GOLD ETF INDIA

Top 10 index mutual funds, ETFs deliver up to 36% return in first half of 2024

Top 10 passive funds and ETFs saw returns of up to 36% in the first half of 2024, with a focus on auto sector funds. Notable performers included ICICI Prudential Nifty Auto ETF and Mirae Asset Nifty India Manufacturing ETF, showcasing strong growth in the market.

NFO Tracker: How new mutual funds launched in 2024 are doing

Discover the top performers like Motilal Oswal Nifty Realty ETF and HDFC Manufacturing Fund, showcasing impressive returns in the market. These funds have attracted significant assets and delivered strong performances within a specific period of time in 2024.

Gold prices may face headwinds from strong dollar, rising yields

Gold ended last week on a lower note, dropping to a two-week low due to a stronger dollar and higher bond yields, said Prathamesh Mallya, DVP- Research, Non-Agri Commodities and Currencies, Angel One. The dollar surged to a near two-month peak, making gold more expensive for non-dollar holders, while U.S. 10-year yields reached a near two-week high.

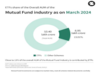

ETFs constitute 13% of the total mutual fund industry AUM: Zerodha Fund House

ETFs now constitute close to 13% of the total Mutual Fund Industry AUM indicating the remarkable adoption of ETFs by retail investors in India, according to a study by Zerodha Fund House.

Gold ETFs add over 1.36 lakh new folios in May, fastest in 60 months. AUM per folio 3rd best in 2 years

Gold ETF schemes added 136,772 folios in May, a 12.5% year-on-year increase. Investors are increasingly choosing Gold ETF mutual schemes for reasons like easy availability and low investment ticket size.

Nippon India Mutual Fund changes fundamental attributes of multi-asset fund. What should you do?

Currently, it is an open-ended scheme that invests in equity, debt, exchange-traded commodity derivatives, and Gold ETFs. After the changes, it will expand to include Silver ETFs as well, becoming an open-ended scheme that invests in equity, debt, exchange-traded commodity derivatives, Gold ETFs, and Silver ETFs.

- Go To Page 1

Not with standing weekly loss, downside in gold likely to remain limited

Going by the action in bonds, the markets are still not giving much credence to the idea of a rate hike. The next week is quite crucial for the financial markets as many major data and reports will be released.

Equity mutual funds continue to witness the maximum share from all states

In April 2024, India saw a 37.29% annual surge in average assets under management (AAUM) to Rs 57.01 lakh crore, with equity-oriented schemes dominating. Maharashtra led in AAUM contribution, followed by New Delhi and Karnataka. No state witnessed a sequential decline in AAUM.

Modi 2.0: Gold ETFs’ AUM jumps 565% to Rs 32,800 crore in 5 years, folios rise by 1,483%

Gold ETFs in India experienced a staggering 565% increase in assets under management (AUM) between June 2019 and April 2024, coinciding with the Modi government's second term. The surge in AUM, from Rs 4,930.44 crore to Rs 32,789 crore, correlates with a 1,483% rise in folios, indicating growing investor interest. This uptick is driven by factors like perceived safety, attractive returns, and the convenience offered by ETFs.

Gold demand expected to primarily revolve around festive period: Kavita Chacko, WGC

After a generally weak March and April, gold demand was resurgent ahead of and around the Akshaya Tritiya festival on 10 May. Considered one of the two most important days for buying gold traditionally, anecdotal evidence suggests that demand exceeded expectations, with strong activity observed in both urban and rural areas; some industry participants even hinting at record buying in value terms.

Silver ETFs beat smallcap, largecap MFs with 26% return in 2024 so far

Silver ETFs outperformed smallcap and largecap mutual funds in 2024, with a 26% return so far. Silver funds, dedicated to investing in silver, delivered an average return of 26.08% in 2024, with top performers including HDFC Silver ETF and UTI Silver ETF FoF.

Big bosses talking up the market is very scary because things can go wrong: PV Subramanyam

PV Subramanyam advises investors to focus on long-term investment strategies, considering market cues cautiously and diversifying portfolios to mitigate risks. He says that we ne need to be careful that the market can go down. The big bosses are talking up the market, which is very scary because things can go wrong and we need to be ready for that.

Gold folio additions surge in April even as smart investors book profits

The assets under management (AUM) of gold ETFs rose by 43% YoY to a record Rs 32,789 crore while the total folio count reached 51 lakh, the data from Association of Mutual Funds in India (AMFI) showed. The total inflow in the past 12 months was Rs 5,248 crore.

