ x

Production workers' wages……… x _____ _____ x _____

Production supervisors' salaries… _____ x _____ _____ x

Sales force commissions………… _____ _____ x x _____

Maintenance supplies used……… _____ x _____ x _____

President's salary………………… _____ _____ x _____ x

Electricity cost for office _____ x x x x

building…………………………..

Real estate taxes for factory ……. _____ x _____ _____ x

Real estate taxes for office

building ………………………… _____ _____ x _____ x

Note: Janitors' wages and electricity probably have mixed cost behavior patterns.

Electricity and real estate taxes for administrative areas would be a period cost.

E13.11.

a. Raw material: cotton/ wool/ rayon used for jersey or material used for team emblems.

b. Direct labor: wages of production-line machine operator.

c. Variable, manufacturing overhead: plant utilities costs or indirect materials (i.e.,

thread).

d. Fixed, manufacturing overhead: depreciation of machinery or property taxes on plant.

e. Fixed, administrative expense: salaries of administrative officers.

f. Fixed, indirect selling expense: advertising costs.

g. Variable, direct selling expense: shipping costs.

E13.12.

a. Raw material: fabric, zipper, shoulder straps.

b. Direct labor: wages of sewing machine operator.

c. Variable, manufacturing overhead: electricity for sewing machine.

d. Fixed, manufacturing overhead: depreciation of sewing machine.

e. Fixed, administrative expense: president's salary.

f. Fixed, indirect selling expense: sales manager's salary.

g. Variable, direct selling expense: sales force commissions.

© McGraw-Hill Education, 2017 13-9

Chapter 13 Cost Accounting and Reporting

E13.13.

a. Predetermined overhead application rate

= ($408,750 estimated total overhead cost / 54,500 estimated direct labor hours)

= $7.50 per direct labor hour

b. Total cost for 750 coffee mugs produced:

Raw materials …………………………………………………………… $ 810

Direct labor (90 direct labor hours * $9.50 per hour) …………………… 855

Overhead (90 direct labor hours * $7.50 predetermined rate)…………… 675

Total manufacturing cost...………………………………………………. $ 2,340

Cost per coffee mug produced = ($2,340 total cost / 750 mugs)

= $3.12 per coffee mug

c. Cost of coffee mugs sold = (530 mugs * $3.12 per mug) = $1,653.60

Cost of coffee mugs in inventory = (220 mugs * $3.12 per mug) = $686.40

E13.14.

a. Predetermined overhead application rate

= ($359,520 estimated total overhead cost / 21,400 estimated machine hours)

= $16.80 per machine hour

b. Total cost for 3,900 hats produced:

Raw materials …………………………………………………………… $ 6,240

Direct labor ……………………………………………………………… 9,165

Overhead (780 machine hours * $16.80 predetermined rate) ………… 13,104

Total manufacturing cost………………………………………………… $28,509

Cost per hat produced = ($28,509 total cost / 3,900 hats produced)

= $7.31 per hat

c. Cost of hats in inventory = (1,050 hats * $7.31 per hat) = $7,675.50

Cost of hats sold = (2,850 hats sold * $7.31 per hat) = $20,833.50

© McGraw-Hill Education, 2017 13-10

Instructor’s Manual / Solutions Manual

E13.15.

a. 9,000 machine hours * $12.70 per machine hour = $114,300 budgeted overhead

b. Actual overhead incurred ………………………………………………… $121,650

Applied overhead (9,100 machine hours * $12.70 per machine hour) ……. (115,570)

Underapplied overhead ………………………………………………… $ 6,080

c. The overapplied or underapplied overhead for the year is normally transferred to cost of

goods sold in the income statement. Since most products made during the year are sold

during the same year, manufacturing overhead costs are assumed to relate primarily to

the products sold. However, if the over- or underapplied overhead is material in dollar

amount, then it may be allocated between work-in-process, finished goods, and cost of

goods sold, based on the respective overhead amount included in the year-end balances.

E13.16.

a. $56,520 overhead applied = (Direct labor hours used * $6.00 predetermined

manufacturing overhead application rate) = 9,420 direct labor hours

b. Actual overhead incurred $49,340

Overhead applied (56,520)

Overhead was overapplied by $ 7,180

c. 1) Actual costs were less than anticipated when the predetermined overhead

application rate was calculated, and/or 2) more hours were worked (and thus more

overhead was applied) than was anticipated.

d. At the end of the month, the overapplied overhead balance will be left in the

manufacturing overhead account because it will probably be offset by underapplied

overhead in a subsequent month. Note: The overapplied or underapplied overhead for

the year is normally transferred to cost of goods sold in the income statement. See

answer to E13.15 part c.

E13.17.

Total cost for 530 ties produced:

Raw materials …………………………………………………………… $1,950

Direct labor (75 direct labor hours)……………………………………… 840

Overhead applied based on raw materials ($1,950 * 140%) ……………. 2,730

Overhead applied based on direct labor hours (75 hours * $7.20) ……… 540

Total manufacturing cost………………………………………………… $6,060

Cost per tie produced = $6,060 / 530 units = $11.43 per unit (rounded)

© McGraw-Hill Education, 2017 13-11

Chapter 13 Cost Accounting and Reporting

E13.18.

a. Total cost for 4,200 toy flutes produced:

Raw materials …………………………………………………………… $490.00

Direct labor (21 direct labor hours)...……………………………………. 357.00

Overhead applied based on machine hours (36 hours * $5.60)...……….. 201.60

Overhead applied based on direct labor cost ($357 * 240%)……………. 856.80

Total manufacturing cost………………………………………………… $1,905.40

Cost per toy flute produced = $1,905.40 / 4,200 units

= $0.4537 per unit (rounded)

b. Ending inventory quantity = (4,200 quantity produced - 3,870 sold) = 330 units

Ending inventory value = (330 units * $0.4537 cost per unit) = $149.72

E13.19.

a. Absorption cost per sweater ……………………………………………… $11.60

Less: Fixed manufacturing overhead per sweater ($22,500 / 9,000)……… (2.50)

Variable cost per sweater ………………………………………………… $ 9.10

b. 1,600 sweaters * $2.50 = $4,000 more cost released to the income statement this month

under absorption costing than under variable costing. Thus, cost of goods sold under

variable costing will be $4,000 lower than under absorption.

c. Total cost = Fixed cost + (variable rate * activity)

