ETMarkets.com

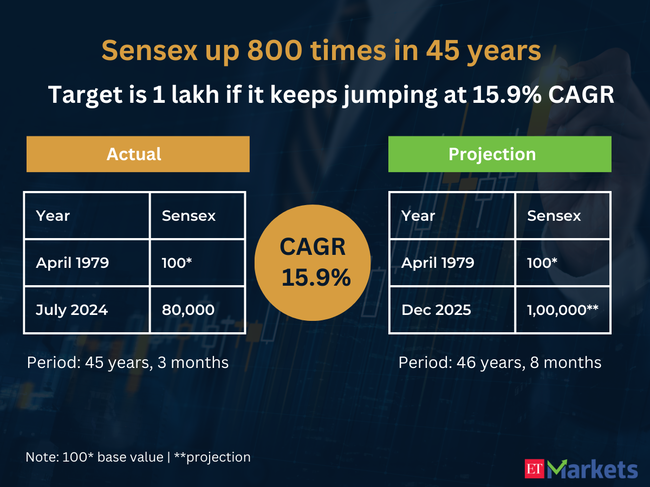

ETMarkets.comConsidering the base value of Sensex at 100 in April 1979, the Dalal Street barometer has jumped 800 times in 45 years by growing at a compounded annual growth rate (CAGR) of 15.9%. If Sensex continues to grow at the same pace of 15.9% per annum, we will be staring at the 1-lakh landmark by December next year.

This calculation doesn't include dividends declared by Sensex constituents from time to time which investors may choose to reinvest back in the market.

The index, launched on January 1, 1986, with a base value of 100 as of April 3, 1979, has experienced only 6 instances of negative returns since 1996. It has doubled in value over the last 5 years when it was around the 40,000 mark.

Dalal Street veteran Raamdeo Agrawal of Motilal Oswal fondly remembers that his journey into the world of stocks began in 1979, the same year Sensex was constituted.

Earlier calculations done by him show that if Sensex keeps on doubling every 5 years it can hit 1.5 lakh in 2029.

"India’s corporate sector profit has compounded at almost 17% over the last three decades. It is reasonable to expect 15% corporate profit growth going forward. If current P/E levels of 25x are maintained, this too, translates to the Sensex compounding of 15% i.e. double every five years. In other words, the Sensex level of 150,000 around the year 2029," he had written in an ET column in April.

Veteran emerging markets investor Mark Mobius, known as an India bull in global circles, also agrees that if India is growing at 7% and companies are growing at 14-15%, the index will also rise at that pace over the next 10 years.

"We are still on that upward trajectory. There will always be corrections, but we are still in that direction (towards 1 lakh). We will hit that. Maybe even before five years. India may be an exception in terms of moving faster," Mobius had told ET Markets earlier in an interview.

In the near term, the Sensex trajectory is likely to be decided by the noise around the Budget, the Fed's rate cut trajectory, and the US Presidential elections. However, if one takes a longer-term view, the growth trajectory looks intact barring short-term fluctuations.

(With data inputs from Ritesh Presswala.)

(What's moving Sensex and Nifty Track latest market news, stock tips, Budget 2024 and expert advice, on ETMarkets. Also, ETMarkets.com is now on Telegram. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds .)

Subscribe to The Economic Times Prime and read the Economic Times ePaper Online.and Sensex Today.

Top Trending Stocks: SBI Share Price, Axis Bank Share Price, HDFC Bank Share Price, Infosys Share Price, Wipro Share Price, NTPC Share Price

Read More News on

(What's moving Sensex and Nifty Track latest market news, stock tips, Budget 2024 and expert advice, on ETMarkets. Also, ETMarkets.com is now on Telegram. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds .)

Subscribe to The Economic Times Prime and read the Economic Times ePaper Online.and Sensex Today.

Top Trending Stocks: SBI Share Price, Axis Bank Share Price, HDFC Bank Share Price, Infosys Share Price, Wipro Share Price, NTPC Share Price

Get Unlimited Access to The Economic Times

Get Unlimited Access to The Economic Times