Business News›Tech›Newsletters›Morning Dispatch›SoftBank may invest in Tata, Mahindra; RBI to set terms of Paytm Payments Bank audit

Morning Dispatch Morning Dispatch |

SoftBank may invest in Tata, Mahindra; RBI to set terms of Paytm Payments Bank audit

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Morning Dispatch

We'll soon meet in your inbox.

For the past six months, SoftBank has been in talks with two Indian conglomerates – Tata and Mahindra – for a potential investment, the CEO of SoftBank Investment Advisers told us in an interview on Monday. The news comes just days after we reported that Tata Digital had sought funds from its parent firm Tata Sons after talks with various global investors stalled.

Also in this letter:

■ RBI to set terms of Paytm Payments Bank audit

■ Tatas to launch ‘super app’ in April with IPL push

■ 700 crypto investors will get notices, says I-T Dept

Rajeev Misra, CEO, SoftBank Investment Advisers

Rajeev Misra, CEO, SoftBank Investment Advisers

Japan’s SoftBank has held discussions with the Tata group and the Mahindras for a potential investment, Rajeev Misra, CEO of SoftBank Investment Advisers, which manages SoftBank Vision Fund, told us in an interview at the ET Global Business Summit on Monday.

The discussions have been going on for six months, he said. The Tatas have been in talks with global investors, including some sovereign and pension money managers, to fund its digital foray, as ET reported earlier.

Misra also spoke about the rebalancing of private tech valuation amid a broader slump in the public markets and the overall macro concerns. Here are some edited excerpts from the interview.

The year has started with so much uncertainty. Is a global downturn around the corner?

Last October saw the peak in tech stocks, after which investors started worrying about inflation and the Fed said it would taper the bond buybacks faster. So we had a one-and-a-half-year liquidity boom from May 2020 to October 2021. But it’s nothing like the 2008 crisis because the banks and the financial system are in good shape.

Are you looking at digital assets of conglomerates like Tata Digital?

We are speaking to a couple of conglomerates [such as] Tata and Mahindra, which have amazing offline reach and amazing brands. They don't have to spend on customer acquisition because they have consumers across all their platforms. It will come down to two things: the valuation and how independent and aligned the management is.

Is an investment imminent?

We have been working on it for six months.