= $22,500 + ($9.10 * number of sweaters)

E13.20.

a. Absorption cost per calculator …………………………………………… $10.25

Less: Fixed manufacturing overhead per calculator ($29,450 / 9,500)…… (3.10)

Variable cost per calculator ……………………………………………… $ 7.15

b. 750 calculators * $3.10 = $2,325 less cost released to the income statement this month

under absorption costing than under variable costing. Thus, operating income under

variable costing will be $2,325 lower than under absorption.

c. Total cost = Fixed cost + (variable rate * activity)

= $29,450 + ($7.15/calculator * number of calculators)

© McGraw-Hill Education, 2017 13-12

Instructor’s Manual / Solutions Manual

P13.21.

a. Total manufacturing cost = (Direct materials + Direct labor + Manufacturing overhead)

Direct materials ……………………………………………….. $3,500,000

Direct labor (160,000 hours * $20 per hour) ………………….. 3,200,000

Manufacturing overhead:

Materials handling ($1.50 per part * 275,000 parts used) ……. $ 412,500

Milling and grinding ($11.00 per machine hour * 95,000 hours)... 1,045,000

Assembly and inspection ($5.00 per labor hour * 160,000 hours). 800,000

Testing ($3.00 per unit * 50,000 units tested)………………… 150,000 2,407,500

Total manufacturing cost……………………………………… $9,107,500

Cost per unit produced and tested = $9,107,500 / 50,000 units = $182.15 per unit

b. The activity based costing approach is likely to provide better information for

manufacturing managers because overhead costs are applied based on the activities (i.e.,

cost drivers) that cause the incurrence of cost. Thus, management attention will be

directed to the critical activities that can be controlled to improve the firm’s operating

performance. ABC systems also produce more accurate product costing information,

which can lead to better decision-making.

P13.22.

a. Total manufacturing cost = (Direct materials + Direct labor + Manufacturing overhead)

Direct materials ……………….……………………………… $107,200

Direct labor (13,120 hours * $15 per hour)…………………… 196,800

Manufacturing overhead:

Materials handling ($0.20 per part * 70,400 parts used)……… $ 14,080

Cutting and lathe work ($1.40 per part * 70,400 parts used) … 98,560

Assembly and inspection ($20.00 per hour * 13,120 labor hours). 262,400 375,040

Total manufacturing cost……………………………………… $679,040

Cost per unit produced = $679,040 / 3,200 units = $212.20 per unit

b. Predetermined overhead application rate

= ($6,000,000 total budgeted overhead / 200,000 total budgeted direct labor hours)

= $30.00 per direct labor hour.

Based on a production level of 50,000 units, the total budgeted overhead cost was

$6,000,000 (sum of the budgeted amounts for each of the three cost drivers). Total

budgeted direct labor hours for the year were given as 200,000 (or divide $4,000,000 by

$20.00 per direct labor hour for assembly and inspection).

Manufacturing overhead applied

= ($30.00 per direct labor hour * 13,120 hours) = $393,600

© McGraw-Hill Education, 2017 13-13

Chapter 13 Cost Accounting and Reporting

P13.22. (continued)

Total manufacturing cost = (Direct materials + Direct labor + Manufacturing overhead)

= $107,200 + $196,800 + $393,600 = $697,600

Cost per unit produced = $697,600 / 3,200 units = $218.00 per unit

c. The activity based costing approach is likely to provide better information for

manufacturing managers because overhead costs are applied based on the activities that

cause the incurrence of each cost. Even in this simplified situation, the advantages of an

ABC system are easy to see. At 50,000 units of production, budgeted labor hours are

200,000. Thus, direct labor is expected to be 4 hours per unit produced. In the month of

July, the actual results were 4.1 labor hours per unit produced (13,120 / 3,200 units).

This direct labor inefficiency caused more overhead costs to be applied in part b than

were applied using the ABC approach in part a.

The results of part a make more sense, because the number of parts used during July

were less than budgeted. The budgeted number of parts per unit produced is 25(1), but

only 22(2) parts per unit were used during the month of July (ask students to verify these

parts-per-unit calculations). The results of the ABC approach in part a reflect this

efficiency because overhead costs for the parts-related activities were applied based on

the actual number of parts used during the month.

(1)

$250,000 / $0.20 = 1,250,000 parts / 50,000 units = 25 parts per unit budgeted

(2)

$70,400 / 3,200 units = 22 parts per unit actual

P13.23.

a. Variable manufacturing costs:

Raw materials ……………………………………………………………. $ 62,100

Direct labor ………………………………………………………………. 16,500

Variable manufacturing overhead………………………………………… 11,250

Total variable costs ……………………………………………………. $ 89,850

Fixed manufacturing overhead…………………………………………… 18,000

Total manufacturing costs……………………………………………… $107,850

Variable cost per rod = $89,850 / 15,000 = $5.99 each

Absorption cost per rod = $107,850 / 15,000 = $7.19 each

b. The fixed cost per rod is $7.19 - $5.99 = $1.20.

This can also be computed as: $18,000 / 15,000 = $1.20.

The total fixed cost associated with the 300 fishing rods in inventory is:

300 * $1.20 = $360.

This amount would be included in ending inventory under absorption costing, but

would be reported as an operating expense under variable costing. Thus, under

variable costing, operating income would be $360 less than under absorption costing.

© McGraw-Hill Education, 2017 13-14

Instructor’s Manual / Solutions Manual

P13.23. (continued)

c. Total cost = $18,000 + $5.99 per fishing rod produced.

The cost of making 200 more units = 200 * $5.99 = $1,198

P13.24.

a. Variable manufacturing costs:

Raw materials …………………………..……………………………… $275,200

Direct labor …………………………..………………………………… 454,400

Variable manufacturing overhead…….………………………………… 115,200

Total variable costs ……………..….………………………………… $844,800

Fixed manufacturing overhead…….….………………………………… 108,800

Total manufacturing costs……….….………………………………… $953,600

Variable cost per recorder = $844,800 / 32,000 = $26.40 each

Absorption cost per recorder = $953,600 / 32,000 = $29.80 each

b. The fixed cost per recorder is $29.80 - $26.40 = $3.40.

This can also be computed as: $108,800 / 32,000 = $3.40.

The total fixed cost associated with the 4,200 recorders in inventory is:

4,200 * $3.40 = $14,280.

