Unwrapped Unwrapped |

Control, Alter, Delete: The dystopian new ‘hacking law’

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Unwrapped

We'll soon meet in your inbox.

Hi, Zaheer here. Our main story today is about government surveillance and begins with a whodunnit. So in the interest of avoiding spoilers, let’s get right to it.

On August 25, a certain country passed a sweeping surveillance bill that gives law enforcement the power to hack the personal computers and networks of suspected cybercriminals, take over their accounts, and—here’s the real kicker—modify or delete their data.

The bill also says that companies, system administrators and others must actively help the police to modify, add, copy, or delete the data of a person under investigation. If they comply, they are protected from civil liability. If they refuse, they could be jailed for up to a decade.

Which sort of government could get away with passing such an invasive and punitive law, or require such total obedience from its private sector and citizens? Any guesses?

If you guessed China, well, that was the point. It isn’t.

The answer is, in fact, sunny Australia. Crikey.

What else is in this disturbing piece of legislation, how was it passed, and what has the response been?

Australian Prime Minister Scott Morrison

Australian Prime Minister Scott Morrison

The bill

Called the Surveillance Legislation Amendment (Identify and Disrupt) Bill, or simply the Identify and Disrupt Bill, it gives three specific, unprecedented powers to the Australian Federal Police (AFP) and Australian Criminal Intelligence Commission (ACIC) to investigate criminal activity online. They are:

■ Data disruption warrant: This warrant gives the police the ability to “disrupt” the data of a suspect by modifying, copying, adding to, or deleting it. This would be done to prevent the “continuation of criminal activity by participants”, and would be “the safest and most expedient option where those participants are in unknown locations or acting under anonymous or false identities", the bill says.

■ Network activity warrant: This warrant would allow law enforcement to collect intelligence from devices or networks that are used, or likely to be used, by those named in it.

■ Account takeover warrant: It would allow police to take over an online account of a suspect to gather information for an investigation.

If that isn’t disturbing enough, the bill says the first two types of warrants don’t even need to be issued by a judge—a member of the Administrative Appeals Tribunal will do. The ATT is an institution that reviews administrative decisions made by government ministers, departments and agencies.

Comply, or else: We mentioned before—and it bears repeating—that when presented with any of these warrants, Australian companies and citizens must comply or face up to 10 years in jail. This means they must actively help the police change, copy and delete data, intercept and alter communications, spy on networks, and change account credentials of fellow citizens suspected of a crime.

The criticism

The day the controversial bill was passed, Australia’s Human Rights Law Centre wrote on its website that the government had “ignored crucial recommendations of the bipartisan Parliamentary Joint Committee on Intelligence and Security that stronger safeguards are needed to protect the privacy of all Australians”.

Lack of safeguards: It said it had told the committee about the lack of safeguards in the bill, especially since it could potentially be used against journalists and whistleblowers. The committee in turn recommended dozens of changes to the proposed law, including narrower criteria for the use of these powers and stronger oversight.

“But the [government] has rejected or only partially adopted approximately half of the committee’s recommendations and rushed the new law through Parliament,” HRLC wrote.

Wide interpretation: Another criticism concerns the types of crimes these powers would be used against.

Last August, then home affairs minister Peter Dutton said they would be used to go after terrorists, paedophiles and drug traffickers online, and would apply “to those people and those people only”, according to a report in the Guardian.

But the bill itself says these powers could be used to counter “all commonwealth offences punishable by a maximum term of three years or more”.

Opposition Labor MP Andrew Giles, who supported the bill, said that this wording could mean that these warrants would be used for “tax offences, trademark infringements and a range of other offences”. He said his party had called to raise this bar but to no avail.

The Greens Party meanwhile said on its website that the police could exercise these powers against a person without formally accusing them of a crime. "This bill enables the AFP and ACIC to be 'judge, jury, and executioner.' That's not how we deliver justice in this country," said Greens senator Lidia Thorpe.

Let's move on to other big developments of the week.

OTHER BIG STORIES BY OUR REPORTERS

Prosus Group CEO Bob Van Dijk

Prosus Group CEO Bob Van Dijk

Prosus, the global investment arm of South African multinational Naspers, said it would acquire Indian payments gateway firm BillDesk for $4.7 billion in an all-cash deal to expand its footprint in the country’s booming fintech sector under the umbrella of its payment gateway PayU. The deal will mark the biggest consolidation in the sector.

