DELHI BUDGET 2024 ANNOUNCEMENT

Is a big boost to power financiers likely in Budget? Deven Choksey answers

Reliance Jio's strategic timing aligns with 5G advancements and tariff adjustments, poised to boost revenue and shareholder value. The company's emphasis on EBITDA margin growth and potential IPO plans suggest a positive outlook for unlocking shareholder value. Deven Choksey says that 12 months forward, with a Rs 1,45,000-1,50,000 crore revenue book, 55% EBITDA margin cannot be ruled out .

Budget 2024: MSME ministry seeks additional ₹5,000 crore for job generation scheme

Budget 2024: The government subsidizes a percentage of the loan amount for self-employment ventures, with applicants required to contribute towards the project cost. Despite the high demand, the budget allocation for PMEGP in the current year is lower than the revised estimates for the previous year.

Budget 2024: Ahead of Sitharaman’s big announcement, a look at govt’s forex war chest to deal with external shocks

India Forex Reserve FY 2023-24 | Finance Minister Nirmala Sitharaman is set to present her seventh Budget in July 2024 amid robust economic indicators, including India's substantial foreign exchange reserves of nearly $654 billion. The Modi 3.0 government's first full budget comes amidst high capital inflows and resilient forex management, underscoring economic resilience and strategic fiscal planning

Budget 2024 should hike basic income tax exemption limit to Rs 5 lakh in both old and new tax regimes: Deloitte

Finance Minister Nirmala Sitharaman is likely to present Union Budget 2024 this month. Salaried taxpayers are eagerly waiting for some much-needed tax benefits from the upcoming Budget. According to Deloitte, salaried people want Finance Minister to revamp tax slab benefits, adjust HRA rates, incentivise EV sales, and promote affordable housing in Budget.

Budget 2024: Will Sitharaman stick to fiscal prudence this time around? All you need to know about India’s fiscal deficit

Fiscal Deficit of India 2023-24 | Finance Minister Nirmala Sitharaman's 2024 Budget, scheduled for July, aims to navigate India's fiscal deficit amidst varied economic priorities and coalition dynamics. With fiscal discipline crucial, the Modi 3.0 government seeks to balance capital expenditure initiatives with rural, healthcare, and educational needs while aiming to achieve a fiscal deficit target of 5.2% and eventually 4.5% by 2025-26 | Union Budget 2024

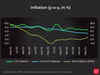

Budget 2024: A look at how India’s inflation panned out within a year before Sitharaman’s key announcements

Budget 2024 India Inflation Rate | Finance Minister Nirmala Sitharaman is set to unveil Budget 2024 amid a focus on India's inflation, a pivotal concern. With inflation easing to a 12-month low of 4.75% in May, the RBI aims for a sustainable 4% target. The budget will navigate challenges like food prices and global uncertainties, shaping economic policies for stability and growth.

- Go To Page 1

India's economy: A-Z all you need to know before announcement of Union Budget

Union Budget will be announced by Finance Minister Nirmala Sitharaman in late July. The report covers key economic indicators, including India's GDP growth at 7.8% in Q4FY24, concerns over consumption expenditure, stable retail inflation at 4.7%, fiscal deficit reduction to 5.6% in FY24, and a narrowing trade deficit | Budget 2024

Outlay for export tax remission plans unlikely to change in Budget

The government is unlikely to increase the allocation for key tax remission schemes for exporters in the 2024-25 budget, despite demands for more support. In the interim budget, ₹16,575 crore was earmarked for the RoDTEP scheme and ₹9,246 crore for the RoSCTL scheme. Exporters argue for adequate allocation to maintain zero-rated exports, a government policy, as merchandise exports rose 5.1% year-on-year in the first two months of this fiscal.

Maharashtra budget 2024 key highlights: Free cylinders & farmer friendly measures

Maharashtra budget 2024: Maharashtra Deputy Chief Minister Ajit Pawar presented the state budget during the ongoing monsoon session from June 27 to July 12. Key highlights include the provision of three free cylinders annually to all households under the CM Anna Chhatra Yojana, a Rs 5,000 per hectare bonus for cotton and soybean farmers, and a Rs 5 per litre bonus to milk-producing farmers after July 1, 2024.

