Business News›Tech›Newsletters›Tech Top 5›Prosus reports strong growth in India; ASCI flags over 400 crypto ads in five months

Daily Top 5 Daily Top 5 |

Prosus reports strong growth in India; ASCI flags over 400 crypto ads in five months

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Daily Top 5

We'll soon meet in your inbox.

Last year, Prosus NV invested more than $1.03 billion in various Indian startups, including Swiggy, Byju’s, Eruditus and Meesho. Now, the Dutch-listed arm of technology investor Naspers has reported strong growth in its Indian portfolio for FY22, driven by Swiggy, Byju’s, and its local fintech arm PayU India.

Credit: Giphy

Credit: Giphy

Also in this letter:

■ Over 400 crypto ads violated ASCI guidelines in five months

■ PropShare raises $47 million, and other done deals

■ Zomato stock nosedives 6.6% after Blinkit deal

Prosus NV, the Dutch-listed arm of Naspers, said it has seen strong growth in its Indian portfolio, while announcing its results for the financial year 2021-2022 (FY22).

Foodtech: It said Swiggy contributed $212 million of its almost $3 billion food tech revenues. Overall losses for Prosus’ foodtech arm stood at $724 million in FY22, on account of its portfolio companies expanding into quick commerce.

Prosus holds a 33% stake in Swiggy and invested a total of $299 million in the foodtech major in FY22. According to Prosus, its share of Swiggy's revenue is calculated on the basis of Prosus' effective stake and the food-tech company’s revenue as of December last year, which is then multiplied for 12 months.

Also Read | Exclusive: Market opportunities justify money floating around for Indian startups, says Prosus group CEO

It also said Swiggy is seeing a 10-fold jump in daily orders on its quick commerce platform Instamart.

Also Read | Swiggy’s food delivery revenue grew 56% from April to Sept, Prosus says

Edtech: While Prosus remains bullish on quick commerce, it also said its overall revenues from edtech grew to $425 million in FY22 on account of increased demand for online learning among its portfolio entities.

It said its share of revenues from Byju’s grew almost 90% year-on-year, driven by market expansion and enhanced offerings from the Indian edtech company. Prosus currently holds a 10% stake in Byju’s.

Fintech: The global internet group also operates its fintech arm PayU in India. It said PayU India revenues stood at $304 million in FY22, driven by merchant diversification. Further, total payment value (TPV) clocked for the year in India grew 66% to $43.8 billion.

Last year, PayU announced its merger with payments firm BillDesk in a $4.7 billion deal. It is yet to be cleared by the Competition Commission of India (CCI) and PayU has filed a revised merger notification seeking the regulator's clearance.

Prosus/Naspers to sell Tencent shares: Meanwhile, Prosus NV will tap its huge stake in China's Tencent to fund a stock buyback in itself and parent Naspers, the Dutch firm said on Monday.

More than 400 crypto ads on social media violated the Advertising Standards Council of India’s (ASCI) guidelines in the first five months of 2022, the ad body has said.

Catch up quick: In February, ASCI issued guidelines for promoting crypto assets and crypto exchanges. The rules kicked in on April 1.

Details: Of the 453 complaints ASCI took up between January and May, 419 violated a mix of crypto and influencer guidelines, with the majority of the complaints involving ads by social media influencers.

Yes, but: ASCI is a self-regulatory body, and its guidelines are not legally binding. In case of a breach, it publishes the names of violators and escalates these cases to the relevant government regulator.

Bull run madness: Amid a bull market in 2021, crypto companies and influencers flooded social media and streaming platforms with ads and branded promotions.

Top crypto exchanges Coin DCX and CoinSwitch Kuber brought on board Bollywood stars Ayushmann Khurrana and Ranveer Singh for IPL ad campaigns as crypto companies spent an estimated Rs 50 crore during the tournament, as we reported last November.

At the time, financial and legal experts raised concerns about some of these ads, saying they towed a fine line between “puffery” and “misrepresentation”.

Critics said some of these ads could lure Indians into investing in an asset class notorious for wild price swings, and without any knowledge about the risks.

Painful crash: Crypto markets have since taken a beating, with bitcoin plummeting from an all-time high of about $69,000 in November 2021 to around $18,000 earlier this month.

Last week we reported that as the bears’ grip on the market tightens, Indian investors who succumbed to FOMO (fear of missing out) and invested in crypto assets in 2021 are faced with a choice—hang in for years to (hopefully) recoup their money or quit with heavy losses.

