Business News›Tech›Newsletters›Morning Dispatch›Rise & rise of secondary deals; advantage desi data centres

Morning Dispatch Morning Dispatch |

Rise & rise of secondary deals; advantage desi data centres

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Morning Dispatch

We'll soon meet in your inbox.

Happy Friday! Total funding raised by Indian startups fell in the first half of 2024, but late-stage activity showed signs of revival. Decoding this and more in today’s ETtech Morning Dispatch.

Also in the letter:

■ Ixigo’s Q4 financial report

■ Zomato suspends ‘Xtreme’ service

■ Telangana seeks compute infra

Secondary stake sales and buyouts are driving most of the larger deals being struck by private equity (PE) and venture capital (VC) funds in new-age firms, data from investment banking firm DC Advisory shared with ETtech showed.

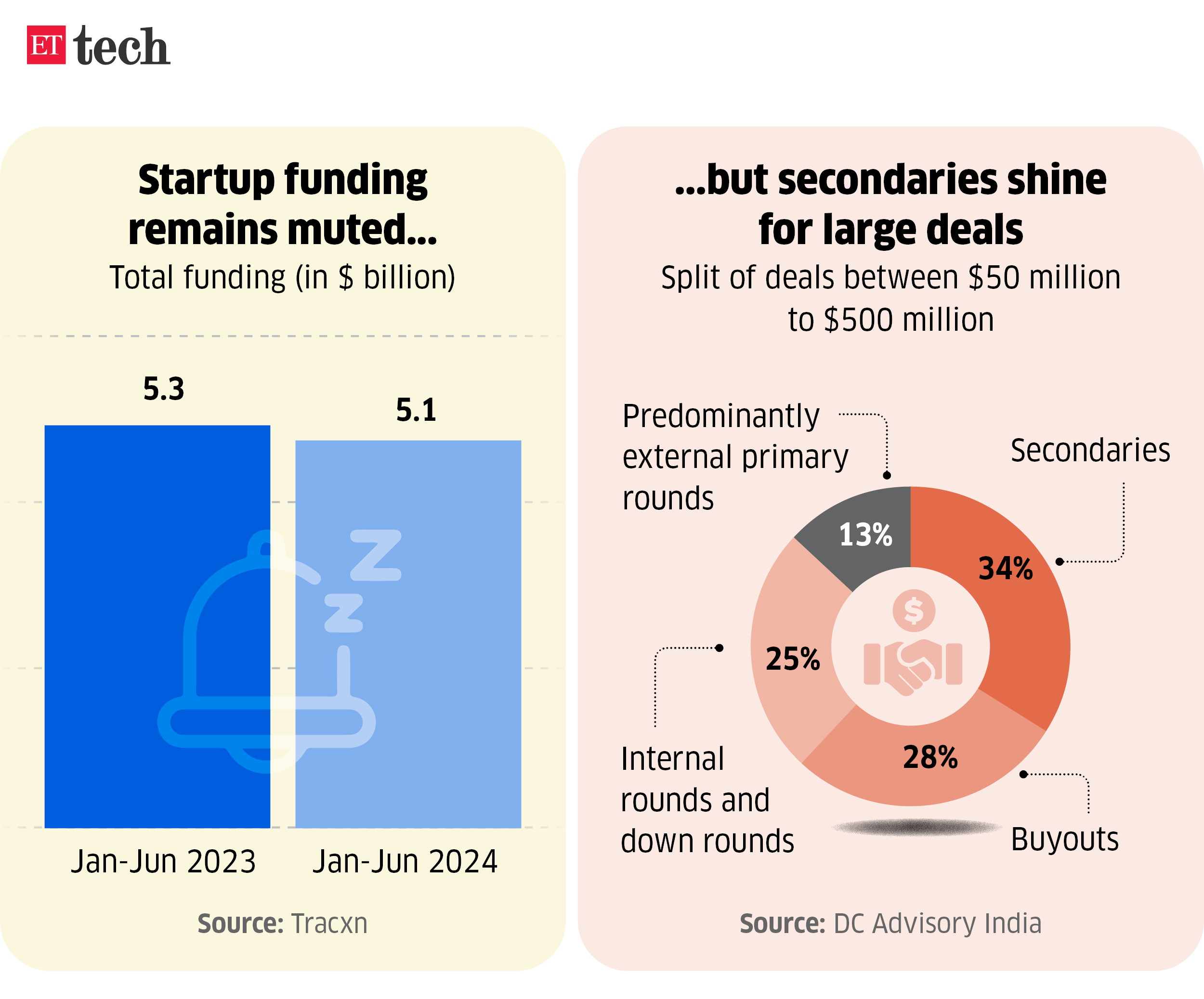

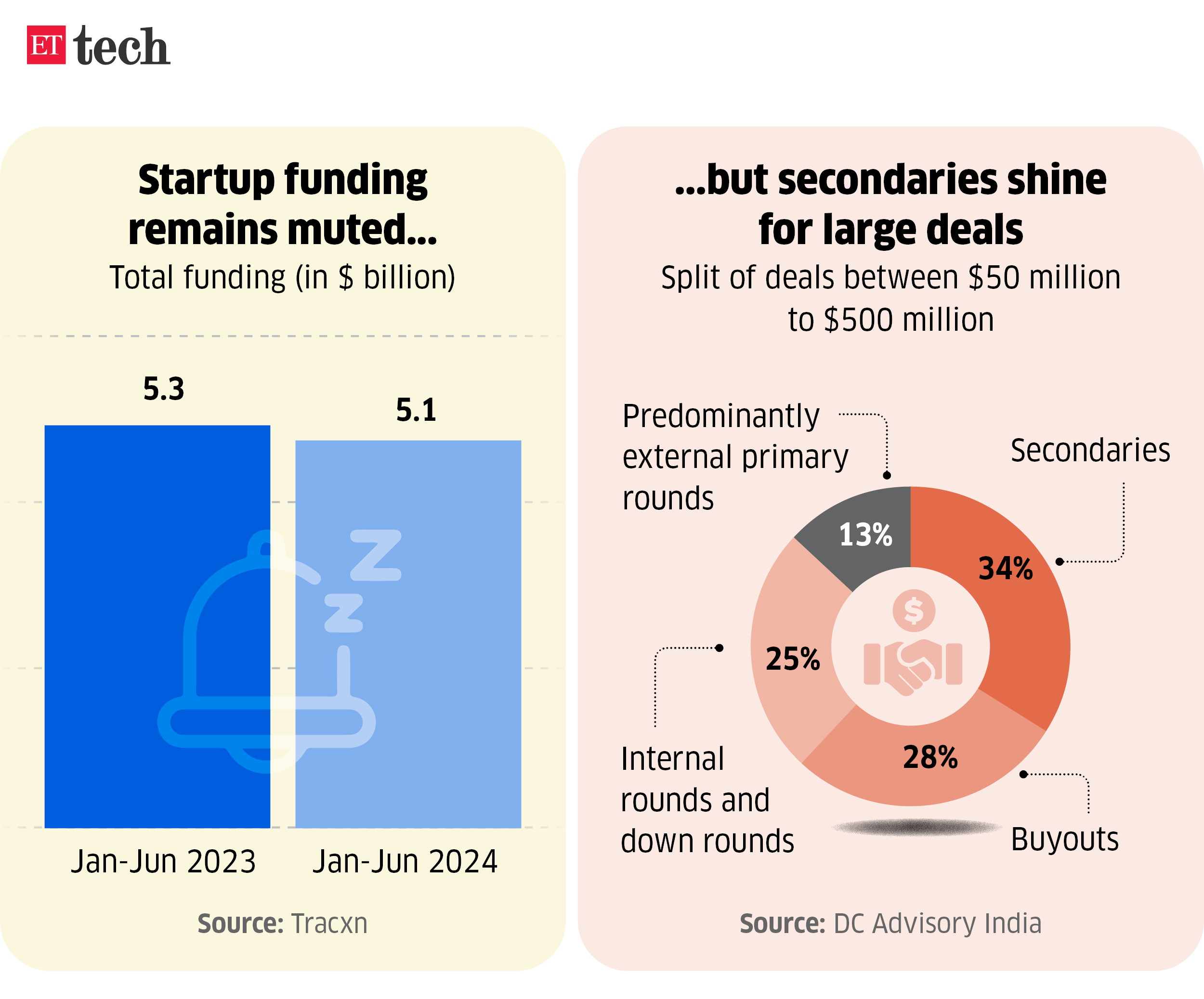

Driving the news: In the first six months of 2024, when 37 deals closed in the $50-500 million range, 62% were secondary transactions or buyouts, with external primary investment rounds making up only 13% of the funding rounds. Meanwhile, total funding for startups was 3.8% lower in the first six months of 2024, coming in at about $5.1 billion, compared to $5.3 billion in the same period last year.

Zoom in: This year has seen a notable rise in VC investors selling their stakes in growth-stage firms, often partially, as the pressure to show returns on investments continues, ET had reported in March. In such secondary deals, the capital is exchanged between existing and incoming investors, and the cash doesn’t go into the company.

Also read | VCs in reset mode amid exit pressure

The bottom line: Private markets in India, however, are still undergoing a ‘reset’, as opposed to the public markets that have grown from strength to strength over the last few months. This has resulted in startups like Byju’s, Elastic Run, ShareChat, Udaan, and PharmEasy seeing significant downward revisions in their valuations in recent months. In a down round, a firm raises funds from existing or new investors at a lower valuation compared to the last funding round.

