ETtech

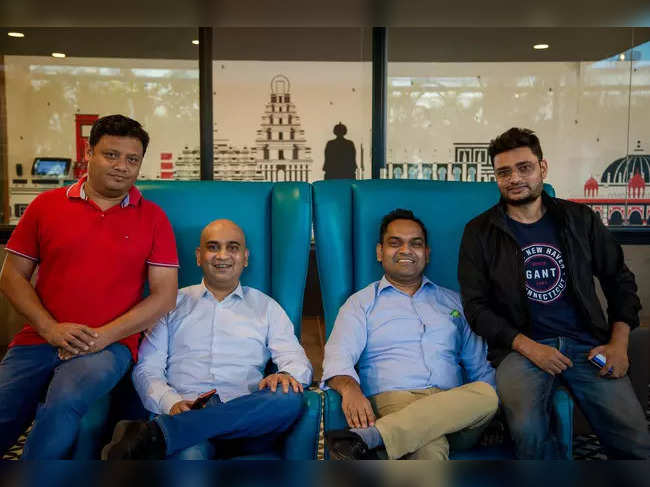

ETtechFounded in 2018 by Rajat Shikhar, Sankar Bora, Sourjyendu Medda and Vineet Rao, DealShare sells daily essentials and targets the middle-income demographic through a community group buying model.

It will use the funds to strengthen technology, product innovations, and hiring.

“We will be utilizing the funds from our Series E round to strengthen our customer base and technology capabilities,” Rao said in a statement.

Discover the stories of your interest

“We aim to democratize online shopping for Bharat users with unmatched service and experience by developing innovative products and tech solutions. This will be supported by building our teams across the country and hiring new tech talent at all levels.”

The ecommerce company leverages the consumer-led virality model of social commerce for demand aggregation. This is different from the reseller-led model of Meesho, which mainly operates in the apparel category. Meesho is now increasingly looking to go direct to consumers, much like Amazon and Flipkart.

“I think we had a very different thesis to social commerce,” Medda told ET. “We always believed social commerce will only work if it is deployed in the grocery space.

For social commerce to work we need virality in the mass consumers. That will only happen when the deals are relevant to the larger population.”

Medda said through the community-led virality model, the company has been able to restrict the fulfilment cost —warehousing and last mile — to 5-6% of the order cost compared to 20% or above for traditional e-commerce.

“The choices in electronics and fashion are large for virality to be created,” he said. “While everyone (other social commerce players) is getting into direct commerce we are the only sizable social commerce player in the country.”

He also said that customer acquisition cost is $1 compared to the average industry cost of $10.

“These big differentiators we will continue to retain,” he said. “We are possibly the fastest growing ecommerce company. We are already close to a $1 billion revenue run rate now. At the same time, we burn very little. We are very close to operational profitability.”

The startup has raised $393 million so far, including the latest round, to compete in a fast-crowding grocery essential market in non-metro cities. Avendus Capital was the exclusive financial advisor to DealShare on the transaction.

Get Unlimited Access to The Economic Times

Get Unlimited Access to The Economic Times