UNION BUDGET 2023 KEY ANNOUNCEMENTS

Union Budget 2024 measures can upgrade India's supply chain in its bid to match up with China

BUDGET EXPECTATION: Finance Minister Nirmala Sitharaman, through Budget 2024, may introduce measures to strengthen India’s supply chain and manufacturing sector. This aligns with India’s strategic pivot to become a global manufacturing alternative to China. Under Prime Minister Modi's leadership, India has gained traction with infrastructure and logistics improvements, drawing multinational interest.

Budget 2024: Ahead of Sitharaman’s big announcement, a look at govt’s forex war chest to deal with external shocks

India Forex Reserve FY 2023-24 | Finance Minister Nirmala Sitharaman is set to present her seventh Budget in July 2024 amid robust economic indicators, including India's substantial foreign exchange reserves of nearly $654 billion. The Modi 3.0 government's first full budget comes amidst high capital inflows and resilient forex management, underscoring economic resilience and strategic fiscal planning

Budget 2024 should hike basic income tax exemption limit to Rs 5 lakh in both old and new tax regimes: Deloitte

Finance Minister Nirmala Sitharaman is likely to present Union Budget 2024 this month. Salaried taxpayers are eagerly waiting for some much-needed tax benefits from the upcoming Budget. According to Deloitte, salaried people want Finance Minister to revamp tax slab benefits, adjust HRA rates, incentivise EV sales, and promote affordable housing in Budget.

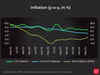

Budget 2024: A look at how India’s inflation panned out within a year before Sitharaman’s key announcements

Budget 2024 India Inflation Rate | Finance Minister Nirmala Sitharaman is set to unveil Budget 2024 amid a focus on India's inflation, a pivotal concern. With inflation easing to a 12-month low of 4.75% in May, the RBI aims for a sustainable 4% target. The budget will navigate challenges like food prices and global uncertainties, shaping economic policies for stability and growth.

India's economy: A-Z all you need to know before announcement of Union Budget

Union Budget will be announced by Finance Minister Nirmala Sitharaman in late July. The report covers key economic indicators, including India's GDP growth at 7.8% in Q4FY24, concerns over consumption expenditure, stable retail inflation at 4.7%, fiscal deficit reduction to 5.6% in FY24, and a narrowing trade deficit | Budget 2024

Outlay for export tax remission plans unlikely to change in Budget

The government is unlikely to increase the allocation for key tax remission schemes for exporters in the 2024-25 budget, despite demands for more support. In the interim budget, ₹16,575 crore was earmarked for the RoDTEP scheme and ₹9,246 crore for the RoSCTL scheme. Exporters argue for adequate allocation to maintain zero-rated exports, a government policy, as merchandise exports rose 5.1% year-on-year in the first two months of this fiscal.

- Go To Page 1

Make in India, the next season India planning a Budget day release

India has launched several initiatives to attract investments to the country, presenting itself as an alternative manufacturing destination to companies seeking a China+1 supply chain shift. The IT hardware and mobile phone programmes have seen success. The Centre is hopeful of a similar shift in other sectors as well and there is a view that PLI plus a lower corporate tax rate will offer investors a competitive return on investment.

States seek infra, rural push in pre-budget meet with FM Sitharaman

States presented demands for higher special assistance, increased allocations for rural schemes, and support for housing programmes to Finance Minister Nirmala Sitharaman in the pre-budget meeting. Sitharaman highlighted the Centre's aid to states through timely tax devolution and release of GST compensation arrears. Andhra Pradesh requested central funds for various projects and initiatives, including the development of Amaravati as its capital.

GST Council Meeting: Railway Platform tickets exempted from GST, biometric authentication push & other key decisions

At its 53rd meeting in New Delhi, the GST Council decided to implement nationwide biometric authentication to combat fake invoicing. Finance Minister Nirmala Sitharaman announced retrospective amendments to input tax credit timelines under the CGST Act from July 2017. The meeting, the first since the new government took office, also addressed various operational issues and recommended uniform GST rates for milk cans and carton boxes.

