Business News›Tech›Newsletters›Tech Top 5›Jefferies bullish despite Zomato freefall; Indian IT firms are biggest post-pandemic winners

Daily Top 5 Daily Top 5 |

Jefferies bullish despite Zomato freefall; Indian IT firms are biggest post-pandemic winners

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Daily Top 5

We'll soon meet in your inbox.

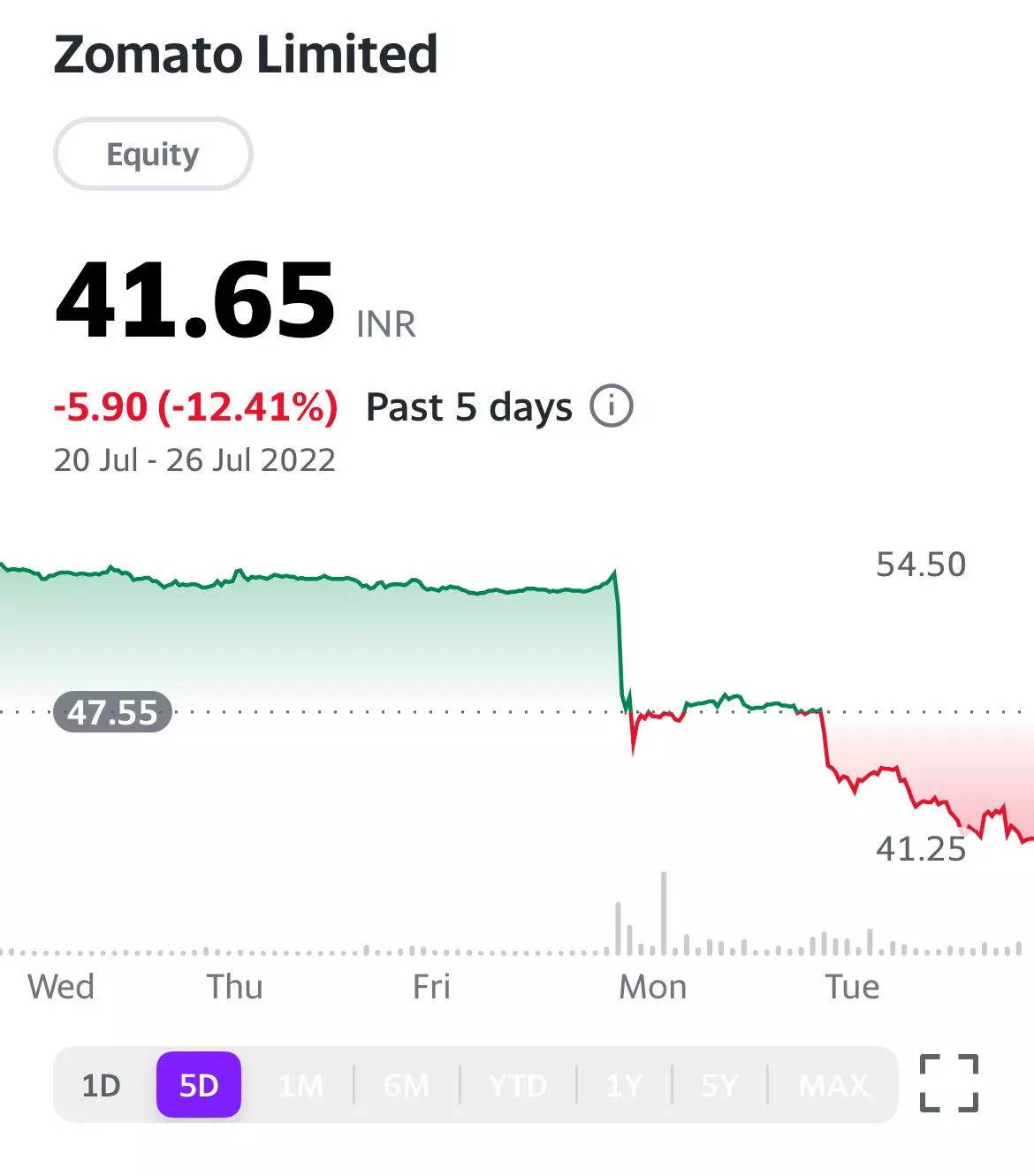

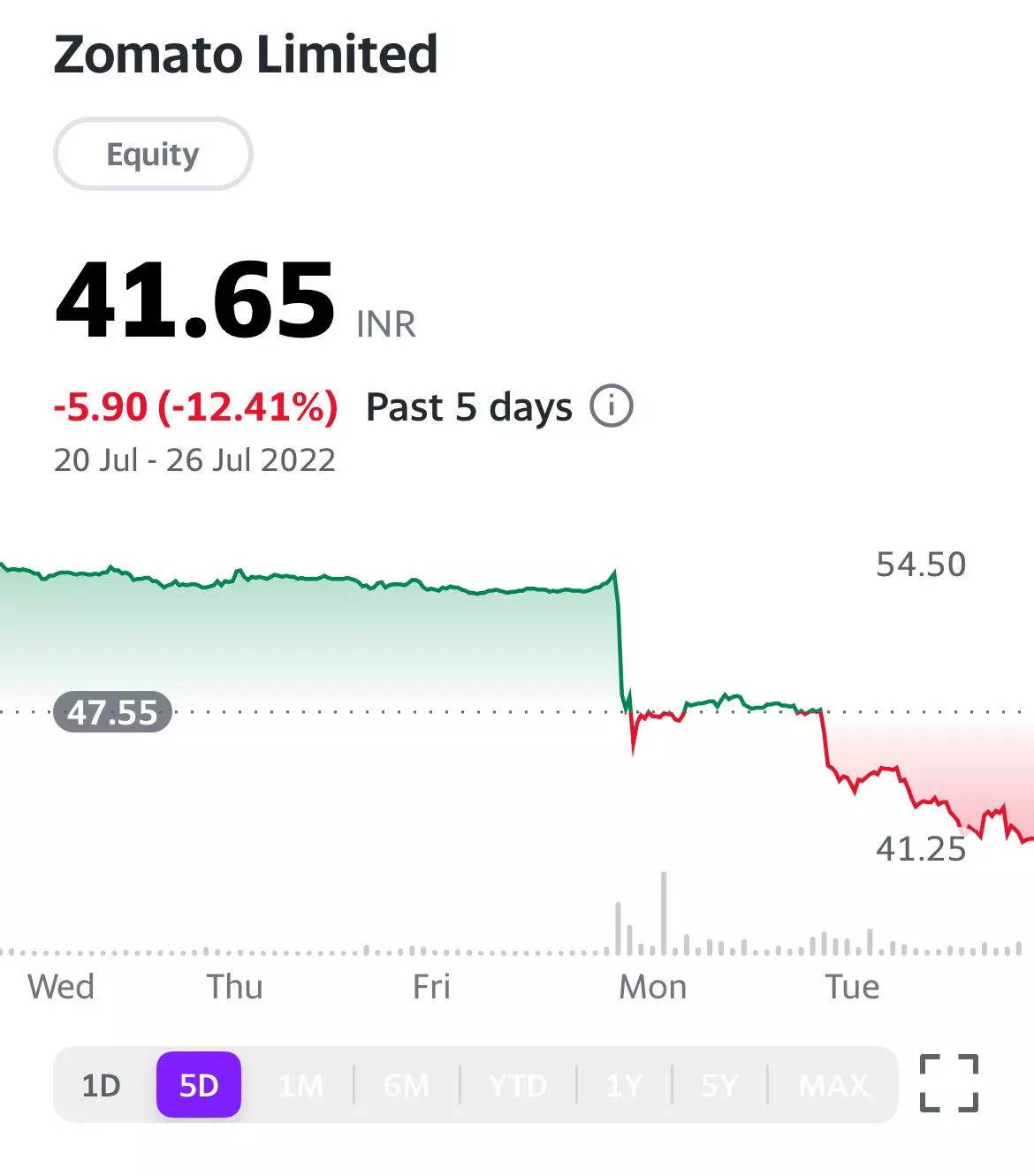

Zomato’s shares have lost almost a quarter of their value in two days. After dropping more than 11% on Monday, the stock shed more than 12% on Tuesday to close the day at Rs 41.65 on BSE. Despite the freefall, brokerage firm Jefferies remains bullish on the stock, with a target price of Rs 100. Other analysts are less exuberant and advise retail traders to stay away.

Credit: Giphy

Credit: Giphy

Also in this letter:

■ Indian IT firms win half of top 10 deals since 2020

■ Alibaba set to apply for dual primary listing in Hong Kong

■ SEC investigates Coinbase over cryptocurrency listings

Shares of food delivery platform Zomato fell more than 12% on Tuesday after dropping more than 11% the previous day. The mandatory lock-in period for pre-IPO shareholders expired on Saturday, a year after the company listed on the stock exchanges, leading to fervent selling.