Also read | Indian venture capitalists need to pivot to a new model of investing

The government may prefer Indian data centre companies to manage the operations of graphics processing units (GPUs) to be procured under the Rs 10,372 crore IndiaAI Mission, sources told us.

Scarce resource: GPUs are currently a precious resource for the AI industry and are manufactured only by a handful of American companies like Nvidia, Intel, and AMD. Sources said Indian data firms can procure GPU units and subsequently provide them to local firms, startups, and researchers at a subsidised rate.

The government is in talks with international companies to understand the supply dynamics of these high-end computing resources, officials said.

Tell me more: Additionally, global firms that want to help operate and manage these GPUs for Indian firms may have to set up operations in India and show “bona fide” that the data being processed will be kept within Indian shores.

“The much-awaited request for proposal (RFP) should be out in the next few days. We are studying the best way to subsidise the GPU, which will also include the operations, maintenance, and upgradation costs,” said one official cited above.

Strategic issue: Setting up AI compute infrastructure has thrown up a strategic concern for countries, with most of them spending billions of dollars to secure capacity for their companies as well as for national security needs. China and the US, for instance, have already started acquiring Nvidia's range of GPUs, including the powerful H100 chips.

L-R: Rajnish Kumar (director and group co-CEO) and Aloke Bajpai (MD and group CEO)

L-R: Rajnish Kumar (director and group co-CEO) and Aloke Bajpai (MD and group CEO)

Online travel booking platform Ixigo reported its first quarterly earnings after it listed on the bourses last month. It reported strong profit figures for the quarter ended March 31, 2024.

By the numbers:

ETtech Q&A | We pivoted multiple times, have been close to bankruptcy: Ixigo founders

Go deeper: Ixigo’s revenue growth in the fourth quarter was at a relatively slower pace owing to the sluggishness in air travel and reserved train ticketing segments. The company’s management also flagged that during the fourth quarter, it compromised on margins to chase growth.

Outlook: The company outlined it will continue to focus on its strategy of inorganic expansion and will be on the lookout for acquisitions. Ixigo has so far acquired train ticketing platform ConfirmTkt and bus reservation app AbhiBus.

Also Read | Ixigo’s stock market debut: Here’s what investors Elevation, Peak XV made on their investments

Zomato suspends hyperlocal goods delivery service Xtreme, restarts intercity deliveries: Gurugram-based Zomato has suspended its hyperlocal goods delivery service ‘Xtreme’ on account of poor demand, according to people aware of the matter. The food delivery platform had launched the service in October last year.

Telangana in talks with CDAC to set up 20 petaflops compute capacity in Hyderabad: The Telangana government is requesting the Ministry of Electronics and Information Technology (MeitY) to set up 20 petaflops (20 quadrillion flops, or 20,000 teraflops) of computing capacity in Hyderabad’s proposed artificial intelligence (AI) city under the National Supercomputing Mission (NSM).

Meta’s Threads turns one with 175 million users. What’s driving the growth? In a year since its launch, the microblogging app Threads has touched more than 175 million monthly active users. Threads, which was launched for the public on July 5, 2023, is intended to be a rival to X (formerly Twitter) after the latter alienated many users and advertisers following Elon Musk's purchase in 2022.

Another text-based app aims to storm social media: noplace | A new, more colourful text-based app ‘noplace’ has arrived on the social media scene, taking on established networks like X (formerly Twitter) and just-turned-one Threads. Mainly geared towards younger users, the app aims to put 'social' back into social media.

■ How Apple Intelligence’s privacy stacks up against Android’s ‘Hybrid AI’ (Wired)

■ SoftBank to prioritise AI deals over share buybacks despite pressure from Elliott (FT)

■ Fizz, the anonymous Gen Z social app, adds a marketplace for college students (TechCrunch)

Also in the letter:

■ Ixigo’s Q4 financial report

■ Zomato suspends ‘Xtreme’ service

■ Telangana seeks compute infra

PE, VC funding slows in first half of 2024; secondary deals become prominent

Secondary stake sales and buyouts are driving most of the larger deals being struck by private equity (PE) and venture capital (VC) funds in new-age firms, data from investment banking firm DC Advisory shared with ETtech showed.

Driving the news: In the first six months of 2024, when 37 deals closed in the $50-500 million range, 62% were secondary transactions or buyouts, with external primary investment rounds making up only 13% of the funding rounds. Meanwhile, total funding for startups was 3.8% lower in the first six months of 2024, coming in at about $5.1 billion, compared to $5.3 billion in the same period last year.

