INDIA INFLATION AIM

RBI aims to get inflation down to 4%, don't expect any rate cut this year: Amitabh Chaudhry, MD, Axis Bank

Axis Bank aims for sustained growth through NIM enhancement, market share expansion, and compliance strengthening under CEO Amitabh Chaudhry's leadership.

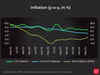

Budget 2024: A look at how India’s inflation panned out within a year before Sitharaman’s key announcements

Budget 2024 India Inflation Rate | Finance Minister Nirmala Sitharaman is set to unveil Budget 2024 amid a focus on India's inflation, a pivotal concern. With inflation easing to a 12-month low of 4.75% in May, the RBI aims for a sustainable 4% target. The budget will navigate challenges like food prices and global uncertainties, shaping economic policies for stability and growth.

India's GDP calculations set for an upgrade as MOSPI sets up panel to revise base year

The Ministry of Statistics and Programme Implementation (MoSPI) has formed a 26-member committee led by Biswantah Goldar to update the base year for national accounts, aiming to align key economic indices with current economic trends. This includes potentially shifting from the current base year of 2011-12 to 2020-21 for indices like the Wholesale Price Index (WPI), Producer Price Index (PPI), and Consumer Price Index (CPI).

Charting the global economy: Inflation ebbs in US, France, Spain

With inflation settling down in many European economies, there are signs that central banks in the areas could reduce interest rates.

Govt mulls more frequent job data surveys

India's Ministry of Statistics and Programme Implementation (MoSPI) is considering increasing the frequency of the Periodic Labour Force Survey (PLFS) from quarterly urban unemployment data to monthly, and shifting the release of rural employment data from annual to quarterly. Officials are also discussing revising the base year for gross domestic product (GDP) and inflation. These efforts aim to leverage technology to enhance efficiency and reduce data lag, ensuring compliance with international standards.

Fitch raises India's FY25 growth forecast but isn't that optimistic about global growth

Fitch Ratings has increased India's growth forecast for the current financial year to 7.2% from 7%, driven by rapid investment expansion. The Indian economy grew 7.8% in the last quarter of FY24 and 8.2% for the entire fiscal year. Fitch predicts sustained investment growth under Prime Minister Modi, a recovery in consumer spending, and declining inflation rates. The RBI is expected to make only a modest rate cut this year.

- Go To Page 1

India’s retail inflation eases to 12-month low of 4.75 per cent in May

India's retail inflation eased to 4.75% annually in May, slightly down from the 11-month low of 4.83% recorded in April, according to government data released on Wednesday. This inflation rate continues to fall within the Reserve Bank of India's (RBI) acceptable range of 2-6%

Domino's aims to double store count to 4,000 in India in 5-6 years

Domino's, the renowned American pizza chain, is poised to double its store count in India to 4,000 within the next 5-6 years. With the recent inauguration of its 2,000th store in India, Domino's has solidified its position as a major player in the Indian market, ranking second globally in operational stores and among the top five in revenue.

RBI MPC Meet 2024: RBI leaves inflation projection for FY25 unchanged at 4.5%

RBI MPC Meet 2024 LIVE: The Reserve Bank of India maintained its inflation forecast at 4.5% for this fiscal year amid concerns over rising food prices. The central bank found some relief as crude prices dipped below $80 per barrel. The RBI's Monetary Policy Committee kept the repo rate unchanged at 6.5% for the eighth consecutive time, citing vigilance against potential inflationary pressures. Governor Shaktikanta Das highlighted the uptick in vegetable prices and global food inflation. Despite a slight easing in overall retail inflation to 4.83%, concerns linger over food price hikes, particularly in items like garlic and ginger.

'Acche din' to continue for FD investors as high fixed deposit interest rates will not drop soon: All eyes on RBI MPC on June 7

The Reserve Bank of India (RBI) will likely keep the repo rate unchanged in the upcoming monetary policy committee review. The question now is how long will the high-FD rate regime continue. Also, what should be the best strategy for your short-term and long-term fixed deposits? ET Wealth Online spoke to experts and here's all you need to know.

BlackRock stays bullish on Indian bonds after narrow Modi win

Neeraj Seth, chief investment officer at BlackRock, predicts that India's fiscal consolidation under Modi's leadership will continue. Cooling inflation may lead the Reserve Bank of India to ease later this year, supporting the preference for longer duration bonds like the seven and 10 year ones.

Election Result 2024: Narendra Modi-led NDA wins world's largest elections, but there's a lot to brood over

Election Result 2024: The BJP-led National Democratic Alliance (NDA) is struggling to achieve the 400-seat target set by Prime Minister Narendra Modi in the 2024 Lok Sabha election. Falling short of the 272-seat majority mark, the BJP will need support from key allies like Chandrababu Naidu's TDP and Nitish Kumar's JD(U) to form the next government. Unemployment, inflation, inequality, farmers' protests, and concerns over a repressive government are major challenges for the new NDA coalition government.

Macro policy choices unclear, but work cut out on reforms agenda

In FY24, nominal GDP grew 9.6%, CPI inflation recorded 5.4%, and real GDP growth was estimated at 8.2%.

