Stock Research Report for Shree Cement Ltd

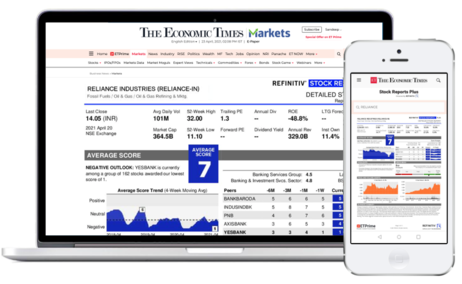

Stock score of Shree Cement Ltd moved down by 1 in 3 months on a 10 point scale (Source: Refinitiv). Get detailed report on Shree Cement Ltd by subscribing to ETPrime.

Get 4000+ Stock Reports worth₹ 1,499* with ETPrimeat no extra cost for you

*As per competitive benchmarking of annual price. T&C apply

Make Investment decisions

with proprietary stock scores on earnings, fundamentals, relative valuation, risk and price momentum

Find new Trading ideas

with weekly updated scores and analysts forecasts on key data points

In-Depth analysis

of company and its peers through independent research, ratings, and market data

Shree Cement Limited is an India-based company, which is engaged in the manufacturing and selling of cement and cement related products. The Company's product categories include Ordinary Portland Cement (OPC), Portland Pozzolana Cement (PPC), Portland Slag Cement (PSC) and Composite Cement (CC). It has a diversified brand portfolio consisting of Shree Jung Rodhak Cement, Roofon Cement, Bangur Cement, Bangur Power Cement, Rockstrong Cement and Rockstrong Premium Cement. Its OPC products can be used both for structural and masonry applications and in pre-stress concrete structures. The Company's PPC products are used in the construction of hydraulic structures, such as sewage pipes, marine works, dams, dikes and more. The Company has a total cement production capacity of approximately 46.4 million tons per annum (MTPA) in India. Its oversea cement production capacity is approximately four MTPA and caters to its customers in the Middle East, Southeast Asia and other nearby markets.