■ Proptech startup PropShare has secured Rs 367 crore ($47 million) in funding led by WestBridge Capital, with participation from existing investors Pravega Ventures. It will use the capital to scale its platform across geographies and real-estate asset classes.

■ Solv, a marketplace for small businesses, has raised $40 million in a round of funding led by Japan-headquartered SBI Holdings, with participation from SC Ventures, which has been an incubator and early-stage investor of the B2B digital marketplace. This round takes Solv’s total funding to nearly $80 million.

■ Electric vehicle (EV) battery swapping startup Battery Smart said it has raised $25 million in a funding round led by Tiger Global, with participation from Blume Ventures and Orios Ventures. The company said it would use the funds to expand to new territories, strengthen its technology, and build its team to continue scaling operations.

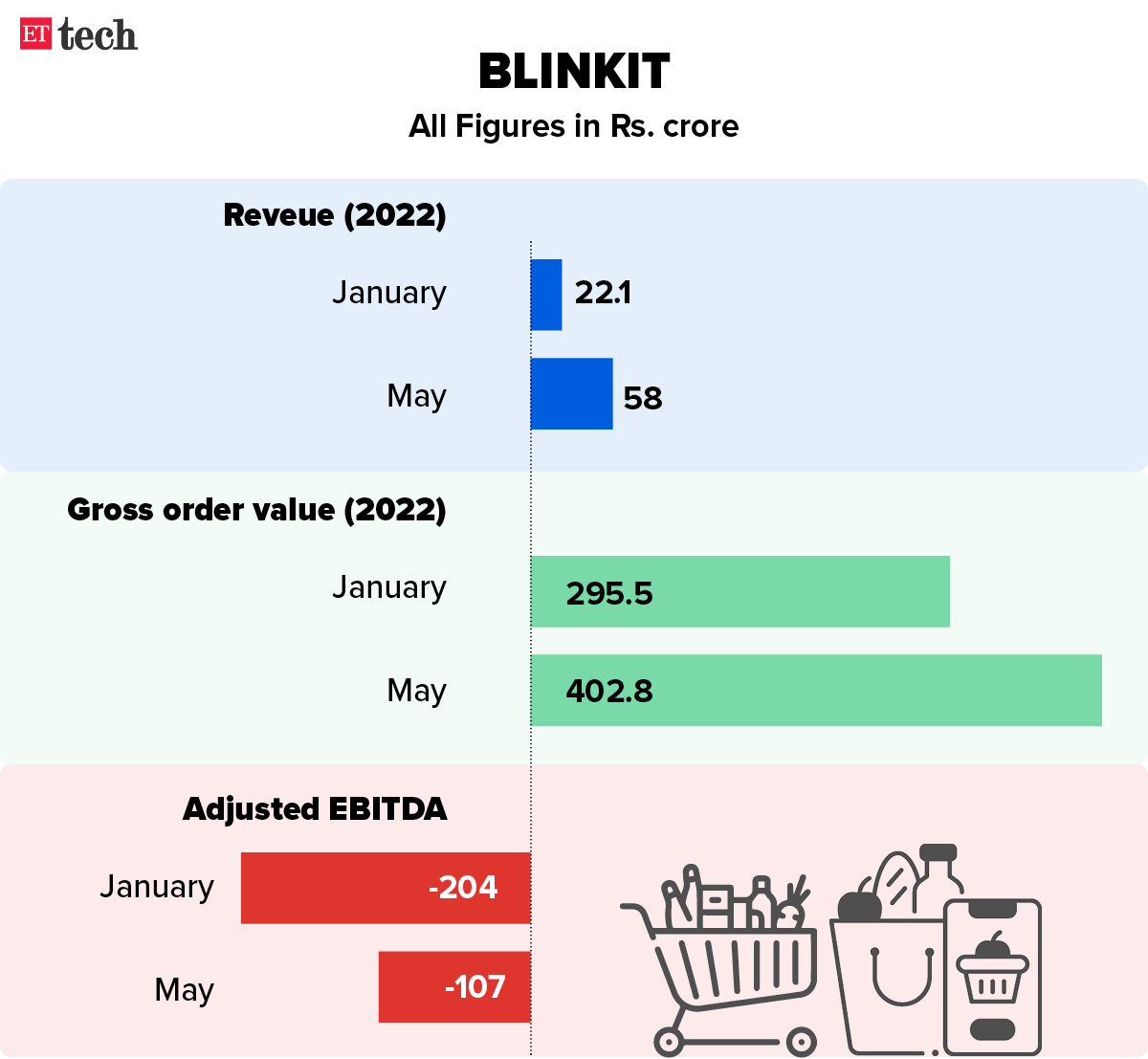

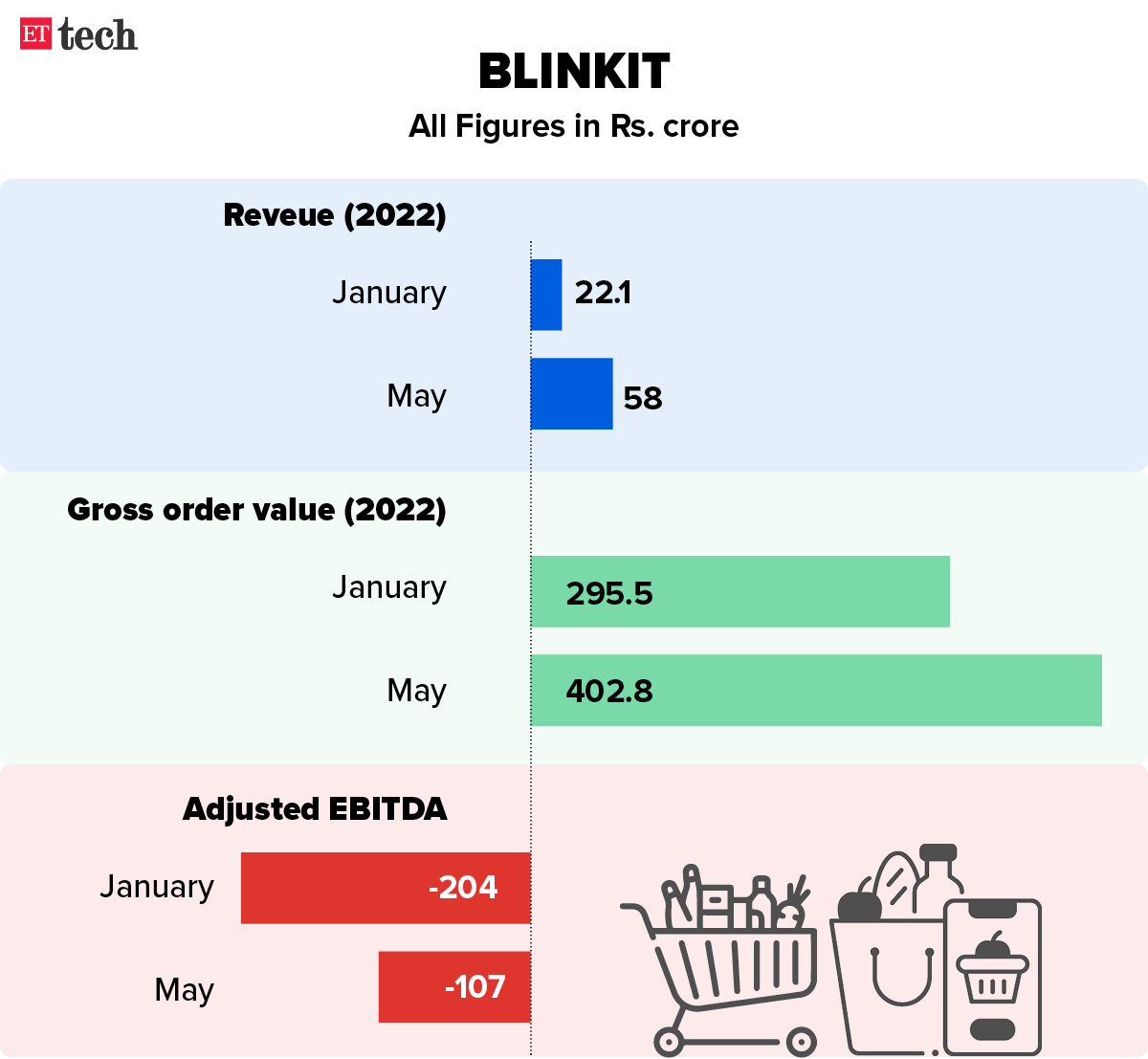

Shares of food delivery firm Zomato plummeted 7% in intraday trade and closed 6.60% down, two days after it acquired quick commerce startup Blinkit for Rs 4,447 crore in an all-stock deal. The transaction value was 40% lower than Blinkit’s last valuation of just over $1 billion.

