RBI RATES

RBI aims to get inflation down to 4%, don't expect any rate cut this year: Amitabh Chaudhry, MD, Axis Bank

Axis Bank aims for sustained growth through NIM enhancement, market share expansion, and compliance strengthening under CEO Amitabh Chaudhry's leadership.

RBI Floating Rate Savings Bond interest for July-December 2024 announced: What is the latest interest rate, when will you get it?

RBI Floating Rate Savings Bond interest rate announced: The Reserve Bank of India has notified the interest rate of RBI Floating Rate Savings Bond (FRSB) 2020 (Taxable) from July 1 to December 31 2024. As the name suggests, the interest rate of RBI Floating Rate Savings Bonds 2020 (Taxable) is not fixed. The interest rate on RBI floating rate savings bond is reset twice in a year. The interest is payable semi-annually. All you need to know about the latest interest rate of RBI Floating Rate Savings Bond and how you will get it.

Budget 2024: A look at India’s GDP growth rate before Sitharaman sets the ball rolling in Lok Sabha

Budget 2024 GDP | Finance Minister Nirmala Sitharaman is preparing to unveil Union Budget 2024 in July, underlining India's robust GDP growth. With GDP climbing to 7.8% in Q4 FY24 and an estimated 8.2% for FY24, policies will focus on sustaining growth momentum. The budget aims to align economic strategies with evolving demands amidst global uncertainties.

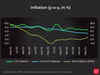

Budget 2024: A look at how India’s inflation panned out within a year before Sitharaman’s key announcements

Budget 2024 India Inflation Rate | Finance Minister Nirmala Sitharaman is set to unveil Budget 2024 amid a focus on India's inflation, a pivotal concern. With inflation easing to a 12-month low of 4.75% in May, the RBI aims for a sustainable 4% target. The budget will navigate challenges like food prices and global uncertainties, shaping economic policies for stability and growth.

Incomplete transmission could delay rate reversal by RBI

High food inflation and incomplete transmission of the 250 basis point policy rate hikes since May 2022 could delay the Reserve Bank of India's (RBI) rate cut. Transmission through loan and deposit rates varied between 111 and 245 bps until May 2024, except for loans linked to external benchmarks, which had immediate full transmission.

Incomplete transmission of policy rates could delay reversal of rate cycle by RBI

RBI faces challenges in rate transmission due to incomplete hikes. Banks show varied transmission rates. Governor Das stresses effective transmission. Rate cuts may come post-October with clearer risk insights.

- Go To Page 1

India's forex reserves rise by $816 million to $653.7 bn as on June 21

India's forex reserves increased by $816 million to $653.7 billion as of June 21, compared to a previous contraction of $2.92 billion to $652.9 billion. Foreign currency assets decreased by $106 million to $574.1 billion. Gold reserves rose by $988 million to $56.95 billion, while SDRs fell by $57 million to $18.04 billion.

India can grow at 8 pc if inflation keeps falling: Ashima Goyal, an external member of MPC

Ashima Goyal, an external member of the Monetary Policy Committee, emphasized the potential for India's economy to grow at 8% if the nominal repo rate falls in line with declining inflation. The Reserve Bank of India has projected a GDP growth of 7.2% for the current fiscal year.

India may reduce rates before US Federal Reserve does

RBI Governor Shaktikanta Das on Friday said that the rate-setting panel will look at domestic conditions while taking rate cut decisions and will not be following the Fed. Other central banks are also diverging from the Fed, as the Bank of Canada and European Central Bank cut rates last week.

No rate cut seen in August either, but enough signs of a shift in stance

In the normal course of events, the rising dissent in the MPC should have led to more joining the camp of rate cut seekers as data turns benign. Inflation may not have come back to the 4% target, but it's not threatening to soar. For the US, it is at 3.4% in April when the target is 2%.

Upward GDP projection and no change in interest rates welcomed by industry and economists

Industry leaders and economists widely accepted RBI's monetary policy stand of no change in interest rates. Besides upward projection of GDP growth for FY25 from 7 per cent to 7.2 per cent is welcomed by the Industry.

RBI MPC: India's forex reserves rise by $4.8 bn to record high of $651.5 bn as of May 31

India's forex reserves reached a record high of $651.5 billion as of May 31, according to RBI Governor Shaktikanta Das. The Reserve Bank of India (RBI) intervenes in the market through liquidity management to prevent rupee depreciation and maintain orderly market conditions by containing excessive exchange rate volatility.

RBI MPC to take call on policy action once 'slow-walking' inflation hits 4 per cent target durably

RBI MPC 2024: Shaktikanta Das, the Governor of the Reserve Bank of India (RBI), has reaffirmed the central bank's commitment to controlling inflation. In a statement on Friday, he emphasised that the Monetary Policy Committee's (MPC) goal is not only to achieve the 4 per cent inflation target but to maintain it steadily.

RBI MPC meeting: India’s FY25 GDP forecast raised to 7.2% from 7%

The Reserve Bank of India (RBI) raised the FY25 real GDP growth forecast to 7.2% from 7% due to improved rural and urban demand, bolstered by monsoon predictions. The Monetary Policy Committee kept the benchmark rate at 6.25%, noting domestic economic resilience. India's FY24 GDP growth accelerated to 8.2%, driven by a sharp decline in the GDP deflator.

