BUDGET 2021 KEY ANNOUNCEMENTS

Budget 2024: Time for Modi 3.0 to focus on rural India and jobs

Budget 2024 Expectations: India's budget may targets rural economy, job creation, and a 5.1% fiscal deficit. Focus includes labor-intensive sectors, MSME credits, services exports, and agricultural infrastructure, addressing unemployment and inflation. Goldman Sachs notes food supply emphasis, while Citi suggests extending incentive schemes. Modi's government returned with Bharatiya Janata Party allies. Sengupta highlights long-term policy impact.

Budget 2024: What's coming up? A Sitharaman budget or a Naidu-Nitish budget?

Budget Expectations: Finance Minister Nirmala Sitharaman will present her seventh full budget on July 23. Known for fiscal prudence, aggressive capital expenditure, and boosting manufacturing, her previous budgets lacked populist proposals. With changed political dynamics post-elections, allies TDP and JD(U) are speculated to seek favorable treatment in the budget. Sitharaman is expected to balance fiscal discipline with growth amidst demands.

Union Budget consultations done, Sitharaman set to announce measures and reforms on July 23

Budget expectations: Finance Minister Nirmala Sitharaman completed pre-Budget consultations with diverse stakeholders, setting the stage for presenting her seventh Union Budget on July 23. This first full budget of Modi's third term aims to steer India towards becoming a developed nation by 2047. President Murmu hinted at significant economic reforms ahead.

Budget 2024: Tax cuts and lower rates top developers’ Budget wishlist

Budget Expectations: As the Union Budget 2024 nears, real estate developers eagerly await tax rationalisation and interest rate cuts for financial viability and growth. The CREDAI and Colliers survey underscores the need for GST input tax concessions and lower interest rates to boost project feasibility. Developers anticipate strong demand in Tier I and II cities, with hopes of sustaining momentum in 2024. Expectations include cost management solutions, price increases, and exploring new residential models. Developers and stakeholders look to Budget 2024 for crucial support in driving sector growth.

6 things salaried taxpayers want from Budget 2024: Hike in standard deduction, HRA exemption, work from home benefits and more

Budget 2024 expectations: The upcoming budget is expected to address salary taxation to benefit salaried individuals and boost the economy. Taxpayers expect revisions in areas like standard deduction, tax slabs, and HRA limits to ease their burden and encourage spending. Here are some of the key changes that salaried taxpayers want from Finance Minister Nirmala Sitharaman in Budget 2024.

Budget 2024: Ahead of Sitharaman’s big announcement, a look at govt’s forex war chest to deal with external shocks

India Forex Reserve FY 2023-24 | Finance Minister Nirmala Sitharaman is set to present her seventh Budget in July 2024 amid robust economic indicators, including India's substantial foreign exchange reserves of nearly $654 billion. The Modi 3.0 government's first full budget comes amidst high capital inflows and resilient forex management, underscoring economic resilience and strategic fiscal planning

- Go To Page 1

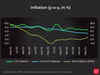

Budget 2024: A look at how India’s inflation panned out within a year before Sitharaman’s key announcements

Budget 2024 India Inflation Rate | Finance Minister Nirmala Sitharaman is set to unveil Budget 2024 amid a focus on India's inflation, a pivotal concern. With inflation easing to a 12-month low of 4.75% in May, the RBI aims for a sustainable 4% target. The budget will navigate challenges like food prices and global uncertainties, shaping economic policies for stability and growth.

India's economy: A-Z all you need to know before announcement of Union Budget

Union Budget will be announced by Finance Minister Nirmala Sitharaman in late July. The report covers key economic indicators, including India's GDP growth at 7.8% in Q4FY24, concerns over consumption expenditure, stable retail inflation at 4.7%, fiscal deficit reduction to 5.6% in FY24, and a narrowing trade deficit | Budget 2024

Mumbai petrol and diesel tax slashed, Ajit Pawar announces in Maharashtra budget

Maharashtra's Deputy Chief Minister Ajit Pawar announced tax reductions on petrol and diesel in Mumbai, lowering diesel prices by 2 rupees per litre and petrol by 65 paise per litre. The state budget also includes provisions such as free gas cylinders under the CM Anna Chhatra Yojana, bonuses for cotton and soybean farmers, and increased compensation for deaths caused by animal attacks to Rs 25 lakhs

Maharashtra budget 2024 key highlights: Free cylinders & farmer friendly measures

Maharashtra budget 2024: Maharashtra Deputy Chief Minister Ajit Pawar presented the state budget during the ongoing monsoon session from June 27 to July 12. Key highlights include the provision of three free cylinders annually to all households under the CM Anna Chhatra Yojana, a Rs 5,000 per hectare bonus for cotton and soybean farmers, and a Rs 5 per litre bonus to milk-producing farmers after July 1, 2024.

