More

CompanyCorporate TrendsDefenceInternationalCanada NewsUK NewsUS NewsUAESaudi ArabiaBusinessWorld NewsET EvokeElectionsLok SabhaResultsExit PollsKey StatesConstituenciesElectoral MapPoll ScheduleAssembly ElectionsAndhra PradeshOdishaSikkimArunachal PradeshSportsScienceEnvironmentET TVLatest NewsMost ReadMost SharedMost Commented

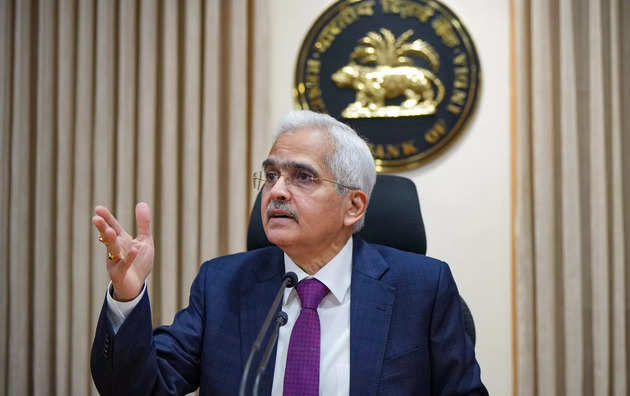

Business News›News›Newsblogs›RBI MPC Meeting 2024 Highlights: MPC to take call on policy action after inflation reaches 4% durably, says Das

LIVE BLOG

RBI MPC Meeting 2024 Highlights: MPC to take call on policy action after inflation reaches 4% durably, says Das

07 Jun 2024 | 02:30:24 PM IST

RBI MPC Meeting 2024 Live: RBI Governor Shaktikanta Das announced that the Monetary Policy Committee has chosen to maintain the policy repo rate at 6.5%, with a 4:2 majority decision. Consequently, the standing deposit facility (SDF) rate remains unchanged at 6.25%, while both the marginal standing facility (MSF) rate and the bank rate stand firm at 6.75%.

This development occurs shortly after the BJP relinquished its parliamentary majority, necessitating power-sharing within a coalition government.

The benchmark repo rate is currently at 6.50 percent with a “withdrawal of accommodation” stance.

As per economists, there’s a risk a BJP-led government may veer from its fiscal path by raising welfare spending to shore up support, an approach that may stoke inflation that’s already above the RBI’s target.

RBI will “have to watch the fiscal outcome of the next month’s budget now more closely before considering the monetary policy path,” Citigroup Inc. economists Samiran Chakraborty and Baqar Murtaza Zaidi told Bloomberg. “A status quo in the June policy is an even more likely outcome with the focus on reducing volatility in uncertain times.”

RBI MPC Meeting Time:

RBI Governor Shaktikanta Das will reveal the decision at 10 in the morning following deliberations by the RBI's rate-setting panel, the Monetary Policy Committee (MPC), which commenced discussions on Wednesday.

Given the uptick in economic growth, experts suggest that the MPC is likely to abstain from implementing rate cuts, despite the persistent repo rate of 6.5 percent since February 2023.

A research paper by SBI indicates that the central bank should persist with its current accommodative stance.

The report, titled 'Prelude to MPC Meeting,' forecasts a repo rate cut in the third quarter of the ongoing fiscal year, with expectations of a modest rate reduction cycle.

Additionally, it anticipates consumer price index (CPI)-based retail inflation to hover around 5 percent in May (data awaited later this month) before easing to 3 percent in July. It projects inflation to remain below 5 percent from October through the end of 2024-25.

The government has tasked the Reserve Bank with ensuring retail inflation at 4 percent with a margin of 2 percent on either side. Retail inflation stood at 4.83 percent in April this year.

The MPC comprises three external members and three RBI officials. External members of the rate-setting panel include Shashanka Bhide, Ashima Goyal, and Jayanth R Varma.

RBI MPC Meet Live Updates: FAQs

What is repo rate?

The repo rate denotes the interest rate at which a nation's central bank (such as the Reserve Bank of India for India) provides loans to commercial banks when there is a shortage of funds. It serves as a tool for monetary authorities to manage inflationary pressures.

What is reverse repo rate?

The reverse repo rate denotes the interest rate at which the country's central bank (in the case of India, the Reserve Bank of India) borrows funds from commercial banks domestically. This mechanism serves as a tool of monetary policy, enabling the regulation of the money supply within the nation.

What is Standing Deposit Facility?

The RBI employs the Standing Deposit Facility as a collateral-free mechanism to absorb surplus liquidity from banks through interest payments.

Show moreThis development occurs shortly after the BJP relinquished its parliamentary majority, necessitating power-sharing within a coalition government.

The benchmark repo rate is currently at 6.50 percent with a “withdrawal of accommodation” stance.

As per economists, there’s a risk a BJP-led government may veer from its fiscal path by raising welfare spending to shore up support, an approach that may stoke inflation that’s already above the RBI’s target.