This amount would be included in ending inventory under absorption costing, but would

be included as an operating expense under variable costing. Thus, under variable

costing, the cost of goods sold would be $14,280 higher than under absorption costing.

c. Total cost = $108,800 + $26.40 per digital voice recorder produced.

The cost of making 500 more recorders = 500 * $26.40 = $13,200

P13.25.

a. Raw materials ……………………………………………………………. $ 33,100

Direct labor ………………………………………………………………. 65,200

Manufacturing overhead ………………………………………………… 44,800

Cost of goods manufactured ……………………………………………… $143,100

Cost per unit = $143,100 / 5,300 = $27

b. Cost of goods sold = $27 * 4,800 = $129,600

c. The difference between cost of goods manufactured and cost of goods sold

is in the finished goods inventory account on the balance sheet. Since

more units were produced (5,300) than sold (4,800), the finished goods

account will increase by $13,500 ($27 per unit * 500 units), and cost of

goods sold will be $13,500 less than cost of goods manufactured.

© McGraw-Hill Education, 2017 13-15

Chapter 13 Cost Accounting and Reporting

P13.25. (continued)

d. MARYVILLE, INC.

Absorption Income Statement

For the month of August

Sales …………………………………………………………………… $244,800

Cost of goods sold……………………………………………………… (129,600)

Gross profit ……………………………………………………………. $115,200

Selling and administrative expenses …………………………………… (46,100)

Operating income ……………………………………………………… $ 69,100

Interest expense………………………………………………………… (9,100)

Income before taxes …………………………………………………… $ 60,000

Income tax expense ……………………………………………………. (18,000)

Net income …………………………………………………………….. $ 42,000

P13.26.

a. Raw materials …………………………………………………………... $ 61,464

Direct labor …………………………………………………………….. 37,752

Manufacturing overhead ………………………………………………. 32,760

Cost of goods manufactured ……………………………………………. $131,976

Cost per unit = $131,976 / 2,600 = $50.76

b. Cost of goods sold = $50.76 * 1,450 = $73,602

c. The difference between cost of goods manufactured and cost of goods sold is in the

finished goods inventory account on the balance sheet. Since more units were produced

(2,600) than sold (1,450), the finished goods account will increase by $58,374 ($50.76

per unit * 1,150 units), and cost of goods sold will be $58,374 less than cost of goods

manufactured.

d.

GRANDSLAM, INC.

Absorption Income Statement

For the month of March

Sales …………………………………………………………………… $138,040

Cost of goods sold……………………………………………………… (73,602)

Gross profit ………………………………..…………………………… $ 64,438

Selling and administrative expenses …………………………………… (45,015)

Operating income ……………………………………………………… $ 19,423

Interest expense………………………………………………………… (7,135)

Income before taxes …….……………………………………………… $ 12,288

Income tax expense ………………………….……….………………… (4,301)

Net income …………...………………………………………………… $ 7,987

© McGraw-Hill Education, 2017 13-16

Instructor’s Manual / Solutions Manual

P13.27.

a. Note: This problem does not require a formal statement of cost of goods manufactured;

the requirements can be solved using a "T" account approach.

Raw materials:

Inventory, Sept. 30 ………………………………………… $ 33,500

Purchases during October …………………………………. 123,900

Raw materials available for use …………………………… 157,400

Less: Inventory, Oct. 31…………………………………… (27,600)

Cost of raw materials used………………………………… $129,800

Direct labor cost incurred…………………………………… 312,200

Manufacturing overhead applied …………………………… 192,300

Total manufacturing costs, October ………………………… $634,300

Add: Work-in-process, Sept. 30 ……………………………. 71,300

Less: Work-in-process, Oct. 31 ……………………………. (64,800)

Cost of goods manufactured, October ……………………… $640,800

b. Finished goods, Sept. 30 …………………………………… $ 47,200

Cost of goods manufactured………………………………… 640,800

Cost of goods available for sale ……………………………. $688,000

Less: Finished goods, Oct. 31 ……………………………… (41,900)

Cost of goods sold …………………………………………. $646,100

P13.28.

a. BUCK & COMPANY

Statement of Cost of Goods Manufactured

For the month of August

Raw materials:

Inventory, August 1 ……………………………………… $ 19,600

Purchases during August ………………………………… 44,100

Raw materials available for use…………………………… 63,700

Less: Inventory, August 31………………………………… (17,900)

Cost of raw materials used………………………………… $ 45,800

Direct labor cost incurred…………………………………… 57,500

Manufacturing overhead applied (1)...……………………..… 92,000

Total manufacturing costs, August ………….……………… $195,300

Add: Work-in-process, August 1…………….……………… 53,200

Less: Work-in-process, August 31 …………..……………… (57,400)

Cost of goods manufactured, August ………..……………… $191,100

Cost per unit = $191,100 / 4,200 = $45.50

(1)

$57,500 / $12.50 = 4,600 DL hours;

MOH applied = $20.00 * 4,600 DL hours = $92,000

© McGraw-Hill Education, 2017 13-17

Chapter 13 Cost Accounting and Reporting

P13.28. (continued)

b. Finished goods, August 1 ………………………………………………… $ 41,800

Cost of goods manufactured ……………………………………………… 191,100

Cost of goods available for sale…………………………………………… $ 232,900

Less: Finished goods, August 31……..…………………………………… (32,700)

Cost of goods sold………………………………………………………… $200,200

c. The difference between cost of goods manufactured and cost of goods sold is in the

finished goods inventory account on the balance sheet. Since fewer units were

produced (4,200) than sold (4,400), the finished goods account will decrease by $9,100

($45.50 per unit * 200 units), and cost of goods sold will be $9,100 more than cost of

goods manufactured.

d. BUCK & COMPANY

Absorption Income Statement

For the month of August

Sales ……………………………………………………………………… $ 272,800

Cost of goods sold………………………………………………………… (200,200)

Gross profit ……………………………..………………………………… $ 72,600

Selling and administrative expenses ……………………………………… (46,500)

Operating income ………………………………………………………… $ 26,100

Interest expense…………………………………………………………… (6,400)

Income before taxes ……………………….……………………………… $ 19,700

Income tax expense ……………………..………………………………… (6,698)

Net income………………………………………………………………… $ 13,002

C13.29.

