- News

- Business News

- India Business News

- PE-VC fundings close 2018 at record high of $33 billion

Trending

This story is from January 2, 2019

PE-VC fundings close 2018 at record high of $33 billion

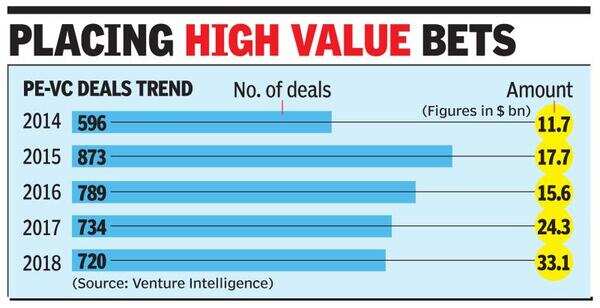

Data from research firm Venture Intelligence showed a 36% increase in PE-VC investments during 2018 across 720 deals, compared to $24.3 billion invested across 734 deals in 2017.

(Representative image)

CHENNAI: Indian startups ended 2018 at an all-time high, as total value of private equity (PE) and venture capital (VC) investments last year clocked a record amount of $33 billion.

Data from research firm Venture Intelligence showed a 36% increase in PE-VC investments during 2018 across 720 deals, compared to $24.3 billion invested across 734 deals in 2017.

The country’s startup ecosystem entered a state of maturity in 2018 as investors were more selective with deals, but made higher value bets.There were 81 investments valued at $100 million or more in 2018, making up 77% of the total value. This tally stood at just 47 transactions in 2017. Among these 81 deals, 40 were larger than $200 million each, compared to just 30 such investments in the year-ago period, according to Venture Intelligence data.

Data from research firm Venture Intelligence showed a 36% increase in PE-VC investments during 2018 across 720 deals, compared to $24.3 billion invested across 734 deals in 2017.

The country’s startup ecosystem entered a state of maturity in 2018 as investors were more selective with deals, but made higher value bets.There were 81 investments valued at $100 million or more in 2018, making up 77% of the total value. This tally stood at just 47 transactions in 2017. Among these 81 deals, 40 were larger than $200 million each, compared to just 30 such investments in the year-ago period, according to Venture Intelligence data.

The eventful year also saw eight startups across the B2C and B2B sectors — such as Oyo, PolicyBazaar, Swiggy, Byjus, BillDesk, Freshworks, Paytm Mall and Udaan.com — enter the elite unicorn club. While historically, deal announcements are subdued at the year-end, Venture Intelligence data showed that December 2018 alone saw 43 deals valued at $3.2 billion — almost double the value of investments raised in the same period last year. The year brought about an inflection point for the PE-VC industry in terms of exits as well. Value of exits achieved by investors during the year stood at over $25.4 billion — a 78% increase from the exits clocked in 2017.

End of Article

FOLLOW US ON SOCIAL MEDIA