RBI will “have to watch the fiscal outcome of the next month’s budget now more closely before considering the monetary policy path,” Citigroup Inc. economists Samiran Chakraborty and Baqar Murtaza Zaidi told Bloomberg. “A status quo in the June policy is an even more likely outcome with the focus on reducing volatility in uncertain times.”

RBI MPC Meeting Time:

RBI Governor Shaktikanta Das will reveal the decision at 10 in the morning following deliberations by the RBI's rate-setting panel, the Monetary Policy Committee (MPC), which commenced discussions on Wednesday.

Given the uptick in economic growth, experts suggest that the MPC is likely to abstain from implementing rate cuts, despite the persistent repo rate of 6.5 percent since February 2023.

A research paper by SBI indicates that the central bank should persist with its current accommodative stance.

The report, titled 'Prelude to MPC Meeting,' forecasts a repo rate cut in the third quarter of the ongoing fiscal year, with expectations of a modest rate reduction cycle.

Additionally, it anticipates consumer price index (CPI)-based retail inflation to hover around 5 percent in May (data awaited later this month) before easing to 3 percent in July. It projects inflation to remain below 5 percent from October through the end of 2024-25.

The government has tasked the Reserve Bank with ensuring retail inflation at 4 percent with a margin of 2 percent on either side. Retail inflation stood at 4.83 percent in April this year.

The MPC comprises three external members and three RBI officials. External members of the rate-setting panel include Shashanka Bhide, Ashima Goyal, and Jayanth R Varma.

RBI MPC Meet Live Updates: FAQs

What is repo rate?

The repo rate denotes the interest rate at which a nation's central bank (such as the Reserve Bank of India for India) provides loans to commercial banks when there is a shortage of funds. It serves as a tool for monetary authorities to manage inflationary pressures.

What is reverse repo rate?

The reverse repo rate denotes the interest rate at which the country's central bank (in the case of India, the Reserve Bank of India) borrows funds from commercial banks domestically. This mechanism serves as a tool of monetary policy, enabling the regulation of the money supply within the nation.

What is Standing Deposit Facility?

The RBI employs the Standing Deposit Facility as a collateral-free mechanism to absorb surplus liquidity from banks through interest payments.

1 New Update

RBI MPC Meet Live: Key Highlights

Rates

Inflation

Growth

Other announcements

- RBI keeps interest rate unchanged at 6.5 pc

- RBI to remain focussed on the withdrawal of accommodative policy

Inflation

- RBI remains committed for aligning inflation to 4 per cent on a durable basis

- RBI projects retail inflation in Q1 of FY25 at 4.9 pc, Q2 at 3.8 pc, Q3 at 4.6 pc, and Q4 at 4.5 pc

- Assuming normal monsoon, the inflation expected to be 4.5 per cent in current fiscal with risk evenly balanced

Growth

- RBI projects GDP growth for FY25 at 7.2 pc

- Current Account Deficit is expected to have moderated in Q4 of FY24

- Increase in contingency risk buffer by 0.5 pc for FY24 will further improve RBI's balance sheet

- With 15.2 pc share in world remittances, India continues to remain largest receiving country

- Gross Foreign Direct Investment remains robust but net FDI moderated in FY24

Other announcements

- RBI to take further steps to moderate unsecured loans and advances

- Few regulated entities still charging certain fees without proper disclosures

- RBI to take further steps to moderate unsecured loans and advances

RBI MPC Meet Live: PHDCCI on rate cuts

RBI MPC Meet Live Updates:Sanjeev Agrawal, President, PHD Chamber of Commerce and Industry, said that we are expecting the inflation trajectory to stabilise within the target band of RBI and thereafter softening of the policy stance of the monetary policy. Favorable inflation trajectory and resilient economic growth will create scope for a repo rate cut in the coming times.

We expect a repo rate cut as and when headline inflation softens around 4.5% and stabilising between 4 to 4.5%, said industry body PHDCCI.

The continuously accelerating economic growth and softening inflation trajectory, coupled with the status quo in repo rate will lead to high GDP growth in FY2025, said Agrawal.

We expect a repo rate cut as and when headline inflation softens around 4.5% and stabilising between 4 to 4.5%, said industry body PHDCCI.

The continuously accelerating economic growth and softening inflation trajectory, coupled with the status quo in repo rate will lead to high GDP growth in FY2025, said Agrawal.

RBI MPC Meet Live: A fairly neutral policy

RBI MPC Meet Live Updates: Niraj Kumar, Chief Investment Officer, Future Generali India Life Insurance Company, said, "MPC has delivered a ‘Fairly Neutral Policy' with a positive undertone. The MPC has been upbeat on growth and nudged the GDP forecasts higher, while yet being cognizant and cautious of achieving the last mile of disinflation. The bump up in growth numbers renders the key optimism in policy and provides the requisite comfort to Equity markets. Given the backdrop of supportive fiscal position and the global bond index inclusion, we reckon monetary policy continues to be complementary and supportive to the bond markets. While MPC refrains from giving cues on further rate actions, 4:2 voting pattern is indeed encouraging and indicative of a possible change in stance in the near future."

