BEST GOLD ETF MUTUAL FUND IN INDIA

Best gilt mutual funds to invest in June 2024

Gilt funds are not recommended to regular debt investors because they are risky and volatile. Gilt funds suffer the most when the rates go up. The bond prices and yields move in opposite directions. When the rates go up, bond prices come down. This drags down the NAVs of schemes.

20 stocks which Quant owns but other mutual funds don't

Sebi is scrutinizing Quant Mutual Fund for alleged front-running. The fund had unique stocks, setting it apart from other asset managers. The diverse holdings across various funds reflect a distinctive investment approach, attracting regulatory attention.

Best corporate bond mutual funds to invest in June 2024

There are no changes in the recommendation list this month. If you are investing in these schemes, you can relax and continue with your investments. Follow our monthly updates regularly.

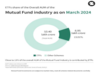

ETFs constitute 13% of the total mutual fund industry AUM: Zerodha Fund House

ETFs now constitute close to 13% of the total Mutual Fund Industry AUM indicating the remarkable adoption of ETFs by retail investors in India, according to a study by Zerodha Fund House.

SBI Mutual Fund launches SBI Silver ETF FoF

SBI Mutual Fund launches SBI Silver ETF Fund of Fund, open for subscription from June 27 to July 5. Fund aims to mirror SBI Silver ETF returns.

- Go To Page 1

SBI Mutual Fund launches SBI Silver ETF

SBI Mutual Fund has introduced the SBI Silver ETF, an open-ended exchange-traded scheme designed to track the price movements of silver.

Gold ETFs add over 1.36 lakh new folios in May, fastest in 60 months. AUM per folio 3rd best in 2 years

Gold ETF schemes added 136,772 folios in May, a 12.5% year-on-year increase. Investors are increasingly choosing Gold ETF mutual schemes for reasons like easy availability and low investment ticket size.

Best arbitrage mutual funds to invest in June 2024

There is no change in the list this month as all schemes have retained their place in the list. Watch out for our monthly updates to ensure your schemes are faring well.

Nippon India Mutual Fund changes fundamental attributes of multi-asset fund. What should you do?

Currently, it is an open-ended scheme that invests in equity, debt, exchange-traded commodity derivatives, and Gold ETFs. After the changes, it will expand to include Silver ETFs as well, becoming an open-ended scheme that invests in equity, debt, exchange-traded commodity derivatives, Gold ETFs, and Silver ETFs.

Sectoral/Thematic mutual funds’ AUM grows 80% YoY in May, folios rise 56%. What is brewing?

In May, investors showed significant interest in sectoral/thematic funds, injecting over Rs 19,200 crore in net inflows. This amount marks the highest among its 10 other equity-oriented mutual fund peers. Experts suggest that the increasing influence of this category stems from investors' attraction to themes promising higher growth potential.

Manufacturing mutual funds offer up to 68% in one year. Should you consider?

Manufacturing mutual funds, including ICICI Prudential Manufacturing Fund and Mirae Asset Nifty India Manufacturing ETF, have delivered impressive returns up to 68% in the last year. Modi's 'Make in India' initiative has boosted the manufacturing sector, attracting investors to thematic and sectoral funds.

Best flexi cap mutual funds to invest in June 2024

Flexi cap mutual funds offer the fund managers the freedom to invest across market capitalisations and sectors/themes. It means the fund managers can invest anywhere based on his outlook on the market. Flexi cap schemes are typically recommended to moderate investors to create wealth over a long period of time. Ideally, one should invest in these schemes with an investment horizon of five to seven years.

Kotak Mutual Fund, two others file draft documents with Sebi for 4 funds

Kotak Nifty Midcap 50 Index Fund will be an open-ended scheme replicating/tracking the NIFTY Midcap 50 Index. Benchmarked against NIFTY Midcap 50 Index, it will be managed by Devender Singhal, Satish Dondapati, and Abhishek Bisen.

Thematic MFs offer up to 14% return in May. Have you invested in any?

Sectoral and thematic mutual funds in May showcased diverse performances with funds like HDFC Defence Fund and Mirae Asset Hang Seng TECH ETF FoF offering up to 14.34% and 7.35% returns respectively.

Best small cap mutual funds to invest in June 2024

Small cap schemes invest in very small companies or their stocks. According to the Sebi mandate, small cap schemes must invest in companies that are ranked below 250 in terms of market capitalisation. These schemes also will have to invest at least 65% in small cap stocks.