Answer: Firm A Firm B Firm C

Beginning raw materials inventory ……….. $ 17,000 $ 23,000 $ 42,000

+ Purchases of raw materials during the year.. 85,000 96,000 226,000

= Raw materials available for use…………… 102,000 119,000 268,000

- Ending raw materials inventory…………… 12,000 18,000 51,000

= Cost of raw materials used………………… 90,000 101,000 217,000

+ Direct labor costs incurred………………… 130,000 75,000 318,000

+ Variable manufacturing overhead applied… 50,000 34,000 72,000

+ Fixed manufacturing overhead applied …… 100,000 60,000 90,000

= Total manufacturing costs incurred ………. 370,000 270,000 697,000

+ Beginning work in process………………… 15,000 7,000 19,000

- Ending work in process …………………… 25,000 11,000 16,000

= Cost of goods manufactured ……………… $360,000 $266,000 $700,000

© McGraw-Hill Education, 2017 13-18

Instructor’s Manual / Solutions Manual

C13.29. (continued) Firm A Firm B Firm C

Sales $480,000 $410,000 $911,000

Less: Cost of goods sold:

Beginning finished goods inventory…………. 30,000 37,000 61,000

+ Cost of goods manufactured…………………. 360,000 266,000 700,000

= Cost of goods available for sale……………… 390,000 303,000 761,000

- Ending finished goods inventory……………. 50,000 30,000 48,000

= Cost of goods sold…………………………… 340,000 273,000 713,000

= Gross profit………………………………….. 140,000 137,000 198,000

- Selling, general, and administrative expenses. 68,000 105,000 109,000

= Income from operations……………………… $ 72,000 $ 32,000 $ 89,000

Calculations:

Firm A

1) $90,000 + $12,000 = $102,000

2) $102,000 - $17,000 = $85,000

3) $370,000 - $90,000 - $130,000 - $100,000 = $50,000

4) $370,000 + $15,000 - $25,000 = $360,000

5) $30,000 + $360,000 = $390,000

6) $390,000 - $50,000 = $340,000

7) $140,000 - $68,000 = $72,000

8) $340,000 + $140,000 = $480,000

Firm B

1) $119,000 - $96,000 = $23,000

2) $119,000 - $101,000 = $18,000

3) $266,000 + 11,000 - $7,000 = $270,000

4) $270,000 - $101,000 - $34,000 - $60,000 = $75,000

5) $303,000 - $266,000 = $37,000

6) $303,000 - $273,000 = $30,000

7) $410,000 - $273,000 = $137,000

8) $137,000 - $32,000 = $105,000

Firm C

1) $42,000 + $226,000 = $268,000

2) $268,000 - $51,000 = $217,000

3) $761,000 - $61,000 = $700,000

4) $700,000 + 16,000 - $19,000 = $697,000

5) $697,000 - $217,000 - $318,000 - $72,000 = $90,000

6) $761,000 - $48,000 = $713,000

7) $198,000 - $89,000 = $109,000

8) $198,000 + $713,000 = $911,000

© McGraw-Hill Education, 2017 13-19

Chapter 13 Cost Accounting and Reporting

C13.30.

a. Predetermined fixed manufacturing overhead application rate

= $312,000 / 96,000 machine hours = $3.25 per machine hour

The predetermined overhead rate will be used to apply fixed manufacturing overhead

to each unit produced during the year at the rate of $3.25 for each machine hour

incurred.

b. Graph of fixed manufacturing overhead relationships:

$'s

Fixed overhead assigned to production

at the rate of $3.25 per machine hour

$312,000 Expected fixed overhead costs

96,000 Machine Hours

The graph illustrates that fixed overhead costs are treated differently for planning

and control purposes than for product costing purposes. For planning purposes, fixed

costs are expected to total $312,000, but for product costing purposes fixed costs are

unitized over some level of activity in order to allow each unit produced to absorb a

share of the total fixed costs. Note that only if Custom Granite generates exactly 96,000

machine hours will the units produced exactly absorb total fixed costs of $312,000. Also

notice that overhead costs are expected to be incurred even if zero machine hours are

used (i.e., no production).

c. Graph of variable manufacturing overhead relationships:

$'s

Variable overhead expected and assigned

to production at the rate of $6.00 per

direct labor hour

Direct Labor Hours

The graph illustrates that variable overhead costs are treated similarly for planning

and control purposes and for product costing purposes. Variable overhead costs are

expected to be incurred at the rate of $6.00 per direct labor hour and they will also be

assigned to each unit produced at the rate of $6.00 per direct labor hour.

© McGraw-Hill Education, 2017 13-20

Instructor’s Manual / Solutions Manual

C13.30. (continued)

d. Raw Materials Inventory

BI 39,000

Purchases 240,000 ? Raw materials used during the year

EI 27,000

Solving for the missing amount, raw materials used = $252,000

Raw material purchases and usage will differ by the amount of change in the inventory

of raw material. Materials purchased in addition to any beginning inventory of raw

material will represent the raw material available for use. The amount of raw materials

used is determined by subtracting any ending inventory of raw material from the raw

material available for use.

e. Direct labor hours worked during the year

= ($480,000 direct labor costs incurred / $16.00 per hour direct labor rate)

= 30,000 direct labor hours

Variable manufacturing overhead applied to work in process

= (30,000 direct labor hours * $6 per hour) = $180,000

Yes, the applied amount of variable overhead for the year could differ from the actual

amount incurred for several reasons. The cost category of variable overhead is

comprised of many individual cost items such as indirect materials, some indirect labor,

electricity, shop supplies, etc. The variable overhead rate of $6.00 per direct labor hour

was based on an expectation of using a certain amount of each variable overhead item

per direct labor hour and paying a certain amount to acquire each variable overhead item.

It is possible that more or less of any variable overhead item could be used during the

year compared to the quantity planned and it is also possible that Custom Granite could

have paid more or less to acquire any particular variable overhead item. It is also likely

that the items comprising variable overhead are not as directly associated with the use of

direct labor as the overhead rate implies.

f. Fixed manufacturing overhead applied to work in process

= (88,000 machine hours * $3.25 per hour) = $286,000

Yes, the amount of fixed overhead applied to work in process during the year could be

different from the amount actually incurred for two reasons. The cost category of fixed

overhead is comprised of many individual cost items such as supervisor salaries,

depreciation, property taxes, maintenance, etc. It is possible that Custom Granite could

have paid more or less to acquire any particular fixed overhead item during the year. In

addition, Custom Granite planned to spread fixed overhead to the units produced based

on working 96,000 machine hours, and if the company incurs more or less than 96,000

machines hours, too much or too little fixed overhead will be applied to work in process.

