INDIA RATINGS

India bond yields may see further uptick as US peers jump

Indian bond yields expected to increase amidst renewed Treasuries selloff. Benchmark 10-year yield likely to stay within 6.99%-7.03% range. U.S. yields rising, with expectations of a 46 bps rate cut by the Fed in 2024.

India looks to match world average for share of women in workforce

Proposals under consideration include incentives to create employment, development of the care economy, and enabling easier access to finance to encourage more women to join the labour force, said people aware of the deliberations.

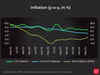

Budget 2024: A look at how India’s inflation panned out within a year before Sitharaman’s key announcements

Budget 2024 India Inflation Rate | Finance Minister Nirmala Sitharaman is set to unveil Budget 2024 amid a focus on India's inflation, a pivotal concern. With inflation easing to a 12-month low of 4.75% in May, the RBI aims for a sustainable 4% target. The budget will navigate challenges like food prices and global uncertainties, shaping economic policies for stability and growth.

PSBs clock higher failure rates for UPI payments

In comparison, private players like HDFC Bank, Axis Bank, ICICI Bank, Yes Bank and IDFC First have an average UPI technical decline of 0.04%. Among private players, Bandhan Bank has seen technical declines of over 1%.

Gold holds ground on US rate-cut expectations

Amidst shifting economic indicators, precious metal prices reflect market uncertainties and investor sentiments influenced by global economic trends and policy decisions. The intricate balance between supply, demand, and macroeconomic factors drives strategic investment choices in the ever-changing financial landscape.

India Ratings pegs bank credit growth at 15.4% for FY25

India Ratings has forecasted a 15.4% loan growth for banks in FY25. The rating agency believes a turnaround in private capital expenditure could alleviate any pressure on overall credit growth during the fiscal year.

- Go To Page 1

Rate sensitivity on the rise in PSB portfolios

"The AFS (available for sale) portfolio's sensitivity (PV01) increased for PSBs (public sector banks) and FBs (foreign banks) since September 2023, while it declined for PVBs (private banks)," the Reserve Bank of India (RBI) said in its June 2024 Financial Stability Report.

Competitive intensity in used vehicle market to be on the rise: India Ratings

India Ratings and Research predicts that vehicle financiers will increase the share of used vehicles in their AUM due to rising new vehicle prices, food inflation, heat wave, moderation in capacity utilization due to elections, and slowing rural economy. The agency also expects a decrease in FY25 growth rates from FY24 levels. The agency expects non-bank finance companies to focus on used vehicles as assets class, presenting a favorable risk-return in terms of asset quality and pricing power.

India central bank policymakers divided over rate-growth debate

Internal members maintain hawkish stance on inflation, with Governor Das cautioning against hasty actions for fear of worsening the situation

Gold loan interest rates in June 2024: Latest gold loan interest rates of 24 banks

A gold loan is a secured loan that allows you to leverage the value of your gold ornaments or jewelry to obtain funds. Latest gold loan interest rates offered by banks in June 2024.

India can grow at 8 pc if inflation keeps falling: Ashima Goyal, an external member of MPC

Ashima Goyal, an external member of the Monetary Policy Committee, emphasized the potential for India's economy to grow at 8% if the nominal repo rate falls in line with declining inflation. The Reserve Bank of India has projected a GDP growth of 7.2% for the current fiscal year.

9.75% FD interest rate: This bank hikes fixed deposit rates by up to 50 bps, now offers 'highest' FD rate in India

Highest FD interest rate: After the hike, the bank is offering rates of up to 9.25% for the public and 9.75% for seniors. As per the bank's announcement, NESFB has raised the interest rate on fixed deposit products from 9.25% to 9.75%.

How ‘Mehengai’ impacts your real rate of return

Inflation impacts stakeholders like companies, investors, and the economy. Central banks manage inflation. Real Rate of Return is crucial for investment performance.

Rate cut hopes, inclusion in JPM index fuel ‘FOMO’ trades in GSecs

Indian sovereign debt players bond with bonds following Mint Road's move to decelerate rate-increase drive and JPMorgan's recognition. CCIL data shows a 40% increase in monthly trades, reaching ₹8.6 lakh crore in 2023.

Global rate-cut juggernaut is struggling to start

Central banks cagey about joining the global interest-rate cutting cycle may reveal themselves this week with a quartet of decisions in advanced economies.

HCC shares jump 15% after Elara Capital initiates buy rating, sees 58% upside

Hindustan Construction Company (HCC) witnessed a significant surge of almost 15% to reach a peak of Rs 45.6 during Tuesday's trading session on the BSE. This increase came after brokerage firm Elara Capital initiated coverage on the stock with a 'Buy' rating and set a target price of Rs 63.