BillDesk cofounder MN Srinivasu

BillDesk cofounder MN Srinivasu

MN Srinivasu, one of the startup's cofounders, told us why BillDesk said yes to Prosus and what the future has in store for the company he helped build 21 years ago.

In an exclusive interview with ET, Prosus group CEO Bob van Dijk said that the Indian market has the potential to deliver hefty returns even to later-stage investors. “We think people will use fintech to pay, save and invest more over the next few years. That’s a strong consumer need where technology will play a larger role over time, which is exactly what we like for an investment. That is where a BillDesk fits in. We believe online payments will grow by at least a factor of 10 in the next few years,” he told us.

Read the full interview here.

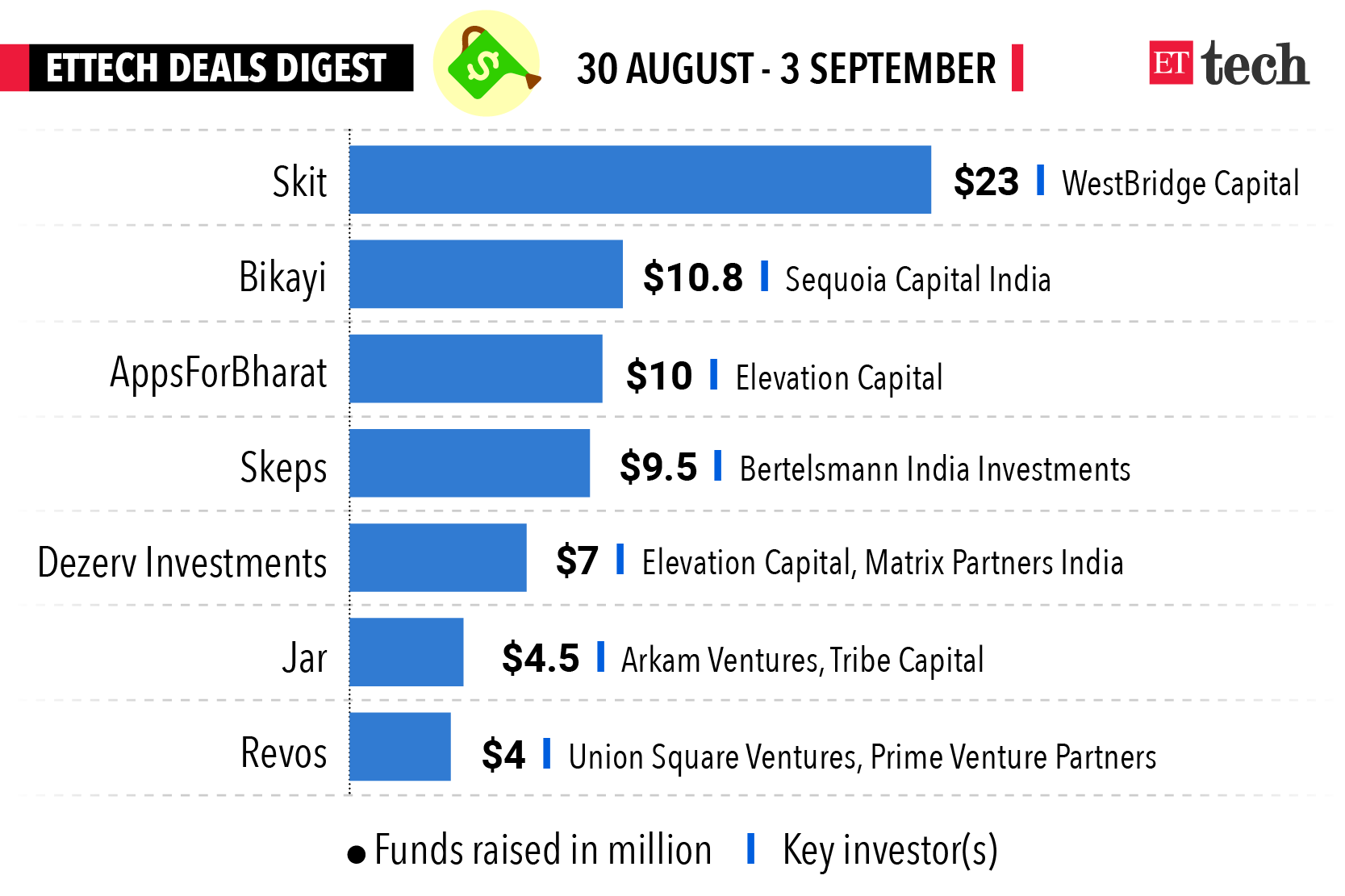

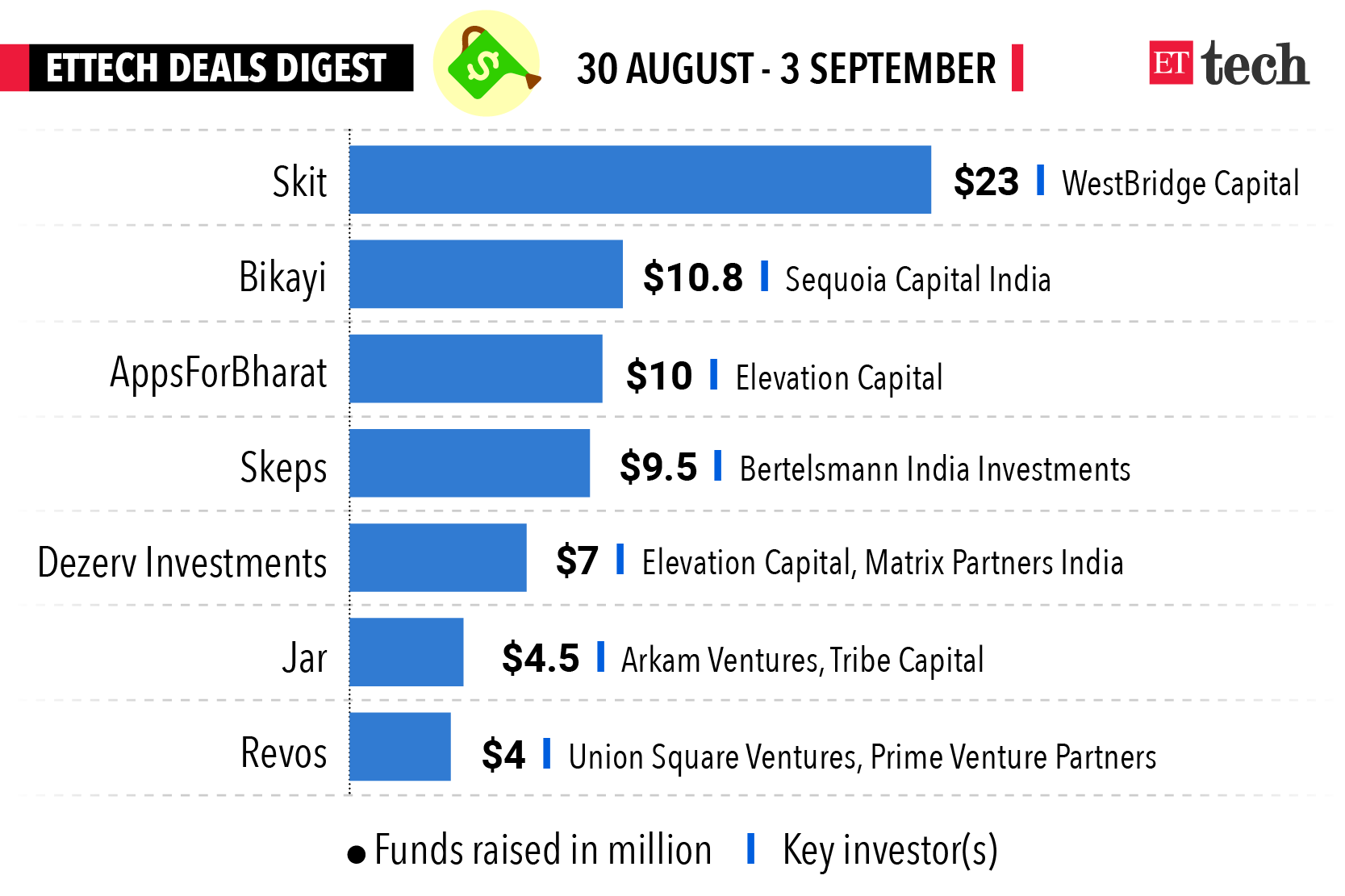

Here’s a quick look at the top funding deals of the week.