Budget 2024 will see many historic economic policies, will be a futuristic one: President Murmu at Parliament

In her address to Parliament, President Droupadi Murmu announced that the upcoming Union Budget will introduce historic economic policies and reforms at an accelerated pace. Highlighting India's contribution of 15% to the global economy, she emphasized that this budget will reflect the government's long-term policies and futuristic vision. Finance Minister Nirmala Sitharaman is set to present this Union Budget in July 2024.

Budget 2024 HRA Exemption: Will Bengaluru, Hyderabad, other non-metro cities be included in 50% HRA tax exemption list?

Budget 2024 HRA Exemption: Many employers offer an HRA as part of their employees' compensation. If an employee receiving HRA is paying rent for their accommodation, they can claim a tax exemption on the HRA. Currently, a rented house in Delhi, Mumbai, Kolkata, and Chennai qualifies for a 50% exemption from HRA, while those located in other places come under the 40% bracket.

Budget 2024: Skilling industry demands incentives, tax rebates and labour codes in meeting with FM Sitharaman

Ahead of the Union Budget for 2024-25, the Union Minister of Finance and Corporate Affairs held the eighth Pre-Budget Consultation in New Delhi, focusing on employment and skill development. Key figures like Anshuman Magazine and Suchita Dutta emphasized the need for skilled workers and job readiness among graduates. Discussions also highlighted incentives for skill improvement and formal employment practices, including lowering GST rates for employment services. There were calls for greater inclusion of women in the workforce and the expansion of social security measures. Startups advocated for foreign language education to tap into global job markets.

Budget Preview: Govt could use part of RBI dividend to reduce fiscal deficit, says Motilal Oswal

A transfer of Rs 2.11 lakh crore by the RBI implies excess receipts of about Rs 1.5 lakh crore in FY25, the MOFSL note said. MOFSL sees the new government largely retaining its tax and non-debt capital receipt (including disinvestment) projections as presented during the interim Budget in February.

Budget 2024: Sitharaman underlines Centre's support to states via timely tax devolution, GST compensation arrears

Union Budget: Finance Minister Nirmala Sitharaman emphasised the Centre's commitment to supporting states through timely tax devolution and GST compensation arrears to boost economic growth during a pre-budget meeting with state finance ministers. She encouraged states to utilize the 50-year interest-free loan scheme for reforms. States appreciated the assistance and provided suggestions for the upcoming Union Budget, with specific requests for projects and allocations.

States seek infra, rural push in pre-budget meet with FM Sitharaman

States presented demands for higher special assistance, increased allocations for rural schemes, and support for housing programmes to Finance Minister Nirmala Sitharaman in the pre-budget meeting. Sitharaman highlighted the Centre's aid to states through timely tax devolution and release of GST compensation arrears. Andhra Pradesh requested central funds for various projects and initiatives, including the development of Amaravati as its capital.

Budget 2024: What will happen to Income Tax in this Budget, will it be cut?

Finance Minister Nirmala Sitharaman is gearing up to present the Union Budget 2024 in late July, her seventh budgetary address. Following the interim budget in February, expectations are high regarding potential income tax rate cuts to stimulate consumption and address economic priorities. Industry bodies like FICCI and CII have advocated for tax relief, while the Ministry of Finance explores measures targeting higher-spending individuals, potentially introducing a new tax bracket.

How is the Budget prepared: Insights and expectations for this year

The Indian Union Budget preparation is a meticulous process overseen by the Ministry of Finance (MoF), involving NITI Aayog and other ministries. It begins around August-September, culminating in the February 1 presentation, in a non-General Election year. Defined by Article 112 of the Constitution, it forecasts revenues and expenditures, balancing fiscal prudence with developmental goals through circular issuance, revenue scrutiny, stakeholder consultations, allocation decisions, and the symbolic Halwa Ceremony.

Budget 2024: What is Dividend Distribution Tax? Know How it will abolition impact the Indian economy?

In 2020-21, India's government abolished the Dividend Distribution Tax (DDT), shifting the tax burden on dividends from companies to shareholders directly. The move aimed to simplify taxation, enhance market appeal for Indian equities, stimulate domestic investment, and potentially attract more Foreign Direct Investment (FDI) into the country's economy.