How is the Budget prepared: Insights and expectations for this year

The Indian Union Budget preparation is a meticulous process overseen by the Ministry of Finance (MoF), involving NITI Aayog and other ministries. It begins around August-September, culminating in the February 1 presentation, in a non-General Election year. Defined by Article 112 of the Constitution, it forecasts revenues and expenditures, balancing fiscal prudence with developmental goals through circular issuance, revenue scrutiny, stakeholder consultations, allocation decisions, and the symbolic Halwa Ceremony.

Budget wishlist from agriculture & MSMEs stakeholders: Sops, infra push, easy loans and PLI schemes

Stakeholders from the agricultural sector and MSMEs provided key suggestions to Finance Minister Nirmala Sitharaman during pre-budget consultations. Suggestions included rationalizing fertilizer subsidies, boosting agricultural infrastructure investment, and implementing employee-centric production-linked incentive schemes.

Union Budget: India mulls income tax cuts in Budget as part of $6 billion consumer boost

India Budget Tax Expectations: India's government under Prime Minister Narendra Modi is considering measures worth over 500 billion rupees to boost consumption in the upcoming budget. This includes tax cuts for lower income individuals for the first time in seven years. The plan aims to target consumers with high propensity to spend amidst economic challenges.

Budget 2024 FAQs: Quick guide on how to read and understand the Budget

Budget 2024 FAQs: The Budget acts as a detailed plan outlining the government's anticipated income and spending for a fiscal year, covering from April 1 to March 31 of the subsequent year. This financial blueprint is pivotal in defining the nation's economic priorities and allocating resources accordingly. After the finance minister delivers the budget speech in the Lok Sabha, these essential documents are promptly uploaded to the official website, ensuring quick and widespread access to critical financial information.

Hike capex by 25%, reduce GST slabs to maximum of 3 in Union Budget: FICCI tells Nirmala Sitharaman

Budget 2024: Industry lobby group FICCI in pre-budget consultation with Finance Minister Nirmala Sitharaman in Delhi emphasized the need to support growth momentum, infrastructure development, rein in food inflation, support MSMEs, and prioritize innovation and research & development for accelerated growth.

FAME-3 may get a budget-day release; Rs 10,000-crore outlay expected

Electric two, three, and four-wheelers are expected to be supported under the Faster Adoption & Manufacturing of Electric Vehicles (FAME) scheme, which could receive a budgetary allocation of about Rs 10,000 crore, people familiar with the deliberations told ET.

Modi 3.0: FMCG companies can cheer the new coalition government

In a symbolic move, Prime Minister Narendra Modi's first action after being sworn in for a third term was releasing the 17th PM-KISAN installment, providing financial relief to 9.3 crore farmers. With a weaker mandate, the government is expected to focus on rural welfare, potentially boosting FMCG sector growth and consumption.

Modi 3.0: Growth sequel starring jobs, investment

The full budget, likely to be presented early in July, will detail specific measures toward this end. "The focus would be to promote labour-intensive growth that will create jobs, with continued emphasis on macroeconomic stability," a top government official aware of the details told ET. A host of measures on startups and taxation - including inverted duty structure correction, along with GST rate rationalisation - is under discussion, said the person cited above.

Real estate sector pushes for tax rationalisation and reduced approval cost as Modi 3.0 set to take oath

With Narendra Modi set to take oath as Prime Minister for the third time, the real estate industry has high expectations from Modi 3.0. The interim budget announced a boost for affordable housing by adding 2 crore more houses to the PMAY-U scheme. Experts emphasize the need for policy reorientation, cost reductions, and tax rationalization to accelerate growth. Industry leaders stress the need for government intervention to drive further growth, including reforms in GST and revisiting affordable housing definitions.

Budget to indicate policy priorities of coalition govt, says Moody's

Moody's Analytics highlighted that the upcoming Union Budget will set policy priorities for the coalition government, shaping the next five years' growth trajectory.