FPIs take out Rs 14,800cr from equities in Jun on poll results, attractive Chinese stock valuations

Foreign investors withdrew nearly Rs 14,800 crore from domestic stocks in the first week of this month, influenced by India's Lok Sabha election results and attractive valuations of Chinese stocks.

Own midcaps? Do a check & balance exercise to avoid decision of haste: 7 midcaps from different sectors with an upside potential of upto 49%

Every now and then the market goes through phases, where it prefers a certain set of stocks, not based on sector but based on the overall market cap. So, sometimes it is large caps, at other mid-caps. Now this partially happens, due to the flows which are coming to markets. For example, if more flows are coming to mid-cap or multicap schemes there is bound to be out performance in the mid-cap space. Now what it does is that it tends to create a sudden surge in mid-cap. Similarly when there is an outflow like the kind of one which we saw in March this year, midcap stocks tend to decline sharply. Essentially, it is the flows which impact the broader matrix of how midcaps behave. So there are phases not owning a midcap stocks appeared to sin and then there phase, where owning them appears to be sin. But if one focuses on the underlying business and some critical parameters, there is a possibility of getting rid of these phases of anxiety which keep coming to the street and create long term wealth.

Sensex climbs 300 points ahead of RBI MPC decision, Nifty above 22,900

The domestic benchmark equity indices, Nifty50 and Sensex, started the day with gains on Friday, as investors anticipated the Reserve Bank of India's policy meeting. It is widely anticipated that the RBI will maintain interest rates unchanged during the meeting.

India rate decision rounds off wild week

India's interest rate decision and Chinese trade figures are key events for Asian investors on Friday amid global political volatility and stock market highs.

Leading Indian hedge fund Avendus Capital sees banking as a top bet

Avendus Capital CEO Holland uncertain about pre-budget rally, mentions potential capital gains tax change ahead of India's full budget presentation in July

Politics may be fluid, but economics is still solid. Time to be somewhat greedy: Raamdeo Agrawal

Post-election, Nifty dropped reacting to exit polls. BJP leads with NDA's mandate for the third government, promising development reforms. PM Modi targets a developed India by 2047 with positive economic indicators like RBI rate cuts, good monsoons, and FIIs re-entry.

Top Nifty50 stocks analysts suggest buying this week

The latest Stock Reports Plus report dated June 2, 2024, highlighted Nifty50 stocks with 'Strong Buy/Buy' recommendations. The report evaluates key components of listed stocks to generate standardized scores for actionable insights.

CLSA tweaks India portfolio, fears de-rating in expensive capex stocks

CLSA adjusts India portfolio post BJP's election setback, favoring defensive stance with HCL Tech replacing L&T. Overweight on banks, commodities, IT, insurance, and staples. Concerns over market valuation amid Nifty's 6% drop and historic high PE ratio.

Election results may trigger India de-rating, Modi stocks to be worst hit

"We expect a market derating in the short term, as the risk on India has gone up. PSUs and Capital goods are the most vulnerable sectors, from which we would stay away for the time being. On the other hand, consumption should come back and we see FMCG and value retailers making a strong return. We are also constructive on Healthcare," said Seshadri Sen of Emkay Global.

India Inc exits FY24 on a strong note, clocks double-digit profit growth in Q4

Corporate India saw double-digit growth in net profit and single-digit revenue increase in the March 2024 quarter. Expectations are for healthy growth in the current fiscal year due to peaking interest rates and government policy continuity.

RBI unlikely to cut rates; Sustained vigil on inflation expected

RBI to hold rates on strong GDP growth. Inflation within target range but food inflation high. RBI cautious on weather impact.

Power stocks: Both PSUs and pvt ones got re-rated. Ready for another round in Modi 3.0? 6 stocks with upside potential of up to 37%

The summer heat leads to high power consumption is a well known fact. What has been the difference in the headlines this year and last two or three years? The news about massive power cuts and the possibility of power plants running out of coal is missing. The news which is dominating is that power demand is high and is being met. This change is the result of many things, right from optimism at one point of time to absolute despair at another. Finally policy push and discipline and integrated approach toward solving the issue of the sector, whether it for thermal, solar, wind or hydro. This led to a certain level of re-rating in Modi 2.0 which is likely to get pace in Modi 3.0. One thing which goes unnoticed is the fact that the power sector moving out of the trouble not only means good news for power companies but also the banks, because after metal, power companies topped the list of NPA of the banks.

SBI increases deposit rates by 25-75 points

Banks adjust deposit rates according to their asset and liability positions and demands for funds in specific tenures. This is the first increase by SBI in deposit rates since December 2023. - Our Bureau

Load More