RBI MPC Meet Live: 'Encouraged by RBI’s outlook on growth in FY25'

RBI MPC Meet Live Updates: Commenting on RBI’s Monetary Policy announcement made earlier, FICCI President Anish Shah said, "We are encouraged by RBI’s outlook on growth in FY25, which has been revised upwards from 7 per cent to 7.2 per cent. The forecast for inflation for FY25 has been maintained at 4.5 per cent. This is positive and reflects RBI’s stellar actions in proactively addressing risks, thus keeping the economy on a strong momentum."

RBI MPC Meet Live: Bulls Bounce Back! Sensex jumps 1,400 points

RBI MPC Meet Live: RBI rate cuts to start in October

RBI MPC Meet Live Updates: Dharmakirti Joshi, Chief Economist, CRISIL, said, "While a decoupling is on across the Atlantic — the European Central Bank (ECB) began cutting the rate on Thursday even as the US Federal Reserve keeps it higher for longer — the Reserve Bank of India (RBI) has preferred to stand pat, in line with consensus."

Joshi added, "The Fed has elbow room to pursue tight monetary policy because growth in the US is robust, while Europe is on the other side, with growth concerns amid elevated inflation."

"The RBI, too, has policy space to keep rates higher and rein in Consumer Price Index-based (CPI) inflation to its stated goal of ~4%. Food continues to drive the gauge in India — food inflation was 8.7% in April, while non-food was a subdued 2.4%. Our base case is a normal monsoon trimming the headline to 4.5%. The RBI has kept its inflation forecast this fiscal unchanged at 4.5%. However, it remains more optimistic of growth, revising up GDP growth by 20 basis points to 7.2%. CRISIL’s estimate is a tad lower at 6.8%. We now see the RBI cutting rates starting October and have lowered our expectation to two rate cuts against three foreseen earlier."

Joshi added, "The Fed has elbow room to pursue tight monetary policy because growth in the US is robust, while Europe is on the other side, with growth concerns amid elevated inflation."

"The RBI, too, has policy space to keep rates higher and rein in Consumer Price Index-based (CPI) inflation to its stated goal of ~4%. Food continues to drive the gauge in India — food inflation was 8.7% in April, while non-food was a subdued 2.4%. Our base case is a normal monsoon trimming the headline to 4.5%. The RBI has kept its inflation forecast this fiscal unchanged at 4.5%. However, it remains more optimistic of growth, revising up GDP growth by 20 basis points to 7.2%. CRISIL’s estimate is a tad lower at 6.8%. We now see the RBI cutting rates starting October and have lowered our expectation to two rate cuts against three foreseen earlier."

RBI MPC Meet Live: A continuity of cautious monetary policy

RBI MPC Meet Live Updates: Anshuman Magazine, Chairman & CEO - India, South-East Asia, Middle East & Africa, CBRE, said, "The Reserve Bank of India's (RBI) decision to retain the repo rate at 6.50% signifies a continuity of cautious monetary policy. This prioritizes the objective of achieving an equilibrium between curbing inflationary pressures and nurturing a robust economic environment. Maintaining the status quo of the repo rate is likely to ensure sustained momentum within the real estate sector, thereby benefiting borrowers. Furthermore, the policy decision is expected to contribute to a broader affirmation of consumer confidence."

RBI MPC Meet Live: Payment outages on RBI radar

RBI does not prescribe minimum investment but banks should invest adequately in IT infra in line with biz growth to cut outages, said Guv Das.

RBI MPC Meet Live: RBI Guv on gold deposits

RBI MPC Meet Live Updates: RBI Governor Shaktikanta Das addressed the issue of the static quantum of gold held outside the country for an extended period. He emphasised the domestic capacity to hold gold and suggested that a portion of it should be retained within the country.

RBI MPC Meet Live: Bulk deposit correction is a routine review, says RBI

RBI MPC Meet Live: Das on stability of overall financial sector

RBI MPC Meet Live Updates: RBI Governor Shaktikanta Das highlighted the stability of the overall financial sector, stating that the central bank engages with outliers wherever they are identified. Out of the 9,500 NBFCs, actions have been taken against only three, a similar trend observed in the banking sector. He reassured that there isn't a widespread deficiency in the system, with the primary focus being on engagement with the regulated entities. Many instances of deficiencies have been addressed through constructive engagement with the concerned entities, indicating a proactive approach to maintaining the sector's health and stability.

Rural demand is showing signs of recovery

- RBI Guv Das

RBI MPC Meet Live: RBI on chances of liquidity risks

RBI MPC Meet Live Updates: RBI in a post-policy presser said, "There can be a liquidity or rollover risks if the gap between credit growth rate and deposit growth rate increases."

RBI MPC Meet Live: RBI on payment outages

RBI MPC Meet Live Updates: Whenever there are any outages, the problem is not at the end of NPCI or UPI, said RBI. It added, it is the banks where the problem shows up. There are many reasons for it, which we are dealing with.

