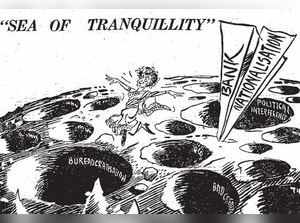

This meant that detailed news of nationalisation, including reactions from politicians and the business community, was crowded among news of Neil Armstrong on the moon. The cartoonist RK Laxman showed the PM happily skipping on the moon, while Mario Miranda made her into a wickedly grinning woman-in-the-moon ejecting a lunar module with the face of Morarji Desai, the finance minister who had just been fired, partly because of his opposition to bank nationalisation.

In a public meeting in Lucknow on September 7th, Mrs Gandhi spoke of how US President Richard Nixon had said the moon landing had dissipated frustration in the US. “Mrs Gandhi said that taking over the banks had similarly raised hopes and generated enthusiasm in the country,” reported the Times of India. ToI also reported a sycophantic Congress politician evoking Armstrong’s words of his step on the moon being “a mighty leap for mankind. Similarly, the bold step which the Prime Minister had taken constituted a mighty leap for the nation.”

The analyses that have come out of the event 50 years on have been as divided as reactions were at that time, but one particular strain of criticism focuses on the short term political reasons that lead to banks being nationalised “at the whim of a Prime Minister,” as YV Reddy, the former RBI governor put it.

What such arguments gloss over is the fact that the attempts to control banks, across the world, have always been driven by immediate political concerns. Most notably the ‘Bank War’ that convulsed the US in the tenure of President Andrew Jackson (1829-1837) was driven by Jackson’s playing the populist vote against ‘elites’ embodied in Nicholas Biddle, president of the Bank of the United States.

Demands for nationalisation of all Indian banks came just months after independence in 1947, from the group that was, for its own reasons, most consistently in support of government control – the employees of the banks. On October 27th, 1947 a conference of employees of the Imperial Bank (later to become the State Bank of India) called on the government “to nationalise forthwith all Banks and Financial Corporations in the country.”

In 1964, the All India Bank Employees Association launched a campaign to collect a million signatures for nationalisation. AIBEA was careful to explain this demand was “so that the vast resources lying at the disposal of private commercial banks are available to provide rural credit for agricultural development, to render financial help to small and medium-scale industries and to regulate industrial development in a balanced way.”

The other drumbeat for nationalisation came from the Left. Bank nationalisation was a constant demand of the socialist and communist parties, but by the 1960s it was also being made by the younger, more left-wing members of the Congress.

In the earlier decade, parliamentary debates on bank nationalisation were instigated by other parties, like the Praja Socialist Party, but by the 1960s it was Congress MPs like Mohan Dharia, Bhagwat Jha Azad and Subhadra Joshi who were pushing for bank nationalisation as a solution to a range of economic ills, from tax evasion to resource mobilisation for farmers.

These views received increasingly irritable pushback from seniors like Desai and TT Krishnamchari, both who served as finance ministers.

These ministers questioned the logic of assuming that bringing banks under government control would suddenly solve all these problems, and they pointed out that the government already had means, through Reserve Bank of India directives, to shape bank policy. But Krishnamachari at least considered the matter serious enough to direct the bureaucrat and economist IG Patel to draw up a draft for nationalisation, something that would become important later on.

One compromise that the seniors suggested was ‘social control’. This somewhat nebulous concept was that banks would respond to government nudging to increase credit to farmers, open banks in remote areas and perform a range of other possibly profitlosing ventures all in the national interest.

And if they failed to do so they could, in theory, be taken over by the government. Social control, Desai, declared in 1967, would work “because those who want nationalisation want it not for itself but for seeing our goals are achieved and social purposes are served properly.”

Those who wanted nationalisation wanted it very much as a symbol in itself as for anything it could achieve. They hated the fact that, as Azad said in 1966 at a meeting of the Congress Parliamentary Party that “a handful of families virtually controlled Rs 2000 crores of investment.”

Increasingly they linked this with another example of elites profiting due to state policy – the princes, erstwhile rules of kingdoms in India, who got ‘privy purses’, promised to them at the time of Independence to induce them to join the new country.