Budget wishlist from agriculture & MSMEs stakeholders: Sops, infra push, easy loans and PLI schemes

Stakeholders from the agricultural sector and MSMEs provided key suggestions to Finance Minister Nirmala Sitharaman during pre-budget consultations. Suggestions included rationalizing fertilizer subsidies, boosting agricultural infrastructure investment, and implementing employee-centric production-linked incentive schemes.

Budget expectation of farm sector: Spotlight on agri research, fertiliser subsidy, climate fight in meeting with FM

Budget 2024 expectations: Experts at the meeting advocated for the consolidation of all agriculture-related subsidies for transfer through Direct Benefit Transfer (DBT) and proposed a hike in the retail price of urea, unchanged since 2018. They also emphasized promoting bio-fertilisers and foliar fertilisers through subsidies.

Budget 2024: Modi 3.0 may have to redo the Budget math to provide more money to Naidu & Nitish-ruled states

Union Budget: Following recent Indian election results, Prime Minister Narendra Modi reasserts control over the federal government. Despite depending on various allies for support, none have significant ministerial roles. The focus shifts to relations between New Delhi and influential state governments, with demands for increased federal funds. The upcoming budget will reveal potential shifts in India's policy landscape.

Looking Back at Modi's Budget: 10 key Budget announcements in 10 years of Narendra Modi government

In its first ever Budget, the Narendra Modi government announced the much-famed Beti Bachao Beti Padhao Yojana. The then finance minister Arun Jaitley allocated Rs 100 crore to the scheme, aimed at educating, empowering and protecting the girl child. The scheme also focused on general awareness and better delivery of welfare services.

Union Budget: India mulls income tax cuts in Budget as part of $6 billion consumer boost

India Budget Tax Expectations: India's government under Prime Minister Narendra Modi is considering measures worth over 500 billion rupees to boost consumption in the upcoming budget. This includes tax cuts for lower income individuals for the first time in seven years. The plan aims to target consumers with high propensity to spend amidst economic challenges.

Budget 2024 FAQs: Quick guide on how to read and understand the Budget

Budget 2024 FAQs: The Budget acts as a detailed plan outlining the government's anticipated income and spending for a fiscal year, covering from April 1 to March 31 of the subsequent year. This financial blueprint is pivotal in defining the nation's economic priorities and allocating resources accordingly. After the finance minister delivers the budget speech in the Lok Sabha, these essential documents are promptly uploaded to the official website, ensuring quick and widespread access to critical financial information.

Union Budget 2024: Key facts and insights you need to know

Union Budget 2024: India's inaugural Budget was announced in pre-independent India on April 7, 1860, by Scottish economist and politician James Wilson of the East India Company, presenting it to the British Crown. Following Independence, India's first post-independence budget was presented on November 26, 1947, by then Finance Minister R K Shanmukham Chetty.

Hike capex by 25%, reduce GST slabs to maximum of 3 in Union Budget: FICCI tells Nirmala Sitharaman

Budget 2024: Industry lobby group FICCI in pre-budget consultation with Finance Minister Nirmala Sitharaman in Delhi emphasized the need to support growth momentum, infrastructure development, rein in food inflation, support MSMEs, and prioritize innovation and research & development for accelerated growth.

Focus on agriculture sector in Budget 2024 as it can generate employment: PHDCCI

Budget expectations: In its pre-Budget recommendations to the Finance Ministry, PHD Chamber of Commerce and Industry (PHDCCI) emphasized focusing on the agriculture sector as a vital employment generator. With a significant portion of India's workforce in agriculture, PHDCCI advocates for boosting rural infrastructure, increasing public and private investments, and reducing post-harvest losses.

Budget must focus on employment generation, boost to manufacturing sector: Economists

Economists attending the pre-Budget consultation with Finance Minister Nirmala Sitharaman emphasized the need for the upcoming Budget to prioritize employment generation and bolster the manufacturing sector. They highlighted concerns over unemployment and urged the government to focus on job creation. There was consensus that with the economy showing resilience, stimulating consumption demand would not be a major challenge.

Govt needs to adopt granular approach to support biz, promote jobs: PwC Chairman

PwC in India Chairperson Sanjeev Krishan emphasizes the need for a granular and tailored approach to support small businesses, promote job creation, and ensure inclusive economic growth in Modi 3.0 government's agenda.

Load More