RBI MPC Meet Live: We have to be watchful on inflation, says RBI

RBI MPC Meet Live Updates: Inflation can reach around 3.8% in Q2. But it is not so that we will cut rates if it happens, as inflation may go up to around 4.6% in the next quarter. So we have to be watchful, said RBI.

RBI MPC Meet Live: When we get the confidence that inflation will stay around 4%, we will take a call on the further monetary policy, says RBI Guv

RBI MPC Meet Live: Elephant is walking very slowly, says RBI Guv on inflation

RBI MPC Meet Live Updates: The RBI remarked that inflation is progressing very slowly, likening it to an elephant's pace. With inflation hovering around 5%, the central bank remains vigilant. Their goal is for inflation to align with the 4% target in a sustainable manner. However, they acknowledged that the final stretch of reaching this target is proving to be particularly challenging.

RBI MPC Meet Live: We dont intend to micromanage biz ops, says RBI

RBI MPC Meet Live Updates: RBI stated that the central bank's intention is to flag any potential buildup of risks and communicate these to regulated entities. He urged bank boards to reassess their strategies in light of the widening gap between deposit rates and credit growth, emphasizing that business plans should align with long-term sustainability. He clarified that the RBI does not intend to micromanage business operations, leaving these decisions to the discretion of the bank boards.

RBI MPC Meet Live: Nothing is off the table

RBI MPC Meet Live Updates: While responding to a question about rate cut, Michael Patra Deputy Governor of the Reserve Bank of India said 'nothing is off the table'.

RBI MPC Meet Live: RBI on unsecured lending

RBI MPC Meet Live Updates: The RBI clarified that it is closely monitoring incoming data and advised against reading too much into this vigilance. The central bank emphasized its attentiveness to all aspects of the overall financial sector, affirming its agility and vigilance. Should further measures become necessary, the RBI assured that they will be implemented promptly.

RBI MPC Meet Live: Even if US Fed eases we may not, clarifies RBI Guv

RBI MPC Meet Live: External sector is expected to remain stable, says RBI Guv

RBI MPC Meet Live: The target is 4%, we will work towards that, says RBI Guv

RBI MPC Meet Live: Last mile of inflation is sticky, says RBI Guv

RBI MPC Meet Live: RBI Guv begins post-policy press conference

RBI MPC Meet Live: Sensex up 1,300 points after RBI announcements

RBI MPC Meet Live: 'Divergence within the MPC growing further'

RBI MPC Meet Live Updates: Sonal Varma, Managing Director and Chief Economist, Nomura, said, "The RBI policy decision is largely on expected lines, but with a surprise on the vote split.

Two external MPC members voted for a cut versus one MPC member earlier, which suggests that the divergence within the MPC is growing further. However, we don’t think this is a signal of an impending cut, as the RBI MPC members will have to pivot to swing the needle.

The RBI continues to see the macroeconomic outlook as one of goldilocks, with higher growth and stable inflation. We largely concur with this assessment. The transition from El Nino to La Nina after June should bode well for food price inflation. With lower wage growth and inflation expectations in check, we expect headline inflation to converge with core inflation and average 4.4% in FY25.

We also agree that the RBI does not have to follow the Fed. India has a large cushion of FX reserves, which gives it the space to follow an independent monetary policy by focussing on domestic considerations.

Overall, with growth still strong and uncertainties high both on global and local front, there is no immediate need for policy easing. However, as inflation settles closer to the target and real rates rise further, we expect some room for easing to open up. We expect the first rate cut in October, with 75bp in cumulative easing in FY25."

Two external MPC members voted for a cut versus one MPC member earlier, which suggests that the divergence within the MPC is growing further. However, we don’t think this is a signal of an impending cut, as the RBI MPC members will have to pivot to swing the needle.

The RBI continues to see the macroeconomic outlook as one of goldilocks, with higher growth and stable inflation. We largely concur with this assessment. The transition from El Nino to La Nina after June should bode well for food price inflation. With lower wage growth and inflation expectations in check, we expect headline inflation to converge with core inflation and average 4.4% in FY25.

We also agree that the RBI does not have to follow the Fed. India has a large cushion of FX reserves, which gives it the space to follow an independent monetary policy by focussing on domestic considerations.

Overall, with growth still strong and uncertainties high both on global and local front, there is no immediate need for policy easing. However, as inflation settles closer to the target and real rates rise further, we expect some room for easing to open up. We expect the first rate cut in October, with 75bp in cumulative easing in FY25."

RBI MPC Meet Live: Sensex jumps 1,000 points higher, Nifty above 23,100; FMCG in green

Price as on 11.41.41 AM, Click on company names for their live prices.

RBI MPC Meet Live: A 4:2 surprise

RBI MPC Meet Live Updates: Aditi Nayar, Chief Economist, Head of Research and Outreach at ICRA, said "The status quo from the MPC was on expected lines, with only the voting change on the stance to 4:2 posing a surprise. Despite this, the 10-year G-sec yield remained above 7%, with the actual start to the rate cut cycle appearing distant."