Zoom in: This year has seen a notable rise in VC investors selling their stakes in growth-stage firms, often partially, as the pressure to show returns on investments continues, ET had reported in March. In such secondary deals, the capital is exchanged between existing and incoming investors, and the cash doesn’t go into the company.

Also read | VCs in reset mode amid exit pressure

The bottom line: Private markets in India, however, are still undergoing a ‘reset’, as opposed to the public markets that have grown from strength to strength over the last few months. This has resulted in startups like Byju’s, Elastic Run, ShareChat, Udaan, and PharmEasy seeing significant downward revisions in their valuations in recent months. In a down round, a firm raises funds from existing or new investors at a lower valuation compared to the last funding round.

Also read | Indian venture capitalists need to pivot to a new model of investing

On A(I) Mission, Centre may go with Indian intel

The government may prefer Indian data centre companies to manage the operations of graphics processing units (GPUs) to be procured under the Rs 10,372 crore IndiaAI Mission, sources told us.

Scarce resource: GPUs are currently a precious resource for the AI industry and are manufactured only by a handful of American companies like Nvidia, Intel, and AMD. Sources said Indian data firms can procure GPU units and subsequently provide them to local firms, startups, and researchers at a subsidised rate.

The government is in talks with international companies to understand the supply dynamics of these high-end computing resources, officials said.

Tell me more: Additionally, global firms that want to help operate and manage these GPUs for Indian firms may have to set up operations in India and show “bona fide” that the data being processed will be kept within Indian shores.

“The much-awaited request for proposal (RFP) should be out in the next few days. We are studying the best way to subsidise the GPU, which will also include the operations, maintenance, and upgradation costs,” said one official cited above.

Strategic issue: Setting up AI compute infrastructure has thrown up a strategic concern for countries, with most of them spending billions of dollars to secure capacity for their companies as well as for national security needs. China and the US, for instance, have already started acquiring Nvidia's range of GPUs, including the powerful H100 chips.

Ixigo’s Q4 profits soar 55%; travel booking site open to inorganic growth

Online travel booking platform Ixigo reported its first quarterly earnings after it listed on the bourses last month. It reported strong profit figures for the quarter ended March 31, 2024.

By the numbers:

- Ixigo’s operating revenue was up 20% on year at Rs 164.8 crore

- Its net profit in Q4 jumped 55% to Rs 7.3 crore

- For the fiscal year 2024, Ixigo’s net profit more than tripled to Rs 73 crore from Rs 23 crore in FY23

- Revenue from operations grew by 31% on year in FY24 to Rs 655.8 crore

ETtech Q&A | We pivoted multiple times, have been close to bankruptcy: Ixigo founders

Go deeper: Ixigo’s revenue growth in the fourth quarter was at a relatively slower pace owing to the sluggishness in air travel and reserved train ticketing segments. The company’s management also flagged that during the fourth quarter, it compromised on margins to chase growth.

Outlook: The company outlined it will continue to focus on its strategy of inorganic expansion and will be on the lookout for acquisitions. Ixigo has so far acquired train ticketing platform ConfirmTkt and bus reservation app AbhiBus.

Also Read | Ixigo’s stock market debut: Here’s what investors Elevation, Peak XV made on their investments

Other Top Stories By Our Reporters

Zomato suspends hyperlocal goods delivery service Xtreme, restarts intercity deliveries: Gurugram-based Zomato has suspended its hyperlocal goods delivery service ‘Xtreme’ on account of poor demand, according to people aware of the matter. The food delivery platform had launched the service in October last year.

Telangana in talks with CDAC to set up 20 petaflops compute capacity in Hyderabad: The Telangana government is requesting the Ministry of Electronics and Information Technology (MeitY) to set up 20 petaflops (20 quadrillion flops, or 20,000 teraflops) of computing capacity in Hyderabad’s proposed artificial intelligence (AI) city under the National Supercomputing Mission (NSM).

Meta’s Threads turns one with 175 million users. What’s driving the growth? In a year since its launch, the microblogging app Threads has touched more than 175 million monthly active users. Threads, which was launched for the public on July 5, 2023, is intended to be a rival to X (formerly Twitter) after the latter alienated many users and advertisers following Elon Musk's purchase in 2022.

Another text-based app aims to storm social media: noplace | A new, more colourful text-based app ‘noplace’ has arrived on the social media scene, taking on established networks like X (formerly Twitter) and just-turned-one Threads. Mainly geared towards younger users, the app aims to put 'social' back into social media.

Global Picks We Are Reading

■ How Apple Intelligence’s privacy stacks up against Android’s ‘Hybrid AI’ (Wired)

■ SoftBank to prioritise AI deals over share buybacks despite pressure from Elliott (FT)

■ Fizz, the anonymous Gen Z social app, adds a marketplace for college students (TechCrunch)

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Morning Dispatch

We'll soon meet in your inbox.