Market will soon start acting and reacting to economic fundamentals

The unexpected election results and resulting uncertainty have triggered market jitters, reminiscent of similar situations in 2004 and 1991

Budget tries to find a counter to a potent weapon of the opposition

Finance Minister Nirmala Sitharaman's interim budget proposed a rooftop solar scheme called Pradhan Mantri Suryodaya Yojana, providing 300 units of free electricity per month to 10 million households. This scheme aims to save households Rs 15,000-18,000 annually and promote solar power generation. It also creates entrepreneurship and employment opportunities. The grid-connected rooftop solar system will reduce burden on electricity distribution companies, lower fossil fuel usage, and contribute to India's renewable energy goals of 500 GW by 2030 and 50% non-fossil fuel power generation capacity.

Budget 2024: Key announcements for different industries

In the Interim Budget for 2024, Finance Minister Nirmala Sitharaman presented key announcements for diverse industries, emphasizing growth and development. Highlights include continued expansion of airports and tourism projects, comprehensive support for dairy farmers, strategies for self-sufficiency in oilseeds, and a new scheme for deep-tech technology in the defence sector.

Interim Budget: Rs 1249 crore for salaries of union ministers, entertainment of guests, ex-governors

Interim Budget: The interim budget 2024-25 allocated a total of Rs 1,248.91 crore for expenses incurred by the council of ministers, cabinet secretariat, prime minister's office and other expenses, which is lower than the previous budget of Rs 1803.01 crore. Specifically, Rs 832.81 crore is allocated for the expenses of the council of ministers, while Rs 200 crore is allocated for the National Security Council Secretariat.

Key budget announcements in Modi 2.0's last financial document you can't miss

Key Budget Announcements: Finance Minister Sitharaman outlined initiatives for the next five years, including increased housing, expanded access to free electricity, and enhanced medical care, especially for women. Sitharaman pledged support for key sectors targeted by Modi, such as farmers, youth, women, and the impoverished, as the country looks towards 'unprecedented development' in the next five years.

Interim Budget: Direct, indirect taxes comprise 63 paise of every rupee in govt coffer

The interim Budget 2024-25 documents reveal that 63 paise of every rupee in government revenue will come from direct and indirect taxes, 28 paise from borrowings and other liabilities, 7 paise from non-tax revenue, and 1 paise from non-debt capital receipts. Direct taxes, including corporate and individual income tax, will contribute 36 paise, while indirect taxes such as GST, excise duty, and customs levy will account for 26 paise. The remaining 38 paise will be allocated for interest payments, states' share of taxes and duties, defence, central sector schemes, centrally-sponsored schemes, Finance Commission and other transfers, subsidies, pension, and other expenditures.

Budget 2024: Expect our govt will be blessed again by people with resounding mandate, says Finance Minister

Budget 2024: Finance Minister Nirmala Sitharaman expressed optimism that the BJP-led government would receive a strong mandate from the people in the upcoming general elections for the Lok Sabha, scheduled to take place in the next few months. Sitharaman also highlighted India's successful navigation through the challenges posed by Covid-19 and the establishment of foundations for a self-reliant India.

India Budget: New Delhi to borrow Rs 14.13 lakh crore in FY25, bond yields plunge

Budget Announcements: The Indian government plans to borrow 14.13 trillion rupees ($170.36 billion) in the next fiscal year, lower than economists' estimates, according to Finance Minister Nirmala Sitharaman. Net borrowings are expected to remain largely unchanged from the current fiscal year, at 11.75 trillion rupees. The funds will be used to finance a fiscal deficit of 5.1% of GDP, with the government also conducting switch auctions worth 1 trillion rupees. Additionally, 4.66 trillion rupees will be raised through India's small savings fund to cover the budget gap.

Budget 2024's key task involves taming a wild inflation hurting Indians

Union Budget: The upcoming interim budget holds critical significance for India amid soaring prices, demanding strategies to curb inflation. The government grapples with measures to rein in inflation, which started the year at 6.5%. Policies targeting food supply volatility might stabilise inflation. Finance Minister Nirmala Sitharaman could introduce fiscal measures to counter rising prices and manage inflation.

Load More