RBI MPC Meet Live: A boon for the Indian real estate sector

RBI MPC Meet Live Updates: Anuj Puri, Chairman of ANAROCK Group said, "The Reserve Bank of India's decision to keep the repo rate unchanged is a boon for the Indian real estate sector. This stability ensures that home loan interest rates remain low, making housing more affordable for potential buyers. With unchanged borrowing costs, both developers and homebuyers benefit from increased market confidence and predictability."

He added, "the mid-range and premium property segments together account for more than 55% of the current supply. Together, they recorded approx. 76,555 units sold in Q1 2024 - nearly 60% of the total sales. The buyers of this segment are sensitive to volatile interest rates, and upward hikes would cause many of them to defer home purchases. This policy continuity supports sustained demand in these two segments."

"The affordable housing sector is, of course, most cost sensitive. While PMAY Urban has sanctioned 118.64 lakh homes against a demand of 112.24 lakh homes, affordable housing (homes priced under INR 40 lakhs) sales in Q1 2024 recorded 26,545 units - a mere 20% of the total sales. However, as we have seen, unchanged home loan rates alone are insufficient to induce new vibrancy in the affordable segment. It is hoped that the government will soon introduce further incentives to support it."

He added, "the mid-range and premium property segments together account for more than 55% of the current supply. Together, they recorded approx. 76,555 units sold in Q1 2024 - nearly 60% of the total sales. The buyers of this segment are sensitive to volatile interest rates, and upward hikes would cause many of them to defer home purchases. This policy continuity supports sustained demand in these two segments."

"The affordable housing sector is, of course, most cost sensitive. While PMAY Urban has sanctioned 118.64 lakh homes against a demand of 112.24 lakh homes, affordable housing (homes priced under INR 40 lakhs) sales in Q1 2024 recorded 26,545 units - a mere 20% of the total sales. However, as we have seen, unchanged home loan rates alone are insufficient to induce new vibrancy in the affordable segment. It is hoped that the government will soon introduce further incentives to support it."

RBI MPC Meet Live: 4:2 majority and probability of a pivot in policies ahead

RBI MPC Meet Live Updates: Upasna Bhardwaj, Chief Economist, Kotak Mahindra Bank said, " RBI’s status quo on rates and stance was in line with market expectations, but the split in voting patterns clearly shows the increasing probability towards a pivot in the policies ahead. However, we believe the robust growth will give enough opportunity for the MPC to remain on a wait and watch mode until better clarity comes from monsoons and quality of expenditure from the Budget. We see room for stance change in the August policy with a plausible easing from October meeting."

RBI MPC Meet Live: FASTags, NCMC payments to become more easier

RBI MPC Meet Live Updates: In its monetary policy meeting, RBI announced the inclusion of recurring payments for services like Fastag and the National Common Mobility Card (NCMC) within the e-mandate framework, featuring an auto-replenishment facility.

RBI MPC Meet Live: India bond yields move up after RBI retains FY25 inflation projection

RBI MPC Meet Live Updates: Indian government bond yields increased after RBI decided to keep its policy rate and stance unchanged. As of 10:50 am, the benchmark 10-year yield stood at 7.0218%, up from its previous close of 7.0112%. Prior to the policy meeting, the yield was approximately at Thursday's close.

RBI MPC Meet Live: RBI to integrate UPI Lite with e-mandate framework

RBI MPC Meet Live Updates: RBI announced the integration of UPI Lite with the e-mandate framework, facilitating the auto-replenishment of UPI Lite balances. Governor Shaktikanta Das stated that this integration will simplify the process of making small-value digital payments.

RBI MPC Meet Live: Das discusses key Rupee initiatives

- The internationalization of India’s payment systems, including UPI, RTGS, and NEFT.

- Participation in both bilateral and multilateral payment system linkage projects with other countries.

- Efforts to boost domestic digital payment usage through the "Har Payment Digital" campaign.

- The phased implementation of the Central Bank Digital Currency, known as the e-Rupee.

RBI MPC Meet Live: Homebuyers may have to wait longer for lower EMIs

RBI MPC Meet Live Updates: Home loan borrowers may need to endure a prolonged wait for relief from high-interest rates as RBI in its MPC meeting opted to maintain the repo rate at 6.5%. This marks the eighth consecutive MPC meeting where the central bank has chosen to maintain the status quo.

RBI MPC Meet Live: Sensex jumps 700 points after RBI MPC announcements

RBI MPC Meet Live: Das proposes to rationalise FEMA Act

RBI MPC Meet Live Updates: RBI proposes to rationalise Foreign Exchange Management Act guidelines related to export-import of goods and services, said Governor Das.

RBI MPC Meet Live: Das on FPI flows

RBI MPC Meet Live Updates: RBI Governor Shaktikanta Das announced a significant surge in Foreign Portfolio Investor (FPI) flows during FY24, with an impressive inflow totaling $41.6 billion.