RBI unlikely to cut interest rate on June 7, say experts

The Reserve Bank of India is unlikely to cut the benchmark interest rate in its upcoming monetary policy review amid inflation challenges and improving economic growth. Scheduled for June 5-7, the Monetary Policy Committee (MPC) is expected to maintain the current 6.5% repo rate. Experts cite steady economic conditions and ongoing inflation concerns as reasons for maintaining the status quo

S&P Global to observe India's fiscal glidepath for ratings upgrade

S&P Global Ratings will monitor India's fiscal consolidation efforts over the next two years for a potential sovereign ratings upgrade. Despite raising the outlook to "positive," the rating remains "BBB-." Focus is on India's fiscal deficit reduction targets, fiscal discipline with RBI's surplus transfer, and its ability to manage inflation.

EU carbon tariff: India preps for a fight at WTO

India is considering challenging the European Union's Carbon Border Adjustment Mechanism (CBAM) at the World Trade Organization, which mandates non-EU steel producers to report emissions, impacting sectors like iron and steel, cement, and more.

Lok Sabha elections: What the new govt's road-ahead might look like

Vote counting is scheduled for June 4, and analysts anticipate Prime Minister Narendra Modi securing a third consecutive term.

Lok Sabha elections 2024: What women of Delhi want from their leaders

Women in Delhi actively participate in politics, with a voter turnout nearly matching men. Their influence includes perspectives, priorities, and life experiences. Concerns about safety, public facilities, affordable transport, inflation, and employment persist. Calls for increased economic opportunities and reforms in education are growing.

Bond buyback: Govt proposes, market disposes, over price

At a buyback auction of government bonds last week, the RBI accepted bids worth only ₹10,512.99 crore versus ₹40,000 crore worth of securities the government had offered to repurchase, with the central bank rejecting most bids.

Navigating economic horizons: RBI's role in FY 2024-2025

RBI's nuanced approach in FY 2024-2025 balances growth, inflation, and stability. Expect cautious yet proactive policy rates. Strategic reserves, global index inclusion, and fiscal discipline shape India's economic landscape.

Nestle India to focus on driving volume growth going forward: CMD Suresh Narayanan

Nestle India is also looking to increase its total touchpoints to 60 lakh across the country in the next 4-5 years, up from 51 lakh at present, Narayanan said while speaking to reporters here. "The future of consumer goods companies will rest on their capability to penetrate more households, with more products for more occasions and usage," he said, while stressing on the need to shore up volume.

RBI announces launch of 'inflation expectations' and 'consumer confidence' surveys for monetary policy inputs

The RBI has launched two new surveys, the 'Inflation Expectations Survey of Households' and the 'Consumer Confidence Survey,' ahead of its June monetary policy review. These surveys will gather insights crucial for monetary policy decisions. The 'Inflation Expectations Survey' will collect data on price changes and inflation expectations from households in 19 cities. Meanwhile, the 'Consumer Confidence Survey' will gather views on the general economic situation, employment, prices, income, and spending. Both surveys aim to provide a comprehensive understanding of economic trends and sentiments.

Centre aims to make India attractive destination for manufacturing, services: Nirmala Sitharaman

Union Finance Minister Nirmala Sitharaman emphasized the government's focus on policies to make India a manufacturing and investment hub, aiming not only for the domestic market but also for exports. Speaking on Elon Musk's postponed visit, Sitharaman highlighted the government's efforts to attract big companies. She also discussed inflation, employment, and the rule for larger companies to pay MSMEs within 45 days. Gujarat's role in attracting FDI and its readiness for semiconductor manufacturing were also highlighted.

India’s inflation almost flat at 5.1% in February; food inflation rises

:India’s headline inflation remained almost flat at 5.09% in February, compared with 5.1% in the previous month, prompting experts to believe that the Reserve Bank of India will hold interest rates steady at its next policy meeting in early April.

RBI MPC Policy: Reserve Bank leaves inflation projection for FY24 unchanged at 5.4%

RBI Monetary Policy: The Reserve Bank of India's Monetary Policy Committee today left interest rate target for the next fiscal year unchanged. India's policymakers implement measures to control inflation through monetary and fiscal interventions, export restrictions, and actions against hoarding. Finance Minister Nirmala Sitharaman recently stated that retail inflation is stable, thanks to government efforts to check price rise in perishable commodities.

India's economic triumph: A chronicle of the fastest-growing major economy

Indian economy: India showcases remarkable resilience, surging as the world's fastest-growing major economy, overtaking the UK to secure fifth place. Bolstered by a robust rebound from COVID-19 shocks, its GDP soared by 7.8%, hitting approximately Rs 40.37 trillion (USD 484.94 billion) in the initial quarter of fiscal year 2023. This growth heralds India's resurgence from the pandemic-induced downturn, shaping a promising economic trajectory ahead.

Monetary policy: RBI leaves inflation projection for FY24 unchanged at 5.4% amid food price concerns

RBI Monetary Policy Committee: The Reserve Bank of India left the inflation aim unchanged at 5.4%. In the August policy, the RBI had raised its FY24 inflation forecast to 5.4% from 5.1%.

Monetary policy: RBI leaves inflation projection for FY24 unchanged at 5.4%, but price pain remains major risk

RBI MPC Meeting: The Reserve Bank of India (RBI) has maintained its inflation forecast for the fiscal year at 5.4%, despite concerns over uneven monsoons and rising global crude oil prices. The RBI's Monetary Policy Committee has kept the key lending rate unchanged at 6.5%, with a focus on withdrawing accommodation. The inflation outlook is uncertain due to factors such as lower oil reserves, volatile global food and energy prices, and the impact of El Nino. The RBI aims to bring inflation down to 4% and will closely monitor risks, including global supply shocks.

Load More