Stock takes a dive: Zomato’s Rs 4,447-crore deal to buy Blinkit failed to lift the stock during Monday’s trading session. While the scrip did open in the green, 3.77% higher at Rs 72.65 on the BSE, it soon erased all the early-morning gains. The stock fell 6.60% to end the day at Rs 65.85 on both BSE and NSE.

Brokerages sceptical: “While management’s ‘educated guess’ is that Blinkit will break even at adjusted Ebitda level over the next three years, we are sceptical,” Edelweiss said.

It noted that Blinkit’s annualised cash burn stands at Rs 1,290 crore ($165 million) and the management expects it to remain well within the guided $400 million burn for the next two years.

Given the intense competitive intensity in the quick commerce space, JM Financial believes it may now take Zomato an additional year to become profitable.

Several states, including Maharashtra, Telangana, and Karnataka, Gujarat and Tamil Nadu had their officials visit Foxconn’s chief executive Young Liu during his visit to India last week.

What’s on offer: People present during Liu’s meeting with Indian state ministers and bureaucrats said the stream of officials arriving in Delhi “one after the other to talk to an investor (Foxconn), did not happen even when Tesla was looking to enter India”.

A senior bureaucrat who was part of his state’s delegation that met Liu said, “it was an opportunity to understand Foxconn’s priorities on its India manufacturing agenda, and their work plan.”

Foxconn to take over Ford factory? Tamil Nadu, where Foxconn currently operates manufacturing units for Apple iPhones and other brands such as Xiaomi, has suggested the Taiwanese major take over a 350-acre factory due to be shuttered by American car maker Ford.

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant in Mumbai and Gaurab Dasgupta in New Delhi. Graphics and illustrations by Rahul Awasthi.

Also in this letter:

■ Over 400 crypto ads violated ASCI guidelines in five months

■ PropShare raises $47 million, and other done deals

■ Zomato stock nosedives 6.6% after Blinkit deal

Swiggy, Byju’s, PayU drive ‘strong growth’ for Prosus in India

Prosus NV, the Dutch-listed arm of Naspers, said it has seen strong growth in its Indian portfolio, while announcing its results for the financial year 2021-2022 (FY22).

Foodtech: It said Swiggy contributed $212 million of its almost $3 billion food tech revenues. Overall losses for Prosus’ foodtech arm stood at $724 million in FY22, on account of its portfolio companies expanding into quick commerce.

Prosus holds a 33% stake in Swiggy and invested a total of $299 million in the foodtech major in FY22. According to Prosus, its share of Swiggy's revenue is calculated on the basis of Prosus' effective stake and the food-tech company’s revenue as of December last year, which is then multiplied for 12 months.

Also Read | Exclusive: Market opportunities justify money floating around for Indian startups, says Prosus group CEO

It also said Swiggy is seeing a 10-fold jump in daily orders on its quick commerce platform Instamart.

Also Read | Swiggy’s food delivery revenue grew 56% from April to Sept, Prosus says

Edtech: While Prosus remains bullish on quick commerce, it also said its overall revenues from edtech grew to $425 million in FY22 on account of increased demand for online learning among its portfolio entities.

It said its share of revenues from Byju’s grew almost 90% year-on-year, driven by market expansion and enhanced offerings from the Indian edtech company. Prosus currently holds a 10% stake in Byju’s.

Fintech: The global internet group also operates its fintech arm PayU in India. It said PayU India revenues stood at $304 million in FY22, driven by merchant diversification. Further, total payment value (TPV) clocked for the year in India grew 66% to $43.8 billion.

Last year, PayU announced its merger with payments firm BillDesk in a $4.7 billion deal. It is yet to be cleared by the Competition Commission of India (CCI) and PayU has filed a revised merger notification seeking the regulator's clearance.

Prosus/Naspers to sell Tencent shares: Meanwhile, Prosus NV will tap its huge stake in China's Tencent to fund a stock buyback in itself and parent Naspers, the Dutch firm said on Monday.

Over 400 crypto ads violated ASCI guidelines in five months

More than 400 crypto ads on social media violated the Advertising Standards Council of India’s (ASCI) guidelines in the first five months of 2022, the ad body has said.