Indian economy is at an inflection point

- RBI Governor Shaktikanta Das

RBI MPC Meet Live: RBI to set up digital payments intelligence platform to curb digital frauds

RBI MPC Meet Live: RBI on high interest rates on small value loans

RBI MPC Meet Live Updates: RBI Governor Shaktikanta Das addressed concerns regarding the interest rates on small value loans, highlighting their perceived high rates. He also noted that some companies continue to impose fees that are not disclosed in key fact statements. Emphasising the need for engagement with sectoral players, the focus remains on addressing these issues to ensure transparency and fairness in lending practices.

RBI MPC Meet Live: Inflation growth balance

RBI MPC Meet Live Updates: The inflation growth balance is moving favorably. Growth is holding firm. Inflation continues to moderate mainly driven by the core component which reached its lowest level in the current series in April 2024. The deflation in fuel prices is ongoing, food inflation, however, remains elevated, said RBI Guv.

RBI MPC Meet Live: Forex at a historical high of USD 651.5 bn as of May 31

RBI MPC Meet Live: CAD expected to have moderated in Q4

RBI MPC Meet Live Updates: The CAD for the current year is expected to remain well within the target. CAD stands for Current Account Deficit.

RBI MPC Meet Live: A prudent balance

RBI MPC Meet Live Updates: The prudent balance between assets and liabilities has to be maintained, said RBI Governor Shaktikanta Das.

Customer protection remains on top of RBI's priorities

- RBI Governor Shaktikanta Das.

RBI MPC Meet Live: Das on unsecured retail loans

RBI MPC Meet Live Updates: There is some moderation in unsecured retail loans following RBI's November measures, said RBI Governor Shaktikanta Das.

RBI MPC Meet Live: RBI stands committed to maintaining stability and orderliness, says RBI Guv

RBI MPC Meet Live Updates: RBI stands committed to maintaining stability and orderliness in all segments of finance markets and institutions that are regulated by RBI, said Shaktikanta Das.

RBI MPC Meet Live: RBI on liquidity

RBI MPC Meet Live Updates: Will be nimble and flexible through main and fine-tuning operations, says RBI Governor Shaktikanta Das.

RBI MPC Meet Live: Rupee unchanged

RBI MPC Meet Live Updates: The Indian rupee maintains its stability alongside an unchanged yield on the 10-year note. Currently, the local currency is trading at 83.47 against the US dollar.

RBI MPC Meet Live: RBI on food prices

RBI MPC Meet Live Updates: Das noted that vegetable prices are currently on the rise for the summer season. He attributed the deflationary trend in fuel prices mainly to cuts in LPG prices. Furthermore, he highlighted the global trend of increasing food prices, indicating a shift in the broader market dynamics.

RBI MPC Meet Live: RBI retains inflation projection for FY25 unchanged at 4.5%

RBI MPC Meet Live: Meanwhile, Sensex jumps 600 points as RBI raises FY25 GDP growth forecast

RBI MPC Meet Live: Monsoon forecast is expected to replenish reservoir levels, says RBI Guv

RBI MPC Meet Live Updates: A forecast of above-normal southwest monsoon by IMD is expected to boost Kharif production, said Shaktikanta Das.

RBI MPC Meet Live: Real GDP growth for FY25 projected at 7.2%, up from 7%

RBI MPC Meet Live: Das on Private consumption

Private consumption is recovering with steady discretionary spending in urban areas, said RBI Governor Shaktikanta Das. He added, investment activity continues to gain traction.

RBI MPC Meet Live: RBI committed to bring inflation back to target of 4% on a durable basis, says RBI Guv

RBI MPC Meet Live: MPC remains vigilant

RBI MPC Meet Live Updates: MPC remains vigilant to outside risks to inflation, particularly food inflation as it could delay the path of disinflation, said Shaktikanta Das.

RBI MPC Meet Live: Deflation in fuel prices is ongoing, food inflation remains elevated, says Shaktikanta Das

RBI MPC Meet Live: RBI to remain focused on 'withdrawal of accommodation'

RBI MPC Meet Live: RBI maintains status quo, keeps interest rates unchanged at 6.5% with majority of 4:2

RBI MPC Meet Live Updates: The repo rate is the interest rate at which RBI provides loans to commercial banks when there is a shortage of funds. It serves as a tool for monetary authorities to manage inflationary pressures.

RBI MPC Meet Live: Indian economy remains resilient, says Shaktikanta Das

RBI MPC Meet Live: RBI to announce decision on rate cuts shortly

RBI MPC Meet Live: Upcoming Budget and fiscal policies

RBI MPC Meet Live Updates: Emphasis will also be placed on Governor Shaktikanta Das' comments concerning the budget and the fiscal policies of the new government. The significant dividend of 2.1 trillion rupees ($25 billion) that the RBI has allocated to the government provides a certain level of leeway to enhance expenditure.

RBI MPC Meet Live: FD investors and rate cuts

RBI MPC Meet Live Updates: Fixed Deposit (FD) investors are anticipated to retain their favorable conditions as the Reserve Bank of India (RBI) is poised to uphold the existing repo rate. Shaktikanta Das is scheduled to reveal the decisions stemming from the Monetary Policy Committee (MPC) meeting, with expectations leaning towards the central bank maintaining the repo rate unchanged.