The results of the 1967 General Election brought all this into focus. Congress came back to power, but with heavy losses to parties across the board. The Opposition included parties, like the economically right-wing Swatantra, and the nationalist rightwing Jan Sangh, that both opposed nationalisation, but it was clearly the opposition from the Left that worried the new PM more. Perhaps it was the influence of her advisers, like PN Haksar, who came from the Left themselves, or perhaps she feared the Left’s potential for grass roots political activism .

Above all, the PM was increasingly frustrated by the influence of the senior Congress ministers, called the Syndicate, who had helped her to gain power and who presumed they could control her. They were also the group most opposed to bank nationalisation and she saw how pushing them into a corner might help her gain control of the party, end disputes and focus on rebuilding Congress power.

So in July 1969 IG Patel, now economic secretary, was summoned to her office and told to prepare in 24 hours a bill for bank nationalisation, a note for the Cabinet and a speech for her to make. As he wrote in his memoir Glimpses of Indian Economic Policy, “there was no pretence this was not a political decision and the message was clear that no argument from me was required.”

Patel writes that he did make two suggestions – to leave out foreign banks, to avoid antagonising other countries, and to focus on just the major banks, which would achieve her purpose and avoid having to deal with the many small one. Mrs. Gandhi agreed, and left him to get on with the job, just emphasising the need for strict secrecy.

Patel could only tell LK Jha, the RBI Governor, asking him to come at once to Delhi along with RK Seshadri, the RBI officer who had helped Patel prepare the earlier draft for Krishnamachari on nationalisation, and who had kept the only copy of it.

That draft now became the basis for the Bill, which the three of them worked at overnight, Patel in his home and Jha and Seshadri in the RBI Governor’s flat in Delhi: “There was no question of using the office or collecting references or consulting others.” Patel writes they chose 14 banks for nationalisation since they accounted for 80-90% of deposits.

The event happened much as Mrs Gandhi must have hoped. The sudden news of nationalisation came as a surprise, blindsiding the Syndicate and gaining strong support from both leftwing Congress members and the leftwing parties. The Swatantra and Jan Sangh parties were opposed, but could be ignored – especially when some on the left called for nationalisation of all banks, allowing the PM to appear as a more moderate voice.

In the months to come Mrs Gandhi moved to further isolate the Syndicate, using their opposition to bank nationalisation as proof of their anti-people politics. This battle came to a head with the election for President, which was narrowly won by her candidate VV Giri. But a loss also appeared in the Supreme Court which, in a case against nationalisation brought by RC Cooper, achartered account and shareholder in Central Bank, held that the rights of shareholders of the banks had to be respected.

In practice this defeat was got around by agreeing to higher compensation for the shareholders. But Mrs Gandhi clearly saw that the court could be a hindrance in her plans – and she noted the only justice, AN Ray, who had voted in her favour. In 1973, in the wake of a further loss in the Kesavananda Bharati case, Ray was appointed chief justice, superseding three more senior judges. Bank nationalisation had given her a taste for decisive, if controversial, action, and that set her path.

It is harder to judge how effective bank nationalisation really was. On every major anniversary it has been debated and the same points come up: it helped expand the reach of banking, but also made the nationalised banks into inefficient behemoths, saddled with bad loans and inefficient services. Beyond these generally accepted points everything else seems eternally up for debate.

Perhaps there is a parallel here with the event with which the announcement of bank nationalisation was entwined. At the time of the moon landing there were wild predictions of how soon it would lead to colonies on the moon and manned trips to further planets.

As we now know the major promises of the Apollo programme were never fulfilled. India’s Chandrayaan, being remedied. Yet the moon mission did have benefits in the way it focussed scientific research on a huge range of areas, from materials development and rocketry – leading to the satellites that now control so much of our lives – to new ways to preserve food and much more. Perhaps this is how progress always happens, with an explosive event, and then decades in which to figure out what it changed.

(Catch all the Business News, Breaking News, Budget 2024 Events and Latest News Updates on The Economic Times.)

Subscribe to The Economic Times Prime and read the ET ePaper online.

(Catch all the Business News, Breaking News, Budget 2024 Events and Latest News Updates on The Economic Times.)

Subscribe to The Economic Times Prime and read the ET ePaper online.

Get Unlimited Access to The Economic Times

Get Unlimited Access to The Economic Times