Zerodha Nifty 1D Rate Liquid ETF crosses Rs 1,000 crore AUM

Apart from the Liquid ETF, the fund house manages three schemes - Zerodha Nifty LargeMidcap 250 Index Fund, Zerodha ELSS Tax Saver Nifty LargeMidcap 250 Index Fund and Zerodha Gold ETF.

Gold beats Nifty in 5-year timeframe. How much should you invest?

Gold's enduring appeal in India extends beyond symbolizing wealth, outperforming Nifty. Central Banks favor Gold amid dollar risks, while QE and rising debts support its safe-haven status. Diversify portfolios with Gold ETFs for stable returns.

Gold ETFs see first outflow after March 2023

Despite the decline, the asset under management (AUM) of gold funds rose 5% to ₹32,789 crore at April-end from ₹31,224 crore in the preceding month, according to the data with the Association of Mutual Funds in India (Amfi).

19% annual returns in 10 years on buying gold on Akshaya Tritiya; should you invest in gold this year too?

Gold price has increased by 18% to Rs 71,502 for 10 grams with 999 purity since the last Akshaya Tritiya. Investing during this period has historically yielded attractive returns due to various factors such as price cyclicality, holding period, and discipline in investment. Safe havens like gold may see increased demand amidst global uncertainties and currency depreciation impacting prices. Experts recommend a 15% allocation to gold for a balanced risk profile.

Bajaj Finserv Mutual Fund launches Multi Asset Allocation Fund

The scheme will be benchmarked against 65% Nifty 50 TRI + 25% NIFTY Short Duration Debt Index + 10% Domestic Prices of Gold. Nimesh Chandan and Sorbh Gupta (equity investments), Nimesh Chandan and Siddharth Chaudhary (debt investments) and Vinay Bafna (commodities investments) will manage this fund.

Why does gold have an important place in everyone's portfolio, irrespective of age and gender?

As Akshaya Tritiya approaches, a time considered auspicious for buying gold for prosperity and good fortune, the gold-buying frenzy is about to be unleashed notwithstanding the current stratospheric rates gold has reached currently. The decision to buy gold this Akshaya Tritiya depends on several factors. Check here before you invest.

Akshaya Tritiya today: Gold ETF AUM doubles in 3 years to Rs 33,000 crore

Gold ETFs have seen exponential growth, with assets doubling to Rs 33,000 crore in three years. In the last one year, gold ETFs have offered an average return of 15.47%.

Google search interest draws attention to India's gold reserves

India's gold reserves garner attention with 29,300 Google searches. The UK and the US follow suit with substantial holdings. According to a report released by The Gold Bullion Company on Tuesday, India possesses around 804 metric tonnes of gold, valued at approximately $50 billion.

Sebi makes nomination optional for joint mutual fund portfolios

"Accordingly, it has been decided that the requirement of nomination ....for mutual funds shall be optional for jointly held mutual fund folios," the Securities and Exchange Board of India (Sebi) said in a circular.

Tata Mutual Fund changes fund manager for eight schemes

The fund house informed its unitholders that the fund manager of its index funds and ETFs will be changed.

Gold vs stocks: Bullion bulls race ahead in MF world. Which side are you on?

Gold and Silver commodity mutual funds have outperformed equity funds in the latest month. Notable performers include Invesco India Gold ETF FoF and Aditya Birla SL Gold Fund. Silver funds led by UTI Silver ETF FoF showed significant returns.

Precious metals: Must-have assets in your investment portfolio

Rising interest in gold and silver as safe haven investments amid uncertainties like interest rate cuts and geopolitical tensions. Investors utilize gold futures and ETFs, with a cautious approach towards silver trading due to its volatility.

People will book their profit in gold and probably reinvest in the market again: G Chandrashekhar

G Chandrashekhar advises caution amidst gold price surge driven by geopolitical uncertainty and speculative trading. He predicts a potential gold price correction, emphasizes portfolio diversification, and highlights silver market opportunities amid global economic factors. Chandrashekhar says: "We have to be optimistic about gold prices in the second half of the year, no doubt at all, but that should be tempered with extreme caution, at least in the short term."

Zerodha Mutual Fund crosses Rs 1,000 crore asset base

Zerodha mutual fund manages four mutual fund schemes which include only passive funds.

Passive mutual funds deliver up to 98% returns in FY24. Is active investing useless?

We calculated returns offered by passive mutual fund schemes during the financial year 2023-24. Returns were calculated starting from April 1, 2023, to March 18, 2024.

Gold ETFs continue to glitter; attract Rs 657 crore in January

With ongoing geo-political tensions and US inflation still higher than the desired number, the appeal of Gold as safe haven and hedge against inflation is expected to continue, Melvyn Santarita, Analyst at Morningstar Investment Research India, said.

Load More