DELHI BUDGET 2024 LIVE

Budget 2024: MSME ministry seeks additional ₹5,000 crore for job generation scheme

Budget 2024: The government subsidizes a percentage of the loan amount for self-employment ventures, with applicants required to contribute towards the project cost. Despite the high demand, the budget allocation for PMEGP in the current year is lower than the revised estimates for the previous year.

Hong Kong, Singapore most expensive cities to live in the world; where do Mumbai & Delhi stand?

According to Mercer's cost-of-living data report, Hong Kong, Singapore, and Zurich are the most expensive cities for international workers in 2024, maintaining their positions from last year. The cities with the lowest living costs are Islamabad, Lagos, and Abuja. Mumbai is the highest-ranked Indian city at 136th, with Delhi moving up to 165th. Other Indian cities listed are Chennai (189), Bengaluru (195), Hyderabad (202), Pune (205), and Kolkata (207).

Budget 2024 should hike basic income tax exemption limit to Rs 5 lakh in both old and new tax regimes: Deloitte

Finance Minister Nirmala Sitharaman is likely to present Union Budget 2024 this month. Salaried taxpayers are eagerly waiting for some much-needed tax benefits from the upcoming Budget. According to Deloitte, salaried people want Finance Minister to revamp tax slab benefits, adjust HRA rates, incentivise EV sales, and promote affordable housing in Budget.

India's economy: A-Z all you need to know before announcement of Union Budget

Union Budget will be announced by Finance Minister Nirmala Sitharaman in late July. The report covers key economic indicators, including India's GDP growth at 7.8% in Q4FY24, concerns over consumption expenditure, stable retail inflation at 4.7%, fiscal deficit reduction to 5.6% in FY24, and a narrowing trade deficit | Budget 2024

Income tax Budget 2024 expectations: 10 ways the finance minister can ease income tax and financial burden of senior citizens

Income tax Budget 2024 expectations: A notable percentage of taxpayers in India are senior citizens since they receive income, frequently through passive means. ET Wealth Online interviewed three specialists to discuss senior citizens' expectations for the forthcoming Union Budget 2024.

Outlay for export tax remission plans unlikely to change in Budget

The government is unlikely to increase the allocation for key tax remission schemes for exporters in the 2024-25 budget, despite demands for more support. In the interim budget, ₹16,575 crore was earmarked for the RoDTEP scheme and ₹9,246 crore for the RoSCTL scheme. Exporters argue for adequate allocation to maintain zero-rated exports, a government policy, as merchandise exports rose 5.1% year-on-year in the first two months of this fiscal.

- Go To Page 1

Section 80C deduction in Budget 2024: Will the government increase Section 80C limit under the old income tax regime in Budget?

Section 80C deduction in Budget 2024: The 80C limit has not increased in line with many people's income and costs. Because of this gap, many taxpayers use the entire 80C limit. This is why many want this limit to be increased.

Income tax relief: Budget 2024 may increase standard deduction under new income tax regime

Will Budget 2024 increase standard deduction: The Finance Minister in the 2023 Budget included a standard deduction of Rs 50,000 for salaried taxpayers and individuals getting pensions in the new tax regime. This standard deduction was made the automatic choice, unless taxpayers chose not to take it.

Sharpen focus on education and health this Budget, experts urge FM

Although the pandemic is behind us, the focus on the health sector shouldn't be diluted, he added. There were also suggestions to tightly monitor the implementation of all such social sector schemes, he added. Facilities at schools and hospitals need to be further improved and vacancies filled up on time, some of them said in the meeting. In the interim Budget for FY25 in February, the government had pegged the outlay for the Ministry of Health and Family Welfare at ₹90,659 crore, up marginally from the FY24 budget estimate of ₹89,155 crore. This outlay also includes spending on health research.

Budget 2024: Govt may adjust income criteria for housing aid in urban areas

The government is preparing to revise the income criteria for middle-income groups (MIGs) to qualify for assistance under the Pradhan Mantri Awas Yojana (Urban) [PMAY(U)]. This change, expected to be included in the 2024-25 budget, aims to better target the housing scheme in urban areas.