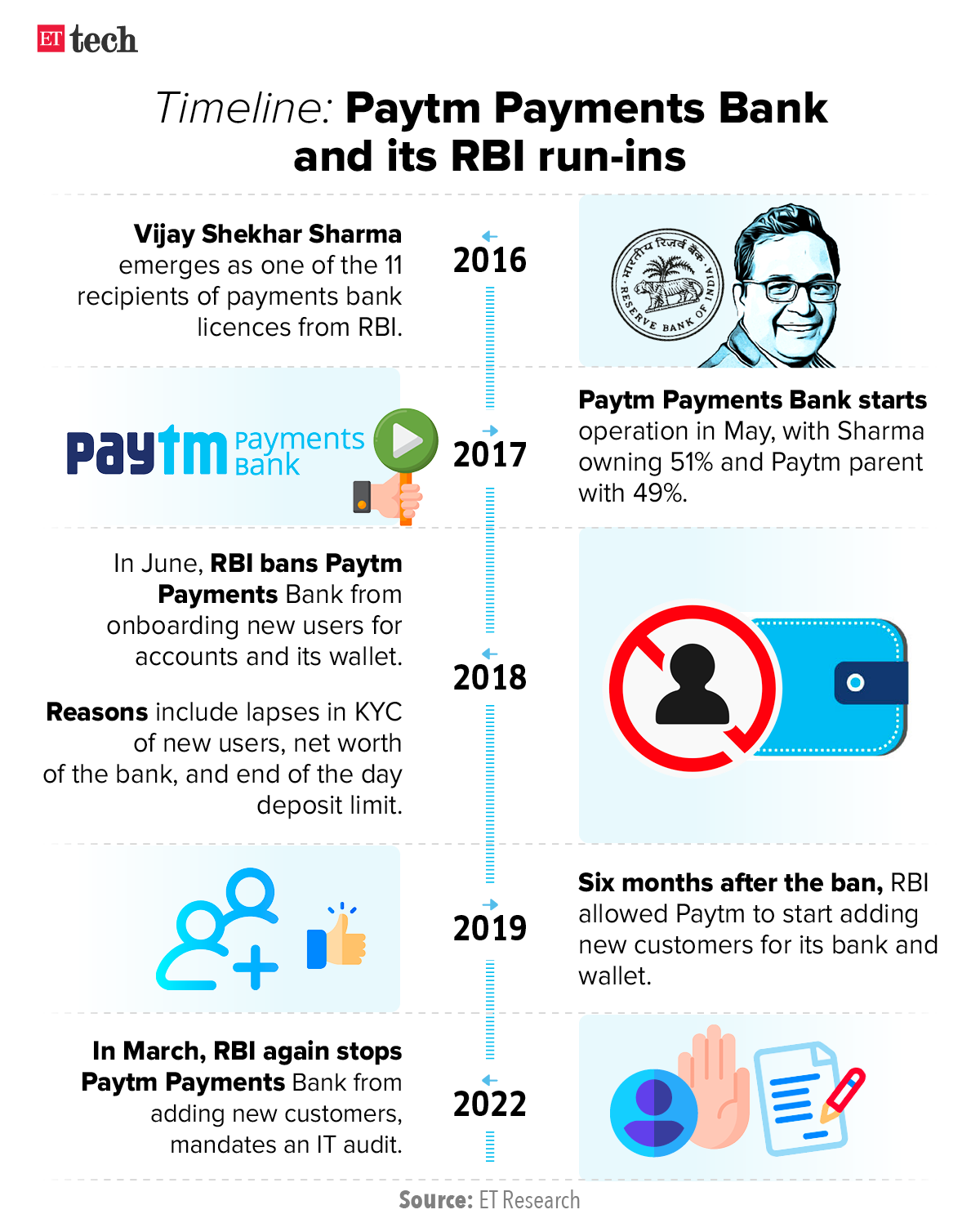

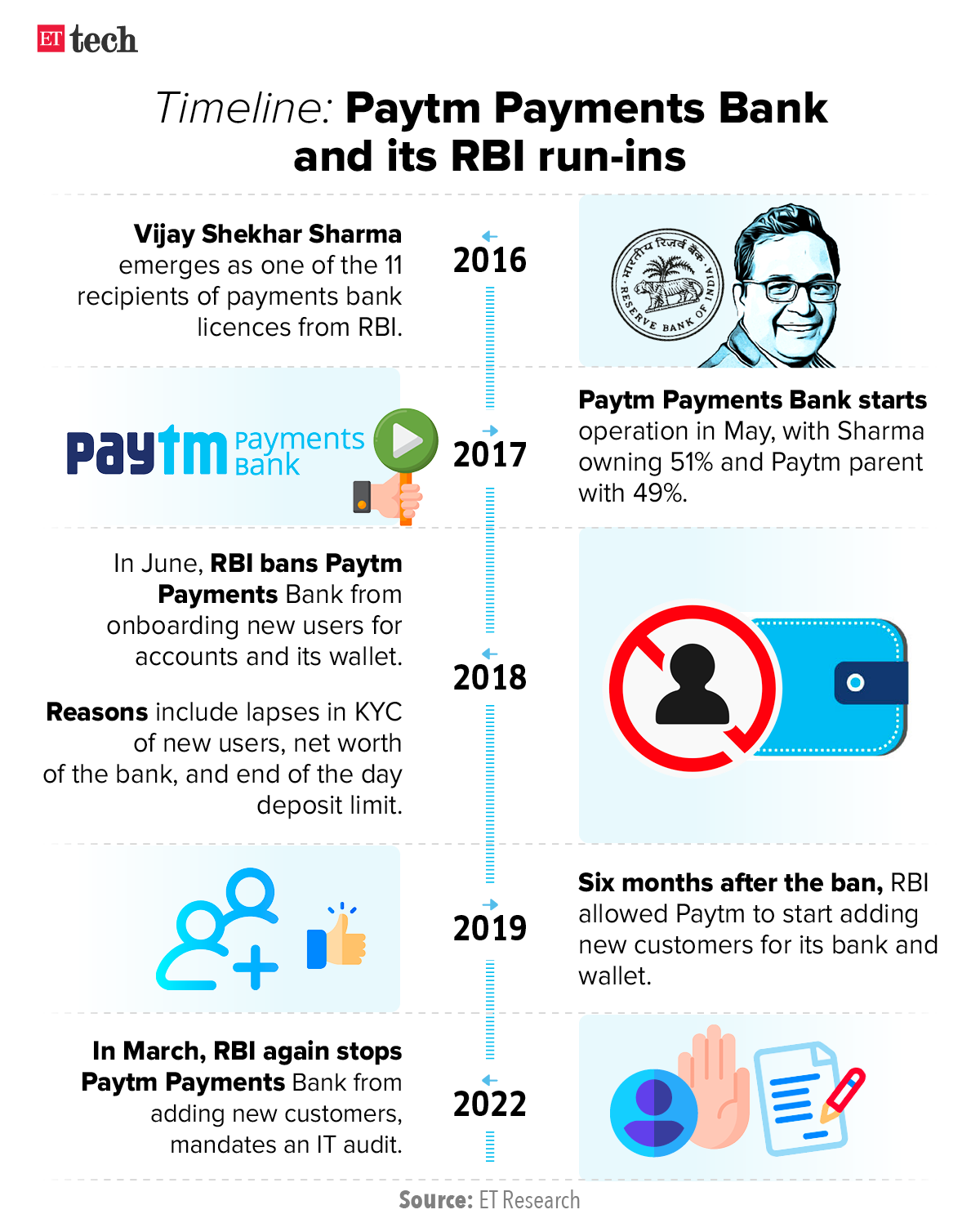

The Reserve Bank of India will set the terms of reference for an independent technology audit of Paytm Payments Bank after it was barred from onboarding new customers for allegedly violating customer acquisition and privacy rules which may have resulted in data flowing to Chinese companies, two people familiar with the matter told us.

Paytm founder Vijay Shekhar Sharma denied a media report that alleged data sharing with Chinese entities may have led to the regulatory curbs.

What’s next? Over the next few days, Paytm Payments Bank will submit the names of potential auditors to the RBI, after which the regulator may finalise the terms of reference based on its findings, our sources said.

Quote: "The payments bank did not plug the gaps in the system even after repeated references by the regulator. There were consistent deficiencies found in the bank's KYC process… [for instance] accounts that needed full KYC were not done,’’ said one of the people cited above. “All in all, compliance was either pending or unsatisfactory."

VSS denies China allegation: Paytm’s founder, billionaire and majority shareholder Vijay Shekhar Sharma, denied allegations that Paytm Payments Bank shared its customers’ data with Chinese companies.

"I want to inform and confirm that in various observations RBI has shared with Paytm Payments Bank, there is absolutely no reference to any data sharing or servers being outside or data sharing with any unauthorised personnel national or international – any country whatsoever," Sharma said. On Monday, Bloomberg reported, citing a source, that the RBI had punished Paytm Payments Bank for leaking data to Chinese entities.

Paytm stock plunges 13%: Shares of Paytm’s parent firm One97 Communications plunged more than 13% to hit an all-time low of Rs 661.50 on March 14. The stock closed the day at Rs 680.40 on NSE, down 12.21%.

After piloting its ‘super app’ among employees over the past many months, the Tata group is gearing up to the much-delayed app, called Tata Neu, next month. The launch will be accompanied by an aggressive marketing push around the Indian Premier League (IPL), multiple sources told us.

The company is expected to officially announce Tata Neu's launch to consumers on April 7, they added.

Tata Neu has been struggling with delays, the last one being in Diwali. ET reported in December that technical issues around integrating various platforms on Tata Neu had pushed the launch to at least March.