T Rowe Price MFs mark up Paytm valuation ahead of IPO

Mutual funds managed by US-based investment management firm T Rowe Price have marked up fintech unicorn Paytm's shares by over 16% from the original acquired price, according to filings that ET has reviewed.

Why mental health startups haven't yet taken off in India

Risk capital has largely eluded mental health startups in India, though the trend seems to be reversing, albeit gradually. Indian mental health startups cumulatively raised only $20 million between 2016 and 2020, data sourced from industry tracker Traxcn showed.

Ola IPO to hit the street early 2022

Ride-hailing aggregator Ola is exploring a public offer early next year, aiming to raise at least $1.5-2 billion, valuing the Bengaluru-based unicorn at $12-14 billion. That will put it in the band of big-ticket tech IPOs that are looking to take advantage of a liquidity-driven market rally.

Amazon wants Reliance-Future deal blocked at Sebi

Amazon has written to India’s market regulator seeking the withdrawal of its conditional approval to the proposed buyout of retail assets of the Future Group by Reliance Industries, as the American online retail giant intensifies its efforts to stall the highly contested deal.

Etail probe: CCI chats with third-party sellers

India’s antitrust regulator has reached out to independent sellers as part of its probe against ecommerce firms Amazon India and Flipkart, sources told us. This is part of the Competition Commission of India’s (CCI) ongoing investigation against the e-tailers over issues like deep discounting and preferential treatment of select sellers.

Startup dreams take wing as India sees one seed round a day

Early-stage investing is at an all-time high in post-pandemic India with the country averaging one seed round a day this year. The unprecedented rush of risk capital has led to more than 240 seed rounds with total disclosed investments of $284 million so far in 2021, according to data from specialist staffing firm Xpheno.

Investors make a beeline for HR tech startups

HR tech startups, which offer full-stack human resources management to companies big and small, are gaining traction among the investor community. Such companies have raised around $200-250 million from investors since January, data compiled by ET shows.