RBI MPC Meet 2024: RBI leaves inflation projection for FY25 unchanged at 4.5%

RBI MPC Meet 2024 LIVE: The Reserve Bank of India maintained its inflation forecast at 4.5% for this fiscal year amid concerns over rising food prices. The central bank found some relief as crude prices dipped below $80 per barrel. The RBI's Monetary Policy Committee kept the repo rate unchanged at 6.5% for the eighth consecutive time, citing vigilance against potential inflationary pressures. Governor Shaktikanta Das highlighted the uptick in vegetable prices and global food inflation. Despite a slight easing in overall retail inflation to 4.83%, concerns linger over food price hikes, particularly in items like garlic and ginger.

Electoral shock dashes hopes of rate cut

Food inflation challenges RBI, impacting rate cuts. Elections, populist spending, and fiscal landscape influence rate cut decisions.

A likely Modi 3.0 might just give Indian economy what it wanted for so long

India's chances of soverign rating upgrade is likely high. Exit polls predict Narendra Modi's BJP-led NDA will secure a third term with a significant majority. The NDA is expected to surpass its 2019 tally, easing concerns about replicating previous success. This likely continuity boosts economic confidence, with S&P upgrading India's outlook to "positive" and fiscal indicators showing robust growth and reduced deficit.

Economy expands 7.8% in Q4, lifting FY24 growth to 8.2%

This is the highest annual growth since FY17, excluding the 9.7% post-Covid rebound in gross domestic product (GDP) in FY22 after the 5.8% contraction in FY21. The advance estimate released in February had pegged FY24 growth at 7.6%. Economists and government expect the high growth to continue though tepid private consumption remains a concern.

India’s forex reserves down $2 bn to come off all-time record high

India's forex reserves fell by $2 billion to $646.67 billion as of May 24, according to the Reserve Bank of India (RBI). This decline follows a previous increase of $4.54 billion, reaching an all-time high of $648.7 billion on May 17. The reduction includes a $1.51 billion decrease in foreign currency assets, a $482 million drop in gold reserves, a $33 million dip in SDRs, and a $1 million decline in IMF reserves.

RBI's dividend transfer may ease deposit rates if govt spends it: Ind-Ra

India Ratings and Research (Ind-Ra) stated that the RBI's Rs 2.11 lakh crore dividend transfer will likely ease liquidity pressure and lower deposit rates in the banking system if the government spends it. The substantial dividend will strengthen the central government's fiscal position, potentially leading to additional spending or fiscal consolidation.

India's growth set to get more broad-based, says Morgan Stanley; pegs 6.8% for 2024

India's strong growth, driven by consumer and business spending, is expected to become more broad-based, according to Morgan Stanley. The global investment bank forecasts 6.8% growth in 2024, attributing it to global offshoring, digitalization, and energy transition. Retail inflation is at 4.83%, within RBI's comfort zone. S&P Global Ratings revised its outlook on India to positive, citing robust economic growth and fiscal policies.

India to get rating support if it uses RBI dividend to reduce fiscal deficit: S&P analyst

S&P Global Rating suggests India could improve its rating if it channels the record Rs 2.1 lakh crore dividend from the RBI to reduce fiscal deficit. The dividend, around 0.35% of GDP, could aid fiscal consolidation, potentially supporting a faster path to reducing the deficit and boosting India's creditworthiness.

GDP likely expanded 6.8% in Q4; FY24 print may hit 7.8%

The strong March quarter print could lift overall gross domestic product (GDP) growth for the full fiscal year to 7.8% against 7.6% assessed in the government's first advance estimates released in February. The International Monetary Fund (IMF) has also forecast 7.8% growth for FY24. The government will release fourth-quarter growth numbers and provisional GDP data for FY24 on May 31.

GDP growth likely to be 6.2 pc in Q4; 7 pc in FY24: Ind-RA

India Ratings and Research forecasts India's GDP growth rate at 6.2% for the March quarter and 6.9-7% for 2023-24 fiscal year, per economist Sunil Kumar Sinha. The government is to release Q4 GDP numbers and fiscal estimates on May 31.

India's forex reserves rise for second straight week, up by $2.56 bn

India’s foreign exchange reserves increased by $2.56 billion to $644.15 billion as of May 10, 2024, according to the Reserve Bank of India (RBI). The previous week, reserves rose by $3.66 billion to $641.59 billion. The RBI's Weekly Statistical Supplement indicated that foreign currency assets (FCAs) grew by $1.49 billion to $565.65 billion.

Indian economy projected to expand at 6.6% in FY25, says Moody's

The agency highlighted that strong credit demand, fueled by robust economic growth, will bolster the profitability of the Non-Banking Financial Company (NBFC) sector.

India inflation likely slipped in April: Reuters poll

India's consumer price inflation is expected to ease to 4.80% in April, driven by persistent food inflation challenges. Economists foresee inflation remaining around 5% or higher in the coming months, with the RBI expected to cut interest rates next quarter.

Economy better placed to pursue non-inflationary growth: CEA V Anantha Nageswaran

A high-level expert panel on floor wages in India is set to re-examine the wage rates finalised earlier, considering minimum wages notified by all states across three categories. The panel, led by SP Mukherjee, will hold its final meeting on May 27 and submit its report to the new government by June 2024. The three-year term of the expert committee, established in 2021, will end on June 30, 2024.

Load More