Best mid cap mutual funds to invest in June 2024

As per Sebi norms, mid cap schemes are mandated to invest in companies that are between 101 and 250 in the market capitalisation. These companies can be leaders of tomorrow. That’s what makes them great bets. If these companies live up to the promise, the market will reward the investors handsomely.

Mirae Asset Mutual Fund files draft document with Sebi for Nifty EV & New Age Automotive ETF

Mirae Asset Mutual Fund has filed a draft document with SEBI for India's first ETF focused on Electric Vehicles (EV) and New Age Automotive. The fund will track Nifty EV & New Age Automotive Index.

Equity mutual funds continue to witness the maximum share from all states

In April 2024, India saw a 37.29% annual surge in average assets under management (AAUM) to Rs 57.01 lakh crore, with equity-oriented schemes dominating. Maharashtra led in AAUM contribution, followed by New Delhi and Karnataka. No state witnessed a sequential decline in AAUM.

Union Mutual Fund files a draft document with Sebi for a multi-asset allocation fund

Union Multi Asset Allocation Fund, an open-ended scheme, aims for long-term capital appreciation through diversified investments in equity, debt, gold, silver, REITs & InvITs. Managed by Hardick Bora, Sanjay Bembalkar, and Anindya Sarkar, it follows a blend of top-down and bottom-up investment approaches.

Modi 2.0: Gold ETFs’ AUM jumps 565% to Rs 32,800 crore in 5 years, folios rise by 1,483%

Gold ETFs in India experienced a staggering 565% increase in assets under management (AUM) between June 2019 and April 2024, coinciding with the Modi government's second term. The surge in AUM, from Rs 4,930.44 crore to Rs 32,789 crore, correlates with a 1,483% rise in folios, indicating growing investor interest. This uptick is driven by factors like perceived safety, attractive returns, and the convenience offered by ETFs.

ET Mutual Funds explains: 5 key differences between index funds and index ETFs in India

Index funds and Index ETFs vary in investment requirements and cost structures, with ETFs requiring a demat account and having lower expense ratios compared to index funds.

Silver ETFs beat smallcap, largecap MFs with 26% return in 2024 so far

Silver ETFs outperformed smallcap and largecap mutual funds in 2024, with a 26% return so far. Silver funds, dedicated to investing in silver, delivered an average return of 26.08% in 2024, with top performers including HDFC Silver ETF and UTI Silver ETF FoF.

Big bosses talking up the market is very scary because things can go wrong: PV Subramanyam

PV Subramanyam advises investors to focus on long-term investment strategies, considering market cues cautiously and diversifying portfolios to mitigate risks. He says that we ne need to be careful that the market can go down. The big bosses are talking up the market, which is very scary because things can go wrong and we need to be ready for that.

Gold folio additions surge in April even as smart investors book profits

The assets under management (AUM) of gold ETFs rose by 43% YoY to a record Rs 32,789 crore while the total folio count reached 51 lakh, the data from Association of Mutual Funds in India (AMFI) showed. The total inflow in the past 12 months was Rs 5,248 crore.

Samco Special Opportunities Fund, and two Bajaj Finserv Mutual Fund NFOs open for subscription this week

Bajaj Finserv Multi Asset Allocation Fund and Samco Special Opportunities Fund NFOs open this week, focusing on diverse investments like equity, debt, Gold ETFs, and special situations for potential capital growth.

Gold ETFs see first outflow after March 2023

Despite the decline, the asset under management (AUM) of gold funds rose 5% to ₹32,789 crore at April-end from ₹31,224 crore in the preceding month, according to the data with the Association of Mutual Funds in India (Amfi).

19% annual returns in 10 years on buying gold on Akshaya Tritiya; should you invest in gold this year too?

Gold price has increased by 18% to Rs 71,502 for 10 grams with 999 purity since the last Akshaya Tritiya. Investing during this period has historically yielded attractive returns due to various factors such as price cyclicality, holding period, and discipline in investment. Safe havens like gold may see increased demand amidst global uncertainties and currency depreciation impacting prices. Experts recommend a 15% allocation to gold for a balanced risk profile.

Bajaj Finserv Mutual Fund launches Multi Asset Allocation Fund

The scheme will be benchmarked against 65% Nifty 50 TRI + 25% NIFTY Short Duration Debt Index + 10% Domestic Prices of Gold. Nimesh Chandan and Sorbh Gupta (equity investments), Nimesh Chandan and Siddharth Chaudhary (debt investments) and Vinay Bafna (commodities investments) will manage this fund.

Load More