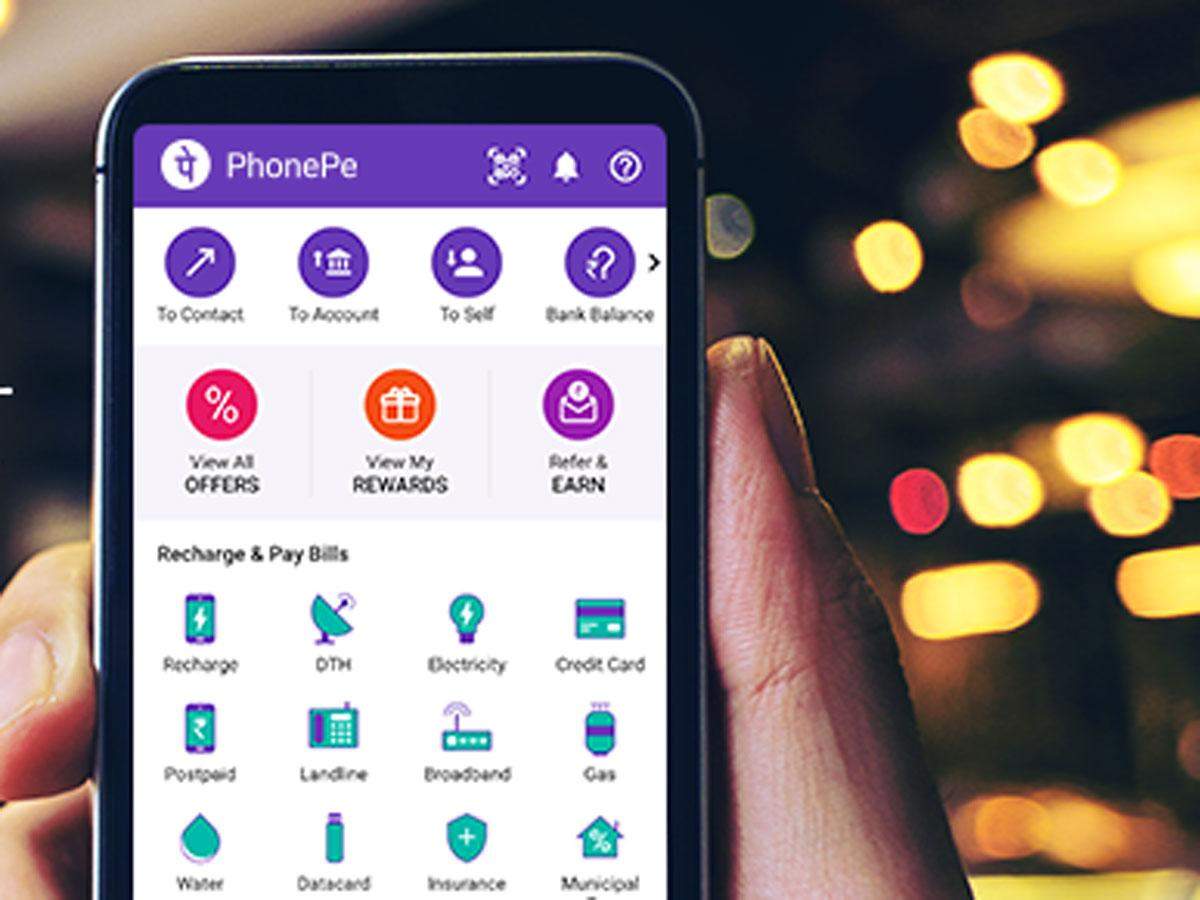

PhonePe mulls its own mutual funds business

PhonePe, a payments platform backed by Flipkart and Walmart, is thinking of applying for an Asset Management Company (AMC) licence, which will allow it to sell its mutual funds, cofounder and CEO Sameer Nigam told ET. It also launched a digital payments market insight platform called Pulse, which will provide researchers, business developers, regulators and journalists access to pin-code-level transaction data across India.

That's about it from us this week. Stay safe and get that jab. 💉

On August 25, a certain country passed a sweeping surveillance bill that gives law enforcement the power to hack the personal computers and networks of suspected cybercriminals, take over their accounts, and—here’s the real kicker—modify or delete their data.

The bill also says that companies, system administrators and others must actively help the police to modify, add, copy, or delete the data of a person under investigation. If they comply, they are protected from civil liability. If they refuse, they could be jailed for up to a decade.

Which sort of government could get away with passing such an invasive and punitive law, or require such total obedience from its private sector and citizens? Any guesses?

If you guessed China, well, that was the point. It isn’t.

The answer is, in fact, sunny Australia. Crikey.

What else is in this disturbing piece of legislation, how was it passed, and what has the response been?

The bill

Called the Surveillance Legislation Amendment (Identify and Disrupt) Bill, or simply the Identify and Disrupt Bill, it gives three specific, unprecedented powers to the Australian Federal Police (AFP) and Australian Criminal Intelligence Commission (ACIC) to investigate criminal activity online. They are:

■ Data disruption warrant: This warrant gives the police the ability to “disrupt” the data of a suspect by modifying, copying, adding to, or deleting it. This would be done to prevent the “continuation of criminal activity by participants”, and would be “the safest and most expedient option where those participants are in unknown locations or acting under anonymous or false identities", the bill says.

■ Network activity warrant: This warrant would allow law enforcement to collect intelligence from devices or networks that are used, or likely to be used, by those named in it.

■ Account takeover warrant: It would allow police to take over an online account of a suspect to gather information for an investigation.

If that isn’t disturbing enough, the bill says the first two types of warrants don’t even need to be issued by a judge—a member of the Administrative Appeals Tribunal will do. The ATT is an institution that reviews administrative decisions made by government ministers, departments and agencies.

Comply, or else: We mentioned before—and it bears repeating—that when presented with any of these warrants, Australian companies and citizens must comply or face up to 10 years in jail. This means they must actively help the police change, copy and delete data, intercept and alter communications, spy on networks, and change account credentials of fellow citizens suspected of a crime.

The criticism

The day the controversial bill was passed, Australia’s Human Rights Law Centre wrote on its website that the government had “ignored crucial recommendations of the bipartisan Parliamentary Joint Committee on Intelligence and Security that stronger safeguards are needed to protect the privacy of all Australians”.

Lack of safeguards: It said it had told the committee about the lack of safeguards in the bill, especially since it could potentially be used against journalists and whistleblowers. The committee in turn recommended dozens of changes to the proposed law, including narrower criteria for the use of these powers and stronger oversight.

“But the [government] has rejected or only partially adopted approximately half of the committee’s recommendations and rushed the new law through Parliament,” HRLC wrote.

