INDIA BUDGET 2023 TAKEAWAYS

Budget 2024: Ahead of Sitharaman’s big announcement, a look at govt’s forex war chest to deal with external shocks

India Forex Reserve FY 2023-24 | Finance Minister Nirmala Sitharaman is set to present her seventh Budget in July 2024 amid robust economic indicators, including India's substantial foreign exchange reserves of nearly $654 billion. The Modi 3.0 government's first full budget comes amidst high capital inflows and resilient forex management, underscoring economic resilience and strategic fiscal planning

Budget 2024 should hike basic income tax exemption limit to Rs 5 lakh in both old and new tax regimes: Deloitte

Finance Minister Nirmala Sitharaman is likely to present Union Budget 2024 this month. Salaried taxpayers are eagerly waiting for some much-needed tax benefits from the upcoming Budget. According to Deloitte, salaried people want Finance Minister to revamp tax slab benefits, adjust HRA rates, incentivise EV sales, and promote affordable housing in Budget.

Budget 2024: Will Sitharaman stick to fiscal prudence this time around? All you need to know about India’s fiscal deficit

Fiscal Deficit of India 2023-24 | Finance Minister Nirmala Sitharaman's 2024 Budget, scheduled for July, aims to navigate India's fiscal deficit amidst varied economic priorities and coalition dynamics. With fiscal discipline crucial, the Modi 3.0 government seeks to balance capital expenditure initiatives with rural, healthcare, and educational needs while aiming to achieve a fiscal deficit target of 5.2% and eventually 4.5% by 2025-26 | Union Budget 2024

Budget 2024: Will India’s robust manufacturing segment sway Sitharaman’s decisions? A look at PMI numbers

India manufacturing PMI Budget 2024 | Finance Minister Nirmala Sitharaman's upcoming Budget for 2024 is set against the backdrop of robust manufacturing PMI readings, signaling strong economic growth. The latest GDP figures for Q4 and FY24 underscore this momentum, driven by resilient manufacturing and services sectors. Amid global uncertainties, the budget aims for continuity, balancing growth and coalition priorities.

Budget 2024: India’s GST kitty remains central focus; a look at overall collection

India GST Collection Budget 2024 | Finance Minister Nirmala Sitharaman is set to incorporate robust Goods and Services Tax (GST) collections, hitting Rs 2.1 lakh crore in April 2024, into Union Budget 2024. With May's collections at Rs 1.73 lakh crore, GST continues to streamline, aiding government fiscal strategies amidst economic growth and coalition governance challenges.

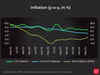

Budget 2024: A look at how India’s inflation panned out within a year before Sitharaman’s key announcements

Budget 2024 India Inflation Rate | Finance Minister Nirmala Sitharaman is set to unveil Budget 2024 amid a focus on India's inflation, a pivotal concern. With inflation easing to a 12-month low of 4.75% in May, the RBI aims for a sustainable 4% target. The budget will navigate challenges like food prices and global uncertainties, shaping economic policies for stability and growth.

- Go To Page 1

India's economy: A-Z all you need to know before announcement of Union Budget

Union Budget will be announced by Finance Minister Nirmala Sitharaman in late July. The report covers key economic indicators, including India's GDP growth at 7.8% in Q4FY24, concerns over consumption expenditure, stable retail inflation at 4.7%, fiscal deficit reduction to 5.6% in FY24, and a narrowing trade deficit | Budget 2024

India gold buyers postpone their purchasing plans, keenly waiting to see if Modi government cuts import duty in Union Budget

BUDGET NEWS: Indian gold demand remains subdued due to high prices, with expectations of an import duty cut in the upcoming budget. Meanwhile, Chinese demand also declined. Domestic gold prices hovered near Rs 71,600 per 10 grams, down from a peak of Rs 74,442 last month. Dealers offered discounts up to $9 per ounce on official prices, including taxes. The market anticipates increased activity closer to the festival season in Q3

India starts preparing for a China-like population problem

Falling fertility rates have left India staring at the spectre of looming demographic challenges that have caused big problems for other Asian powerhouses such as China and Japan. The government is now beginning to plan for an aging India which could be a reality within a decade or two.

