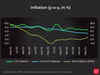

INFLATION READINGS

US job openings rise to 8.1 million despite higher interest rates

U.S. job openings increased slightly to 8.1 million in May, despite higher interest rates aimed at cooling the labor market, as reported by the Labor Department. Layoffs rose slightly, while the number of Americans quitting their jobs remained stable. The economy and job market have shown resilience despite the Federal Reserve's efforts to raise rates. Job openings have decreased since a peak in March 2022, signaling a possible slowdown in the economy.

Fed chief Jerome Powell says more evidence of falling inflation needed before rate cuts

Federal Reserve Chair Jerome Powell stated the U.S. central bank requires more data before reducing interest rates to confirm the recent lower inflation is accurate. May data showed no increase in the Fed’s preferred inflation measure, with the 12-month rate decreasing to 2.6%, still above the 2% target.

Fed's Powell says more evidence of falling inflation needed before rate cuts

The Fed has kept its benchmark policy interest rate steady in the 5.25%-5.5% range since last July, but officials are debating when to ease monetary policy as inflation edges back to the central bank's 2% target. Inflation is still more than half a percentage point above that target, according to the Fed's preferred personal consumption expenditures price index, and was described as "elevated" in the central bank's June 12 policy statement.

Zero factual inaccuracies with our Adani research: Hindenburg on Sebi notice | Read short seller's full response here

Adani-Hindenburg Case: US-based short-seller Hindenburg Research stated Kotak Bank, one of India’s largest banks and brokerage firms founded by Uday Kotak, which created and oversaw the offshore fund structure used by our investor partner to bet against Adani. Instead it simply named the K-India Opportunities fund and masked the “Kotak” name with the acronym “KMIL”

Budget 2024: A look at how India’s inflation panned out within a year before Sitharaman’s key announcements

Budget 2024 India Inflation Rate | Finance Minister Nirmala Sitharaman is set to unveil Budget 2024 amid a focus on India's inflation, a pivotal concern. With inflation easing to a 12-month low of 4.75% in May, the RBI aims for a sustainable 4% target. The budget will navigate challenges like food prices and global uncertainties, shaping economic policies for stability and growth.

Charting the global economy: Inflation ebbs in US, France, Spain

With inflation settling down in many European economies, there are signs that central banks in the areas could reduce interest rates.

- Go To Page 1

US inflation cools in May, boosting hopes of Fed rate cut

May's stable inflation, influenced by service costs and goods prices, sets the stage for potential Federal Reserve interest rate changes. The report highlights slight consumer spending growth and hints at the Fed's aim for a controlled economic slowdown through core inflation moderation.

Fed gets heartening inflation data, but slow road ahead

The US Federal Reserve has received encouraging data suggesting inflation is cooling, which has eased concerns about the effectiveness of monetary policy. However, the road to the Fed's 2% inflation goal, measured in year-over-year terms, is likely to be long, complicating discussions about when to cut interest rates.

US inflation cools in May; consumer spending rises moderately

ART HOGAN from B RILEY WEALTH notes the stable 2.6% core PCE, potentially leading to Fed rate cuts. The overall economic indicators suggest a favorable environment for equities, with ongoing downward trends in treasury yields.

Gold prices hover near two-week low on firm dollar, yields

Gold prices reflect global economic uncertainties amidst discussions on interest rates by central banks, impacting market sentiments. The interplay between various economic indicators and policy decisions continues to shape the trajectory of gold as an investment choice.

Asian shares shaky as investors wary before US inflation data

Asian stocks hesitated in early trade amid anticipation for a crucial U.S. inflation reading. Concerns over potential Japanese intervention lingered as the yen approached 160 per dollar. Japan and Taiwan stocks rallied, while China's market saw a slight decline. Fed comments and stable housing market data influenced rate cut expectations.

Gold flat as dollar, yields firm; investors seek more US data

Amid economic indicators and central bank actions, market focus extends to U.S. housing data, French employment stats, and Fed rate cut forecasts, influencing gold price dynamics.

Fed's Daly: inflation not the only risk, policy must 'exhibit care'

San Francisco Fed President Daly emphasizes caution in addressing inflation control and rising unemployment risks, highlighting the need to restore price stability without harming the economy.

Dollar steady ahead of inflation reading; yen teeters toward 160

The dollar steadied on Monday as traders awaited clues on U.S. inflation influencing interest rates, while Japanese authorities' actions had little impact on the yen's decline to 159.94 per dollar, its lowest since April 29.