Wide interpretation: Another criticism concerns the types of crimes these powers would be used against.

Last August, then home affairs minister Peter Dutton said they would be used to go after terrorists, paedophiles and drug traffickers online, and would apply “to those people and those people only”, according to a report in the Guardian.

But the bill itself says these powers could be used to counter “all commonwealth offences punishable by a maximum term of three years or more”.

Opposition Labor MP Andrew Giles, who supported the bill, said that this wording could mean that these warrants would be used for “tax offences, trademark infringements and a range of other offences”. He said his party had called to raise this bar but to no avail.

The Greens Party meanwhile said on its website that the police could exercise these powers against a person without formally accusing them of a crime. "This bill enables the AFP and ACIC to be 'judge, jury, and executioner.' That's not how we deliver justice in this country," said Greens senator Lidia Thorpe.

Let's move on to other big developments of the week.

OTHER BIG STORIES BY OUR REPORTERS

Prosus, the global investment arm of South African multinational Naspers, said it would acquire Indian payments gateway firm BillDesk for $4.7 billion in an all-cash deal to expand its footprint in the country’s booming fintech sector under the umbrella of its payment gateway PayU. The deal will mark the biggest consolidation in the sector.

MN Srinivasu, one of the startup's cofounders, told us why BillDesk said yes to Prosus and what the future has in store for the company he helped build 21 years ago.

In an exclusive interview with ET, Prosus group CEO Bob van Dijk said that the Indian market has the potential to deliver hefty returns even to later-stage investors. “We think people will use fintech to pay, save and invest more over the next few years. That’s a strong consumer need where technology will play a larger role over time, which is exactly what we like for an investment. That is where a BillDesk fits in. We believe online payments will grow by at least a factor of 10 in the next few years,” he told us.

Read the full interview here.

Here’s a quick look at the top funding deals of the week.

T Rowe Price MFs mark up Paytm valuation ahead of IPO

Mutual funds managed by US-based investment management firm T Rowe Price have marked up fintech unicorn Paytm's shares by over 16% from the original acquired price, according to filings that ET has reviewed.

Why mental health startups haven't yet taken off in India

Risk capital has largely eluded mental health startups in India, though the trend seems to be reversing, albeit gradually. Indian mental health startups cumulatively raised only $20 million between 2016 and 2020, data sourced from industry tracker Traxcn showed.

Ola IPO to hit the street early 2022

Ride-hailing aggregator Ola is exploring a public offer early next year, aiming to raise at least $1.5-2 billion, valuing the Bengaluru-based unicorn at $12-14 billion. That will put it in the band of big-ticket tech IPOs that are looking to take advantage of a liquidity-driven market rally.

Amazon wants Reliance-Future deal blocked at Sebi

Amazon has written to India’s market regulator seeking the withdrawal of its conditional approval to the proposed buyout of retail assets of the Future Group by Reliance Industries, as the American online retail giant intensifies its efforts to stall the highly contested deal.

Etail probe: CCI chats with third-party sellers

India’s antitrust regulator has reached out to independent sellers as part of its probe against ecommerce firms Amazon India and Flipkart, sources told us. This is part of the Competition Commission of India’s (CCI) ongoing investigation against the e-tailers over issues like deep discounting and preferential treatment of select sellers.

Startup dreams take wing as India sees one seed round a day

Early-stage investing is at an all-time high in post-pandemic India with the country averaging one seed round a day this year. The unprecedented rush of risk capital has led to more than 240 seed rounds with total disclosed investments of $284 million so far in 2021, according to data from specialist staffing firm Xpheno.

Investors make a beeline for HR tech startups

HR tech startups, which offer full-stack human resources management to companies big and small, are gaining traction among the investor community. Such companies have raised around $200-250 million from investors since January, data compiled by ET shows.

PhonePe mulls its own mutual funds business

PhonePe, a payments platform backed by Flipkart and Walmart, is thinking of applying for an Asset Management Company (AMC) licence, which will allow it to sell its mutual funds, cofounder and CEO Sameer Nigam told ET. It also launched a digital payments market insight platform called Pulse, which will provide researchers, business developers, regulators and journalists access to pin-code-level transaction data across India.

That's about it from us this week. Stay safe and get that jab. 💉

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Unwrapped

We'll soon meet in your inbox.