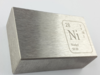

NICKEL PRICE

Aluminium prices rise on supply concerns. Will the rally sustain?

Aluminium prices surged to two-year highs driven by supply constraints in China and demand optimism. The domestic market followed suit, gaining over 15% this year despite a slide in other industrial metals.

Copper slides as China factory output data disappoints

Copper prices fell on Monday due to weaker-than-expected industrial output in China and a stronger U.S. dollar. Three-month copper on the London Metal Exchange dropped 1.1% to $9,637 per metric ton, while the most-traded July copper contract on the Shanghai Futures Exchange slid 2% to 78,110 yuan.

Smallcaps: Narrative might go against them, but if chosen with right filters, don't bother, 5 stocks from different sectors with long term perspective

When investing in stock markets, it’s crucial to make the distinction between high-quality and poor-quality businesses across the small, mid, and large-cap spectrums, as well as the difference between the intrinsic value of a stock and the overall value of the company. Certain niche small businesses may still generate significant returns over time if they are held long enough. On the other hand, if one's approach to small-cap investments is merely based on the absolute value of a stock with hopes of a tenfold increase, then it's a misconception. Stock market investing, whether in small, mid, or large caps, should not be driven by unrealistic expectations; otherwise, it leads to nothing but undue stress, rather than substantial returns.

Smallcaps: Don't be afraid of narrative against them, but surely check critical points: 5 stock from different sectors for long-term investors

Soon after election results, there was and probably still there is chatter on the street that small caps are not going to see the same kind of performance as they have seen in the last two years. Can anyone argue against a broad based statement ? Probably, No. But then expecting a small cap rally all the time is also incorrect. There are more than 2000 small caps stocks, a handful are actually worth looking at and even fewer worth having in a portfolio. If one is able to get the right of the small cap stock then the returns are extremely high, but at the same time, risk of getting it wrong and capital erosion is ever present. At times when one cannot rule our phases of volatility, for investors looking for small caps, some rules need to be followed to avoid wrong decisions of buying in haste or selling in panic.

Copper hits lowest in more than five weeks on firm dollar

London copper prices hit a five-week low due to a strong dollar and weak physical demand, affecting LME and SHFE markets.

Gold inches higher as inflation data looms, set for fourth monthly gain

Gold prices edge up for a fourth straight monthly gain as investors await key U.S. inflation data for insights into the Federal Reserve's policy path.

- Go To Page 1

Not a market for bargain hunters; look beyond June 4 for investment opportunities in next five years: Abhay Agarwal

Abhay Agarwal, Founder & Fund Manager at Piper Serica, discusses market focus on earnings, growth, and India's economic potential post-event. Grasim's expansion into the paint segment and Titan's nervousness are key points. Agarwal also says he expects the Birla Group will get re-rated because of various things they are doing like the Novelis IPO which was pending for a long time, which will unlock capital for Hindalco.

How is the violent unrest in New Caledonia impacting global nickel prices?

Global nickel prices have surged following violent unrest in New Caledonia, a major nickel producer. Social unrest erupted over French constitutional changes allowing certain residents to vote in elections. New Caledonia holds significant nickel reserves, critical for electric vehicles and other industries. The turmoil has disrupted supplies, contributing to the price spike.

Asia shares touch two-year top as China plans property boost

Brent crude futures touched a one-week high of $84.14 a barrel in early trade, with the crash, in heavy fog, of a helicopter carrying Iran's president drawing traders' attention to the Middle East. Gold hovered close to a record high at $2,423 an ounce.

Domestic copper at lifetime highs; factors affecting the price surge

Record copper prices are driven by Chinese stimulus, mine supply concerns as well as green demand. MCX and LME futures surge. The Chinese 1 trillion yuan stimulus has boosted industrial metals demand for electric vehicles, renewable energy, and power grids. Goldman Sachs predicts major copper market deficit with US manufacturing rebound.

Jindal Stainless eyes 20% volume growth in FY25, to spend over Rs 5,000 crore on capex

The country’s largest producer of stainless steel sold 2.17 million tonne of stainless steel in 2023-24 (Apr-Mar), a growth of 23%, surpassing the company’s guidance of 20% for the year.

Metal stocks rally up to 14% on China demand

Shares of metal giants Vedanta and Hindustan Copper surged by 4% on BSE to Rs 410.45 and Rs 372.25, respectively, while Hindustan Zinc saw a remarkable 14% leap to a new 52-week high of Rs 520. The surge is attributed to heightened demand from China, a major player in the global metal market.

Copper and aluminium prices at multi-year highs. Here’s why

Looking ahead, as prices are hovering near multi-year highs, there are chances of a technical correction, but such moves are unlikely to set into major liquidation. Since the supply-demand dynamics are supportive of prices, the ongoing positive sentiment will remain intact for the short run.