Budget will announce historic steps, present a ‘futuristic vision,’ says President Murmu

President Murmu said that today India alone contributes to 15% of the global growth and reiterated her government’s commitment to make India the third largest economy in the world. She sought the support of the Opposition to meet this goal, invoking the Vedas and said all sides should work together “with a common idea and goal”.

GST Council Meeting: Railway Platform tickets exempted from GST, biometric authentication push & other key decisions

At its 53rd meeting in New Delhi, the GST Council decided to implement nationwide biometric authentication to combat fake invoicing. Finance Minister Nirmala Sitharaman announced retrospective amendments to input tax credit timelines under the CGST Act from July 2017. The meeting, the first since the new government took office, also addressed various operational issues and recommended uniform GST rates for milk cans and carton boxes.

How is the Budget prepared: Insights and expectations for this year

The Indian Union Budget preparation is a meticulous process overseen by the Ministry of Finance (MoF), involving NITI Aayog and other ministries. It begins around August-September, culminating in the February 1 presentation, in a non-General Election year. Defined by Article 112 of the Constitution, it forecasts revenues and expenditures, balancing fiscal prudence with developmental goals through circular issuance, revenue scrutiny, stakeholder consultations, allocation decisions, and the symbolic Halwa Ceremony.

Looking Back at Modi's Budget: 10 key Budget announcements in 10 years of Narendra Modi government

In its first ever Budget, the Narendra Modi government announced the much-famed Beti Bachao Beti Padhao Yojana. The then finance minister Arun Jaitley allocated Rs 100 crore to the scheme, aimed at educating, empowering and protecting the girl child. The scheme also focused on general awareness and better delivery of welfare services.

Budget 2024 FAQs: Quick guide on how to read and understand the Budget

Budget 2024 FAQs: The Budget acts as a detailed plan outlining the government's anticipated income and spending for a fiscal year, covering from April 1 to March 31 of the subsequent year. This financial blueprint is pivotal in defining the nation's economic priorities and allocating resources accordingly. After the finance minister delivers the budget speech in the Lok Sabha, these essential documents are promptly uploaded to the official website, ensuring quick and widespread access to critical financial information.

Union Budget 2024: Key facts and insights you need to know

Union Budget 2024: India's inaugural Budget was announced in pre-independent India on April 7, 1860, by Scottish economist and politician James Wilson of the East India Company, presenting it to the British Crown. Following Independence, India's first post-independence budget was presented on November 26, 1947, by then Finance Minister R K Shanmukham Chetty.

Cement, infra are key sectors to look at because of prospect of policy continuity: Pankaj Pandey

Pankaj Pandey discusses the impact of the incumbent government's majority on the market, focusing on earnings, Budget expectations, and sector performance post-elections. Pandey further says once this monsoon gets over the focus will shift towards the overall infra spend side. Cement has not seen much of a price performance and key players like ACC, Ambuja, UltraTech or JK Cement are going to experience a slightly better growth rate than the industry.

Samajwadi Party manifesto: Key announcements and highlights

Samajwadi Party's manifesto for 2024 Lok Sabha elections includes promises like caste census, MSP legal guarantee, women's reservation, free education, and Smart Village Cluster Development Authority establishment. Contesting 62 seats in UP INDIA bloc.

India has bigger strategies for aam aadmi beyond Budget's income tax slab disappointment

The common man awaits to hear in the Budget if the govt will ease tax rates, impacting cash in hand. While the interim Budget didn't change income tax slabs, it did address the headache of fiscal deficit, which impacts a country's wallet. Fiscal prudence was prioritised, and the government aims to narrow the budget gap. A higher fiscal deficit leads to higher government debt and higher interest payments. The government stuck to fiscal prudence despite elections, and reduced borrowing may lead to lower interest rates.