The stock closed the day at Rs 41.65 on BSE, down 12.41%. It closed at Rs 54 last Friday, which means it has shed a jaw-dropping 23% over the past two days.

Credit: Yahoo Finance

Credit: Yahoo Finance

Despite a blockbuster listing last year, Zomato has underperformed its peers and is in fact India's worst-performing internet stock, down 70% since the start of the year.

Yet, but: Brokerage firm Jefferies remains bullish on the stock as it believes Zomato’s management has accelerated its journey towards better unit economics. It has a target price of Rs 100 on the stock, indicating an upside of 125%.

"Blinkit acquisition elongates the path to profitability and despite management guidance on a break-even in food delivery, investors are not giving much benefit of doubt," it added. "Night is darkest just before dawn."

Others differ: Other analysts were less exuberant. Mohit Nigam of Hem Securities said, "We do not recommend any fresh entries before any new positive trigger."

Rajnath Yadav, a research analyst at Choice Broking, said large investors with high risk appetites could consider the stock, adding it was not suitable for retail investors.

Grover trolls firm: Ashneer Grover, former managing director of BharatPe, trolled Zomato as its shares crashed for the second straight day. He said Blinkit had delivered misery to Zomato in 10 minutes, and that the company’s shares would have risen to Rs 450 if it had merged with Swiggy instead.

As recently as May, Grover had hinted that buying Zomato shares wouldn't be a bad idea. On May 9, he tweeted, “At Rs 56 per share, markets are giving everyone Esops (employee stock options)."

Also Read: Twitter-govt hearing in K’taka High Court adjourned to August 25

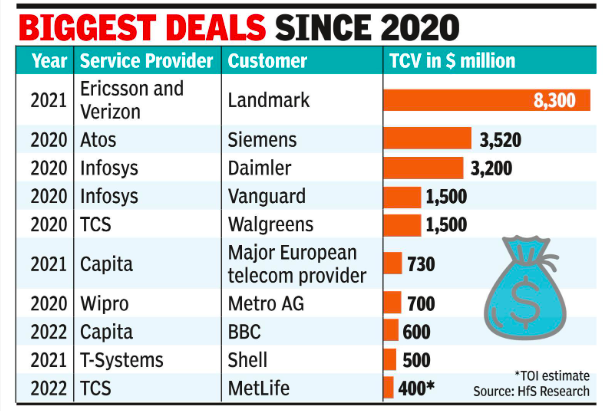

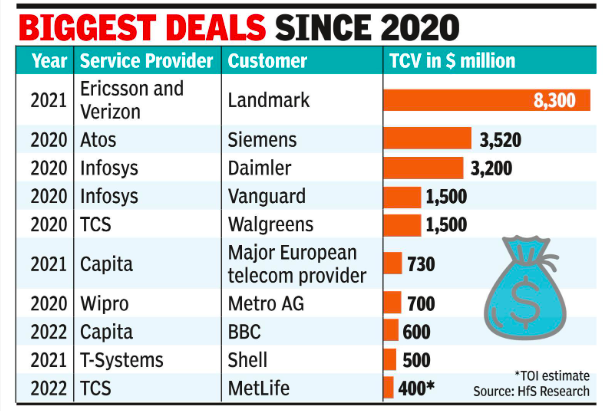

Indian IT firms have been among the biggest beneficiaries of deal consolidations in the sector in the past two years. At least half of the top global deals were snagged by Indian IT players, according to data from HfS Research.

Big fish: The data shows Infosys won a $3.2 billion deal from Daimler and a $1.5 billion deal from Vanguard.

Phil Fersht, CEO of HfS Research, said consolidation deals are usually contract renewals where services are consolidated under a smaller number of providers. Many customers are moving away from a long tail of service providers to sharpen service offerings and accountability, besides trusting IT partners who can take out dollars from the run-the-business side, and pour the cost savings into new digital initiatives.

Mega deals are often margin dilutive initially, but Indian IT firms have cost optimisation and operational levers to make it margin accretive over the long tenure of the deal.

TCS is said to have recently further consolidated its business in MetLife, winning a larger pie from other IT players, including some part of the business from Cognizant. TCS CEO Rajesh Gopinathan said in the June quarter commentary it had won two $400 million deals in the quarter, both of which resulted from a massive consolidation exercise.

China’s ecommerce giant Alibaba is set to apply for a dual primary listing in Hong Kong amid growing scrutiny of Chinese tech companies worldwide. Alibaba had listed on the New York Stock Exchange in 2014, in what was the largest IPO in history at the time.