Catch up quick: In February, ASCI issued guidelines for promoting crypto assets and crypto exchanges. The rules kicked in on April 1.

Details: Of the 453 complaints ASCI took up between January and May, 419 violated a mix of crypto and influencer guidelines, with the majority of the complaints involving ads by social media influencers.

Yes, but: ASCI is a self-regulatory body, and its guidelines are not legally binding. In case of a breach, it publishes the names of violators and escalates these cases to the relevant government regulator.

Bull run madness: Amid a bull market in 2021, crypto companies and influencers flooded social media and streaming platforms with ads and branded promotions.

Top crypto exchanges Coin DCX and CoinSwitch Kuber brought on board Bollywood stars Ayushmann Khurrana and Ranveer Singh for IPL ad campaigns as crypto companies spent an estimated Rs 50 crore during the tournament, as we reported last November.

At the time, financial and legal experts raised concerns about some of these ads, saying they towed a fine line between “puffery” and “misrepresentation”.

Critics said some of these ads could lure Indians into investing in an asset class notorious for wild price swings, and without any knowledge about the risks.

Painful crash: Crypto markets have since taken a beating, with bitcoin plummeting from an all-time high of about $69,000 in November 2021 to around $18,000 earlier this month.

Last week we reported that as the bears’ grip on the market tightens, Indian investors who succumbed to FOMO (fear of missing out) and invested in crypto assets in 2021 are faced with a choice—hang in for years to (hopefully) recoup their money or quit with heavy losses.

Tweet of the day

ETtech Done Deals

■ Proptech startup PropShare has secured Rs 367 crore ($47 million) in funding led by WestBridge Capital, with participation from existing investors Pravega Ventures. It will use the capital to scale its platform across geographies and real-estate asset classes.

■ Solv, a marketplace for small businesses, has raised $40 million in a round of funding led by Japan-headquartered SBI Holdings, with participation from SC Ventures, which has been an incubator and early-stage investor of the B2B digital marketplace. This round takes Solv’s total funding to nearly $80 million.

■ Electric vehicle (EV) battery swapping startup Battery Smart said it has raised $25 million in a funding round led by Tiger Global, with participation from Blume Ventures and Orios Ventures. The company said it would use the funds to expand to new territories, strengthen its technology, and build its team to continue scaling operations.

Zomato stock nosedives 6.6% after Blinkit deal

Shares of food delivery firm Zomato plummeted 7% in intraday trade and closed 6.60% down, two days after it acquired quick commerce startup Blinkit for Rs 4,447 crore in an all-stock deal. The transaction value was 40% lower than Blinkit’s last valuation of just over $1 billion.

Stock takes a dive: Zomato’s Rs 4,447-crore deal to buy Blinkit failed to lift the stock during Monday’s trading session. While the scrip did open in the green, 3.77% higher at Rs 72.65 on the BSE, it soon erased all the early-morning gains. The stock fell 6.60% to end the day at Rs 65.85 on both BSE and NSE.

Brokerages sceptical: “While management’s ‘educated guess’ is that Blinkit will break even at adjusted Ebitda level over the next three years, we are sceptical,” Edelweiss said.

It noted that Blinkit’s annualised cash burn stands at Rs 1,290 crore ($165 million) and the management expects it to remain well within the guided $400 million burn for the next two years.

Given the intense competitive intensity in the quick commerce space, JM Financial believes it may now take Zomato an additional year to become profitable.

States compete to land Foxconn’s EV factory

Several states, including Maharashtra, Telangana, and Karnataka, Gujarat and Tamil Nadu had their officials visit Foxconn’s chief executive Young Liu during his visit to India last week.

What’s on offer: People present during Liu’s meeting with Indian state ministers and bureaucrats said the stream of officials arriving in Delhi “one after the other to talk to an investor (Foxconn), did not happen even when Tesla was looking to enter India”.

A senior bureaucrat who was part of his state’s delegation that met Liu said, “it was an opportunity to understand Foxconn’s priorities on its India manufacturing agenda, and their work plan.”

Foxconn to take over Ford factory? Tamil Nadu, where Foxconn currently operates manufacturing units for Apple iPhones and other brands such as Xiaomi, has suggested the Taiwanese major take over a 350-acre factory due to be shuttered by American car maker Ford.

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant in Mumbai and Gaurab Dasgupta in New Delhi. Graphics and illustrations by Rahul Awasthi.

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Daily Top 5

We'll soon meet in your inbox.