© McGraw-Hill Education, 2017 13-21

Chapter 13 Cost Accounting and Reporting

C13.30. (continued)

g. Analysis of the Work in Process Inventory account:

Beginning balance ……………………………………………………… $ 33,000

Add: Raw materials used ………………………..……………………… 252,000

Direct labor ……………………………..………………………… 480,000

Fixed manufacturing overhead applied….………………………… 286,000

Variable manufacturing overhead applied………………………… 180,000

Total manufacturing costs ………………….…………………………… 1,231,000

Less: Cost of goods manufactured ……………………………………… ( ? )

Ending balance ………………………..………………………………… $ 51,500

Solving for the missing amount, cost of goods manufactured = $1,179,500

h. Analysis of the Finished Goods Inventory account:

Beginning balance $ 104,000

Add: Cost of goods manufactured 1,179,500

Less: Cost of goods sold ( ? )

Ending balance $ 122,000

Solving for the missing amount, cost of goods sold = $1,161,500

The cost of goods manufactured and not sold is represented by the

ending balance of the finished goods inventory = $122,000

"T" accounts for requirements (g) and (h):

Work in Process Inventory Finished Goods Inventory

BI 33,000 BI 104,000

Raw Material Used 252,000 ? 1,179,500 ?

Direct Labor 480,000 Cost of Goods Manufactured Cost of Goods Sold

Variable OH Applied 180,000

Fixed OH Applied 286,000

EI 122,000

EI 51,500

i. Observing the graph in requirement (b) illustrates that when Custom Granite generates

less than 96,000 machine hours, it will not apply the $312,000 amount of expected fixed

overhead for the year. Conversely, if Custom Granite generates more that 96,000

machine hours it will apply more than the $312,000 expected fixed overhead for the

year. By generating 8,000 less machine hours than planned, Custom Granite

underapplied fixed overhead costs in the amount of (8,000 MH x $3.25/MH) $26,000 to

the units produced. Therefore, work in process and finished goods inventories would be

understated on the balance sheet and cost of goods sold would be understated on the

income statement.

© McGraw-Hill Education, 2017 13-22

Instructor’s Manual / Solutions Manual

C13.31.

For requirements a and b, the following information is used from the 2014, 2013, and

2012 annual reports for Campbell Soup Company (amounts are in millions). The

student will need to recognize the relationship of the inventory amounts for work in

process (which does not happen to exist for Campbell) and finished goods and think

backwards through the flow of costs model, beginning with cost of goods sold, to arrive

at the answer. In addition the student will need to recognize that the ending inventory in

one year becomes the beginning inventory in the next year.

2014 2013 2012 2011

Raw Material Inventory 399 364 277 261

Work in Process Inventory 0 0 0 0

Finished Goods Inventory 617 561 437 506

Total Inventory 1,016 925 714 767

Cost of Goods Sold 5,370 5,140 4,365

a. Analysis of the Finished Goods Inventory account (working backwards):

2014 2013 2012

Beginning balance 561 437 506

Add: Cost of goods manufactured ? ? ?

Less: Cost of goods sold 5,370 5,140 4,365

Ending balance 617 561 437

Solving for the missing amount, 2014 cost of goods manufactured = $5,426

Solving for the missing amount, 2013 cost of goods manufactured = $5,264

Solving for the missing amount, 2012 cost of goods manufactured = $4,296

b. Analysis of the Work in Process Inventory account (working backwards):

2014 2013 2012

Beginning balance 0 0 0

Add: Cost of raw material + direct

labor + manufacturing overhead ? ? ?

Less: Cost of goods manufactured 5,426 5,264 5,296

Ending balance 0 0 0

Solving for the missing amount, 2014 total manufacturing cost = $5,426

Solving for the missing amount, 2013 total manufacturing cost = $5,264

Solving for the missing amount, 2012 total manufacturing cost = $4,296

Note: Campbell carries no WIP inventory and therefore, Total Manufacturing cost will

always equal Cost of Goods Manufactured. Nevertheless, the solution model is

illustrated here to emphasize the cost flow relationships.

© McGraw-Hill Education, 2017 13-23

Chapter 13 Cost Accounting and Reporting

C13.31. (continued)

c. The 2014 management discussion and analysis of financial condition and results of

operations provides the following ratios for gross profit (Net Sales – Cost of products

sold) a percentage of net revenue for the years 2014, 2013, and 2012. Cost of sales can

therefore be calculated as:

2014 2013 2012

Net revenue 100.0% 100.0% 100.0%

Cost of sales 64.9% 63.8% 60.8%

Gross profit 35.1% 36.2% 39.2%

Overall trend: The overall trend for the three year period of review shows ratios for cost

of sales has increased and related gross profit has decreased. It is interesting to note that

while Campbell described a 3% decrease in the gross profit ratio for 2013 compared to

2012, the amount of gross profit actually increased by $102 million in 2013. Had

Campbell been able to maintain the 39.2% gross profit ratio in 2013 that it achieved in

2012, based on 2013 sales of 8,052 million, the 2013 amount of gross profit would have

increased by $343 million. A 3% decline in the gross profit ratio may not appear on the

surface as a significant decline, but in this case it amounted to a decline gross profit of

$241 million. Management attributes the three year decline in the gross profit ratio to

cost inflation of supply chain costs and other factors, a higher level of promotional

spending, and the impact of acquisitions.

d. Overall trend: The swing in inventory levels over the three-year period is trending up

where both raw material and finished goods inventories have increased rather

significantly. Calculating the three-year inventory turnover trend indicates improvement

in 2013 but a clear decline in 2014, and calculating the day's sales in inventory for the

three-year period reinforces the concerning upward trend in inventory dynamics for

2014, 2013 and 2012. Calculations are as follows:

2014 2013 2012 2011

Total Inventory (above) $ 1,016 $ 925 $ 714 $ 767

Average Inventory 970.5 819.5 740.5

(BI + EI) / 2

Cost of Goods Sold (above) $ 5,370 $ 5,140 $ 4,365

Inventory Turnover 5.53 times 6.27 times 5.89 times

CGS / Avg. Inv.