The company seeks to complete the listing by the end of this year, with chief executive Daniel Zhang claiming a dual listing would help it foster a “wider and more diversified investor base”.

Rule tweak: Alibaba’s move for a dual listing comes after the Hong Kong Stock Exchange allowed Chinese companies with weighted voting rights or variable interest entities to carry out dual primary listings in the city in January.

Meanwhile, its annual report revealed that seven Ant executives, including CEO Eric Jing, have stepped down from Alibaba Partnership as both companies seek to go their separate ways owing to regulatory pressure.

The US Securities and Exchange Commission is investigating Coinbase over whether it allowed Americans to trade digital assets that should have been registered as securities, reports Bloomberg.

Insider trading arrest: A few days ago, the SEC had launched a probe and arrested former Coinbase product manager, Ishan Wahi over alleged insider trading. Wahi was charged along with his brother Nikhil with leaking information about nearly 25 crypto tokens before they were listed on Coinbase. Nine of the tokens were identified as securities.

Tough year: Coinbase has had a tough year so far, having laid off nearly 18% of its workforce amidst a “crypto winter” and seen a plunge in trading volumes. The company’s stock is down over 70% from the start of the year.

Funding continues: Meanwhile, despite the crypto winter, startups continue to attract VC funding. According to Pitchbook, VCs have poured about $17.5 billion into crypto startups so far this year, putting them on track to surpass last year’s funding record of $26.9 billion.

"The current market conditions – I don't think they faze investors. The capital available is massive,” said Roderik van der Graf, founder of Hong Kong investment firm Lemniscap.

Immigrants have founded more than half of America’s unicorns, or startups valued at $1 billion or higher, with the highest number of such founders coming from India, revealed a new study by the National Foundation for American Policy (NFAP).

According to the study, 66 US unicorns were founded by Indian immigrants. Prominent names included Mohit Aron (Nutanix and Cohesity), Ashutosh Garg (Bloomreach and Eightfold.ai), Ajeet Singh (Nutanix and ThoughtSpot) and Jyoti Bansal (AppDynamics and Harness).

The study, which underscores the importance of immigrants to the US economy, also found that almost 80% of America’s unicorn companies have an immigrant founder or an immigrant in a key leadership role, such as CEO or vice president of engineering.

“The research shows the importance of immigrants in cutting-edge companies and the US economy at a time when US immigration policies have pushed talent to other countries,” said Stuart Anderson, NFAP’s executive director.

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant in Mumbai and Ruchir Vyas in New Delhi. Graphics and illustrations by Rahul Awasthi.

Also in this letter:

■ Indian IT firms win half of top 10 deals since 2020

■ Alibaba set to apply for dual primary listing in Hong Kong

■ SEC investigates Coinbase over cryptocurrency listings

Jefferies bullish on Zomato even as stock sheds another 12%

Shares of food delivery platform Zomato fell more than 12% on Tuesday after dropping more than 11% the previous day. The mandatory lock-in period for pre-IPO shareholders expired on Saturday, a year after the company listed on the stock exchanges, leading to fervent selling.

The stock closed the day at Rs 41.65 on BSE, down 12.41%. It closed at Rs 54 last Friday, which means it has shed a jaw-dropping 23% over the past two days.

Despite a blockbuster listing last year, Zomato has underperformed its peers and is in fact India's worst-performing internet stock, down 70% since the start of the year.

Yet, but: Brokerage firm Jefferies remains bullish on the stock as it believes Zomato’s management has accelerated its journey towards better unit economics. It has a target price of Rs 100 on the stock, indicating an upside of 125%.

"Blinkit acquisition elongates the path to profitability and despite management guidance on a break-even in food delivery, investors are not giving much benefit of doubt," it added. "Night is darkest just before dawn."

Others differ: Other analysts were less exuberant. Mohit Nigam of Hem Securities said, "We do not recommend any fresh entries before any new positive trigger."

Rajnath Yadav, a research analyst at Choice Broking, said large investors with high risk appetites could consider the stock, adding it was not suitable for retail investors.

Grover trolls firm: Ashneer Grover, former managing director of BharatPe, trolled Zomato as its shares crashed for the second straight day. He said Blinkit had delivered misery to Zomato in 10 minutes, and that the company’s shares would have risen to Rs 450 if it had merged with Swiggy instead.

As recently as May, Grover had hinted that buying Zomato shares wouldn't be a bad idea. On May 9, he tweeted, “At Rs 56 per share, markets are giving everyone Esops (employee stock options)."

