Business News›Tech›Newsletters›Morning Dispatch›Byju’s yet to close $800M round; govt may quiz FB, Twitter on compliance rate

Morning Dispatch Morning Dispatch |

Byju’s yet to close $800M round; govt may quiz FB, Twitter on compliance rate

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Morning Dispatch

We'll soon meet in your inbox.

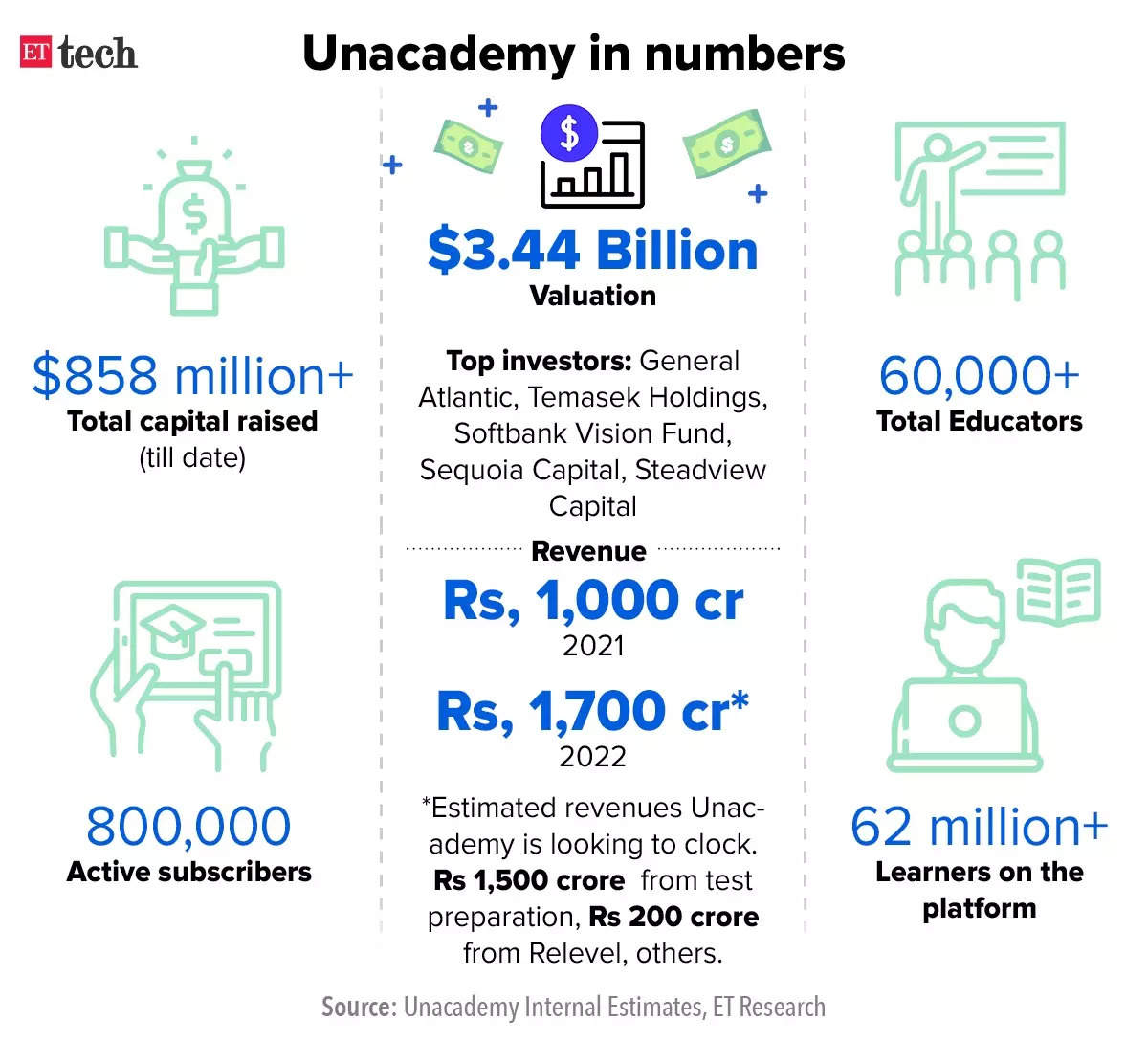

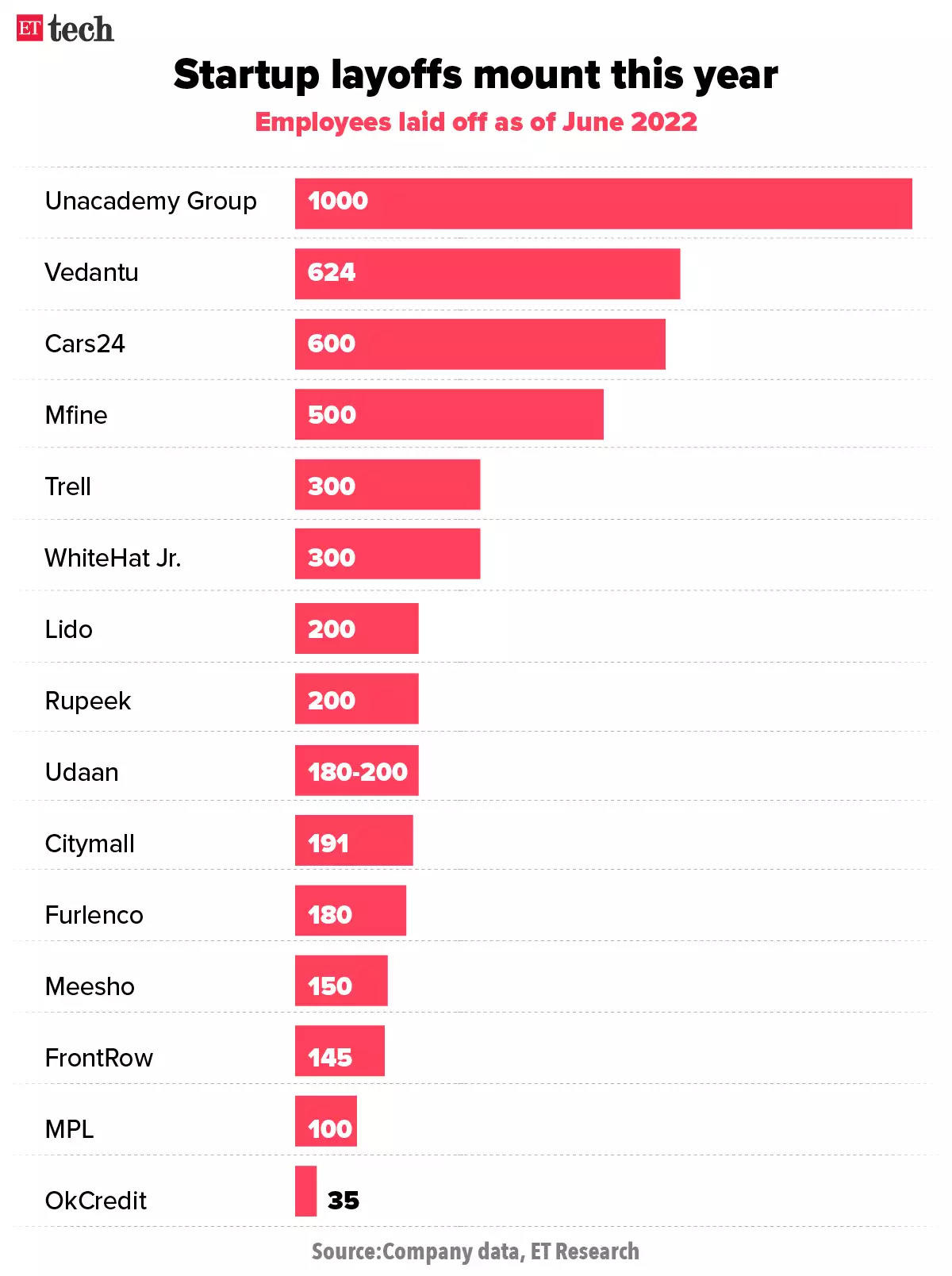

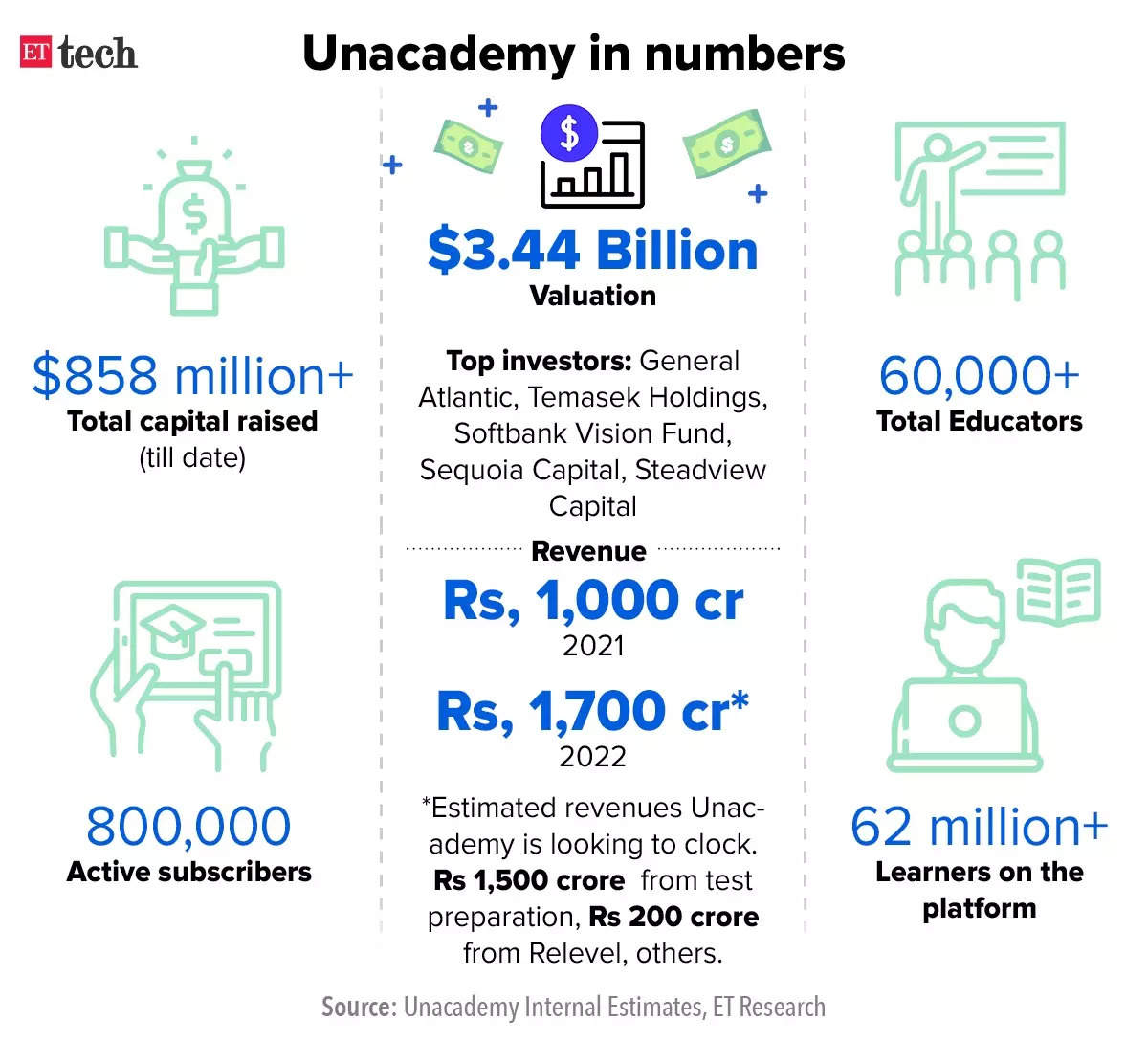

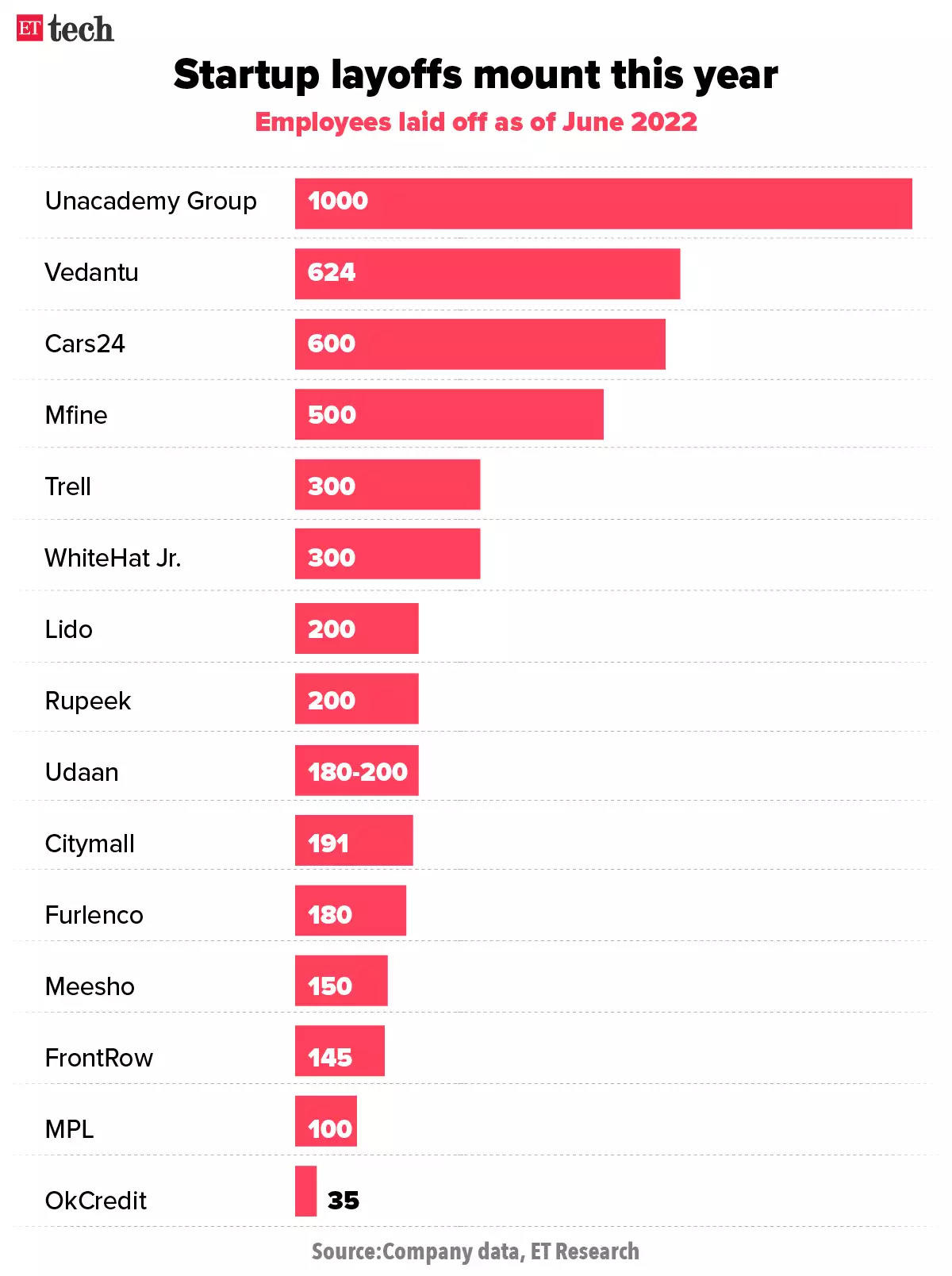

Byju’s, which recently finished paying for its nearly $1 billion buyout of Aakash Educational Services after seeking an extension, is still waiting for its $800 million funding round to close, with two investors yet to send the $250 million they committed. Fellow edtech giant Unacademy, meanwhile, is giving its founders and top management pay cuts and shutting its global test prep business as it looks to cut costs. Both companies have also laid off hundreds of employees this year.

Also in this letter:

■ Govt may quiz FB, Twitter over lower compliance rate on legal notices

■ Unacademy gives top brass pay cuts, shuts global test prep business

■ Wheelocity raises $12 million, and other done deals

Byju’s is yet to receive funds from Sumeru Ventures and Oxshott, which committed to investing about $250 million in the edtech firm’s latest funding round.