Budget 2024 HRA Exemption: Will Bengaluru, Hyderabad, other non-metro cities be included in 50% HRA tax exemption list?

Budget 2024 HRA Exemption: Many employers offer an HRA as part of their employees' compensation. If an employee receiving HRA is paying rent for their accommodation, they can claim a tax exemption on the HRA. Currently, a rented house in Delhi, Mumbai, Kolkata, and Chennai qualifies for a 50% exemption from HRA, while those located in other places come under the 40% bracket.

Budget 2024: Skilling industry demands incentives, tax rebates and labour codes in meeting with FM Sitharaman

Ahead of the Union Budget for 2024-25, the Union Minister of Finance and Corporate Affairs held the eighth Pre-Budget Consultation in New Delhi, focusing on employment and skill development. Key figures like Anshuman Magazine and Suchita Dutta emphasized the need for skilled workers and job readiness among graduates. Discussions also highlighted incentives for skill improvement and formal employment practices, including lowering GST rates for employment services. There were calls for greater inclusion of women in the workforce and the expansion of social security measures. Startups advocated for foreign language education to tap into global job markets.

Focus on upcoming Budget: Policy in the works on finance, health support for elders

India is considering policy measures for senior care, including expanding healthcare access through Ayushman Bharat, revising pension under the Indira Gandhi scheme, and providing healthcare under NPHCE.

States seek infra, rural push in pre-budget meet with FM Sitharaman

States presented demands for higher special assistance, increased allocations for rural schemes, and support for housing programmes to Finance Minister Nirmala Sitharaman in the pre-budget meeting. Sitharaman highlighted the Centre's aid to states through timely tax devolution and release of GST compensation arrears. Andhra Pradesh requested central funds for various projects and initiatives, including the development of Amaravati as its capital.

Budget wishlist from agriculture & MSMEs stakeholders: Sops, infra push, easy loans and PLI schemes

Stakeholders from the agricultural sector and MSMEs provided key suggestions to Finance Minister Nirmala Sitharaman during pre-budget consultations. Suggestions included rationalizing fertilizer subsidies, boosting agricultural infrastructure investment, and implementing employee-centric production-linked incentive schemes.

Finance Minister Nirmala Sitharaman chairs fifth pre-budget consultation with MSME representatives

Union Minister Nirmala Sitharaman chaired the fifth Pre-Budget Consultation in New Delhi, focusing on inputs from the MSME sector for the forthcoming General Budget 2024-25.

Budget expectation of farm sector: Spotlight on agri research, fertiliser subsidy, climate fight in meeting with FM

Budget 2024 expectations: Experts at the meeting advocated for the consolidation of all agriculture-related subsidies for transfer through Direct Benefit Transfer (DBT) and proposed a hike in the retail price of urea, unchanged since 2018. They also emphasized promoting bio-fertilisers and foliar fertilisers through subsidies.

Budget 2024: Modi 3.0 may have to redo the Budget math to provide more money to Naidu & Nitish-ruled states

Union Budget: Following recent Indian election results, Prime Minister Narendra Modi reasserts control over the federal government. Despite depending on various allies for support, none have significant ministerial roles. The focus shifts to relations between New Delhi and influential state governments, with demands for increased federal funds. The upcoming budget will reveal potential shifts in India's policy landscape.

Union Budget: India mulls income tax cuts in Budget as part of $6 billion consumer boost

India Budget Tax Expectations: India's government under Prime Minister Narendra Modi is considering measures worth over 500 billion rupees to boost consumption in the upcoming budget. This includes tax cuts for lower income individuals for the first time in seven years. The plan aims to target consumers with high propensity to spend amidst economic challenges.

Union Budget 2024: Key facts and insights you need to know

Union Budget 2024: India's inaugural Budget was announced in pre-independent India on April 7, 1860, by Scottish economist and politician James Wilson of the East India Company, presenting it to the British Crown. Following Independence, India's first post-independence budget was presented on November 26, 1947, by then Finance Minister R K Shanmukham Chetty.