Tata group’s top assets like online grocer BigBasket, epharmacy 1mg, electronics focused retailer Croma, flight booking services across Tata group airlines including Air Asia and Vistara and Tata Cliq (which sells products across Tata companies such as Titan and Tanishq) are now fully integrated on Tata Neu now, these people said. Westside and Starbucks are on board.

High-value crypto transactions of about 700 investors are under the scanner of the income tax department, which now plans to issue notices to them. These individuals or entities could face a 30% tax, plus penalties and interest.

Income tax officials said most of these cases involved users who have either not mentioned their crypto gains in tax returns or haven’t filed returns at all.

Officials added that there are instances where gains have exceeded Rs 40 lakh, yet the user has either not filed returns or filed returns with zero income.

“We have a long list of people who were transacting in crypto assets but not paying tax. Initially, (we) have shortlisted about 700 transactions where tax liability is very high,” a senior Central Board of Direct Taxation (CBDT) official told ET.

Who’s on the list? Apart from high net-worth individuals (HNIs), non-resident Indians (NRIs) and startups, the list also includes students and housewives who have never filed returns. The department is also examining whether their names had been used by others to evade tax.

In her February 1 budget, finance minister Nirmala Sitharaman proposed a 30% tax on capital gains from crypto currencies, crypto assets from the next fiscal year. The budget further stated that a flat tax would apply irrespective of how long an individual has possessed the virtual digital asset.

Taxing issue: The crypto industry has reached out to the finance ministry, seeking to either reduce or eliminate the 1% tax deducted at source (TDS) proposed on the proceeds of all crypto transactions, as the Finance Bill will be approved in the Parliament session that commenced Monday.

Top crypto players are taking up the demand with the ministry through the Blockchain and Crypto Assets Council (BACC), which is part of the Internet and Mobile Association of India, and startup industry body IndiaTech.

Crypto platforms that are members of the BACC have recommended that the proposed TDS be reduced to about 0.01%.

Meanwhile, startup industry body IndiaTech has written to finance minister Nirmala Sitharaman and revenue secretary Tarun Bajaj, requesting to eliminate the TDS entirely or to bring it down to 0.01%.

Influencer-led social commerce startup Trell, which is under investigation for alleged financial irregularities, is looking to lay off hundreds of employees amidst growing uncertainty about the implications of the probe, people with knowledge of the development said.

"The company has begun to fire people with immediate effect," one of these people said. It was not immediately clear how many employees would be fired.

A Trell spokesperson said, "... the board has decided to focus on a few core initiatives and strengthen our systems and processes before we plan to raise the next round of funding. “Unfortunately, this also means that we will have to do some right-sizing within the firm. This can entail some roles getting redundant while there will be new roles that will also be added."

EY submits interim report: ET was the first to report about an ongoing investigation into the company's books of accounts on March 12. A forensic team from EY India has now submitted an interim report, four sources with direct knowledge of the matter said.

Trell’s board of directors is likely to act on the EY report over the next few weeks, they added.

$100 million venture fund for AI, robotics startups: AI & Robotics Technology Park (ARTPARK), promoted by the Indian Institute of Science (IISc), Bengaluru, said it is in the process of launching a $100 million venture fund. The CEO of ARTPARK, Umakant Soni, told ET in an interview that the venture fund is expected to be launched formally by the end of this month based on SEBI approval, and deployment of funds will probably begin by May or June.

Dassault Systemes to up local job creation: Dassault Systemes has increased its India headcount by more than 25% over the last two years and intends to further double this in the next five years, a senior executive said. India is a strong research and development base as well as an important market for the French engineering technology firm, Samson Khaou, executive vice president - APAC, told ET.

■ Tencent faces possible record fine for anti-money-laundering violations (WSJ)

■ Russian influencers take stock after Instagram access blocked (The Guardian)

■ In Ukraine’s cyber-war with Russia, who is a civilian and what is a war crime? (Rest of World)

Today’s ETtech Morning Dispatch was curated by Zaheer Merchant in Mumbai and Judy Franko in New Delhi. Graphics and illustrations by Rahul Awasthi.