The company attributed the delay to “macroeconomic changes” and said it expects the funds to come in by August.

Meanwhile, founder Byju Raveendran has completed his $400 million personal investment as part of the company’s $800 million funding round, Byju’s said in a statement.

Raising the stakes: The founder group, which comprises Raveendran, his wife Divya Gokulnath, some of their family members, and the top management and employees, holds more than 25% in the firm. Their stake is expected to increase to about 29% once the round is completed.

Raveendran has secured a credit line of $400 million from various financial institutions to increase his stake.

Byju’s recently cleared its payments for Aakash Educational Services Ltd, which it acquired for just under $1 billion last year, after postponing the initial timelines.

The Sequoia Capital-backed startup recently fired at least 600 employees – 300 each from Toppr and WhiteHat Jr.

The company is also looking to acquire US edtech firm 2 U and is finalising a $2.4 billion bid, sources told us.

The union government may seek an explanation from social media companies including Twitter and Meta’s Facebook on the lower rate of compliance by these platforms to legal notices served in India compared with other major countries, people directly aware of the issue told us.

The ministry of electronics and information technology (MeitY) is compiling comparative reports of such action taken by significant social media intermediaries (SSMIs) – both voluntarily and in response to official notices – in India and overseas for a detailed review, the sources said.

The issue is likely to be discussed at "the next fortnightly meeting between the ministry and SSMIs", they added.

At present, Meta counts India as its largest market with more than 400 million users while Twitter has roughly 24 million users in India, which accounts for about 10% of its global user base of 330 million monthly active users.

“But if you compare the compliance rates, SSMIs lag here," said an official, who did not wish to be named.

A Twitter spokesperson said the platform had no comment to offer.

A representative for Meta said the company’s "community standards outline what is and is not allowed on our platform. If the content violates our Community Standards, we remove it from the platform."

Twitter suing govt over takedown orders: Earlier this month, Twitter approached the Karnataka High Court with a plea challenging 39 legal demands made by the government of India between February 2021 and June 2022, on the grounds that they do not pass the test of "proportionality".

Unacademy cofounder and CEO Gaurav Munjal told employees in an internal note on Monday that the firm's founders and top management will take pay cuts, and that the company will shut its global test preparation business to increase efficiency and cut costs.

In his words: “Even though we have more than Rs 2,800 crore in the bank (as of this morning), we are not efficient at all. We spend crores on travel for employees and educators. Sometimes it's needed, sometimes it's not. There are a lot of unnecessary expenses that we do. We must cut all these expenses. We have a strong core business. We must turn profitable asap,” Munjal told his employees.

He said the firm’s cofounders have already taken pay cuts, which will be extended to the rest of the firm’s top management team soon.

“We have to do an initial public offering (IPO) in the next two years. And, we have (to) turn cash flow positive. For that, we must embrace frugality as a core value,” he added.

Note-worthy: This is the second such note Munjal has sent his team in recent months. In May, he told employees that the funding winter had arrived and said the company must change its ways.

Unacademy is one of several startups – including many edtech firms – that have laid off employees amid the funding slowdown this year. It sacked around 1,000 employees in March and April, and another 150 in June.

Mfine merges with Lifecell: Meanwhile, troubled healthcare startup Mfine said it is merging with the diagnostics arm of Lifecell International, a genetic testing service provider, in what is being considered a distress deal. LifeCell’s diagnostics business and MFine will merge to form a new entity called LifeWell.

We reported on May 23 that Mfine had laid off around 500 employees, about half of its workforce, as it struggled to cope with the funding winter.

■ Wheelocity, a supply-chain network for fresh commerce, has raised $12 million (about Rs 95 crore) in its Series A round, led by Lightspeed Venture Partners. The funding round had a debt component of $2 million. Anicut Capital also participated in the round along with other investors.

■ Biotech startup String Bio raised $20 million from Woodside Energy Group, Ankur Capital, Dare Ventures, Redstart, and Zenfold Ventures. The company’s solutions are used to create products related to animal nutrition, agriculture and other emerging markets.

■ Solar financing platform Aerem raised $2.5 million in a funding round led by Blume Ventures. The company said it would use the fresh funds to grow its loan book and build its tech platform.