Gold edges higher; hovers near one-week low on tempered Middle East fears

Policymakers including U.S. Federal Reserve Chair Jerome Powell last week backed away from providing any guidance on when interest rates might be cut, saying instead that monetary policy needs to be restrictive for longer.

Metals whipsawed as US, UK sanctions on new Russian supplies rattle LME

But the sanctions will still reverberate through metals markets because of the LME's central position at the heart of the industry. Its prices are used as a benchmark and referenced in a huge number of contracts around the world, and many buyers view the ability to deliver on the LME as essential.

LME ban on Russian origin metals to see aluminium, copper & nickel prices go up in short term: Amit Dixit

ICICI Securities' Analyst, Amit Dixit, examines the impact of Russian metal bans on commodity prices, emphasizing short-term fluctuations and the evolving steel sector in India amidst changing global dynamics. He says: "There would be ways and means by which you would find that the actual impact would be far lower than what people are expecting currently."

Metal traders see price rising after LME Russia ban

But there are disagreements about the broader impact of the move: Some argue that removing one of the largest producers from the market will drive prices higher, while others are focusing on the prospect of a flood of old Russian metal getting dumped onto the LME.

Gold will probably reach $2350-2400 per ounce very quickly; silver may have more upside: Peter McGuire

Peter McGuire predicts silver to outperform gold, driven by underinvestment and industrial demand. Geopolitical tensions could push crude prices higher, while Bitcoin's volatility continues amidst stable USD index. The economic outlook for the second quarter remains uncertain. McGuire also says that silver might have more upside than gold over the next matter of months in the sense of performance and ratio to gold .

A tale of two metals will determine the future of energy

Nickel and copper have long been recognized as vital components of a decarbonised economy.

Battery metal price plunge is closing mines and stalling deals

It’s a dramatic reversal from the ebullience of recent years that sent prices soaring and sparked a rush by some of the auto industry’s biggest players to secure future supply.

Investor concerns grow as US airlines face uncertain future

Investors worry about the future of U.S. airlines amid concerns about a weakening economy and rising costs. United Airlines shares drop by about 10% after forecasting lower-than-expected fourth-quarter profit. Delta Air Lines faces challenges in controlling operating costs, with analysts viewing their profit target as aspirational. A decline in ticket prices raises concerns about how airlines will offset rising costs. Rising fuel prices and labor contracts suggest that cost pressures will persist for airlines

UBS' Credit Suisse takeover with nickel and a dime. Is this the 'deal of the century'?

UBS's acquisition of Credit Suisse for $3.25 billion in March has been hailed as the "deal of the century" after UBS reported a net profit of $29.2 billion for the second quarter. The exceptional gain was attributed to the difference between the purchase price and Credit Suisse's book value. However, critics argue that the takeover has created a monopolistic situation and put Switzerland at risk if the new mega-bank faces a crisis. UBS still faces challenges ahead and it remains to be seen whether the deal was truly worth it.

Government tightens norms for sale of aluminium, copper, and nickel from December

Ministry of Mines has issued Quality Control (QC) orders to restrict the sale of poor-quality aluminium, copper, and nickel from December 2023 onwards. The Indian government had proposed Quality Control orders on aluminium, copper, and nickel back in March and draft orders for aluminium alloys and these metals were floated till May-end.

Base metals fall as China's COVID curbs spike demand worries

China stocks fell, as COVID-19 flare-ups added to concerns of a dim economic outlook, amid fears that growth will be sacrificed for ideology-driven policies under President Xi Jinping's new leadership team.

Commodities market volatility sparks spillover concerns

Prices for Brent crude are up more than 30% since the invasion began, while nickel prices doubled on Tuesday – a move that appeared to have been exacerbated by a Chinese firm covering bets against the metal and reducing its exposure to costly margin calls.

LME nickel surge puts clearing houses in the spotlight

The LME, which clears all trading of its metals contracts, said on Friday it was raising margin requirements for nickel contracts by 12.5% to $2,250 a tonne. The extra charge kicks in at close of business on Tuesday, March 8.

LME suspends nickel trading for the day after prices see record run

"The LME has taken this decision on orderly market grounds," the exchange said in a statement, adding that "trading will be disabled in LMEselect, and nickel trading will not be permitted on the Ring."

Five things to know about nickel’s 90% price surge

Most importantly, there’s no need to panic — there’s a supply boom underway and this spike is unlikely to last.

LME nickel more than doubles, tops $100,000/T on Russia supply risks

Russia supplies the world with about 10% of its nickel needs, mainly for use in stainless steel and electric vehicle batteries.

Load More