Also in this letter:

■ RBI to set terms of Paytm Payments Bank audit

■ Tatas to launch ‘super app’ in April with IPL push

■ 700 crypto investors will get notices, says I-T Dept

SoftBank in investment talks with Tatas, Mahindra: Rajeev Misra

Japan’s SoftBank has held discussions with the Tata group and the Mahindras for a potential investment, Rajeev Misra, CEO of SoftBank Investment Advisers, which manages SoftBank Vision Fund, told us in an interview at the ET Global Business Summit on Monday.

The discussions have been going on for six months, he said. The Tatas have been in talks with global investors, including some sovereign and pension money managers, to fund its digital foray, as ET reported earlier.

Misra also spoke about the rebalancing of private tech valuation amid a broader slump in the public markets and the overall macro concerns. Here are some edited excerpts from the interview.

The year has started with so much uncertainty. Is a global downturn around the corner?

Last October saw the peak in tech stocks, after which investors started worrying about inflation and the Fed said it would taper the bond buybacks faster. So we had a one-and-a-half-year liquidity boom from May 2020 to October 2021. But it’s nothing like the 2008 crisis because the banks and the financial system are in good shape.

Are you looking at digital assets of conglomerates like Tata Digital?

We are speaking to a couple of conglomerates [such as] Tata and Mahindra, which have amazing offline reach and amazing brands. They don't have to spend on customer acquisition because they have consumers across all their platforms. It will come down to two things: the valuation and how independent and aligned the management is.

Is an investment imminent?

We have been working on it for six months.

RBI to set terms of Paytm Payments Bank audit

The Reserve Bank of India will set the terms of reference for an independent technology audit of Paytm Payments Bank after it was barred from onboarding new customers for allegedly violating customer acquisition and privacy rules which may have resulted in data flowing to Chinese companies, two people familiar with the matter told us.

Paytm founder Vijay Shekhar Sharma denied a media report that alleged data sharing with Chinese entities may have led to the regulatory curbs.

What’s next? Over the next few days, Paytm Payments Bank will submit the names of potential auditors to the RBI, after which the regulator may finalise the terms of reference based on its findings, our sources said.

Quote: "The payments bank did not plug the gaps in the system even after repeated references by the regulator. There were consistent deficiencies found in the bank's KYC process… [for instance] accounts that needed full KYC were not done,’’ said one of the people cited above. “All in all, compliance was either pending or unsatisfactory."

VSS denies China allegation: Paytm’s founder, billionaire and majority shareholder Vijay Shekhar Sharma, denied allegations that Paytm Payments Bank shared its customers’ data with Chinese companies.

"I want to inform and confirm that in various observations RBI has shared with Paytm Payments Bank, there is absolutely no reference to any data sharing or servers being outside or data sharing with any unauthorised personnel national or international – any country whatsoever," Sharma said. On Monday, Bloomberg reported, citing a source, that the RBI had punished Paytm Payments Bank for leaking data to Chinese entities.

Paytm stock plunges 13%: Shares of Paytm’s parent firm One97 Communications plunged more than 13% to hit an all-time low of Rs 661.50 on March 14. The stock closed the day at Rs 680.40 on NSE, down 12.21%.

TWEET OF THE DAY

Tatas plan to launch ‘super app’ in April with IPL marketing push

After piloting its ‘super app’ among employees over the past many months, the Tata group is gearing up to the much-delayed app, called Tata Neu, next month. The launch will be accompanied by an aggressive marketing push around the Indian Premier League (IPL), multiple sources told us.

The company is expected to officially announce Tata Neu's launch to consumers on April 7, they added.

Tata Neu has been struggling with delays, the last one being in Diwali. ET reported in December that technical issues around integrating various platforms on Tata Neu had pushed the launch to at least March.

Tata group’s top assets like online grocer BigBasket, epharmacy 1mg, electronics focused retailer Croma, flight booking services across Tata group airlines including Air Asia and Vistara and Tata Cliq (which sells products across Tata companies such as Titan and Tanishq) are now fully integrated on Tata Neu now, these people said. Westside and Starbucks are on board.