Budget must focus on employment generation, boost to manufacturing sector: Economists

Economists attending the pre-Budget consultation with Finance Minister Nirmala Sitharaman emphasized the need for the upcoming Budget to prioritize employment generation and bolster the manufacturing sector. They highlighted concerns over unemployment and urged the government to focus on job creation. There was consensus that with the economy showing resilience, stimulating consumption demand would not be a major challenge.

SBI Chairman pitches for tax relief on interest income in Budget

"If at all some relief could be given in the Budget regarding tax on the interest earnings, it will be an incentive to depositors. Eventually, the banking sector uses deposits mobilised for the capital formation in the country," Khara told PTI in an interview.

Two options for budget: Split session or single parliament sitting? When will govt present the Budget?

There’s a discussion on whether to have a single budget session or to split it into two. The government will take a decision in the next few days, though it may be inclined towards a session divided by a recess — with the motion of thanks in the first part, and the budget presented in the latter.

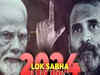

Lok Sabha Election Winner List 2024: Here is the full list of all 543 BJP, Congress, SP, TMC and other victorious MPs

Election Result Full Winner List 2024: The BJP faces unexpected losses in Uttar Pradesh, Haryana, and Rajasthan, with the NDA coalition projected to secure around 290 seats. The BJP alone falls short of a majority, leading in only 191 seats despite gains in Odisha, Telangana, and Kerala. The INDIA alliance leads with 234 seats. The BJP will need strong support from allies to maintain a majority.

Telangana Exit Polls 2024 Live Updates: BJP to make gains in Telangana with 7-9 seats, according to ABP-C Voter exit poll

Exit Polls 2024 Telangana News Live: One of the BJP's prominent faces, Madhavi Latha, saw a case registered against her for allegedly checking the identity of burqa-clad women by asking them to show their faces. Latha claimed that rigging occurred in Riyasat Nagar, alleging police inaction. "Rigging is going on inside," she asserted in a video posted by BJP Telangana. Latha is fighting AIMIM supremo Owaisi in the Hyderabad consituency.

Lok Sabha Elections 2024 Exit Polls Result Live Updates: NDA alliance to come out on top in UP, MP and Gujarat; to make big gains in Bengal

The 2024 Lok Sabha elections exit poll forecasts reveal BJP's potential gains in Tamil Nadu and West Bengal, with NDA alliance predicted to win over 350 seats. The showdown between NDA and Congress-led INDIA bloc intensifies as both aim for victory.

Haryana Exit Polls 2024 Live Updates: BJP to dominate Haryana with 6-8 seats, predicts multiple exit polls

Haryana2024 Exit Polls Live Updates: The state of Haryana, ranking 18th in India's Lok Sabha seat allocation, has ten seats. Out of these, nearly eight are unreserved, and two are reserved for SC candidates. The BJP had won all ten seats, building on their success from 2014 when they secured seven seats.

Delhi Exit Polls 2024 Result Live: BJP looks to clean sweep national capital, yet again, predicts multiple exit polls

Exit Polls 2024 Delhi: In a closely contested battle between the BJP and the AAP-Congress alliance for Delhi’s seven Lok Sabha seats, voter turnout on May 25 surpassed 54 percent, despite the scorching summer heat. In the 2019 elections, the voter turnout in Delhi was 60.52 percent, with the BJP sweeping all seats. This year, the AAP and Congress have joined forces to challenge BJP's supremacy.

IPL fever boosts bar and pub business amid sweltering heatwave

As the Indian Premier League (IPL) playoffs commence, bars, pubs, and cafes are capitalizing on the surge in fan interest. The ongoing heatwave is driving cricket enthusiasts to seek air-conditioned comfort in these establishments rather than enduring the sweltering stadiums. Businesses are offering live screenings, stadium-like atmospheres, sports menus, cocktails, and team merchandise. Despite alcohol-free dry days during elections in Mumbai and Delhi-Gurgaon, establishments expect strong turnout, emphasizing the social experience.

Load More