RBI MPC Meet Live: Status quo and homebuyers

RBI MPC Meet Live Updates: Ashish Agarwal, Director of AU Real Estate, emphasized that maintaining the repo rate at its current level will help uphold affordability for prospective homebuyers, thus sustaining the positive momentum within the housing market.

RBI MPC Meet Live: India's gold reserves

RBI MPC Meet Live Updates: According to official data, the nation's total gold reserves surged by 27.46 metric tonnes during FY24, reaching a total of 822 metric tonnes.

RBI MPC Meet Live: RBI's massive gold moves

RBI MPC Meet Live Updates: In the fiscal year 2024, India successfully repatriated 100 metric tonnes of its gold reserves from storage facilities in the UK to domestic vaults. This relocation marks a significant event, reminiscent of the nation's actions in 1991 when a portion of its gold reserves was pledged to alleviate a foreign exchange crisis, necessitating the movement of gold out of overseas vaults.

RBI MPC Meet Live: India's forex

RBI MPC Meet Live Updates: India's foreign exchange reserves witnessed a decline of USD 2.027 billion, reaching USD 646.673 billion by the end of the week concluding on May 24, as announced by the Reserve Bank on Friday. The previous week had seen a remarkable surge, with the reserves hitting a record high of USD 648.7 billion, marking an increase of USD 4.549 billion.

RBI MPC Meet Live: Eyes on fiscal results of the upcoming budget before cuts

RBI MPC Meet Live Updates: According to economists Samiran Chakraborty and Baqar Murtaza Zaidi from Citigroup Inc., the Reserve Bank of India (RBI) will need to closely monitor the fiscal results of the upcoming budget before contemplating any adjustments to the monetary policy. They suggested to Bloomberg that maintaining the current policy stance in the June review is increasingly probable, with an emphasis on stabilizing the financial environment amidst ongoing uncertainties.

RBI MPC Meet Live: Ahead of rate cut decision, Nifty Smallcap Index recovers 90% of verdict day decline

RBI MPC Meet Live: RBI's inflation task

RBI MPC Meet Live Updates: The government has tasked the Reserve Bank with the responsibility of maintaining retail inflation at 4 percent, with a permissible range of 2 percent on either side. In April of this year, retail inflation stood at 4.83 percent.

RBI MPC Meet Live: Sensex declines 100 pts, slips below 75K; Nifty tests 22,800 ahead of RBI policy outcome

RBI MPC Meet Live: When will RBI cut rates?

RBI MPC Meet Live Updates: The report, "Prelude to MPC Meeting," anticipates that the Reserve Bank of India (RBI) will reduce the repo rate in the third quarter of the current fiscal year, noting that this rate cut cycle is expected to be gradual and limited.

RBI MPC Meet Live: 'RBI should maintain its position'

RBI MPC Meet Live Updates: A research paper from SBI suggests that the central bank should maintain its current approach of retracting accommodation.

RBI MPC Meet Live: Markets may open higher ahead of RBI's decision

RBI MPC Meet Live Updates: Indian markets are poised to open with a slight uptick on Friday. As of 07:40 a.m. IST, the Gift Nifty was trading at 22,905, suggesting that the benchmark Nifty 50 will open slightly higher compared to its previous close of 22,821.40 on Thursday.

RBI MPC Meet Live: India bond yields seen little changed with focus on RBI policy decision

Anticipated to remain stable, Indian government bond yields are poised to hold steady during the initial session on Friday, with investors eagerly awaiting the Reserve Bank of India's monetary policy announcement later in the day.

A trader affiliated with a state-run bank told Reuters, India's benchmark 10-year yield is expected to fluctuate within a range of 6.99% to 7.03% until the policy decision, mirroring its previous close of 7.0112%.

A trader affiliated with a state-run bank told Reuters, India's benchmark 10-year yield is expected to fluctuate within a range of 6.99% to 7.03% until the policy decision, mirroring its previous close of 7.0112%.

RBI MPC Meet Live: GDP expands by 7.8 per cent

RBI MPC Meet Live Updates: India's gross domestic product (GDP) expanded by 7.8 percent annually during the final quarter (Q4) of the fiscal year FY24. Additionally, according to data released by the Ministry of Statistics and Programme Implementation (MOSPI) on Friday, the government now anticipates the overall growth rate for FY24 to be 8.2 percent.

RBI MPC Meet Live: Economic growth gains momentum

RBI MPC Meet Live Updates: The MPC might also decide against reducing interest rates because economic growth is gaining momentum, despite the high repo rate of 6.5 percent that has been in effect since February 2023.

RBI MPC Meet Live: Canada becomes first G7 nation to cut interest rates

RBI MPC Meet Live Updates: Earlier on Wednesday, the Bank of Canada also reduced its key policy rate becoming the first G7 nation to take this step. This anticipated decision aims to alleviate the burden on heavily indebted consumers. However, the bank noted that any additional rate cuts would be implemented slowly and would depend on economic data.