The restructuring of its digital business arm will help keep in check Cognizant Technology Solutions’ attrition levels and is a result of the evolving nature of digital transformation deals, analysts have said.

Nasdaq-listed Cognizant is promoting two executives as part of the restructuring exercise under which the company is merging its Digital Business and Technology (DB&T) and Digital Business Operations (DBO) units to create four new integrated practices.

After the restructuring, which is aimed at delivering client business outcomes aligned by industry, Rajesh Nambiar would cease to serve as executive vice president and president of DB&T but remain as executive vice president, chairman and managing director of Cognizant India.

As a part of the restructuring announcement, Annadurai Elango will lead core technology and insights, while Rob Vatter will lead enterprise platform services, the company told ET. Elango and Vatter will join Cognizant’s executive committee and report directly to CEO Brian Humphries.

Paytm hits annual loan disbursal run rate of nearly $3B in Q1: One97 Communications Ltd., which owns Paytm, hit an annual loan disbursal run rate of roughly $3 billion (or Rs 24,000 crore) in Q1, the Noida-based firm informed the exchanges on Monday morning.

India among top four markets for GE Healthcare Intercontinental:India is among the top four markets for GE Healthcare Intercontinental, a new region set up earlier this year, and home to four of its manufacturing units, its top executive told ET. The company’s most recent manufacturing unit was launched earlier this year under the government’s Production-Linked Incentive (PLI) scheme to boost the production of medical devices in the country.

■ Twitter stock drops after Elon Musk looks to nix deal (WSJ)

■ Juul nears its last gasp — after it hooked a generation on vaping (Wired)

■ Tiger Global is on the prowl in Pakistan (Rest of World)

Also in this letter:

■ Govt may quiz FB, Twitter over lower compliance rate on legal notices

■ Unacademy gives top brass pay cuts, shuts global test prep business

■ Wheelocity raises $12 million, and other done deals

Byju’s yet to close $800 million funding round

Byju’s is yet to receive funds from Sumeru Ventures and Oxshott, which committed to investing about $250 million in the edtech firm’s latest funding round.

The company attributed the delay to “macroeconomic changes” and said it expects the funds to come in by August.

Meanwhile, founder Byju Raveendran has completed his $400 million personal investment as part of the company’s $800 million funding round, Byju’s said in a statement.

Raising the stakes: The founder group, which comprises Raveendran, his wife Divya Gokulnath, some of their family members, and the top management and employees, holds more than 25% in the firm. Their stake is expected to increase to about 29% once the round is completed.

Raveendran has secured a credit line of $400 million from various financial institutions to increase his stake.

Byju’s recently cleared its payments for Aakash Educational Services Ltd, which it acquired for just under $1 billion last year, after postponing the initial timelines.

The Sequoia Capital-backed startup recently fired at least 600 employees – 300 each from Toppr and WhiteHat Jr.

The company is also looking to acquire US edtech firm 2 U and is finalising a $2.4 billion bid, sources told us.

Govt may quiz FB, Twitter over lower compliance rate on legal notices

The union government may seek an explanation from social media companies including Twitter and Meta’s Facebook on the lower rate of compliance by these platforms to legal notices served in India compared with other major countries, people directly aware of the issue told us.

The ministry of electronics and information technology (MeitY) is compiling comparative reports of such action taken by significant social media intermediaries (SSMIs) – both voluntarily and in response to official notices – in India and overseas for a detailed review, the sources said.

The issue is likely to be discussed at "the next fortnightly meeting between the ministry and SSMIs", they added.

At present, Meta counts India as its largest market with more than 400 million users while Twitter has roughly 24 million users in India, which accounts for about 10% of its global user base of 330 million monthly active users.

“But if you compare the compliance rates, SSMIs lag here," said an official, who did not wish to be named.

A Twitter spokesperson said the platform had no comment to offer.

A representative for Meta said the company’s "community standards outline what is and is not allowed on our platform. If the content violates our Community Standards, we remove it from the platform."

Twitter suing govt over takedown orders: Earlier this month, Twitter approached the Karnataka High Court with a plea challenging 39 legal demands made by the government of India between February 2021 and June 2022, on the grounds that they do not pass the test of "proportionality".

