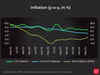

INFLATION RATE

RBI aims to get inflation down to 4%, don't expect any rate cut this year: Amitabh Chaudhry, MD, Axis Bank

Axis Bank aims for sustained growth through NIM enhancement, market share expansion, and compliance strengthening under CEO Amitabh Chaudhry's leadership.

Budget 2024: A look at how India’s inflation panned out within a year before Sitharaman’s key announcements

Budget 2024 India Inflation Rate | Finance Minister Nirmala Sitharaman is set to unveil Budget 2024 amid a focus on India's inflation, a pivotal concern. With inflation easing to a 12-month low of 4.75% in May, the RBI aims for a sustainable 4% target. The budget will navigate challenges like food prices and global uncertainties, shaping economic policies for stability and growth.

Rain deficit may spike food inflation further, warn experts

A note from Madhavi Arora, lead economist at Emkay Global Financial Services Ltd, said cumulative rainfall till June 21 was 17% below the long-term average (LTA), while the weekly rainfall (till June 19) was 33% below the LTA. Overall, basin-wise reservoir levels were in deficit and below last year's level as well. On June 20, the overall level was about 9% below the LTA and 19% below last year's level.

India's inflation also 'K-shaped'; rural folk more hurt by price-rise: HSBC

The government lent a helping hand by cutting several fuel prices but many of the fuels like petrol, diesel and LPG are not commonly used in rural areas, like they are in urban centres, leading to rural inflation being much higher than urban, it said.

Time to reset the 4% inflation target?

A scenario where real wages rise slowly may mitigate the impact of inflation surpassing its target on economic growth. Sustaining an 8% growth rate will require a resurgence in both consumption and investment. Any decline in consumption could adversely affect investment, prompting the RBI to exercise caution in reducing interest rates until inflation aligns with or falls below the target. If the economy can maintain higher growth rates at lower inflation levels, there may be a need to reconsider the inflation target. Structural shifts in the economy indicate that achieving this goal is increasingly feasible in the near future.

India can grow at 8 pc if inflation keeps falling: Ashima Goyal, an external member of MPC

Ashima Goyal, an external member of the Monetary Policy Committee, emphasized the potential for India's economy to grow at 8% if the nominal repo rate falls in line with declining inflation. The Reserve Bank of India has projected a GDP growth of 7.2% for the current fiscal year.

No rate cut seen in August either, but enough signs of a shift in stance

In the normal course of events, the rising dissent in the MPC should have led to more joining the camp of rate cut seekers as data turns benign. Inflation may not have come back to the 4% target, but it's not threatening to soar. For the US, it is at 3.4% in April when the target is 2%.

Upward GDP projection and no change in interest rates welcomed by industry and economists

Industry leaders and economists widely accepted RBI's monetary policy stand of no change in interest rates. Besides upward projection of GDP growth for FY25 from 7 per cent to 7.2 per cent is welcomed by the Industry.

RBI MPC to take call on policy action once 'slow-walking' inflation hits 4 per cent target durably

RBI MPC 2024: Shaktikanta Das, the Governor of the Reserve Bank of India (RBI), has reaffirmed the central bank's commitment to controlling inflation. In a statement on Friday, he emphasised that the Monetary Policy Committee's (MPC) goal is not only to achieve the 4 per cent inflation target but to maintain it steadily.

RBI MPC Meet 2024: RBI leaves inflation projection for FY25 unchanged at 4.5%

RBI MPC Meet 2024 LIVE: The Reserve Bank of India maintained its inflation forecast at 4.5% for this fiscal year amid concerns over rising food prices. The central bank found some relief as crude prices dipped below $80 per barrel. The RBI's Monetary Policy Committee kept the repo rate unchanged at 6.5% for the eighth consecutive time, citing vigilance against potential inflationary pressures. Governor Shaktikanta Das highlighted the uptick in vegetable prices and global food inflation. Despite a slight easing in overall retail inflation to 4.83%, concerns linger over food price hikes, particularly in items like garlic and ginger.

Electoral shock dashes hopes of rate cut

Food inflation challenges RBI, impacting rate cuts. Elections, populist spending, and fiscal landscape influence rate cut decisions.

Rising heat cools mfg PMI to 3-mth low as input costs bite

Manufacturing activity decreased to 57.5 in May from 58.8 in the previous month due to heatwaves and rising costs, as per a private survey by HSBC. The sector saw a softer rise in new orders and output, impacting work hours and production volumes for manufacturing firms.

S&P Global to observe India's fiscal glidepath for ratings upgrade

S&P Global Ratings will monitor India's fiscal consolidation efforts over the next two years for a potential sovereign ratings upgrade. Despite raising the outlook to "positive," the rating remains "BBB-." Focus is on India's fiscal deficit reduction targets, fiscal discipline with RBI's surplus transfer, and its ability to manage inflation.

India’s near-8% growth gives Modi a boost as elections end

India is expected to report close to 8% economic growth for the fiscal year ending in March, boosting Prime Minister Modi’s government as elections conclude. The growth in the first three months is predicted to be 7%, with the full year reaching 7.9%. The quarterly GDP release is eagerly awaited.

India's growth set to get more broad-based, says Morgan Stanley; pegs 6.8% for 2024

India's strong growth, driven by consumer and business spending, is expected to become more broad-based, according to Morgan Stanley. The global investment bank forecasts 6.8% growth in 2024, attributing it to global offshoring, digitalization, and energy transition. Retail inflation is at 4.83%, within RBI's comfort zone. S&P Global Ratings revised its outlook on India to positive, citing robust economic growth and fiscal policies.

Compensation gap between private & public sector widens in FY23

Total compensation of employees working with private corporations increased to 13.5% of the GDP in FY23 from 12.8% in the previous year while households, which largely represent the informal sector, saw their wages rise to the highest level in nine years to 8.5% of the GDP in FY23 from 8.4% in FY22.

GDP likely expanded 6.8% in Q4; FY24 print may hit 7.8%

The strong March quarter print could lift overall gross domestic product (GDP) growth for the full fiscal year to 7.8% against 7.6% assessed in the government's first advance estimates released in February. The International Monetary Fund (IMF) has also forecast 7.8% growth for FY24. The government will release fourth-quarter growth numbers and provisional GDP data for FY24 on May 31.

Due to demand-supply mismatches, pulses inflation to stay high till October: Experts

Experts caution on prolonged high pulse prices until new crop in October, impacting food inflation. In April, pulse inflation was 16.8%, with tur at 31.4%, gram at 14.6%, and urad at 14.3%. Government eases import restrictions, including duty-free lentils imports, to address production challenges.

Inflation eases further to an 11-month low of 4.83% in April, despite higher food inflation

India's inflation decreased to a low of 4.83% in April, which is the lowest in 11 months, compared to 4.85% in the previous month, due to a slight increase in food inflation caused by high vegetable and pulses prices.

Load More