Average Day's CGS $ 14.71 $ 14.08 $ 11.96

CGS / 365

Days Sales in Inventory 69.07 days 65.69 days 59.70 days

Ending Inv. / Avg. day's CGS

© McGraw-Hill Education, 2017 13-24

Instructor’s Manual / Solutions Manual

C13-32.

Note to instructor: The purpose of the case is to make students aware of the

practical applications of activity-based costing by having them read, summarize,

compare, and communicate the results of their findings. SAS presents information

about their software solution and testimonials from companies in the several

industries who have successfully implemented activity-based costing.

This case also serves as an excellent classroom discussion activity that allows

students to share their findings and reinforce the pervasive application of activity-

based costing.

The following screen captures, as of May 2015, identify the source of information

for required activities in parts a and b of this case.

a. Activity-Based Management Fact Sheet:

© McGraw-Hill Education, 2017 13-25

Chapter 13 Cost Accounting and Reporting

C13.32. (continued)

b. Activity-Based Management Success Stories:

© McGraw-Hill Education, 2017 13-26

Instructor’s Manual / Solutions Manual

TAKE-HOME QUIZ: CHAPTER 13 NAME______________________

1. Gears, Inc., manufactures a single product. During March, 6,700 units of product were

manufactured, and 6,350 units of the product were sold. There were no beginning

inventories. During March, the following costs were incurred:

Raw Materials $ 76,900

Direct Labor 132,600

Manufacturing Overhead 64,800

Selling Expenses 46,700

Administrative Expenses 19,300

Interest Expense 9,300

a. Calculate the total cost of goods manufactured during March, and the average cost of a

single unit of the product.

b. Calculate the cost of goods sold during March.

c. Calculate the ending finished goods inventory for March.

d. Where in the financial statements will the difference between the total cost of goods

manufactured and cost of goods sold be classified?

© McGraw-Hill Education, 2017 13-27

Chapter 13 Cost Accounting and Reporting

TAKE-HOME QUIZ KEY: CHAPTER 13

1. a. Total manufacturing cost = (Direct materials + Direct labor + Manufacturing

overhead)

Direct materials $ 76,900

……………………………………………………………

Direct 132,600

labor…………………………………………………………………

Manufacturing 64,800

overhead……………………………………………………

Total manufacturing cost $274,300

#…………………………………………………

# Since there was no information about the Work in Process Inventory account, it can

be assumed that there was no change in the balance of this account. Thus, the cost of

goods manufactured is equal to the total manufacturing cost incurred during March.

Cost per unit produced = $274,300 / 6,700 units = $40.94 per unit (rounded)

b. (6,350 units sold @ $ 40.94 each) = $259,969

c. Units produced 6,700

Less units sold 6,350

Ending inventory 350 @ $ 40.94 each = $14,329 (rounded)

d. The difference between cost of goods manufactured and cost of goods sold will be in

the Finished Goods Inventory account on the balance sheet. Since more units were

produced (6,700) than sold (6,350), the Finished Goods account increased by $14,329

($40.94 per unit * 350 units), and cost of goods sold was $14,329 less than cost of

goods manufactured.

© McGraw-Hill Education, 2017 13-28

You might also like

- Essentials of Investments 11th Edition Bodie Solutions ManualDocument7 pagesEssentials of Investments 11th Edition Bodie Solutions ManualDavidWilliamsxwdgs94% (18)

- Ethics and The Conduct of Business 8th Edition Boatright Test BankDocument25 pagesEthics and The Conduct of Business 8th Edition Boatright Test BankEricFuentesfxgir100% (15)

- SM-Gehl RT105 & Mustang 1050RT Compact Track Loaders Service Repair Manual 50950457Document353 pagesSM-Gehl RT105 & Mustang 1050RT Compact Track Loaders Service Repair Manual 50950457tonyNo ratings yet

- Accounting What The Numbers Mean 11th Edition Marshall Test Bank DownloadDocument24 pagesAccounting What The Numbers Mean 11th Edition Marshall Test Bank DownloadRalph Puentes96% (25)

- Early Childhood Experiences in Language Arts Early Literacy 11th Edition Machado Test BankDocument18 pagesEarly Childhood Experiences in Language Arts Early Literacy 11th Edition Machado Test Bankmichelehamiltontozxjeqbkn94% (16)

- Fundamentals of Corporate Finance 8th Edition Brealey Solutions ManualDocument6 pagesFundamentals of Corporate Finance 8th Edition Brealey Solutions ManualEmilyJohnsonfnpgb100% (10)

- Fundamentals of Information Systems 9th Edition Stair Test BankDocument15 pagesFundamentals of Information Systems 9th Edition Stair Test BankIsaiahHahnaszxk100% (14)

- Fundamentals of Corporate Finance 7th Edition Brealey Solutions ManualDocument6 pagesFundamentals of Corporate Finance 7th Edition Brealey Solutions ManualEmilyJohnsonfnpgb100% (13)

- Foundations of Marketing 7th Edition Pride Solutions ManualDocument20 pagesFoundations of Marketing 7th Edition Pride Solutions ManualDennisLongonjqi100% (11)

- Marketing Strategy A Decision-Focused Approach 8th Edition Walker Test Bank DownloadDocument8 pagesMarketing Strategy A Decision-Focused Approach 8th Edition Walker Test Bank DownloadDinorah Strack100% (18)

- Contemporary Business Mathematics For Colleges 17th Edition Deitz Test Bank DownloadDocument16 pagesContemporary Business Mathematics For Colleges 17th Edition Deitz Test Bank DownloadKathryn Mackenzie100% (24)

- Corporate Finance 10th Edition Ross Test Bank DownloadDocument47 pagesCorporate Finance 10th Edition Ross Test Bank DownloadJames Netzer100% (22)

- Biological Science 6th Edition Freeman Solutions Manual DownloadDocument16 pagesBiological Science 6th Edition Freeman Solutions Manual DownloadAlyce Vargas100% (24)

- Cerebral Palsy PAC Centered StrategiesDocument192 pagesCerebral Palsy PAC Centered Strategieswahyuniza100% (2)

- Accounting What The Numbers Mean 11th Edition Marshall Solutions Manual 1Document36 pagesAccounting What The Numbers Mean 11th Edition Marshall Solutions Manual 1amandawilkinsijckmdtxez100% (37)