Also Read: Twitter-govt hearing in K’taka High Court adjourned to August 25

Indian IT firms win half of top 10 deals since 2020

Indian IT firms have been among the biggest beneficiaries of deal consolidations in the sector in the past two years. At least half of the top global deals were snagged by Indian IT players, according to data from HfS Research.

Big fish: The data shows Infosys won a $3.2 billion deal from Daimler and a $1.5 billion deal from Vanguard.

- TCS bagged a $1.5 billion deal from US retail and wholesale pharmacy major Walgreens Boots Alliance (WBA), and more recently a $2.3 billion deal from US consumer research firm Nielsen.

- Wipro won a $700 million contract from German wholesaler Metro.

Phil Fersht, CEO of HfS Research, said consolidation deals are usually contract renewals where services are consolidated under a smaller number of providers. Many customers are moving away from a long tail of service providers to sharpen service offerings and accountability, besides trusting IT partners who can take out dollars from the run-the-business side, and pour the cost savings into new digital initiatives.

Mega deals are often margin dilutive initially, but Indian IT firms have cost optimisation and operational levers to make it margin accretive over the long tenure of the deal.

TCS is said to have recently further consolidated its business in MetLife, winning a larger pie from other IT players, including some part of the business from Cognizant. TCS CEO Rajesh Gopinathan said in the June quarter commentary it had won two $400 million deals in the quarter, both of which resulted from a massive consolidation exercise.

Alibaba set to apply for dual primary listing in Hong Kong

China’s ecommerce giant Alibaba is set to apply for a dual primary listing in Hong Kong amid growing scrutiny of Chinese tech companies worldwide. Alibaba had listed on the New York Stock Exchange in 2014, in what was the largest IPO in history at the time.

The company seeks to complete the listing by the end of this year, with chief executive Daniel Zhang claiming a dual listing would help it foster a “wider and more diversified investor base”.

Rule tweak: Alibaba’s move for a dual listing comes after the Hong Kong Stock Exchange allowed Chinese companies with weighted voting rights or variable interest entities to carry out dual primary listings in the city in January.

Meanwhile, its annual report revealed that seven Ant executives, including CEO Eric Jing, have stepped down from Alibaba Partnership as both companies seek to go their separate ways owing to regulatory pressure.

Tweet of the day

SEC investigates Coinbase over cryptocurrency listings

The US Securities and Exchange Commission is investigating Coinbase over whether it allowed Americans to trade digital assets that should have been registered as securities, reports Bloomberg.

Insider trading arrest: A few days ago, the SEC had launched a probe and arrested former Coinbase product manager, Ishan Wahi over alleged insider trading. Wahi was charged along with his brother Nikhil with leaking information about nearly 25 crypto tokens before they were listed on Coinbase. Nine of the tokens were identified as securities.

Tough year: Coinbase has had a tough year so far, having laid off nearly 18% of its workforce amidst a “crypto winter” and seen a plunge in trading volumes. The company’s stock is down over 70% from the start of the year.

Funding continues: Meanwhile, despite the crypto winter, startups continue to attract VC funding. According to Pitchbook, VCs have poured about $17.5 billion into crypto startups so far this year, putting them on track to surpass last year’s funding record of $26.9 billion.

"The current market conditions – I don't think they faze investors. The capital available is massive,” said Roderik van der Graf, founder of Hong Kong investment firm Lemniscap.

India is top country of origin for immigrant-founded US unicorns: study

Immigrants have founded more than half of America’s unicorns, or startups valued at $1 billion or higher, with the highest number of such founders coming from India, revealed a new study by the National Foundation for American Policy (NFAP).

According to the study, 66 US unicorns were founded by Indian immigrants. Prominent names included Mohit Aron (Nutanix and Cohesity), Ashutosh Garg (Bloomreach and Eightfold.ai), Ajeet Singh (Nutanix and ThoughtSpot) and Jyoti Bansal (AppDynamics and Harness).

The study, which underscores the importance of immigrants to the US economy, also found that almost 80% of America’s unicorn companies have an immigrant founder or an immigrant in a key leadership role, such as CEO or vice president of engineering.

“The research shows the importance of immigrants in cutting-edge companies and the US economy at a time when US immigration policies have pushed talent to other countries,” said Stuart Anderson, NFAP’s executive director.

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant in Mumbai and Ruchir Vyas in New Delhi. Graphics and illustrations by Rahul Awasthi.

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Daily Top 5

We'll soon meet in your inbox.