Real rate of interest at 1.5 pc apt for economy: Shashanka Bhide

Shashanka Bhide, an external member of the rate-setting panel, suggests a real interest rate of 1.5% for India, closely tied to achieving the Monetary Policy Committee's 4% inflation target. He emphasizes the importance of favorable macroeconomic conditions for high economic growth.

Dollar steadies; sterling dips ahead of inflation test

The dollar weakened after soft U.S. retail sales data increased expectations of Federal Reserve rate cuts, while sterling dipped ahead of UK inflation data. Markets predict a 67% chance of rate cuts in September.

India's disinflation process proving to be arduous thanks to stubborn food inflation: RBI Guv Das

RBI Governor Shaktikanta Das stated that bringing India's retail inflation to the 4% target is challenging due to persistent food price inflation, driven by weather-related supply issues. Speaking at an event, he highlighted that despite moderating core inflation, food inflation remains high, averaging 8% over the past seven months.

Fed's Goolsbee: 'More months' of good inflation data needed

Federal Reserve Bank of Chicago President Austan Goolsbee expressed relief over cooling inflation in May but prefers more months of data before cutting interest rates.

Wholesale inflation surges to 15-month high of 2.61% in May

Manufactured products, which account for nearly two-thirds of weight in the Wholesale Price Index (WPI), returned to inflation for the first time since February 2023 with a 0.78% rise last month.

Yen falls after BOJ decision; euro stutters towards weekly loss

The yen fell after the Bank of Japan kept rates unchanged and announced plans to reduce bond buying. Meanwhile, the euro faced political turmoil and a weekly loss.

What to expect from the upcoming Fed meeting? Mark Matthews answers

Well, there was another election on the other side of the world almost at the same time, which was in Mexico. And there, there was a left wing, that government was elected and their stock market has tanked since then.

US inflation rises in line with expectations in April

U.S. inflation tracked sideways in April, a worrying sign for the U.S. central bank that suggests the elevated pace of price increases could last longer than expected and casts doubt on how soon it will be able to cut interest rates. The personal consumption expenditures (PCE) price index increased 0.3% last month, the Commerce Department's Bureau of Economic Analysis said on Friday, matching the unrevised gain in March.

Gold inches higher as inflation data looms, set for fourth monthly gain

Gold prices edge up for a fourth straight monthly gain as investors await key U.S. inflation data for insights into the Federal Reserve's policy path.

Europe's STOXX 600 dips as rate worries linger

European shares slipped for a third straight session on Thursday ahead of further economic data from the euro zone that will provide more clues on the European Central Bank's interest rate path, while rate woes continued to dampen sentiment.

UK inflation rate slows to 2.3% in April, lowest reading since July 2021

UK consumer prices rose 2.3 per cent annually in April, down from March's 3.2 per cent, hitting their lowest since July 2021. Prime Minister Rishi Sunak called it a significant economic moment. Despite this, inflation slightly exceeded Bank of England and Reuters forecasts. The BOE aims to stabilize prices at 2 per cent

US stocks near record highs with inflation prints in focus

Of the 459 S&P 500 companies that reported through Friday, 77.3% beat analysts' profit estimates, according to LSEG data. The long-term average is 66.7%. At 11:24 a.m. the Dow Jones Industrial Average rose 47.17 points, or 0.12%, to 39,560.01, the S&P 500 gained 2.90 points, or 0.06%, to 5,225.58 and the Nasdaq Composite gained 42.66 points, or 0.26%, to 16,383.53.

India & China inflation readings are worlds apart, India is playing catch-up after Covid: Moody's Analytics

Moody's Analytics reports contrasting retail inflation outlooks for India and China, with China experiencing minimal inflation due to demand shortages and falling pork prices, while India's inflation remains around 5%, nearing the upper limit of the RBI's tolerance band. India's recovery from the pandemic-induced economic downturn is slow, with output still 4% lower than pre-pandemic levels.

Jerome Powell says Fed wants to see ''more good inflation readings'' before it can cut rates

The combination of sturdy growth and decelerating inflation has raised hopes that the Fed is engineering a "soft landing'' - taming inflation without causing a recession. The central bank has signalled that it expects to reverse policy and cut rates three times this year.

Over Rs 5 lakh crore added to investors' kitty! 5 key factors behind today's market rally

Fed Chair Powell's hints of an interest rate cut in June boosted Indian markets. The market capitalisation surged, rate cut odds rose, and various sectors saw gains. Meanwhile, US treasury yields declined, and global markets rallied.

Load More