- Foundations of Macroeconomics 8th Edition Bade Solutions ManualDocument13 pagesFoundations of Macroeconomics 8th Edition Bade Solutions ManualDennisLongonjqi100% (15)

- Engineering Design Process 3rd Edition Haik Solutions ManualDocument40 pagesEngineering Design Process 3rd Edition Haik Solutions Manualmatthewnolanbcoxswkfqe100% (10)

- Payroll Accounting 2015 1st Edition Landin Solutions Manual DownloadDocument42 pagesPayroll Accounting 2015 1st Edition Landin Solutions Manual DownloadTommie Clemens100% (21)

- Fundamental Financial Accounting Concepts 9th Edition Edmonds Solutions Manual DownloadDocument26 pagesFundamental Financial Accounting Concepts 9th Edition Edmonds Solutions Manual DownloadKeith Meacham100% (25)

- Financial Accounting 10th Edition Harrison Solutions Manual DownloadDocument79 pagesFinancial Accounting 10th Edition Harrison Solutions Manual DownloadSandra Andersen100% (29)

- College Physics 1st Edition Freedman Solutions Manual DownloadDocument47 pagesCollege Physics 1st Edition Freedman Solutions Manual DownloadDonna Smith100% (23)

- Weather Report - 1977 - Heavy Weather PDFDocument8 pagesWeather Report - 1977 - Heavy Weather PDFMaple NeckNo ratings yet

- Caselets in Probability and Probability DistributionsDocument2 pagesCaselets in Probability and Probability Distributionsnishu63No ratings yet

- CS Ch15 Bee StingDocument3 pagesCS Ch15 Bee StingCra_KenNo ratings yet

- Step by Step Apparel ProductionDocument6 pagesStep by Step Apparel Productionarivaazhi100% (1)

- Chap 005Document40 pagesChap 005Erica JurkowskiNo ratings yet

- Focus On Personal Finance 5th Edition Kapoor Solutions ManualDocument23 pagesFocus On Personal Finance 5th Edition Kapoor Solutions ManualDeanPetersrpmik100% (16)

- Computer Accounting With Sage 50 Complete Accounting 2013 17th Edition Carol Yacht Solutions Manual DownloadDocument14 pagesComputer Accounting With Sage 50 Complete Accounting 2013 17th Edition Carol Yacht Solutions Manual DownloadWanda Webb100% (23)

- Fundamental Managerial Accounting Concepts 9th Edition Edmonds Solutions ManualDocument35 pagesFundamental Managerial Accounting Concepts 9th Edition Edmonds Solutions ManualDrMichelleHutchinsonegniq100% (15)

- Contemporary Business Law 8th Edition Cheeseman Test Bank DownloadDocument24 pagesContemporary Business Law 8th Edition Cheeseman Test Bank DownloadMarcos Roberson100% (18)

- Criminology A Canadian Perspective 7th Edition Linden Test BankDocument5 pagesCriminology A Canadian Perspective 7th Edition Linden Test BankCindyCurryqofjd100% (11)

- Economics 2nd Edition Karlan Test Bank DownloadDocument96 pagesEconomics 2nd Edition Karlan Test Bank DownloadFrederic Harper100% (24)

- Cengage Advantage Books Foundations of The Legal Environment of Business 3rd Edition Jennings Test Bank DownloadDocument28 pagesCengage Advantage Books Foundations of The Legal Environment of Business 3rd Edition Jennings Test Bank DownloadNilsa Lin100% (23)

- Foundations of Marketing 5th Edition Pride Test BankDocument37 pagesFoundations of Marketing 5th Edition Pride Test BankDennisLongonjqi100% (12)

- Corporate Finance 11th Edition Ross Test Bank DownloadDocument70 pagesCorporate Finance 11th Edition Ross Test Bank DownloadJames Netzer100% (27)

- Fundamentals of Physical Geography 2nd Edition Petersen Test Bank DownloadDocument13 pagesFundamentals of Physical Geography 2nd Edition Petersen Test Bank DownloadWalter Smith100% (23)

- Fundamentals of Management 10th Edition Robbins Test Bank DownloadDocument48 pagesFundamentals of Management 10th Edition Robbins Test Bank DownloadTawanda Medved100% (23)

- Psychology From Inquiry To Understanding Canadian 3rd Edition Lilienfeld Test Bank DownloadDocument74 pagesPsychology From Inquiry To Understanding Canadian 3rd Edition Lilienfeld Test Bank DownloadRoger Juelfs100% (21)

- Economics 2nd Edition Karlan Solutions Manual DownloadDocument15 pagesEconomics 2nd Edition Karlan Solutions Manual DownloadFrederic Harper100% (25)

- Biological Science Canadian 2nd Edition Freeman Test Bank DownloadDocument13 pagesBiological Science Canadian 2nd Edition Freeman Test Bank DownloadAlyce Vargas100% (22)

- Fundamentals of Investments 3rd Edition Alexander Test BankDocument10 pagesFundamentals of Investments 3rd Edition Alexander Test BankIsaiahHahnaszxk100% (12)

- Global Business Today 9th Edition Hill Solutions Manual DownloadDocument21 pagesGlobal Business Today 9th Edition Hill Solutions Manual DownloadMichelle Thayer100% (21)

- Companii ConstructiiDocument36 pagesCompanii ConstructiiGrigore OnofreiNo ratings yet

- A+ Guide To Hardware 9th Edition Andrews Test Bank DownloadDocument13 pagesA+ Guide To Hardware 9th Edition Andrews Test Bank DownloadJohn Bird100% (28)

- Becoming A Multiculturally Competent Counselor 1st Edition Duan Test Bank DownloadDocument7 pagesBecoming A Multiculturally Competent Counselor 1st Edition Duan Test Bank DownloadLarry Niece100% (20)

- Test Bank For 3 2 1 Code It 2020 8th Edition Michelle Green Full DownloadDocument24 pagesTest Bank For 3 2 1 Code It 2020 8th Edition Michelle Green Full Downloadrobertabergmjnxqrasct100% (53)

- Economics 2nd Edition Hubbard Solutions Manual DownloadDocument42 pagesEconomics 2nd Edition Hubbard Solutions Manual DownloadSharon Sharp100% (22)

- Economics 2nd Edition Hubbard Test Bank DownloadDocument45 pagesEconomics 2nd Edition Hubbard Test Bank DownloadSharon Sharp100% (15)