States hike in healthcare expenditure to help meet India's '2.5% of GDP' target

India's expenditure on health, including clean water and sanitation, is on track to reach the target of 2.5% of GDP by 2024-25. States have surpassed the Centre's allocation to achieve a combined effort of 2.13% of GDP. Despite concerns over declining spending on healthcare systems, increased state allocations may help reach the 2.5% target by 2025.

Rising vegetable prices strain household budgets across India: Survey

A survey by LocalCircles highlighted significant consumer concerns over rising prices of essential vegetables—onion, potato, and tomato. It found that 16% of households are cutting consumption or feeling financial strain due to these price hikes, with another 31% anticipating impact if prices exceed INR 50 per kg. Currently, 2 in 3 households are paying above-average prices: Rs 25/kg or more for tomatoes, Rs 30/kg or more for potatoes, and Rs 35/kg or more for onions.

Budget 2024: Fin Min considering income tax rate cuts to boost consumption

BUDGET expectations: The Indian government is exploring personal tax cuts for individuals earning over ₹1.5 million annually to boost consumption and savings. This move, considered for the July budget after the BJP’s electoral setback, aims to address inflation and unemployment concerns. These adjustments may modify the existing 2020 tax scheme, potentially lowering the 30% top tax rate.

'Unemployment is not a problem': Arvind Panagariya's prescription to FM Nirmala Sitharaman ahead of Budget

Arvind Panagariya believes India's job challenge lies in reallocating capital to labor-intensive sectors rather than creating jobs. He emphasizes that too much capital is tied up in industries like machinery and pharmaceuticals that don't hire many workers. Panagariya suggests redirecting capital to sectors that generate more jobs per investment, stressing the upcoming budget as a critical policy statement.

India utilised 99.9% of its capex target in FY24

India has used Rs 9,48,506 crore in its capital expenditure in FY24, up from the revised estimate of Rs 9,49,555 crore. The government plans to narrow its fiscal deficit to 5.1% in FY25 from 5.8% in FY24. Private capex is expected to be an important driver of growth and job creation. India's GDP growth was 7.8% in Q4 of FY24, and the overall growth rate is now estimated to be 8.2%.

Cheaper 5G phones chip away at average prices

Flat Average selling prices (ASP) in the March quarter was largely due to a 22% on-year rise in shipments of mass budget phones priced at $100-200 at 16.3 million units, compared with 13.4 million units a year earlier, marking a resurgence from previous quarters.

India may raise FY25 CPSE dividend target in full budget

The finance ministry is set to increase CPSE dividend estimates by Rs 5,000 crore to approximately Rs 53,000 crore for the current fiscal year in the full budget to be presented in July. This adjustment reflects improved dividend forecasts based on updated financial data. Dividend receipts for 2023-24 totaled Rs 63,000 crore.

Key takeaways from MPC meet: RBI keeps interest rates, inflation & GDP unchanged, but has a warning for growth

Reserve Bank of India Governor Shaktikanta Das announced the Monetary Policy Committee's decision to maintain interest rates at 6.5%. With a 5:1 majority, the committee opts to retain the stance of 'withdrawal of accommodation'. Das stresses on returning India's retail inflation to a sustained 4%. Analysts anticipate MPC aligning with cautious policies of US and UK central banks.

Amrit Kaal Budget with fiscal consolidation being ‘Amrit’

The projected fiscal deficit of 5.8% for the current fiscal and 5.1% for FY25 aligns with the government's chosen policy trajectory, maintaining a positive outlook. This path reflects the government's emphasis on policy continuity, encompassing both taxation and spending decisions made over the preceding 12 months.

What Budget 2024 means for you: Positive takeaways from the interim Budget

No hike in basic exemption, no increase in deductions, not even a change in tax slabs– why should taxpayers feel happy about the interim Budget announced last week? Read here to find out

Fiscal prudence vs populist pomp: Nirmala Sitharaman chooses the road less travelled

The Budget numbers are undoubtedly encouraging. It trimmed the fiscal deficit to 5.8% of GDP, a slight but symbolic reduction from the previously budgeted 5.9%, and eyes a more ambitious 5.1% for the next financial year.