RBI MPC Meet Live: India's Services sector

RBI MPC Meet Live Updates: India's services sector experienced a slowdown in growth during May, reaching its lowest point in five months, according to a private survey released on Wednesday. The seasonally adjusted HSBC India Services Business Activity Index fell to 60.2 from 60.8 in April. This decline indicates a reduction in service activities, attributed to extreme heat waves and rising prices, which have limited output.

An index reading above 50 signifies expansion, and for India, the index has consistently been above 60 since the beginning of 2024, reflecting strong growth in orders.

An index reading above 50 signifies expansion, and for India, the index has consistently been above 60 since the beginning of 2024, reflecting strong growth in orders.

RBI MPC Meet Live: European Central Bank cuts interest rates for the first time since 2019

RBI MPC Meet Live Updates: The European Central Bank (ECB) reduced its main interest rate by a quarter point on Thursday, taking a step ahead of the U.S. Federal Reserve. This action reflects a global trend among central banks towards lowering borrowing costs, a move that will significantly impact home buyers, savers, and investors.

RBI MPC Meet Live: RBI’s record dividend

RBI MPC Meet Live Updates: Earlier, RBI announced it will distribute an unprecedented dividend of ₹2.1 lakh crore for FY24, surpassing the amount the government had initially planned for by over twice the expected sum. This significant increase in surplus is attributed to the RBI's exceptional interest earnings from its foreign investments. Aditi Nayar, chief economist at the rating agency Icra, noted that this substantial transfer from the central bank will expand New Delhi's financial capacity in FY25. This could lead to either increased spending or a more rigorous fiscal consolidation than what was outlined in the budget approved in February, ahead of the elections.

RBI MPC Meet Live: ADB pledges USD 2.6 billion in sovereign lending

RBI MPC Meet Live Updates: In 2023, the Asian Development Bank (ADB) pledged USD 2.6 billion (approximately Rs 21,500 crore) in sovereign loans to India for several initiatives. This funding is intended to bolster urban development, aid the development of industrial corridors, foster power sector reforms, improve India's climate resilience, and enhance connectivity.

RBI MPC Meet Live: India set for first current account surplus

RBI MPC Meet Live Updates: India Ratings and Research (Ind-Ra) forecasts that India's current account balance (CAB) will see a surplus of around USD 6 billion, which is 0.6 percent of the GDP, in the fourth quarter of the fiscal year 2024 (Q4FY24).

RBI MPC Meet Live: First RBI MPC meet after election results

RBI MPC Meet Live Updates: Today's RBI announcement follows closely on the heels of BJP's loss of clear majority, compelling it to form a coalition government. Analysts caution against the possibility of a BJP-led administration deviating from its fiscal trajectory by increasing welfare expenditure to bolster its popularity. Such a strategy could exacerbate inflation, which already surpasses the RBI's desired level.

RBI MPC Meet Live: Dip in deal activity

RBI MPC Meet Live Updates: The total deal activity fell by 3 percent in May, reaching USD 5.023 billion, down from USD 5.192 billion in April. Merger and acquisition activities saw a significant decline of 58 percent, dropping to USD 1.05 billion from April's USD 2.526 billion.

RBI MPC Meet Live: Inflation hit - Veg thali gets dearer

RBI MPC Meet Live Updates: In May, the average cost of a vegetarian thali increased by 9 percent, mainly driven by higher prices for onions, tomatoes, and potatoes, according to a report. The cost of a non-vegetarian meal decreased due to a drop in broiler prices, as detailed in the monthly "Roti Rice Rate" report by Crisil Market Intelligence and Analysis.

RBI MPC Meet Live: Status quo on rate cuts?

RBI MPC Meet Live Updates: Experts believe that the RBI will keep interest rates unchanged due to ongoing concerns about inflation.

RBI MPC Meet Live: Repo rate at 6.5 per cent

RBI MPC Meet Live Updates: Since February 2023, the Reserve Bank of India has maintained the key interest rate (repo) at 6.5 percent.

RBI MPC Meet Live: A look at MPC members

RBI MPC Meet Live Updates: The Monetary Policy Committee (MPC) comprises three individuals from outside the Reserve Bank of India (RBI) and three RBI officials. Serving as external members on this panel are Shashanka Bhide, Ashima Goyal, and Jayanth R Varma.

RBI MPC Meet Live: Decision after deliberations

RBI MPC Meet Live Updates: Shaktikanta Das will reveal the decision at 10 a.m., following the Monetary Policy Committee's (MPC) deliberations. The RBI's rate-setting panel began their discussions on Wednesday.

RBI MPC Meet Live: Das to reveal decision on rate cut

RBI MPC Meet Live Updates: Reserve Bank Governor Shaktikanta Das is set to reveal the upcoming monetary policy decisions on Friday morning, with many anticipating that the benchmark interest rates will remain unchanged.

RBI MPC Meet Live: Hello and Welcome to ET Online

RBI MPC Meet Live Updates: Good morning, Readers! RBI will announce monetary policy decisions today. Stay tuned to get the latest updates and in-depth analysis of rate cuts and policy path of India.