- Foundations of Education 12th Edition Ornstein Test BankDocument10 pagesFoundations of Education 12th Edition Ornstein Test BankDebraThompsonpozma100% (13)

- Health Insurance Today A Practical Approach 5th Edition Beik Test BankDocument8 pagesHealth Insurance Today A Practical Approach 5th Edition Beik Test BankJosephJohnsonfmixo100% (11)

- OHAUS Navigator BalanceDocument49 pagesOHAUS Navigator BalanceHanka Kubik100% (2)

- Purchasing and Supply Chain Management 5th Edition Monczka Solutions ManualDocument57 pagesPurchasing and Supply Chain Management 5th Edition Monczka Solutions Manualsamuelwilliamsswokymnjga100% (15)

- Contemporary Business Mathematics Canadian 11th Edition Hummelbrunner Test Bank DownloadDocument27 pagesContemporary Business Mathematics Canadian 11th Edition Hummelbrunner Test Bank DownloadKathryn Mackenzie100% (28)

- Crime Victims An Introduction To Victimology 8th Edition Andrew Karmen Test Bank DownloadDocument10 pagesCrime Victims An Introduction To Victimology 8th Edition Andrew Karmen Test Bank DownloadEsther Johnson100% (24)

- Fundamentals of Cost Accounting 3rd Edition Lanen Solutions ManualDocument57 pagesFundamentals of Cost Accounting 3rd Edition Lanen Solutions ManualEricJacksoneonmd100% (12)

- Marketing Management 3rd Edition Marshall Test BankDocument45 pagesMarketing Management 3rd Edition Marshall Test Bankericarobbinsacdspnwemk100% (11)

- Group 5 - Case 1Document7 pagesGroup 5 - Case 1Nirmal Kumar RoyNo ratings yet

- Parkin 8e TIF Ch13Document41 pagesParkin 8e TIF Ch13Akram SaiyedNo ratings yet

- Strategic Management 3rd Edition Rothaermel Test Bank DownloadDocument120 pagesStrategic Management 3rd Edition Rothaermel Test Bank DownloadFrancine Lalinde100% (23)

- Principles of Economics 6th Edition Frank Solutions ManualDocument9 pagesPrinciples of Economics 6th Edition Frank Solutions Manualericafergusonbgjmfzidsx100% (12)

- Management of A Sales Force 12th Edition Spiro Test BankDocument34 pagesManagement of A Sales Force 12th Edition Spiro Test Bankcarolinemooreigtjqesyox100% (16)

- Administrative Management Setting People Up For Success 1st Edition Cassidy Solutions Manual DownloadDocument13 pagesAdministrative Management Setting People Up For Success 1st Edition Cassidy Solutions Manual DownloadMarjorie Tafoya100% (25)

- Costing Theory: Golden Rule To Clear Costing SubjectDocument82 pagesCosting Theory: Golden Rule To Clear Costing SubjectPiyal HossainNo ratings yet

- Chap 018Document25 pagesChap 018Neetu RajaramanNo ratings yet

- MTP Multiphase Transfer Pump Brochure LFDocument8 pagesMTP Multiphase Transfer Pump Brochure LFDeddy IrawanNo ratings yet

- Techniques For Improving Productivity: Work Study - Method StudyDocument82 pagesTechniques For Improving Productivity: Work Study - Method StudySitangshu PalNo ratings yet

- Eg Unit 4 QPDocument3 pagesEg Unit 4 QPMICHEL RAJ MechNo ratings yet

- 02 Filters and Filter Media 2010vol1Document0 pages02 Filters and Filter Media 2010vol1cornerstone2No ratings yet

- Applications of Cell CultureDocument17 pagesApplications of Cell CultureHarini Balasubramanian100% (1)

- (Brochure) New Coke Oven Plant Posco Krakatau en PDFDocument4 pages(Brochure) New Coke Oven Plant Posco Krakatau en PDFbulituk100% (1)

- Cerita SangkuriangDocument6 pagesCerita SangkuriangmarinaNo ratings yet

- Pooja ItemsDocument5 pagesPooja ItemskrishsudhNo ratings yet

- Ned Masters RequirementDocument3 pagesNed Masters Requirementsohaib389892No ratings yet

- Chart Title: Fuel Economy, 2003 Models (Select Compact and Midsize Cars Only)Document7 pagesChart Title: Fuel Economy, 2003 Models (Select Compact and Midsize Cars Only)Prasiddha PradhanNo ratings yet

- Nanopartikel AseklofenakDocument9 pagesNanopartikel AseklofenakReski WahyuNo ratings yet

- Waste To Energy ProjectDocument12 pagesWaste To Energy ProjectRosa Michelle ThenNo ratings yet

- FTXA Service Manual R32 Split Stylish - EN PDFDocument84 pagesFTXA Service Manual R32 Split Stylish - EN PDFolivier CHOUILLOUNo ratings yet

- Curriculum Map: Palawig Academy Educational FoundationDocument6 pagesCurriculum Map: Palawig Academy Educational FoundationMelvin Jake ManaogNo ratings yet

- SLDocument5 pagesSLLingga SuhadhaNo ratings yet

- Flygt FGC Brochure 893463Document4 pagesFlygt FGC Brochure 893463Consul TechNo ratings yet

- 15.2 Introduction in World ReligionDocument6 pages15.2 Introduction in World ReligionKurt Russel LeonemNo ratings yet

- Especificação E3D2.1Document3 pagesEspecificação E3D2.1erikestrelaNo ratings yet

- A GUIDE TO ROCK CORE LOGGING Part 1Document19 pagesA GUIDE TO ROCK CORE LOGGING Part 1CocoNo ratings yet

- Titles For Forensic Science - Allocated (1) .FinalDocument3 pagesTitles For Forensic Science - Allocated (1) .FinalTSHIRELETSO KOLAAGANONo ratings yet

- Codage TutorialDocument12 pagesCodage TutorialhallNo ratings yet

- Inverter Station 1500vdcDocument4 pagesInverter Station 1500vdcsmrasteg12No ratings yet

- LT Cable CodeDocument3 pagesLT Cable CodeSVR12No ratings yet

- Poisson Processes and Jump Diffusion ModelDocument13 pagesPoisson Processes and Jump Diffusion ModellycancapitalNo ratings yet

- Cladding Inspection TemplateDocument3 pagesCladding Inspection Templatescott.baileyNo ratings yet