India Budget 2024: Key takeaways from Modi 2.0's last finance bill

India's interim Budget disappoints taxpayers with no changes to tax structure. However, the government focuses on fiscal consolidation, capital expenditure, and social welfare services. Finance Minister Sitharaman aims to reduce fiscal deficit to 4.5% of GDP by FY26. Revised fiscal deficit target is 5.8% of GDP for FY25. Here are the other top takeaways from the Interim budget

M&M Group’s Anish Shah on internal reorganization and Budget takeaways

Amarjyoti Barua, a strong finance leader with international experience, joins Mahindra Group as CFO. He will continue the capital allocation strategies implemented by outgoing CFO Manoj Bhat and drive exponential growth. Bhat has been made CEO of Mahindra Holidays which Mahindra Group aims to make a key player in the tourism industry and grow its resorts at least 3X. The budget presented by the government focuses on long-term economic growth. The private sector is expected to step up its capex as the government reduces its commitment.

TCS rates codified to 20%; there’s a PLI for R&D and innovation: Rohinton Sidhwa, Deloitte India

Deloitte India partner Rohinton Sidhwa discusses the changes in the TCS rates imposed on foreign exchange remittances. The TCS rate has been aligned to 20% as per cicular number 10 of 2023. There are also potential changes in the calculation of agricultural income. The finance minister mentioned a PLI for R&D and innovation with a funding of Rs 1 lakh crore. There is also a focus on credit to the tourism sector. Sidhwa believes that the revenue growth assumptions are conservative and expects an increase in tax collection due to rising incomes and an expanding tax net.

Budget 2024: A picture of growth, welfare and fiscal rectitude

The Budget also demonstrates the government’s focus on fiscal consolidation, with a reduction in the fiscal deficit to 5.8% for FY24 vs. a budgeted 5.9%, a further reduction to 5.1% for FY25 and aims to reach a target of below 4.5% by FY26. This is a significant move given that the nominal growth for the current year stands at 9% versus the Budget estimate of 10%.

Budget 2024 impacts stock market investors in 5 ways if you look beyond Sensex

There were neither any shocks nor pleasant surprises in the interim Budget, with no myopic measures being announced. The government did not bow down to the populist measures in the election year and kept the tax regime unchanged but ensured fiscal prudence. The fiscal deficit is set at 5.1%, significantly lower than expected.

Interim Budget: Rs 1249 crore for salaries of union ministers, entertainment of guests, ex-governors

Interim Budget: The interim budget 2024-25 allocated a total of Rs 1,248.91 crore for expenses incurred by the council of ministers, cabinet secretariat, prime minister's office and other expenses, which is lower than the previous budget of Rs 1803.01 crore. Specifically, Rs 832.81 crore is allocated for the expenses of the council of ministers, while Rs 200 crore is allocated for the National Security Council Secretariat.

Key budget announcements in Modi 2.0's last financial document you can't miss

Key Budget Announcements: Finance Minister Sitharaman outlined initiatives for the next five years, including increased housing, expanded access to free electricity, and enhanced medical care, especially for women. Sitharaman pledged support for key sectors targeted by Modi, such as farmers, youth, women, and the impoverished, as the country looks towards 'unprecedented development' in the next five years.

I did not get any takeaway to look at a particular kind of stock or vertical: Porinju Veliyath

Porinju Veliyath believes that the formation of tourism hubs, along with themes like affordable housing, is important. He mentions the potential of religious and pilgrimage tourism with international airports and sufficient infrastructure. The development of tourism can contribute 1% to India's GDP. EIH is a good bet in the luxury tourism sector, especially with new opportunities like Ayodhya. There is potential for growth in the tourism sector, which will have an overall impact on the economy. Porinju expects ONGC to lead the PSU pack in the next one to two years due to its low valuation.

Load More