Budget tries to find a counter to a potent weapon of the opposition

Finance Minister Nirmala Sitharaman's interim budget proposed a rooftop solar scheme called Pradhan Mantri Suryodaya Yojana, providing 300 units of free electricity per month to 10 million households. This scheme aims to save households Rs 15,000-18,000 annually and promote solar power generation. It also creates entrepreneurship and employment opportunities. The grid-connected rooftop solar system will reduce burden on electricity distribution companies, lower fossil fuel usage, and contribute to India's renewable energy goals of 500 GW by 2030 and 50% non-fossil fuel power generation capacity.

Budget 2024: Key announcements for different industries

In the Interim Budget for 2024, Finance Minister Nirmala Sitharaman presented key announcements for diverse industries, emphasizing growth and development. Highlights include continued expansion of airports and tourism projects, comprehensive support for dairy farmers, strategies for self-sufficiency in oilseeds, and a new scheme for deep-tech technology in the defence sector.

Budget throws spotlight on more than 50 stocks from 7 sectors

Within the confines of the available fiscal space, the government is channeling enough for capex which is almost 40% of the additional total outlay. This is being directed to roads, railways, and defence and it can have positive linkage effects with industries like steel, cement, capital goods etc, Way2Wealth said.

Budget 2024 Priorities: FM's announcements for Gareeb, Mahilayen, Yuva, Annadata

Union Finance Minister Nirmala Sitharaman emphasised during her Budget 2024 speech that the government will prioritise four main castes - Garib (Poor), Mahilayen (Women), Yuva (Youth), and Annadata (Farmer). "The government under the leadership of the Prime Minister firmly believes to focus on four major castes i.e. 'Garib' (poor), 'Mahilayen' (women), 'Yuva' (youth) and 'Annadata' (farmer). Their needs, their aspirations, and their welfare are our highest priority. The country progresses when they progress. All four require and receive government support in their quest to better their lives. Their empowerment and well-being will drive the country forward," the Finance Minister said.

Key budget announcements in Modi 2.0's last financial document you can't miss

Key Budget Announcements: Finance Minister Sitharaman outlined initiatives for the next five years, including increased housing, expanded access to free electricity, and enhanced medical care, especially for women. Sitharaman pledged support for key sectors targeted by Modi, such as farmers, youth, women, and the impoverished, as the country looks towards 'unprecedented development' in the next five years.

Interim Budget: Direct, indirect taxes comprise 63 paise of every rupee in govt coffer

The interim Budget 2024-25 documents reveal that 63 paise of every rupee in government revenue will come from direct and indirect taxes, 28 paise from borrowings and other liabilities, 7 paise from non-tax revenue, and 1 paise from non-debt capital receipts. Direct taxes, including corporate and individual income tax, will contribute 36 paise, while indirect taxes such as GST, excise duty, and customs levy will account for 26 paise. The remaining 38 paise will be allocated for interest payments, states' share of taxes and duties, defence, central sector schemes, centrally-sponsored schemes, Finance Commission and other transfers, subsidies, pension, and other expenditures.

Budget 2024: Expect our govt will be blessed again by people with resounding mandate, says Finance Minister

Budget 2024: Finance Minister Nirmala Sitharaman expressed optimism that the BJP-led government would receive a strong mandate from the people in the upcoming general elections for the Lok Sabha, scheduled to take place in the next few months. Sitharaman also highlighted India's successful navigation through the challenges posed by Covid-19 and the establishment of foundations for a self-reliant India.

India Budget: New Delhi to borrow Rs 14.13 lakh crore in FY25, bond yields plunge

Budget Announcements: The Indian government plans to borrow 14.13 trillion rupees ($170.36 billion) in the next fiscal year, lower than economists' estimates, according to Finance Minister Nirmala Sitharaman. Net borrowings are expected to remain largely unchanged from the current fiscal year, at 11.75 trillion rupees. The funds will be used to finance a fiscal deficit of 5.1% of GDP, with the government also conducting switch auctions worth 1 trillion rupees. Additionally, 4.66 trillion rupees will be raised through India's small savings fund to cover the budget gap.

Budget 2024 announcements: When and where to watch live stream and telecast of finance minister Sitharaman's speech today

Budget 2024 announcements : Finance Minister Nirmala Sitharaman is expected to exercise fiscal prudence in the interim budget 2014 before the upcoming elections, which will be subsequently replaced by a new budget after the formation of the government post the April-May elections. The budget is anticipated to serve as an economic manifesto, outlining Prime Minister Narendra Modi's vision for the next five years. Sitharaman's upcoming budget presentation is significant as it marks the final budget before general elections.

Load More