Unacademy gives top brass pay cuts, shuts global test prep business

Unacademy cofounder and CEO Gaurav Munjal told employees in an internal note on Monday that the firm's founders and top management will take pay cuts, and that the company will shut its global test preparation business to increase efficiency and cut costs.

In his words: “Even though we have more than Rs 2,800 crore in the bank (as of this morning), we are not efficient at all. We spend crores on travel for employees and educators. Sometimes it's needed, sometimes it's not. There are a lot of unnecessary expenses that we do. We must cut all these expenses. We have a strong core business. We must turn profitable asap,” Munjal told his employees.

He said the firm’s cofounders have already taken pay cuts, which will be extended to the rest of the firm’s top management team soon.

“We have to do an initial public offering (IPO) in the next two years. And, we have (to) turn cash flow positive. For that, we must embrace frugality as a core value,” he added.

Note-worthy: This is the second such note Munjal has sent his team in recent months. In May, he told employees that the funding winter had arrived and said the company must change its ways.

Unacademy is one of several startups – including many edtech firms – that have laid off employees amid the funding slowdown this year. It sacked around 1,000 employees in March and April, and another 150 in June.

Mfine merges with Lifecell: Meanwhile, troubled healthcare startup Mfine said it is merging with the diagnostics arm of Lifecell International, a genetic testing service provider, in what is being considered a distress deal. LifeCell’s diagnostics business and MFine will merge to form a new entity called LifeWell.

We reported on May 23 that Mfine had laid off around 500 employees, about half of its workforce, as it struggled to cope with the funding winter.

ETtech Done Deals

■ Wheelocity, a supply-chain network for fresh commerce, has raised $12 million (about Rs 95 crore) in its Series A round, led by Lightspeed Venture Partners. The funding round had a debt component of $2 million. Anicut Capital also participated in the round along with other investors.

■ Biotech startup String Bio raised $20 million from Woodside Energy Group, Ankur Capital, Dare Ventures, Redstart, and Zenfold Ventures. The company’s solutions are used to create products related to animal nutrition, agriculture and other emerging markets.

■ Solar financing platform Aerem raised $2.5 million in a funding round led by Blume Ventures. The company said it would use the fresh funds to grow its loan book and build its tech platform.

Cognizant rejig may make digital arm nimbler, stem attrition

The restructuring of its digital business arm will help keep in check Cognizant Technology Solutions’ attrition levels and is a result of the evolving nature of digital transformation deals, analysts have said.

Nasdaq-listed Cognizant is promoting two executives as part of the restructuring exercise under which the company is merging its Digital Business and Technology (DB&T) and Digital Business Operations (DBO) units to create four new integrated practices.

After the restructuring, which is aimed at delivering client business outcomes aligned by industry, Rajesh Nambiar would cease to serve as executive vice president and president of DB&T but remain as executive vice president, chairman and managing director of Cognizant India.

As a part of the restructuring announcement, Annadurai Elango will lead core technology and insights, while Rob Vatter will lead enterprise platform services, the company told ET. Elango and Vatter will join Cognizant’s executive committee and report directly to CEO Brian Humphries.

TWEET OF THE DAY

Other Top Stories By Our Reporters

Paytm hits annual loan disbursal run rate of nearly $3B in Q1: One97 Communications Ltd., which owns Paytm, hit an annual loan disbursal run rate of roughly $3 billion (or Rs 24,000 crore) in Q1, the Noida-based firm informed the exchanges on Monday morning.

India among top four markets for GE Healthcare Intercontinental:India is among the top four markets for GE Healthcare Intercontinental, a new region set up earlier this year, and home to four of its manufacturing units, its top executive told ET. The company’s most recent manufacturing unit was launched earlier this year under the government’s Production-Linked Incentive (PLI) scheme to boost the production of medical devices in the country.

Global Picks We Are Reading

■ Twitter stock drops after Elon Musk looks to nix deal (WSJ)

■ Juul nears its last gasp — after it hooked a generation on vaping (Wired)

■ Tiger Global is on the prowl in Pakistan (Rest of World)

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Morning Dispatch

We'll soon meet in your inbox.