Undeclared crypto transactions of 700 users under IT scanner

High-value crypto transactions of about 700 investors are under the scanner of the income tax department, which now plans to issue notices to them. These individuals or entities could face a 30% tax, plus penalties and interest.

Income tax officials said most of these cases involved users who have either not mentioned their crypto gains in tax returns or haven’t filed returns at all.

Officials added that there are instances where gains have exceeded Rs 40 lakh, yet the user has either not filed returns or filed returns with zero income.

“We have a long list of people who were transacting in crypto assets but not paying tax. Initially, (we) have shortlisted about 700 transactions where tax liability is very high,” a senior Central Board of Direct Taxation (CBDT) official told ET.

Who’s on the list? Apart from high net-worth individuals (HNIs), non-resident Indians (NRIs) and startups, the list also includes students and housewives who have never filed returns. The department is also examining whether their names had been used by others to evade tax.

In her February 1 budget, finance minister Nirmala Sitharaman proposed a 30% tax on capital gains from crypto currencies, crypto assets from the next fiscal year. The budget further stated that a flat tax would apply irrespective of how long an individual has possessed the virtual digital asset.

Taxing issue: The crypto industry has reached out to the finance ministry, seeking to either reduce or eliminate the 1% tax deducted at source (TDS) proposed on the proceeds of all crypto transactions, as the Finance Bill will be approved in the Parliament session that commenced Monday.

Top crypto players are taking up the demand with the ministry through the Blockchain and Crypto Assets Council (BACC), which is part of the Internet and Mobile Association of India, and startup industry body IndiaTech.

Crypto platforms that are members of the BACC have recommended that the proposed TDS be reduced to about 0.01%.

Meanwhile, startup industry body IndiaTech has written to finance minister Nirmala Sitharaman and revenue secretary Tarun Bajaj, requesting to eliminate the TDS entirely or to bring it down to 0.01%.

Trell to lay off hundreds of employees amid probe

Influencer-led social commerce startup Trell, which is under investigation for alleged financial irregularities, is looking to lay off hundreds of employees amidst growing uncertainty about the implications of the probe, people with knowledge of the development said.

"The company has begun to fire people with immediate effect," one of these people said. It was not immediately clear how many employees would be fired.

A Trell spokesperson said, "... the board has decided to focus on a few core initiatives and strengthen our systems and processes before we plan to raise the next round of funding. “Unfortunately, this also means that we will have to do some right-sizing within the firm. This can entail some roles getting redundant while there will be new roles that will also be added."

EY submits interim report: ET was the first to report about an ongoing investigation into the company's books of accounts on March 12. A forensic team from EY India has now submitted an interim report, four sources with direct knowledge of the matter said.

Trell’s board of directors is likely to act on the EY report over the next few weeks, they added.

Other Top Stories By Our Reporters

$100 million venture fund for AI, robotics startups: AI & Robotics Technology Park (ARTPARK), promoted by the Indian Institute of Science (IISc), Bengaluru, said it is in the process of launching a $100 million venture fund. The CEO of ARTPARK, Umakant Soni, told ET in an interview that the venture fund is expected to be launched formally by the end of this month based on SEBI approval, and deployment of funds will probably begin by May or June.

Dassault Systemes to up local job creation: Dassault Systemes has increased its India headcount by more than 25% over the last two years and intends to further double this in the next five years, a senior executive said. India is a strong research and development base as well as an important market for the French engineering technology firm, Samson Khaou, executive vice president - APAC, told ET.

Global Picks We Are Reading

■ Tencent faces possible record fine for anti-money-laundering violations (WSJ)

■ Russian influencers take stock after Instagram access blocked (The Guardian)

■ In Ukraine’s cyber-war with Russia, who is a civilian and what is a war crime? (Rest of World)

Today’s ETtech Morning Dispatch was curated by Zaheer Merchant in Mumbai and Judy Franko in New Delhi. Graphics and illustrations by Rahul Awasthi.

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Morning Dispatch

We'll soon meet in your inbox.