Getty Images

Getty Images-Amir Parvez

To begin with, yes, you can sell your investments in regular equity mutual funds and invest the money in an ELSS fund to claim tax deductions.

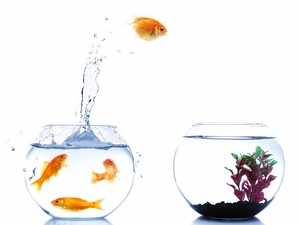

Mutual fund advisors refer to this process recycling of investments - the process of shifting money from existing mutual funds (ELSS or otherwise) to ELSS funds to claim tax deductions. Though it is perfectly legal to do it, it can have serious impact on your long-term financial goal. If you have accounted for certain investments in equity mutual funds every year, there could be a shortfall because of recycling of investments.

Finally, it is not easy to predict the market. You cannot be sure that the market might crash simply because the Sensex hit its historic peak recently. There could be a correction, may be a big fall, possibly. What happens after that? A big rally? Will you be able to predict it. Many experts have concluded after long years of investments that it is futile to predict the market. That is why they started advocating investing regularly over a long period as the ideal strategy to make money. That is the reason why many investors are using SIP to invest regularly. Do not waste your time predicting the market. Instead focus more on your career and earn more. That will help you to invest more and create more wealth over a long period. Let your fund manager worry about the market and buy and sell stocks to justify his fee.

(Catch all the Mutual Fund News, Breaking News, Budget 2024 Events and Latest News Updates on The Economic Times.)

Subscribe to The Economic Times Prime and read the ET ePaper online.

Read More News on

(Catch all the Mutual Fund News, Breaking News, Budget 2024 Events and Latest News Updates on The Economic Times.)

Subscribe to The Economic Times Prime and read the ET ePaper online.

Get Unlimited Access to The Economic Times

Get Unlimited Access to The Economic Times